The Great Credit Card Purge: Why Americans Are Cutting Up Cards in Record Numbers (Gen Z backlash against debt culture)

Gen Z leads the movement to ditch credit cards amid debt fears, rising costs, and mental health concerns

USA — A growing number of Americans, particularly from Generation Z, are cutting up their credit cards and walking away from revolving debt as a new wave of anti-debt sentiment sweeps the country. What started as a few scattered posts on social media has quickly turned into a financial movement dubbed by observers as “The Great Credit Card Purge.”

The shift in financial behaviour comes at a time when U.S. credit card debt remains near historic highs and the cost of living continues to put pressure on household budgets. But it’s not just economics driving the change—it’s emotion, anxiety, and a generational rejection of what many young Americans view as an outdated and predatory debt system.

Debt at a Breaking Point

According to recent estimates, American consumers currently hold over $1.18 trillion in credit card debt. Delinquency rates are rising, and more consumers are carrying balances month-to-month. The average annual percentage rate (APR) on credit cards has also climbed above 20 percent, making unpaid balances more expensive than ever.

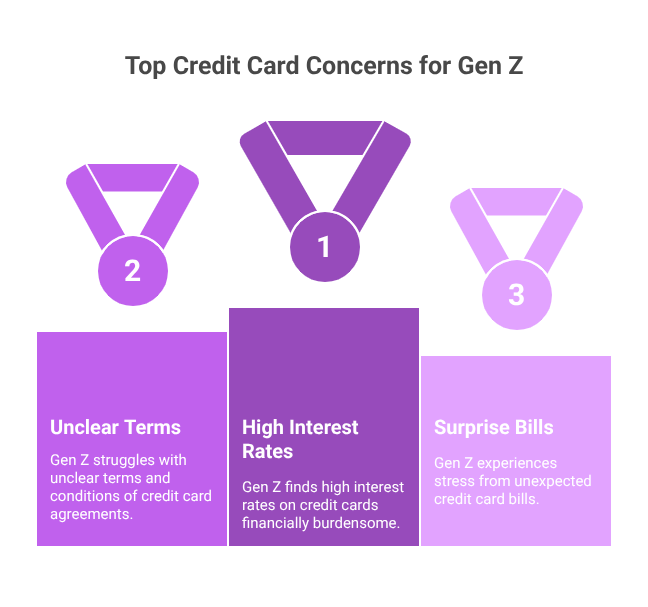

For Gen Z—the generation born roughly between 1997 and 2012—this is both a financial and psychological burden. Many young Americans are increasingly uncomfortable with credit products that come with high interest rates, late fees, and what they describe as “unclear” terms and conditions.

“I closed my first credit card after just six months,” said 23-year-old Brooklyn resident Tasha Greene. “The points weren’t worth the stress. I’d rather know exactly how much I have in my account than worry about some surprise bill.”

A Generational Rejection

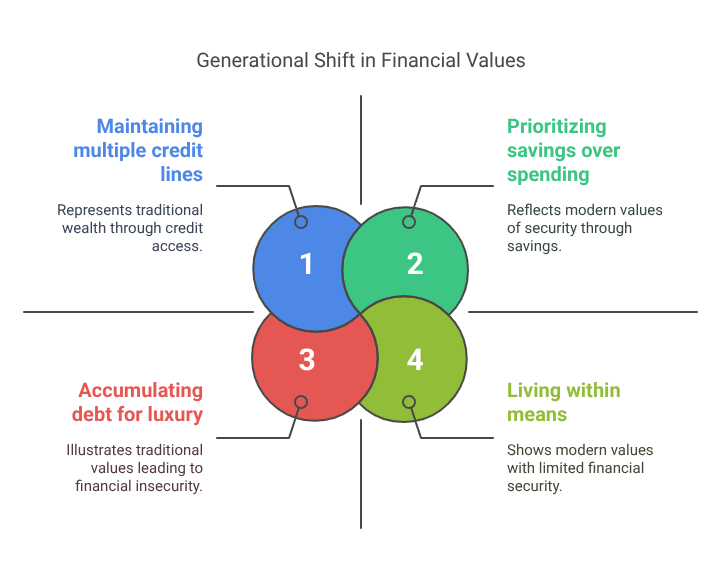

Surveys show that nearly two-thirds of Gen Z adults now prefer debit cards or cash to credit. Many say they associate credit cards with anxiety, debt traps, and financial instability. This marks a sharp contrast to previous generations, for whom credit cards symbolized financial freedom, purchasing power, and social status.

“Credit cards were always positioned as a tool to build your credit score or earn rewards,” said financial behaviour analyst Kevin Rosario. “But Gen Z doesn’t seem interested in playing that game. Their focus is on simplicity and avoiding stress.”

Experts believe the 2008 financial crisis—which many Gen Zer’s witnessed as children—played a significant role in shaping their views. “They saw their parents lose jobs, homes, and savings,” said Rosario. “That trauma left an impression.”

From TikTok to Trash Can

The credit card backlash has found a natural home on social media. On platforms like TikTok and Instagram, users post videos showing themselves cutting their credit cards in half, closing accounts, and celebrating a return to what they call “financial clarity.”

Some have even created hashtags like #CreditCardCleanse and #DebtFreeGenZ to share their stories. The content often includes tips on budgeting, how to live within one’s means, and testimonials from people who say their mental health improved after quitting credit.

“I didn’t realize how much anxiety my credit card caused until I got rid of it,” said 20-year-old college student Julian Ortiz. “Now I just use my debit card and track everything. It feels like I’m finally in control.”

The Mental Toll of Debt

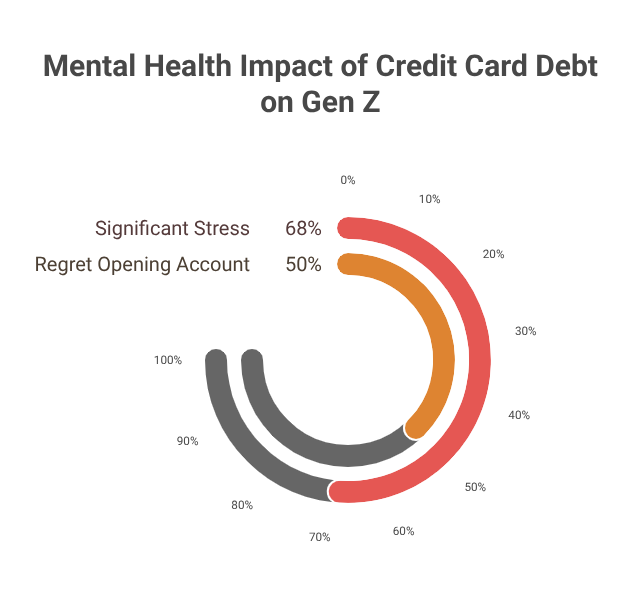

Financial stress is not new, but younger Americans are speaking out more openly about its effects on mental health. Studies have shown that people in their twenties and thirties are more likely to report anxiety, sleep disturbances, and even depression related to debt.

In a national poll conducted this year, 68 percent of Gen Z respondents said credit card bills caused them “significant stress.” More than half said they regretted ever opening a credit card account, and many reported feelings of guilt and confusion about interest charges.

Therapists say the link between financial and emotional health is becoming increasingly clear. “There’s no doubt that debt contributes to anxiety, especially among younger clients,” said licensed counsellor Dana Wu, who specializes in financial trauma. “When people take action—like cancelling credit cards—they often feel a sense of relief and empowerment.”

The Return of Cash and Budgeting Basics

While older Americans embraced the idea of leveraging credit for perks and purchases, many Gen Zers are moving in the opposite direction, favouring cash, debit cards, and strict budgeting. In some cases, they are reviving methods like the “envelope system,” in which cash is physically divided into spending categories.

Apps such as Mint, YNAB (You Need a Budget), and GoodBudget have seen increased downloads among younger users in the past year. These digital tools allow users to categorize expenses, set spending limits, and avoid overdrafts without resorting to credit.

“I don’t need cashback or airline miles,” said Ortiz. “I need peace of mind.”

Industry Response and Economic Implications

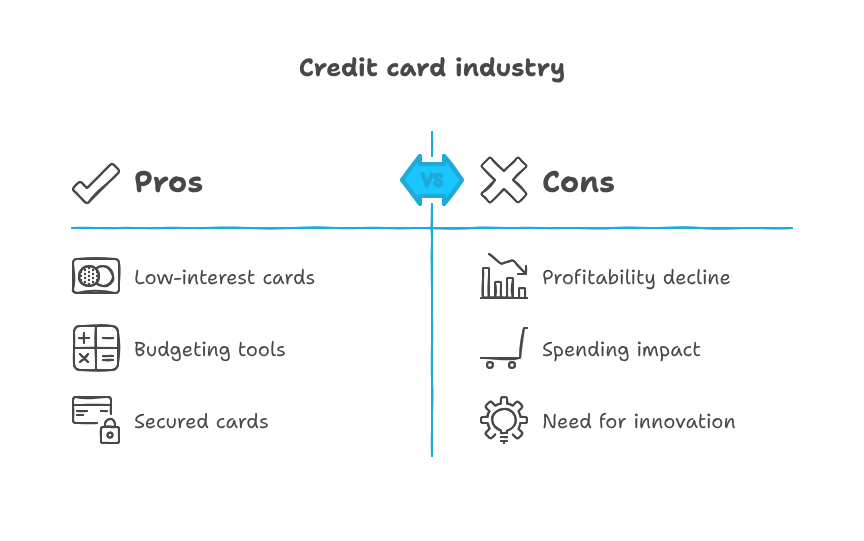

The growing disinterest in credit cards among younger consumers has not gone unnoticed by banks and credit issuers. Some financial institutions have responded by offering low-interest cards, simpler terms, and integrated budgeting tools. Others are pushing “secured” credit cards to help users build credit with minimal risk.

But the industry faces an uphill battle. If younger generations continue to avoid revolving debt, the long-term profitability of traditional credit products could decline. Credit cards have historically been a major source of revenue for banks through interest and fees.

“Banks need to rethink how they serve younger clients,” said financial services consultant Priya Malhotra. “Transparency, trust, and tech-friendly design will be essential.”

The decline in credit card use could also impact consumer spending, which plays a major role in the U.S. economy. With fewer people willing to borrow, demand for nonessential goods and services may decline, especially in sectors that rely on impulse or luxury purchases.

Buy Now, Pay Later: A Risky Alternative?

Although many Gen Zer’s are moving away from credit cards, some are turning to instalment-based services like Buy Now, Pay Later (BNPL). Providers such as Klarna, Affirm, and Afterpay allow users to split purchases into interest-free payments if they pay on time.

However, financial experts warn that BNPL is not risk-free. Missed payments can lead to penalties, and the lack of traditional credit reporting means users may struggle to track their total debt.

“There’s a misconception that BNPL is safer than credit cards,” said Rosario. “But without proper regulation and oversight, it can be just as dangerous.”

Is Cutting Up Cards the Right Move?

Not all experts agree that eliminating credit cards entirely is the best strategy. Credit cards, when used responsibly, can offer valuable benefits, including fraud protection, emergency funds, and credit score improvement.

“Credit isn’t inherently bad,” said Malhotra. “It’s how you use it. The goal should be to develop healthy habits, not necessarily to avoid credit forever.”

Still, for many young people, stepping away from credit is a necessary first step toward financial stability. For some, it’s a temporary measure; for others, a permanent choice.

A New Financial Ethic

What’s emerging is more than a trend—it’s a redefinition of what it means to be financially successful. Where past generations saw wealth as having multiple lines of credit and access to luxury spending, Gen Z seems to equate financial wellness with simplicity, savings, and security.

Living within your means is becoming the new status symbol. Cancelling a credit card is not a sign of failure, but of discipline. And for many, the absence of debt is more satisfying than any reward points could ever be.

Looking Ahead

The Great Credit Card Purge marks a clear generational shift in how Americans view money, credit, and personal responsibility. Whether the movement sustains itself over the long term remains to be seen, but its immediate impact is undeniable.

Gen Z is signalling to financial institutions and older generations alike: the future of finance is less about spending power and more about peace of mind.

As inflation, economic uncertainty, and financial stress continue to shape consumer behaviour, one thing is clear—cutting up the card is, for many, cutting out the chaos.