US Student Loan Forgiveness Updates: Who Qualifies in 2025?

Student loan forgiveness has remained a critical topic in the United States, especially as borrowers search for avenues to ease their financial burdens. As we enter 2025, updates to forgiveness programs and eligibility rules continue to evolve. This article explores the latest changes, explains who qualifies, and offers practical guidance for navigating the process. Whether you’re a teacher, healthcare provider, public servant, or recent graduate, this guide will help you understand where you stand in the journey toward debt relief.

1. Why Student Loan Forgiveness Still Matters

Student debt remains a pressing issue in America: over 45 million borrowers owe more than $1.7 trillion in student loans. High payments—often over $300 a month—limit life choices. Forgiveness programs seek to:

- Rein in monthly payments

- Encourage careers in public service or education

- Foster economic growth by relieving long-term debt

- Stimulate home buying and business investment

For many, forgiveness offers a lifeline. Updates in 2025 bring renewed opportunity—and complexity.

2. Major Forgiveness Programs in 2025

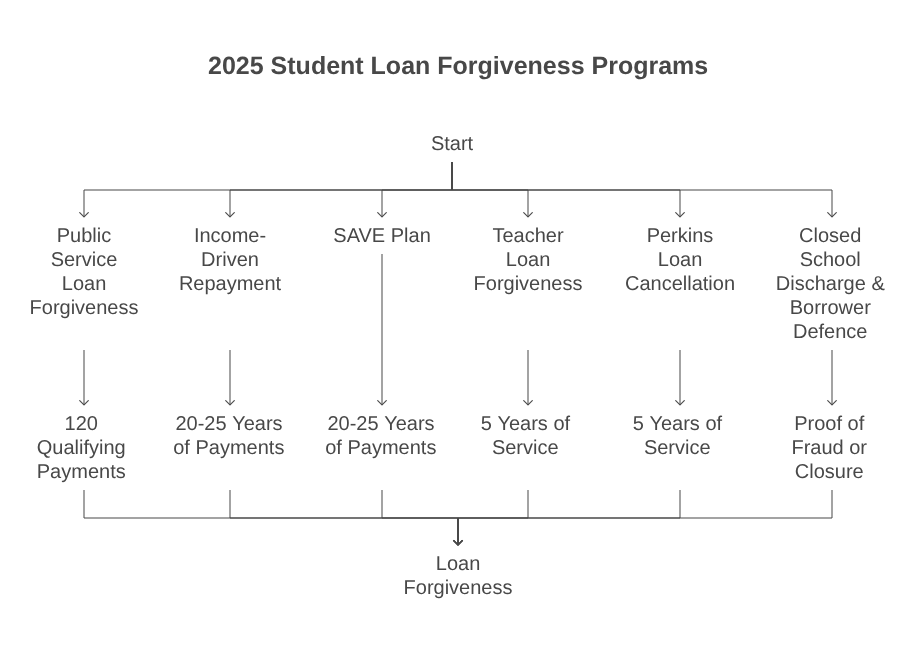

Several federal student loan forgiveness initiatives remain active or have received updates:

a) Public Service Loan Forgiveness (PSLF)

- Available to those employed full-time by qualifying public or nonprofit organizations.

- Forgives the remaining balance after 120 qualifying payments (10 years).

- Requires loans under the Direct Loan Program and employer certification.

- As of 2025, Temporary Expanded PSLF (TEPSLF) and PSLF Limited Waiver are permanent, streamlining previous burdens and enhancing eligibility retroactively.

b) Income-Driven Repayment (IDR) Forgiveness

- Eligible plans: REPAYE, PAYE, IBR, ICR.

- Forgives the remaining balance after 20–25 years of qualifying payments (20 years for undergraduate, 25 for graduate).

- New guidance in 2025 ensures that unpaid interest capitalization is limited under REPAYE, making forgiveness more attainable.

c) SAVE Plan (Replaces REPAYE)

- Rolled out in late 2023 and refined through 2024–2025.

- Caps monthly payments for borrowers: 5% of discretionary income for undergraduate debt, 10% for graduate debt.

- Payments are rounded to the nearest convenient amount.

- After 20 years (undergraduate) or 25 years (graduate), the remaining debt is forgiven.

- Unlike REPAYE, no mandatory payment for low-income borrowers.

d) Teacher Loan Forgiveness

- Teachers in low-income schools can receive up to $17,500 in forgiveness after five consecutive years.

- 2025 updates simplified school certification and broadened eligible Title I institutions.

e) Perkins Loan Cancellation

- Certain public service professionals can cancel Perkins Loans over five years.

- 2025 guidance added mental health and social work positions as eligible roles.

f) Closed School Discharge & Borrower Defence

- Borrowers defrauded by their institution or left stranded due to school closure may discharge loans.

- Pandemic-era expansions became permanent in 2025, easing proof of fraud in some cases.

3. What Qualified Payments Mean

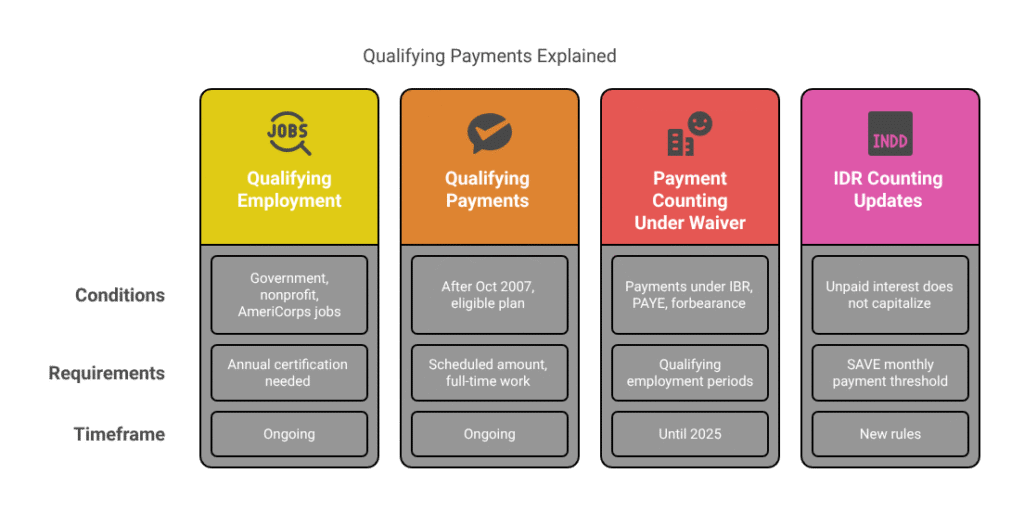

a) Qualifying Employment (PSLF)

Employment at the government, military, an innocent nonprofit, or AmeriCorps/VISTA programs qualifies. Now includes private sector contractors funded mostly by the government. Employment certification via the Department of Education (ED) must be submitted annually or after job changes.

b) Qualifying Payments

Payments must be:

- Made after Oct 1, 2007

- Under an eligible repayment plan

- At least the scheduled payment amount

- Made while working full-time for a qualified employer (for PSLF)

- No delinquency or default

c) Payment Counting Under Waiver

Under the Limited PSLF Waiver, credits are granted retroactively even for payments under IBR, PAYE, or forbearance for qualifying employment periods. As of 2025, the Department has fully integrated those counts into borrower records.

d) IDR Counting Updates

New rules specify that unpaid interest— if not covered by payment—does not capitalize once the SAVE monthly payment threshold is exceeded. This prevents interest from ballooning and improves forgiveness outcomes.

4. Who in 2025 Qualifies for Student Loan Forgiveness?

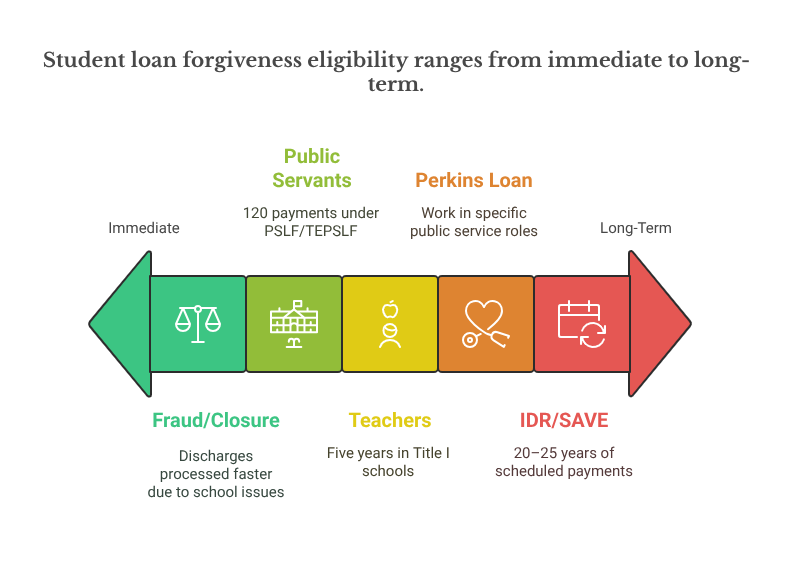

A) Public Servants & Nonprofit Employees

If you have:

- Direct Loans (or consolidated into a Direct Loan).

- Made 120 qualifying payments under PSLF/TEPSLF.

- Certified employment for each period.

This includes teachers, government employees at all levels, and nonprofit staff. Military personnel count too, whether active or reservists.

B) Borrowers on IDR or SAVE

For those paying under:

- SAVE (successor to REPAYE)

- PAYE

- IBR

- ICR

If you consistently make scheduled payments for 20–25 years, you’ll qualify for forgiveness. New 2025 rules help reduce accumulated interest and improve eligibility counts.

C) Perkins Loan holders

You must work in roles like K–12 education, nursing, law enforcement, firefighting, among others. Perkins loans are held by institutions, not servicers, but eligibility is clearer as of 2025.

D) Teachers in Low-Income Areas

Five years of teaching in designated Title I schools. Must have Direct or FFEL loans (consolidation allowed). School certification by the principal or the district.

E) Reimbursement for Fraud or School Closures

If your institution closed mid-2018 or later, or investigators found misrepresentations, discharge claims filed with the ED in 2025 saw faster processing.

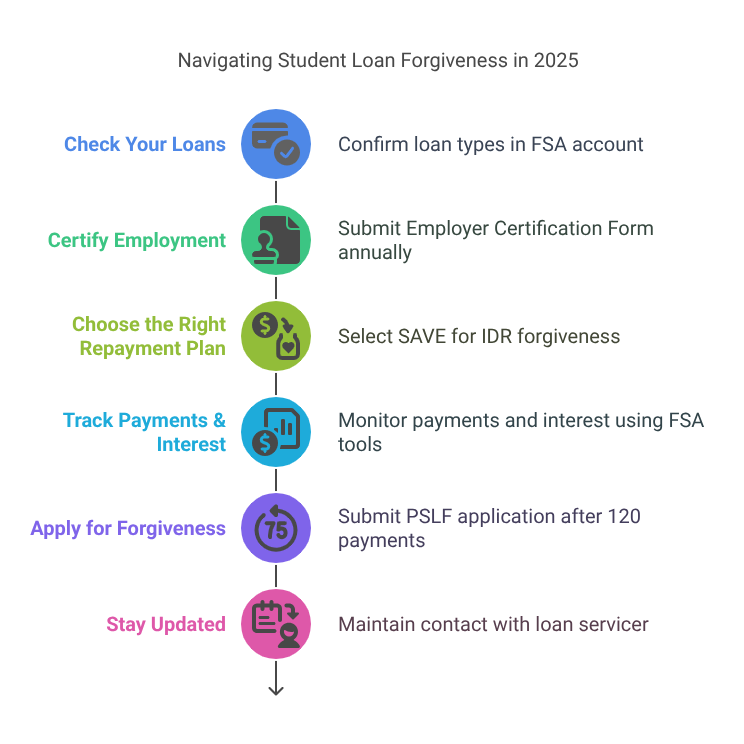

5. How to Navigate the Forgiveness Process in 2025

Step 1: Check Your Loans

Use your Federal Student Aid (FSA) account. Confirm all your loans are Direct or consolidated into Direct.

Step 2: Certify Employment

For PSLF, submit the Employer Certification Form annually and with job changes. Keep records of your W-2s, pay stubs, and employment documentation.

Step 3: Choose the Right Repayment Plan

- PSLF: IDR, primarily SAVE.

- IDR Forgiveness: Choose SAVE for its interest reduction features.

- Perkins: Contact your school’s loan office.

Step 4: Track Payments & Interest

Use FSA payment history tools. For SAVE and IDR, confirm your payment meets the discretionary income thresholds. Use the repayment estimator tools.

Step 5: Apply for Forgiveness

- PSLF: Submit the PSLF Loan Forgiveness Application once 120 payments have been made.

- IDR: File IDR account review after 20/25 years of repayment.

- Perkins and Teacher federal loan forgiveness: Applications via school or servicer.

Step 6: Stay Updated

Maintain contact with the loan servicer, update income annually under IDR, and respond to each notice or certification request. Monitor new legislation—some state programs may complement federal forgiveness in 2025.

6. 2025 Tips & Strategies for Borrowers

Consolidate FEEL or FFEL to Direct

FFEL or Perkins loans must be consolidated to qualify for federal forgiveness. Do this early to start qualifying for payments.

Work for TEPSLF-Eligible Employers

Even if you have non-profit roles previously ineligible, the TEPSLF limited waiver may credit qualifying payments retroactively.

Track Income-Driven Benefits

SAVE’s lower thresholds and interest subsidies reduce the burden for low-income borrowers. Consider switching repayment plans if eligible.

Document Everything

Keep annual income updates, PSLF certification forms, and DAVID documentation. ED is streamlining reviews, but thorough paperwork ensures accuracy.

Use Loan Forgiveness Calculators

FSA loan simulator (fedloan.gov) shows a timeline toward forgiveness. Use it often as salary, family size, or income shifts.

Stay Informed on Policy

Administration proposals in 2025 include:

- Expanding forgiveness eligibility to more consumer finance and health professions.

- State-level programs—many align with PSLF for supplemental relief.

- Advocacy may influence Congressional override measures.

7. Common Questions—Clarified

- Can private loans be forgiven?

Only through private lender programs—these are rare, and most forgiveness programs are exclusively federal. - What if I used forbearance or deferment?

Under the PSLF waiver, non-pay periods during qualifying employment can earn credit. Under IDR/SAVE, pre-2024 forbearance does not count. - What if my spouse has income?

SAVE looks only at the borrower’s income if filing separately. Filing tax separately using married filing separately status may lower payments—consult a tax advisor. - If I consolidate now, will past payments count?

Only payments made on the new Direct Consolidation Loan count. But under waivers, PSLF-eligible payments before consolidation might apply retroactively if certified.

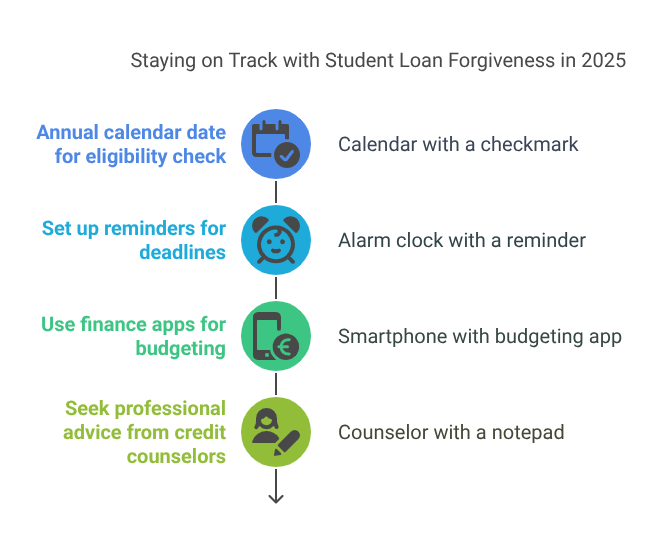

8. How to Stay on Track in 2025

- Mark an annual calendar date: Check and recertify IDR and PSLF eligibility once a year.

- Set up reminders for rate hikes or repayment rescind deadlines.

- Use finance apps to budget around projected future payments.

- Get professional advice if pursuing forgiveness as a financial plan—non-profit credit counsellors can help.

9. Looking Ahead: The Future of Student Debt Relief

2025 marks a continued focus on making forgiveness more accessible. Anticipated trends include:

- Permanent application of PSLF waiver benefits

- Expansion of income-driven thresholds across repayment plans

- State-federal collaboration for forgiveness expansion

- Technology automation in loan processing

- Legislative proposals to cap undergraduate debt forgiven annually at $10,000–$20,000

Who Qualifies in 2025?

To summarize, the following borrowers can expect meaningful progress toward loan forgiveness this year:

- Public servants, military, nonprofit employees: Using PSLF keys like Direct consolidation and certification

- Save-plan participants: Borrowers on SAVE nearing 20–25-year marks

- Teachers in eligible schools: 5 years in Title I schools

- Perkins borrowers in qualifying roles: Nurses, law enforcement, and mental health

- Borrowers defrauded or affected by school closures: With stronger evidence processing in 2025

By verifying loan types, choosing the right repayment plan, certifying employment, and tracking qualifying payments—even prior to 2025—borrowers set themselves up for forgiveness earlier than expected. The reforms and clarifications made in 2025 empower more individuals to complete the path to debt relief.

If you believe you qualify—or want to switch to SAVE and make progress—start today. Speak to your loan servicer, run loan simulations, gather your documentation, and apply. With strategic planning, 2025 could be the year your student loan debt finally comes under control.