How to Negotiate Credit Card Debt with Banks (Step-by-Step Guide)

Credit card debt can feel like a never-ending trap. With rising interest rates and unexpected expenses, millions of Americans are struggling to keep their balances under control. If you’re one of them, you’re not alone—and there are ways to ease the burden. One of the most effective approaches involves working with your credit card issuer to explore potential relief options.

Knowing how to navigate this process—what to say, what to ask for, and what to expect—can make a significant difference. Whether you’re trying to avoid falling further behind or looking for a path toward financial recovery, understanding your options and how to approach them can empower you to take back control.

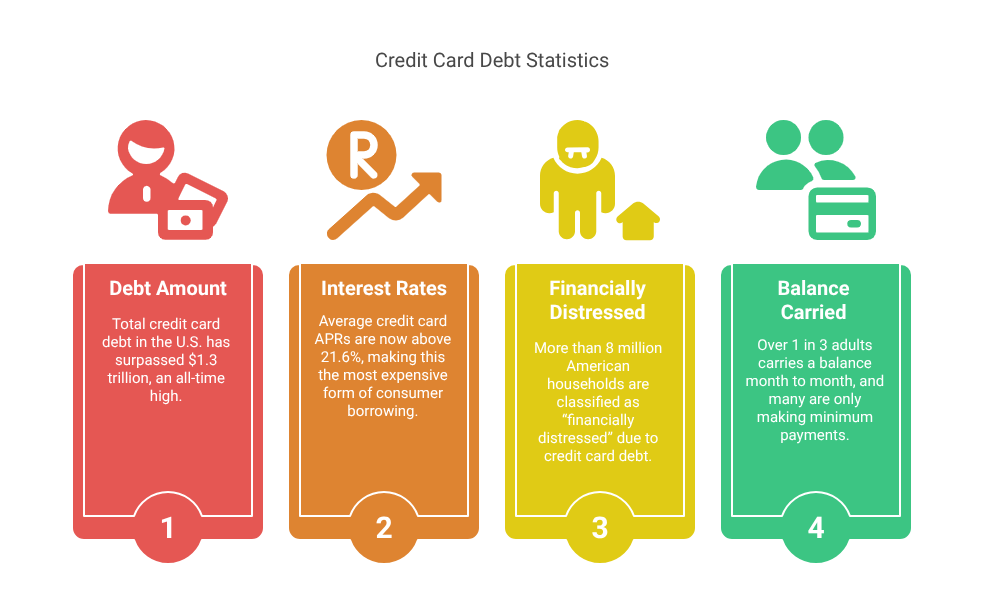

The Growing Pressure of Credit Card Debt in America

In 2025, U.S. households are facing record-breaking debt burdens. According to the latest data:

- Total credit card debt in the U.S. has surpassed $1.3 trillion, an all-time high.

- Average credit card APRs are now above 21.6%, making this the most expensive form of consumer borrowing.

- More than 8 million American households are classified as “financially distressed” due to credit card debt.

- Over 1 in 3 adults carry a balance month to month, and many are only making minimum payments.

Steps to Negotiate Credit Card Debt with Banks

This financial pressure has pushed more Americans to consider proactive steps, like reaching out to their card issuers for relief.

Step 1: Understand Where You Stand

Before engaging with your credit card provider, take time to evaluate your current financial picture. This step lays the groundwork for a realistic and effective negotiation.

Key information to gather:

- Current balances on each card

- Minimum monthly payments

- Interest rates and due dates

- Any late fees or penalty APRs applied

- Your net monthly income and total expenses

Build a basic spreadsheet or use a budgeting app to visualize your situation. This will help you assess what you can afford to offer and avoid promising payments you can’t sustain.

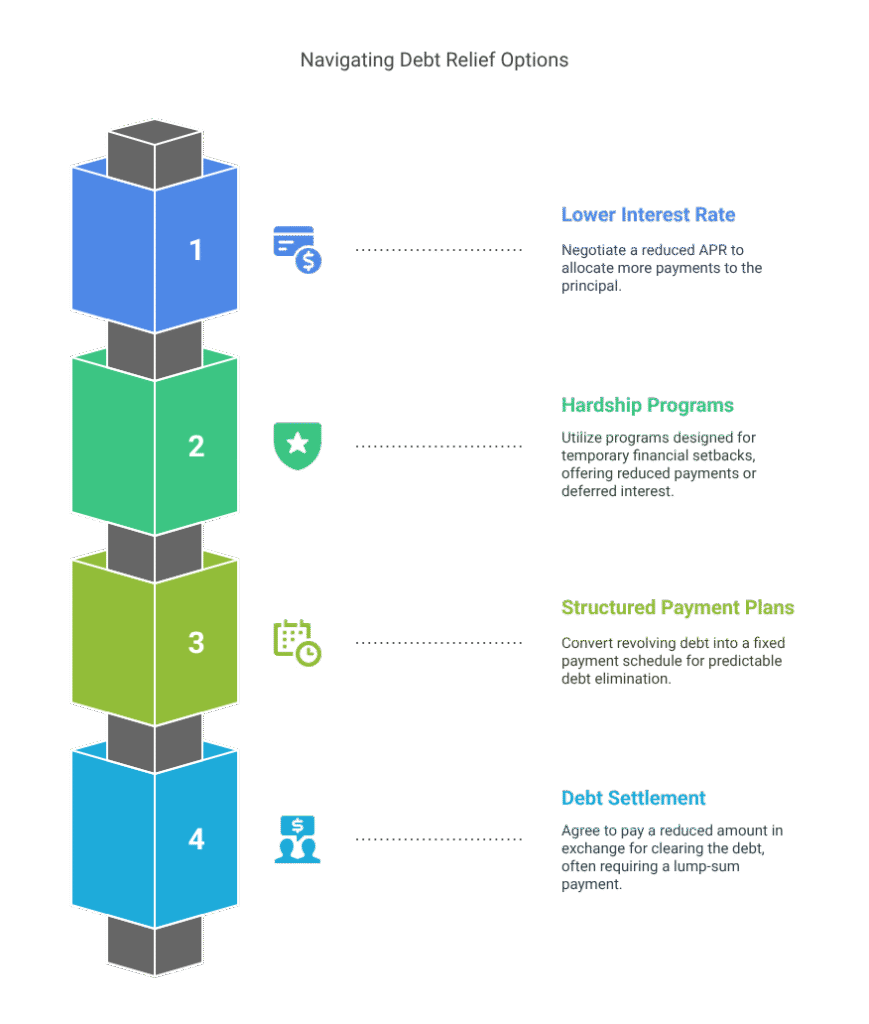

Step 2: Know What Relief Options Are Available

Banks don’t always advertise the full range of debt relief options they offer, but most have internal programs to assist struggling borrowers. Understanding these options gives you a roadmap for negotiation.

1. Lower Interest Rate

Banks may reduce your APR, especially if you’ve had a good payment record before falling behind. Lower rates mean more of your payment goes toward the principal.

2. Hardship Programs

Offered during temporary financial setbacks like job loss or medical issues, these programs may include reduced payments, waived fees, or deferred interest. As of 2025, 22% of cardholders have used such programs.

3. Structured Payment Plans

These plans allow you to convert revolving debt into a fixed payment schedule, helping you eliminate the balance over time with more predictability.

4. Debt Settlement

If you’re behind by several months, the bank may agree to settle your debt for less than the full amount, often in exchange for a lump-sum payment.

Step 3: Contact the Right Department

When you’re ready, call your card issuer—but don’t start with general customer service. Ask to speak directly to the hardship team or collections department, as these are the departments authorized to make changes to your account terms.

Be calm and professional. Explain your situation clearly and express a genuine willingness to find a resolution. Stick to the facts—monthly income, expenses, and what you can reasonably afford to pay.

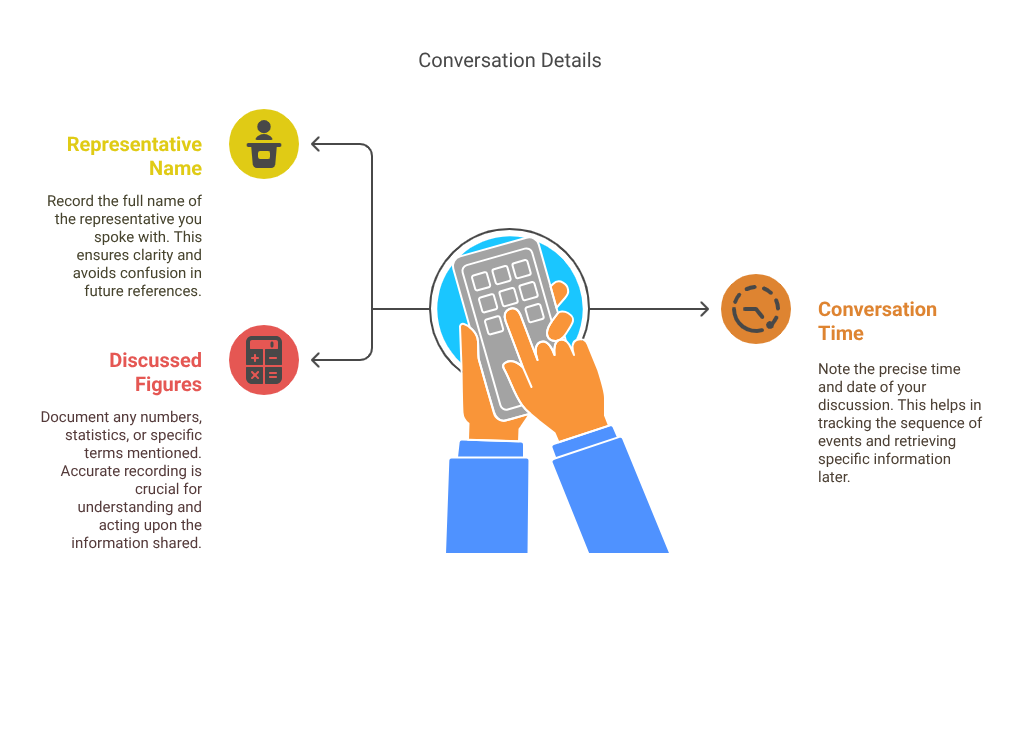

Take note of:

- The name of the representative

- Time and date of the conversation

- Any figures or terms discussed

Having detailed records will protect you in case of a future dispute or miscommunication.

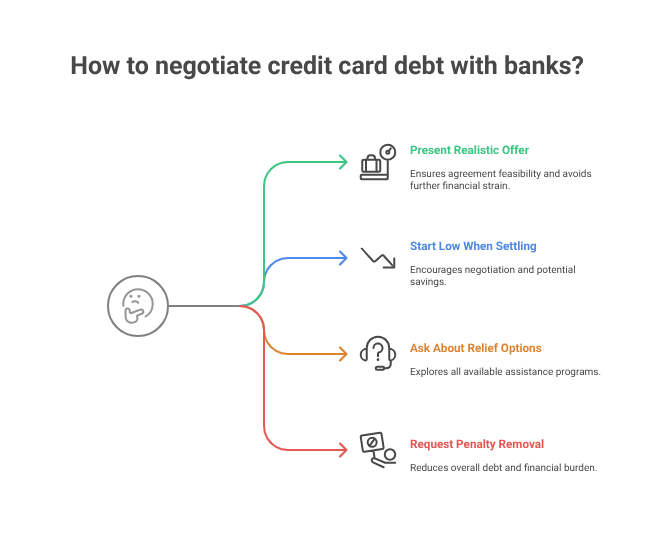

Step 4: Negotiate Strategically

Think of this call as a negotiation, not a plea. You are offering a realistic repayment solution that helps both you and the bank avoid further financial risk.

Present a Realistic Offer

Base your offer on your actual budget. Overpromising can lead to a failed agreement and further financial strain.

Start Low When Settling

If you’re offering a lump sum to settle a debt, consider starting around 30–40% of the outstanding balance. Banks often meet you in the middle.

Ask About All Relief Options

Don’t assume the first offer is the best they can do. Ask if a hardship program is available or if interest can be frozen temporarily.

Request Penalty Removal

Push for the removal of late fees, over-limit charges, and any penalty interest. These are often negotiable, especially if you’re making a good-faith effort to resolve the debt.

With serious delinquency rates (90+ days late) now reaching 6.3% in 2025, banks are more open to compromise than ever.

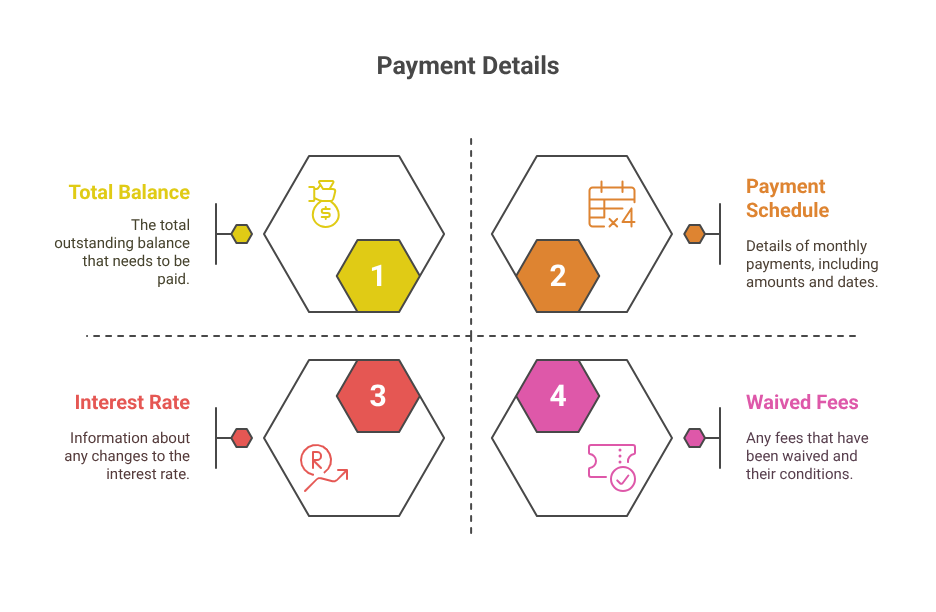

Step 5: Confirm Everything in Writing

Once you’ve reached a new agreement, do not send any money until you receive written confirmation. Verbal promises are not enough and could lead to serious issues down the line.

Your written agreement should include:

- Total balance to be paid or settled

- Monthly payment amounts and schedule (if applicable)

- Interest rate changes

- Any waived fees or conditions

If your agreement is sent by email, save and print a copy. If it arrives by mail, store it securely. You may need this document for tax purposes or future credit disputes.

Step 6: Stick to the New Terms

Once the agreement begins, follow it exactly as outlined. Even a single missed payment can void your arrangement and send your account back to collections.

To avoid missteps:

- Set up automatic payments

- Set calendar reminders

- Track payments through your bank account

It’s also a good idea to check in with the issuer after the first few payments to confirm everything is on track. Staying engaged shows responsibility and can open doors to future renegotiation if needed.

Step 7: Monitor Your Credit Reports

After your new payment terms begin, keep an eye on how your account is reported to credit bureaus. Depending on the agreement, it might be listed as:

- “Settled for less than full balance.”

- “Account paid as agreed.”

- “Closed by creditor”

Each status affects your credit score differently. Use this time to also review other parts of your credit report and dispute any errors. You’re entitled to one free report annually from each of the three major bureaus: Equifax, Experian, and TransUnion.

For proactive monitoring, consider using free credit apps that offer monthly score tracking and alerts.

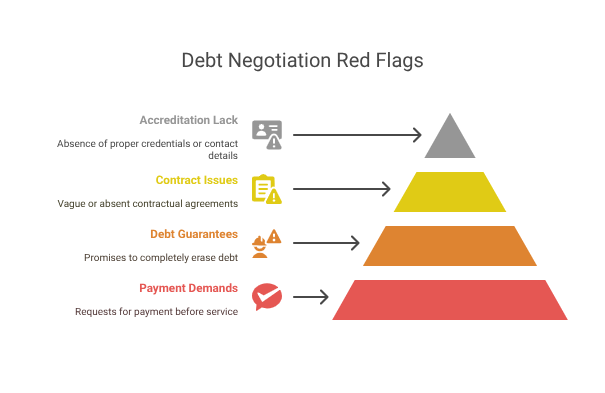

Step 8: Watch Out for Scams

The rise in consumer debt has unfortunately led to a rise in debt relief scams. These companies often promise huge savings but charge large upfront fees and deliver little in return.

Red flags to avoid:

- Demands for payment before services are provided

- Guarantees to eliminate your debt

- Vague or missing contracts

- Lack of accreditation or contact information

Remember: you can speak to your bank directly for free. If you need additional help, choose only nonprofit, certified credit counsellors with a strong reputation.

Step 9: Know When to Bring in a Professional

If your debt situation involves multiple creditors, legal notices, or collection agencies, consider consulting a professional.

Certified Credit Counsellors

They can create a Debt Management Plan (DMP) that consolidates your payments and may reduce interest rates.

Debt Management Agencies

Reputable nonprofit agencies often have better leverage with banks and can secure more favourable terms on your behalf.

Bankruptcy Attorneys

As a last resort, bankruptcy may be necessary for those facing extreme financial distress. While it carries long-term credit consequences, it can offer a clean slate in some cases.

Explore professional help if your personal negotiation efforts have stalled or if your situation feels overwhelming.

Reclaiming Your Financial Future

Negotiating credit card debt isn’t just possible—it’s often the smartest financial move you can make when your balance becomes unmanageable. The key is to act early, be informed, and communicate clearly with your bank.

Whether you’re seeking a lower interest rate, a reduced payment plan, or even a debt settlement, taking initiative can save you thousands and help you avoid long-term financial damage. You don’t need to feel helpless. Banks are often more flexible than you think, especially if you reach out before defaulting.

Don’t wait until the calls from collections become daily. Take a proactive step. Review your budget, pick up the phone, and ask for a path forward. Financial stress can feel overwhelming, but solutions are often just a conversation away.