Student Loan Forgiveness Program Extended by Six Months

USA. — The U.S. federal government has announced a six-month extension to the student loan forgiveness program, offering much-needed relief to millions of borrowers across the country. This decision, aimed at addressing the ongoing financial pressures caused by economic uncertainty, comes as part of broader efforts to stabilize household finances and support economic recovery. The extension highlights the government’s commitment to tackling the growing issue of student loan debt, a burden that continues to weigh heavily on the finances of many Americans.

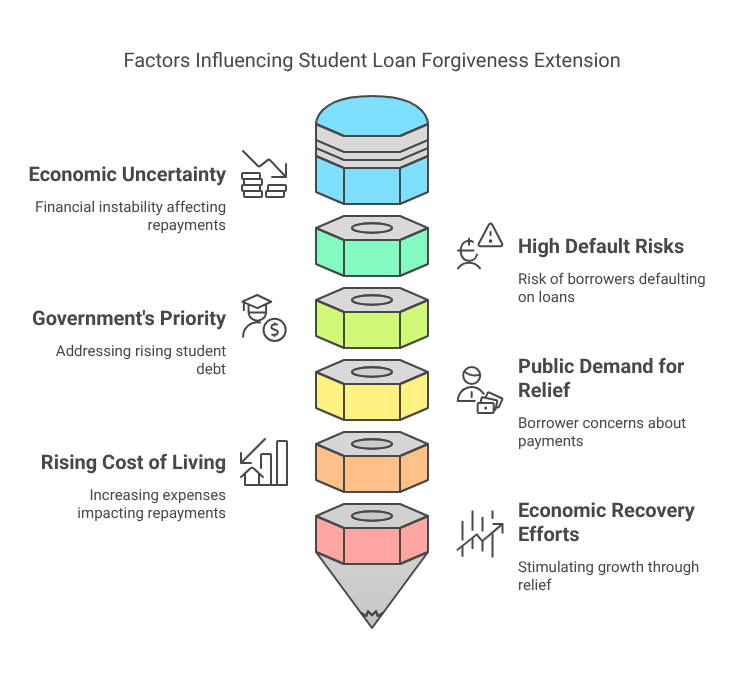

Why Was the Student Loan Forgiveness Program Extended?

The extension of the student loan forgiveness program comes in response to multiple economic and social factors that have made it increasingly difficult for borrowers to manage their loan repayments. Among the key reasons driving the decision are economic uncertainty, rising inflation, job instability, and the increasing financial burden faced by borrowers. The government’s recognition of these issues underscores the importance of maintaining relief measures for those struggling with student debt.

Economic Uncertainty

Rising inflation, slow wage growth, and job instability have placed significant financial strain on borrowers, complicating their ability to meet repayment obligations. The uncertain economic landscape, exacerbated by global events and domestic challenges, has left many struggling to balance their financial responsibilities. This extension is part of the government’s efforts to provide some stability and relief to those most affected by these economic difficulties.

High Default Risks

Recent reports indicate that over 20% of federal student loan borrowers were at risk of default before the introduction of relief measures. High default rates pose a threat not only to individual borrowers but also to the broader financial system. The government sees this extension as a necessary step to prevent a further rise in defaults, which could destabilize both personal finances and the national economy.

Government’s Priority

With federal student loan debt now exceeding $1.7 trillion, addressing the issue of student loan debt has become a central policy priority. The increasing amount of student debt, which continues to grow each year, has become an urgent concern for policymakers. The government’s efforts to reduce this financial burden align with its broader goal of providing long-term solutions to the student debt crisis, while also offering immediate relief to struggling borrowers.

Public Demand for Relief

A recent survey revealed that 60% of borrowers were concerned about the impact of restarting payments without additional support. Many borrowers had already enjoyed a prolonged period without payments during the pandemic and were concerned that resuming payments without assistance would lead to financial distress. This feedback from borrowers played a significant role in shaping the decision to extend the forgiveness program.

Rising Cost of Living

The increasing cost of living, including higher prices for housing, healthcare, and childcare, has made it even more challenging for borrowers to stay on top of their student loan repayments. For many individuals, the choice between paying off student loans and covering basic living expenses has become a difficult and distressing reality. As the cost of living continues to rise, the need for continued support for borrowers becomes even more evident.

Economic Recovery Efforts

The extension of the student loan forgiveness program is also part of broader efforts to stabilize the economy as the country continues to recover from the impacts of the COVID-19 pandemic. By offering relief to borrowers, the government hopes to stimulate consumer spending and improve overall economic stability. When borrowers are not burdened by the stress of loan repayments, they are more likely to contribute to the economy by spending and investing, thus supporting recovery efforts.

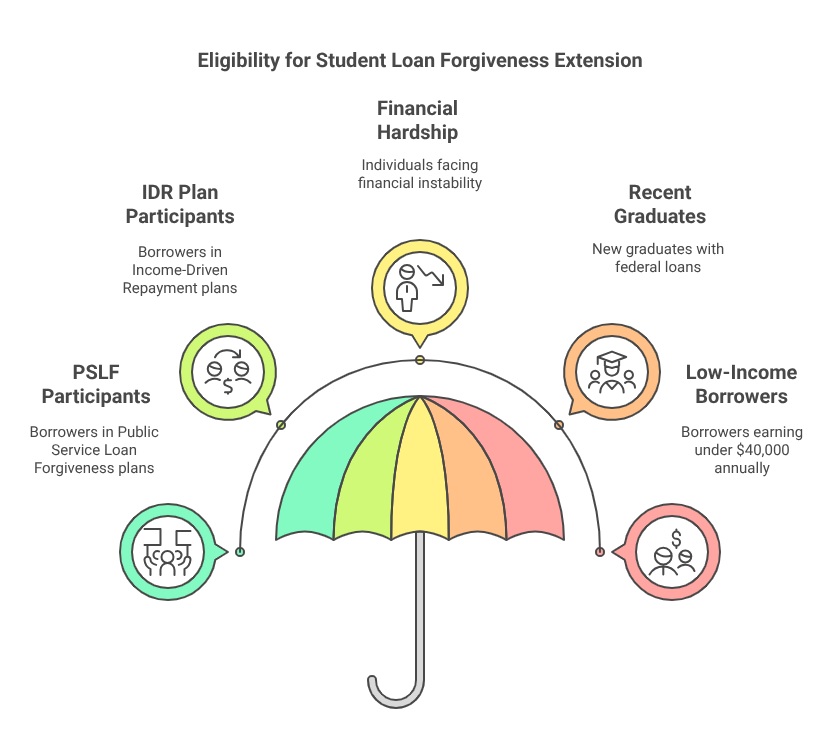

Who Qualifies for the Extension?

The U.S. government has outlined specific eligibility criteria for those who will benefit from the student loan forgiveness extension. Borrowers who meet the following conditions are eligible for temporary relief:

- Participants in Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans.

- Borrowers nearing forgiveness eligibility.

- Individuals experiencing financial hardship due to job loss or income instability.

- Recent graduates with federal student loans.

- Low-income borrowers earn under $40,000 annually.

The focus on low-income borrowers is especially important, as these individuals are often the most vulnerable to financial instability. Recent graduates, who may not yet have established a stable financial footing, are also a key group that will benefit from this extension.

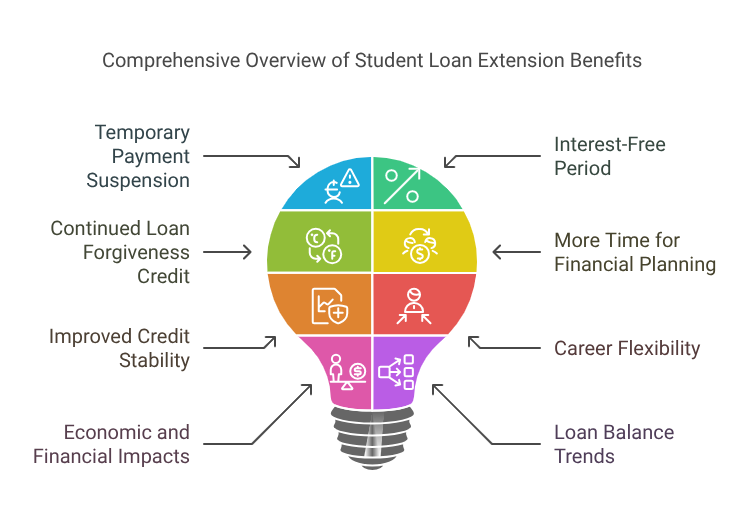

Key Benefits of the Extension

The six-month extension provides several significant benefits for borrowers, offering them additional time to reassess their financial situations and make better financial decisions moving forward. These benefits go beyond just the temporary suspension of payments, offering relief in multiple ways.

Temporary Payment Suspension

During this extension period, no payments will be required from borrowers, offering a temporary reprieve from financial pressures. This relief gives borrowers the opportunity to focus on other financial priorities, without the immediate burden of student loan payments. The additional time allows individuals to adjust their budgets and make informed decisions about their finances.

Interest-Free Period

For borrowers with qualifying loans, no interest will be accrued during the extension, preventing their loan balances from growing. This is particularly beneficial for borrowers who are already struggling to make ends meet, as it ensures that their debt will not become more unmanageable over time. Without the added burden of accruing interest, borrowers can focus on reducing their debt more effectively.

Continued Loan Forgiveness Credit

Borrowers in the PSLF and IDR programs will continue to receive credit toward loan forgiveness, even during the extension period. This means that borrowers will continue making progress toward loan forgiveness without the need for additional payments, further reducing the overall burden of their loans.

More Time for Financial Planning

The extension provides borrowers with additional time to reassess their repayment strategies and plan for the future. This extra time can be used to explore alternative repayment options, consider refinancing options, or take steps to improve financial stability. Borrowers who use this time wisely may be able to secure better terms or reduce their overall debt burden in the long run.

Improved Credit Stability

By avoiding missed payments during the extension period, borrowers can help protect their credit scores. Credit stability is an essential component of overall financial health, and this extension will prevent borrowers from experiencing the negative consequences of missed payments, which could harm their creditworthiness in the future.

Career Flexibility

The extension also allows borrowers to explore career opportunities without the immediate pressure of loan repayments. For some borrowers, this relief may make it easier to consider career changes or pursue higher-paying job opportunities, ultimately improving their financial situation in the long run.

Economic and Financial Impacts

The extension is expected to have several economic and financial effects, both for individual borrowers and the wider economy. By offering borrowers more time to manage their loans, the government hopes to mitigate some of the broader financial impacts of student loan debt.

Loan Balance Trends

A 2024 report from the Centre for American Progress revealed that many borrowers, particularly those from minority groups, saw their loan balances increase due to accrued interest during previous payment pauses. The extension aims to minimize further increases in loan balances, helping borrowers maintain better control over their debt.

Inflation and Cost of Living

The U.S. Bureau of Labor Statistics reported that inflation remains at approximately 3%, which continues to affect borrowers’ purchasing power. Rising costs in housing, healthcare, and childcare further complicate the ability to repay loans. The extension provides a brief respite, allowing borrowers to better manage the financial pressures caused by inflation and cost-of-living increases.

Risk of Default

According to a report from the Consumer Financial Protection Bureau (CFPB), nearly 42% of federal student loan borrowers were unaware of affordable repayment options. For many borrowers, especially Pell Grant recipients, the risk of default remains high. This extension offers a chance for borrowers to better understand their repayment options and avoid default.

Expert Insights

While the extension provides immediate relief, experts agree that more long-term solutions are needed to address the student loan crisis. Education policy analysts warn that many borrowers, even those with full-time jobs, struggle with loan repayment. Financial advisors suggest that borrowers take advantage of the extension by using the extra time to strengthen their financial security, reduce high-interest debt, and build emergency funds.

Mixed Reactions to the Extension

The extension has generated a range of reactions across the political and economic spectrum. Some lawmakers and advocacy groups have praised the move as a vital step toward greater equity, while critics argue that it places an unnecessary burden on taxpayers and may delay long-term economic recovery.

Supporters highlight the positive impact of the extension, particularly for public servants and low-income borrowers, while critics express concerns about the fairness of continuing relief measures without addressing the root causes of student debt.