CERB 2.0? Emergency Relief Program Returns Amid Recession Fears (Government Debt Dilemma)

Ottawa, July 11, 2025 — In a striking move that has reignited debate across economic and political circles, the Canadian government has unveiled a new emergency income support plan, unofficially dubbed “CERB 2.0,” amid mounting fears of an imminent recession. The program, formally known as the Emergency Economic Relief Benefit (EERB), is designed to cushion Canadians from economic fallout as key sectors falter and inflationary pressures rise. But critics warn it may be a short-term lifeline with long-term fiscal consequences.

Launched just over four years after the original Canada Emergency Response Benefit (CERB) supported nearly 9 million citizens during the height of the COVID-19 pandemic, the EERB comes at a time when economic growth has stalled, household debt is at an all-time high, and global markets remain volatile.

The Economic Context: A Nation on the Brink

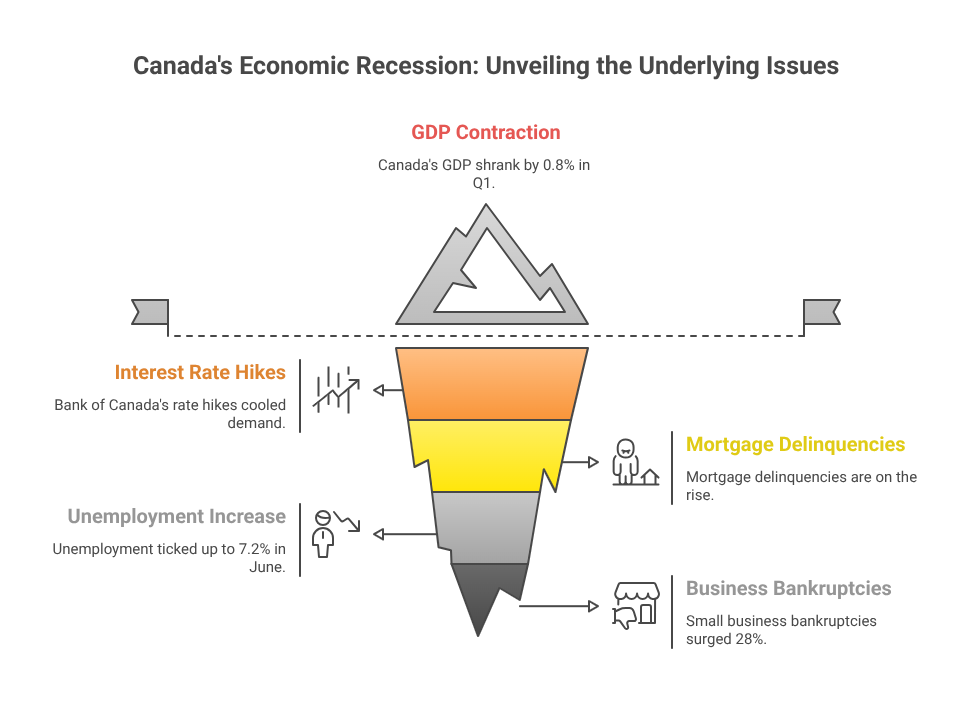

Canada’s economic engine has been sputtering in recent quarters. According to data released by Statistics Canada in June 2025, the country’s GDP shrank by 0.8% in Q1, following a marginal 0.2% contraction in Q4 of 2024, marking two consecutive quarters of negative growth and pushing Canada into a technical recession.

The Bank of Canada’s repeated interest rate hikes from 2022 to 2024, intended to curb inflation, have finally cooled consumer demand — but at a steep cost. Mortgage delinquencies are on the rise, unemployment ticked up to 7.2% in June (a three-year high), and small business bankruptcies surged 28% year-over-year.

“Our concern isn’t just about numbers. It’s about people — about families who can’t make rent, about workers who just lost their jobs, and businesses forced to close,” said Chrystia Freeland, Deputy Prime Minister and Finance Minister, during a press conference in Ottawa this morning.

She added, “EERB is a necessary bridge to help Canadians weather this storm while we implement broader recovery strategies.”

What Is CERB 2.0? Key Features of the EERB Program

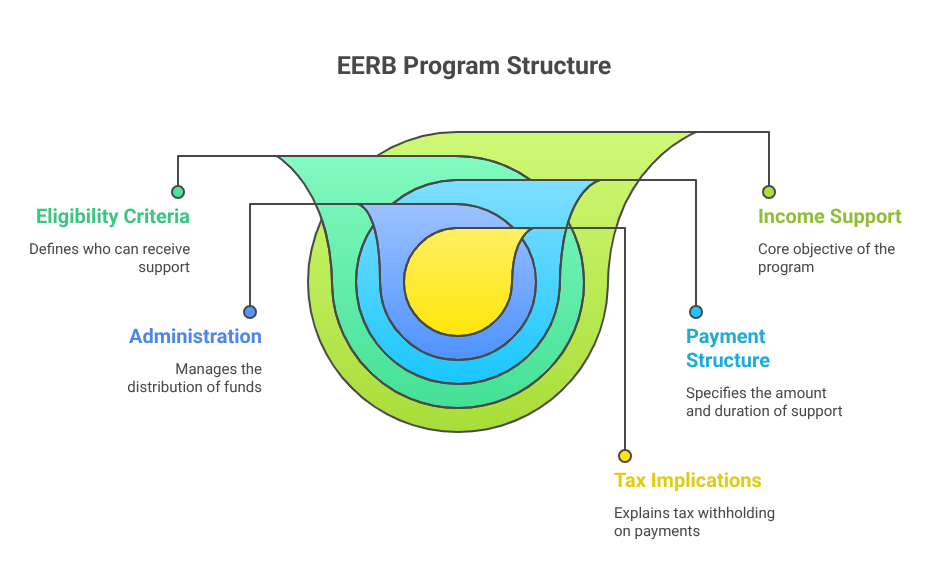

The EERB aims to provide short-term income support to Canadians who have lost employment, seen a significant drop in income, or are otherwise economically vulnerable due to the downturn. Here are the core components of the program:

- Eligibility: Canadians aged 15 and over who earned at least $5,000 in the previous year and have lost income due to economic conditions.

- Payment: $2,000 per month for up to four months.

- Delivery: Administered by the Canada Revenue Agency, with applications opening July 15 and funds expected to be disbursed within 5–10 business days.

- Taxable: Unlike the original CERB, EERB payments will have tax withheld at source to avoid surprises at tax season.

While the government insists the program is temporary and targeted, concerns about fiscal discipline are growing.

A Widening Deficit: Canada’s Debt Crisis Looms Larger

The new relief package, estimated to cost $35 billion if uptake matches CERB levels, will further deepen Canada’s budget deficit. The Parliamentary Budget Officer (PBO) recently warned that federal debt could balloon past $1.6 trillion by 2026 if emergency spending continues unchecked.

Canada’s debt-to-GDP ratio, once a model of fiscal prudence among G7 nations, now sits at 50.2% — up from 30.9% in 2019. The resurgence of income support programs is reigniting the debate about long-term sustainability versus short-term necessity.

“We’re entering dangerous territory,” said Kevin Page, former Parliamentary Budget Officer and president of the Institute of Fiscal Studies and Democracy. “While supporting people is essential, there needs to be a plan to scale back — otherwise, we risk compounding our structural debt problem.”

Bond markets have already reacted. Canadian 10-year government bond yields have edged up 18 basis points since Monday, signalling investor anxiety about increased borrowing.

Political Ramifications: Relief or Recklessness?

Unsurprisingly, the EERB has become a political lightning rod.

The governing Liberal Party insists the program reflects responsible leadership in turbulent times. “Canadians remember what it felt like during COVID. We won’t abandon them now,” Prime Minister Justin Trudeau said in a televised address.

But opposition parties have sounded the alarm.

“This is not CERB 2.0. It’s DEBT 2.0,” said Conservative Party leader Pierre Poilievre in a fiery response on Parliament Hill. “The Liberals are mortgaging our future to buy temporary popularity. This is reckless economic policy masquerading as compassion.”

NDP leader Jagmeet Singh has taken a more nuanced stance, supporting the relief but calling for a wealth tax to help fund it. “Let billionaires pay their fair share. Don’t let working people shoulder the burden of this crisis.”

The political divide reflects a larger societal debate: How much should governments spend to protect citizens in downturns, and when does that support become a liability?

Small Business Reaction: A Mixed Bag

For Canada’s struggling small businesses, the EERB has triggered mixed reactions.

Shawn McKenzie, who owns a family-run restaurant in downtown Toronto, says he supports the initiative. “My staff were terrified about making rent next month. This buys us some breathing room.”

However, other entrepreneurs are concerned that it could discourage work and lead to labour shortages, which is a common complaint from the first iteration of CERB.

“Last time, I couldn’t find kitchen staff for three months,” said Lisa Wong, a bakery owner in Vancouver. “If people can get $2,000 a month to stay home, how do I compete with that?”

The government has promised tighter monitoring to avoid abuse and is requiring applicants to actively seek employment or training opportunities to remain eligible — an attempt to address criticisms from the original CERB rollout.

Economic Experts Weigh In: Relief vs. Reform

Economists are split on the EERB.

Some argue it’s a necessary move to stabilize consumer confidence. “If people don’t feel secure, they stop spending — and that makes the recession worse,” said Dr. Jean-Claude Tremblay, a senior economist.

Others worry that the program masks deeper structural problems and delays hard choices. “We need productivity gains, investment in innovation, and housing reform — not just cheques in the mail,” said Heather Bouchard, policy director.

There’s also growing concern about inflation. Although rates have cooled to 3.1%, any renewed surge in disposable income could reignite price pressures, especially in housing and groceries.

Public Sentiment: Relief Brings Temporary Calm

Despite the political noise and economic concerns, many ordinary Canadians appear to welcome the return of income support.

A recent Ipsos-Reid poll conducted after the EERB announcement found that 62% of Canadians support the program, with support highest among younger workers (aged 18–34) and those living in urban centres.

“I lost my job at the car dealership last week. This program might help me avoid eviction,” said Samantha Green, a single mother in Halifax. “It’s not a long-term fix, but it’s something.”

Still, some Canadians are uneasy. “I got CERB last time and ended up owing a lot of tax. I’m worried the same thing will happen again,” said Jordan Pierre, a freelancer.

Global Context: Canada Is Not Alone

Canada’s approach mirrors moves in other developed economies. The United States is reportedly considering targeted stimulus checks if its jobless rate climbs past 6%, while Germany has unveiled a €40 billion “stabilization package” to support workers in vulnerable industries.

“The return of income support shows that governments around the world are preparing for economic turbulence,” said Dr. Sofia Ramos, global economist at the OECD. “But how they fund these programs — and what trade-offs they make — will determine their long-term resilience.”

What Happens Next?

As the first EERB payments roll out later this month, eyes will be on uptake levels, fiscal impacts, and the effectiveness of accompanying job retraining and economic diversification plans.

The government has hinted that EERB could evolve into a broader guaranteed basic income framework — a politically charged idea that has been gaining traction in policy circles.

“CERB 2.0 may be a trial run for something bigger,” said Dr. Andrea Khan, a public policy expert at the University of Toronto. “But whether Canada can afford that shift — politically or financially — remains to be seen.”

A High-Stakes Gamble

With the reintroduction of CERB-style support, Canada has stepped into familiar yet dangerous territory. The EERB may offer much-needed relief, but it also rekindles debates over fiscal responsibility, labour market incentives, and the role of government in times of crisis.

In the words of one economist: “It’s a Band-Aid — but on a wound that may need surgery.”

As Canada braces for what could be a prolonged economic slump, the EERB represents both a promise and a peril. For millions of Canadians, it’s a lifeline. For policymakers, it’s a test of priorities and consequences.