AI Debt Collectors: How ChatGPT-Style Bots Are Negotiating Your Bills (Fintech Disruption)

NEW YORK — In a quiet but powerful shift sweeping across the American financial landscape, artificial intelligence has entered the debt collection arena. AI-powered bots, modelled after conversational platforms like ChatGPT, are now negotiating bills, offering repayment plans, and interacting with consumers in real time, marking a profound disruption in the way overdue accounts are managed.

How AI Bots Are Negotiating Your Bills?

With personal debt levels in the United States hitting historic highs, companies and institutions are turning to automated systems that can talk, reason, and even empathize. These AI debt collectors are replacing traditional call centre operations and redefining how Americans experience financial recovery efforts.

The New Voice Behind Your Past-Due Notice

Gone are the days of endless phone calls and mailed reminders. Today, overdue account holders are increasingly contacted via personalized text messages, in-app conversations, or emails that read like a genuine human is on the other end. In reality, these are sophisticated AI bots capable of understanding tone, intent, and emotion.

Unlike earlier robotic scripts, these bots adapt their tone in real-time. If a consumer expresses financial hardship, the bot may respond with empathy and suggest a manageable payment option. If the consumer is ready to pay, the bot can provide immediate links and confirm receipts—no human required.

These bots are available 24/7, can manage thousands of conversations at once, and are programmed to follow federal and state compliance standards such as the Fair Debt Collection Practices Act (FDCPA).

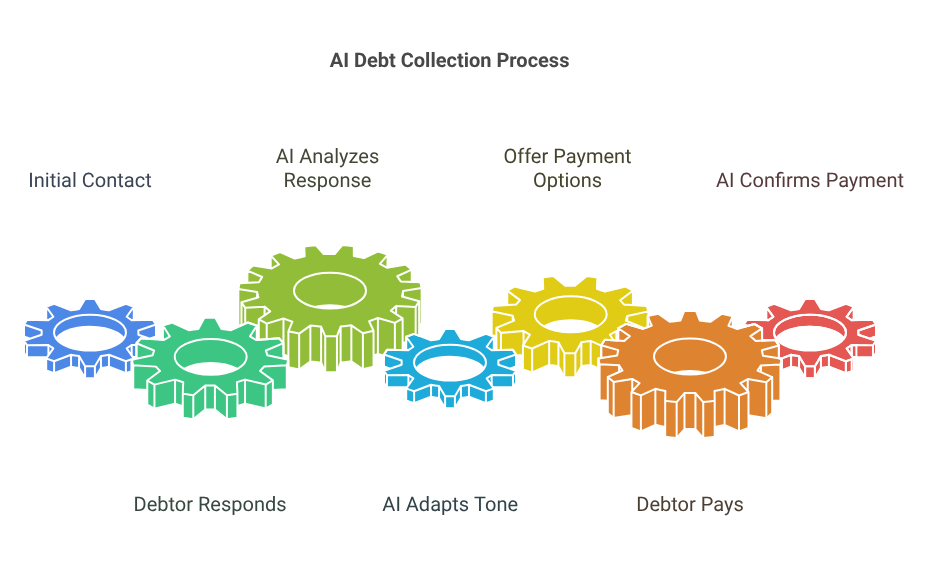

How It Works: Conversations That Convert

Built on advanced natural language processing (NLP) and machine learning models, these AI systems engage in intelligent conversations that adjust based on a debtor’s responses.

For example:

- A user types, “I can’t pay this month. I lost my job.”

- The AI responds, “We understand these situations can be difficult. Would you like to set up a payment plan starting next month or request a one-time extension?”

The AI doesn’t just respond—it reasons. It pulls from data patterns, repayment history, and even behavioural signals to determine the most effective next step. Each interaction is logged and auditable, ensuring both transparency and compliance.

Why This Is Happening Now

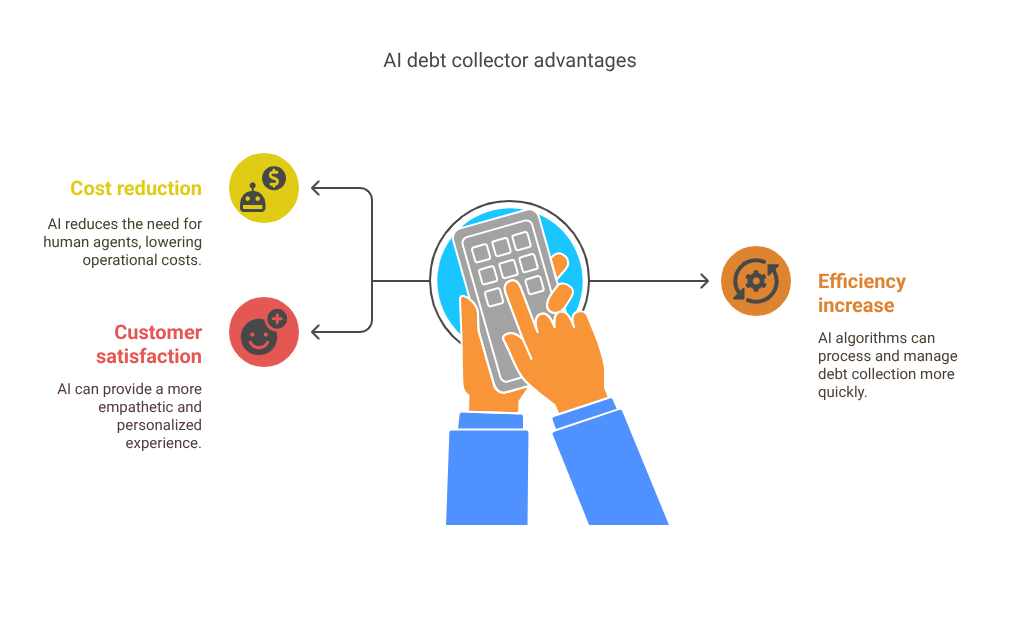

The surge in consumer debt, combined with rising inflation and interest rates, has left millions of Americans struggling with credit card balances, personal loans, and medical bills. Traditional collection models—heavily reliant on human agents—are costly, inefficient, and often lead to customer dissatisfaction.

In contrast, AI debt collectors offer:

- Lower operational costs

- 24/7 availability

- Instant resolution options

- High scalability

- Data-driven recovery strategies

These bots are capable of reaching a broader segment of the population without the stigma or anxiety often associated with human collectors. They offer flexibility, patience, and—perhaps most importantly—privacy.

Consumers Responding Positively

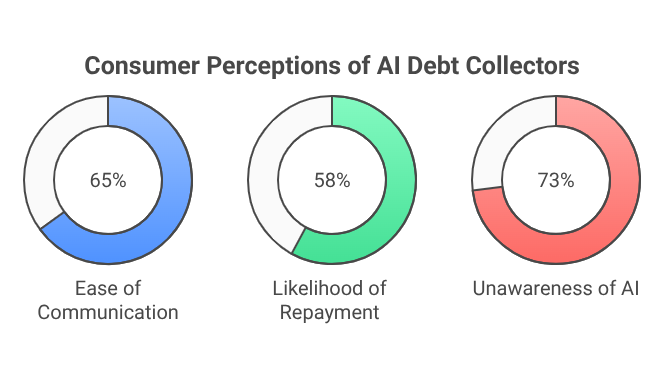

What might seem dystopian at first is, surprisingly, being welcomed by many. Consumers report feeling more comfortable discussing finances with bots than with people. There is no perceived judgment, no raised voice, no awkwardness.

A recent survey of U.S. consumers with overdue balances revealed:

- 65% felt more at ease communicating with a chatbot

- 58% were more likely to enter a repayment plan when contacted by AI

- 73% were unaware they were speaking with a machine

This psychological comfort is proving to be a critical factor in improving collection rates and reducing delinquencies.

Not Without Controversy

Despite the promise, concerns are mounting around ethics, privacy, and accountability.

Consumer protection advocates warn that while bots may sound empathetic, they still serve a financial goal: to collect money. There’s growing debate over whether AI can truly assess hardship or if it might push vulnerable consumers toward decisions they can’t afford.

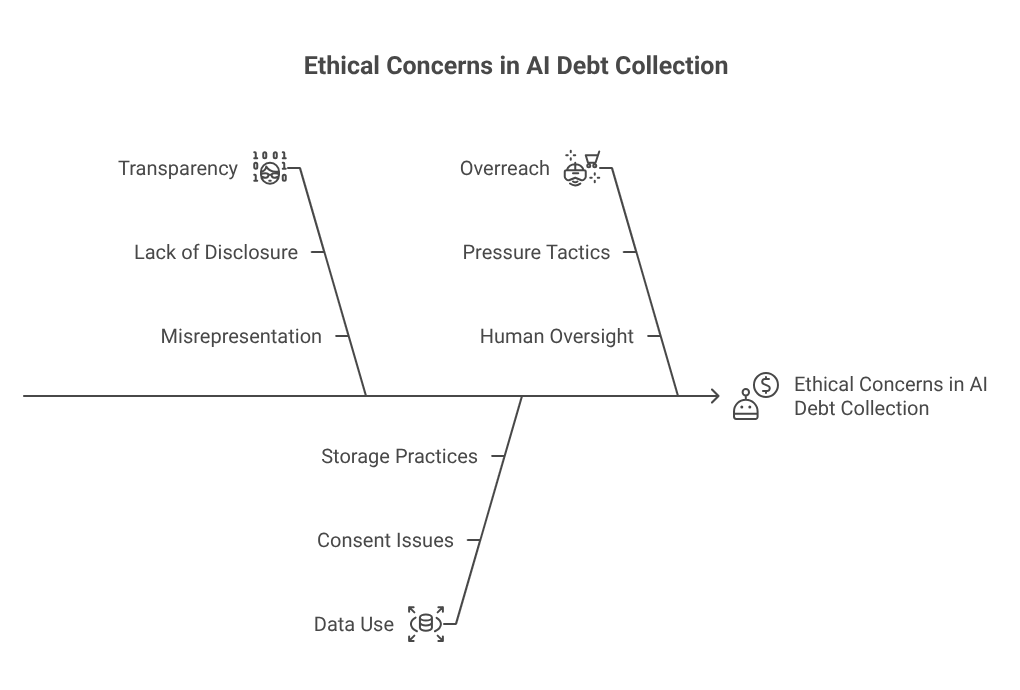

Key concerns include:

- Lack of transparency: Should consumers be informed they’re talking to a machine?

- Consent and data use: How is personal financial data being stored and analysed?

- Overreach: Can AI accidentally pressure consumers without human oversight?

Regulators are now paying close attention. The Consumer Financial Protection Bureau (CFPB) is evaluating whether current debt collection laws sufficiently address AI systems. There may soon be requirements to disclose AI involvement, enforce consent protocols, and audit automated decisions for bias.

Not Replacing Humans—Yet

While AI systems are powerful, they are not flawless. Experts emphasize that human oversight is still critical, especially for complex cases, escalations, or legal disputes.

Most modern systems operate on a hybrid model: bots handle initial outreach and common scenarios, while human agents take over when flagged. This balance allows for both efficiency and empathy where it’s needed most.

Furthermore, many professionals in the collections industry are now being trained to supervise AI systems, audit interactions, and intervene when necessary. Far from being displaced, human agents are shifting into higher-value roles that require judgment and emotional intelligence.

ChatGPT’s Role in the Revolution

The influence of conversational AI like ChatGPT cannot be overstated. What began as an academic breakthrough and viral tech demo has rapidly matured into a serious business tool.

Debt collection is just one of many industries now reshaped by this technology. Thanks to ChatGPT-style models, AI is no longer a passive tool—it’s an active participant in financial dialogue, capable of persuasive reasoning, adaptive tone, and decision-making.

By fine-tuning these models with financial data, compliance parameters, and behavioural insights, organizations are creating bots that not only sound human but also behave responsibly, most of the time.

What the Future Holds

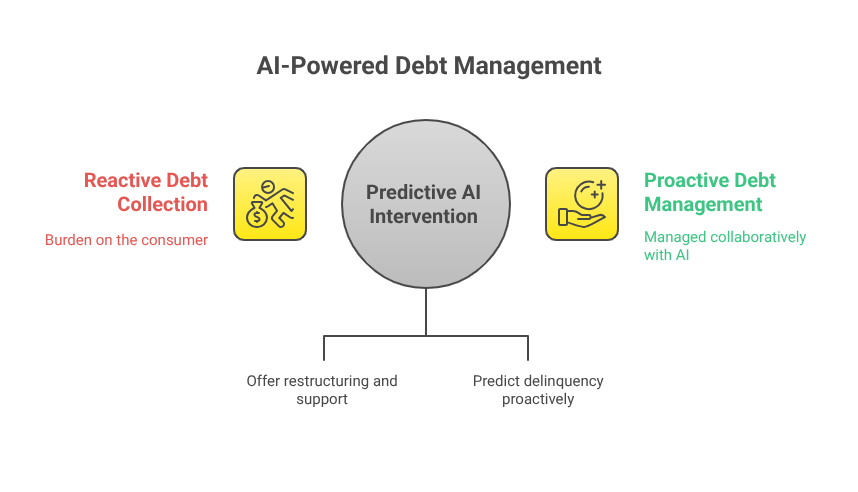

The future of debt collection is shifting from reactive to predictive. Advanced AI models are being developed to analyse user behaviour and predict delinquency before it happens. This will allow lenders and service providers to intervene early with offers of restructuring or support, reducing defaults altogether.

Imagine receiving a message like:

“We’ve noticed a change in your spending pattern. Would you like to explore a pre-emptive payment adjustment to avoid penalties?”

This kind of proactive financial assistance may redefine how consumers relate to debt—not just as a burden, but as something that can be managed collaboratively with AI guidance.

A More Humane Form of Collection?

In a strange twist, AI debt collectors may actually humanize the experience. With no shouting, no threats, and no shame—just structured, polite, and consistent communication—these systems remove many of the emotional hurdles that plague traditional collections.

And for the millions of Americans who are behind on payments, that shift could be life-changing.

What This Means

As the U.S. economy continues to grapple with high consumer debt and tightening credit conditions, the rise of AI-powered debt collectors signals a major transformation. What was once a tense and adversarial process is becoming more conversational, data-driven, and—in many ways—more effective.

Yet as AI assumes greater control over personal finance conversations, it must be guided by clear rules, ethical safeguards, and human oversight.

Because when machines collect your debts, the question isn’t just how well they work, but how fairly they operate.