How to Prioritize Debts and Pay Off Faster

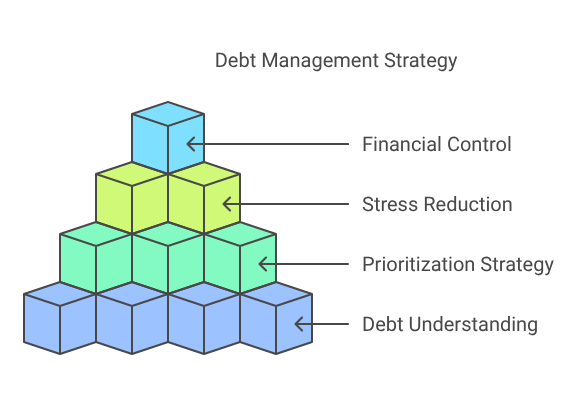

Managing debt effectively is crucial to achieving financial stability. When debts accumulate, it can be overwhelming to decide where to start. Prioritizing your debts strategically not only helps you reduce financial stress but also accelerates the path to becoming debt-free. By following a structured approach, you can manage repayments efficiently and regain control over your finances.

Understanding Your Debt Profile

Before creating a repayment strategy, it is essential to assess your current debt situation. Start by listing all your debts, including credit cards, personal loans, mortgages, and any outstanding balances. For each debt, note the following details:

- Outstanding balance

- Interest rate

- Monthly minimum payment

- Due dates

By organizing this information, you can better understand your financial obligations and identify which debts require immediate attention. Additionally, knowing your total debt amount allows you to set realistic goals for repayment and track your progress effectively.

Prioritizing High-Interest Debts First

One of the most effective strategies is to focus on high-interest debts, often called the “avalanche method.” This method involves paying off the debt with the highest interest rate first while making minimum payments on other accounts. By targeting high-interest debts, you minimize the total amount paid in interest over time.

For example, if you have multiple credit cards with varying interest rates, start by allocating extra funds toward the one with the highest rate. Once that debt is cleared, shift your focus to the next highest-rate debt, and so on. This strategy is particularly useful for minimizing long-term costs and saving substantial money over time.

The Snowball Method: Gaining Momentum

An alternative strategy, known as the “snowball method,” involves paying off the smallest debt first, regardless of interest rates. While this may not minimize interest payments as efficiently, it helps build psychological momentum. Successfully clearing smaller debts early can motivate you to continue your repayment journey with confidence.

This method is ideal for those who need frequent victories to stay encouraged during their debt repayment process. Additionally, as smaller debts are eliminated, the freed-up cash flow can be redirected to tackle larger debts more effectively.

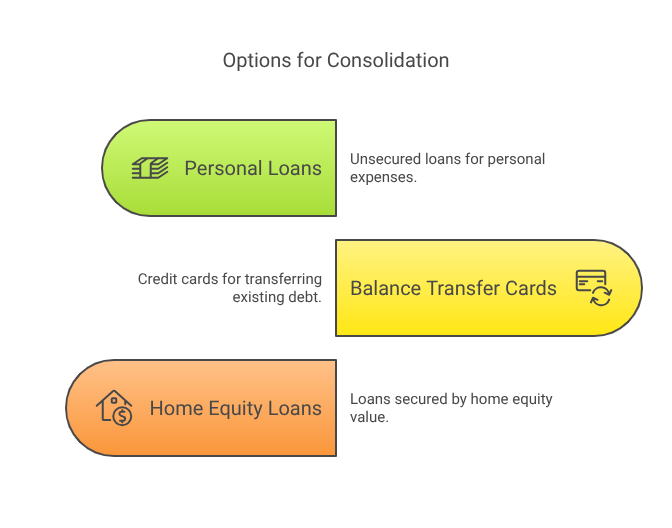

Consolidating Debts for Simplified Payments

Debt consolidation can streamline repayment by combining multiple debts into a single account, often with a lower interest rate. Options for consolidation may include:

- Personal loans

- Balance transfer credit cards

- Home equity loans

Consolidation simplifies the repayment process by reducing multiple due dates and may lower your overall interest costs. However, it’s essential to evaluate fees and terms to ensure this option aligns with your financial goals. Additionally, before opting for consolidation, consider your spending habits and ensure you won’t accumulate further debt during the repayment process.

Creating a Realistic Budget

Budgeting plays a critical role in prioritizing debt repayments. Establish a budget that outlines your income, fixed expenses, and discretionary spending. Identify areas where you can reduce expenses, redirecting those savings toward debt payments.

For example, cutting back on dining out, entertainment subscriptions, or non-essential purchases can free up additional funds to pay down your outstanding balances. Additionally, tracking your daily expenses and setting spending limits can help you stay on top of your budget.

Using budgeting tools or mobile apps can simplify this process. Apps like Mint, YNAB (You Need a Budget), and Pocket Guard offer features to categorize expenses, track debt progress, and set financial goals.

Setting Up Automatic Payments

Missed payments can lead to penalties and damage your credit score. To ensure consistency, set up automatic payments for at least the minimum required amounts on each debt. Automating payments reduces the risk of forgetting due dates and keeps your repayment plan on track.

Automatic payments are particularly helpful for fixed expenses like student loans, mortgages, and auto loans. By automating these essential payments, you reduce the risk of falling behind and ensure steady progress toward clearing your debts.

Exploring Additional Income Streams

Boosting your income can accelerate your debt repayment journey. Consider exploring side hustles, freelance work, or part-time jobs to generate extra earnings. Applying this additional income directly toward your debt can significantly reduce repayment timelines.

Some popular side income options include:

- Freelancing in areas like writing, graphic design, or coding

- Driving for ride-sharing services

- Selling unused items online

- Offering tutoring services

By dedicating extra income to high-interest debts, you can reduce the overall financial burden faster.

Communicating with Creditors

If you’re facing financial hardship, reaching out to creditors may help you manage your obligations. Some lenders offer hardship programs, reduced interest rates, or extended repayment terms to support borrowers. Being proactive can prevent penalties and demonstrate your commitment to resolving your debts responsibly.

When contacting creditors, explain your financial situation clearly and propose a realistic repayment plan. Creditors are often more willing to cooperate if they see your proactive approach and willingness to resolve outstanding balances.

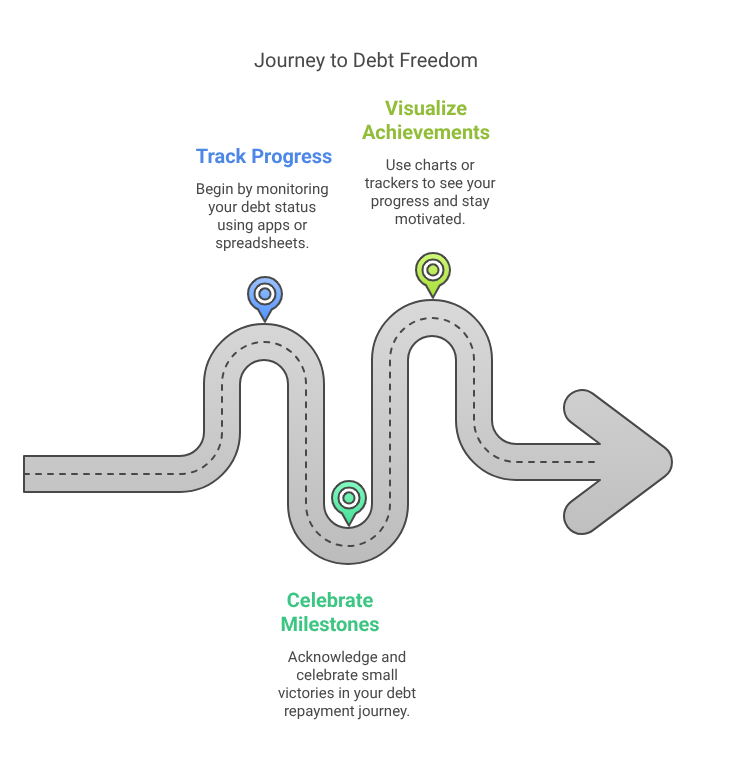

Tracking Progress and Staying Motivated

Monitoring your progress is essential to maintaining focus. Use financial apps or spreadsheets to track your debt balances, interest savings, and milestones achieved. Celebrating small victories, such as fully repaying a credit card or loan, can keep you motivated throughout the process.

Visualizing your progress can also boost morale. Creating a debt payoff chart or using a visual goal tracker allows you to see your achievements and encourages continued efforts.

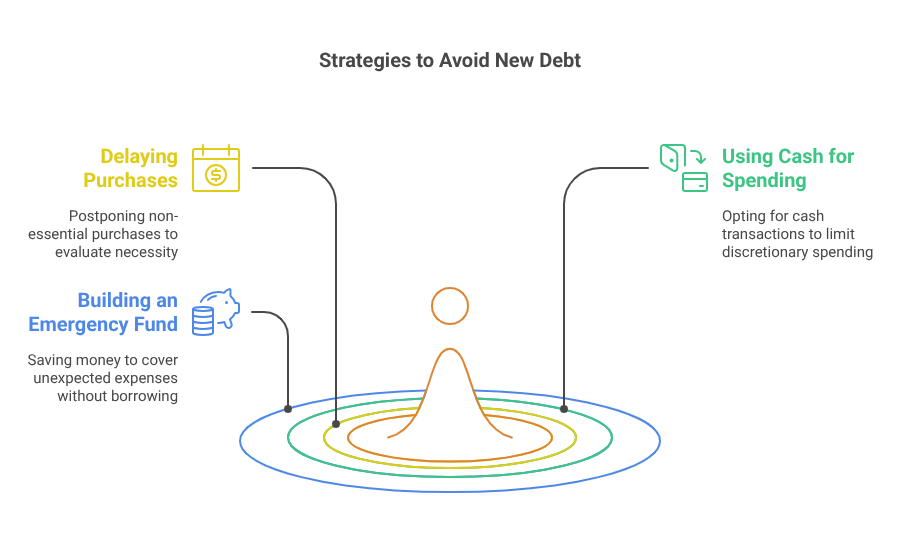

Avoiding New Debt

While repaying existing debts, it’s crucial to avoid accumulating new debt. Resist impulsive spending and evaluate purchases carefully. Focus on improving your financial discipline to ensure you stay on track with your debt reduction goals.

Consider adopting strategies like:

- Delaying non-essential purchases for 30 days to assess their necessity

- Using cash instead of credit for discretionary spending

- Building an emergency fund to handle unexpected expenses without borrowing

By controlling new debt accumulation, you can maintain consistent progress toward financial stability.

Building an Emergency Fund

While prioritizing debt repayment, setting aside a small emergency fund is equally important. This fund acts as a financial cushion for unexpected expenses like medical emergencies, car repairs, or job loss. Having an emergency fund reduces the need to rely on credit cards or loans, which can further complicate debt management.

Start by saving a modest amount, such as $500 to $1,000, and gradually increase it to cover three to six months’ worth of expenses.

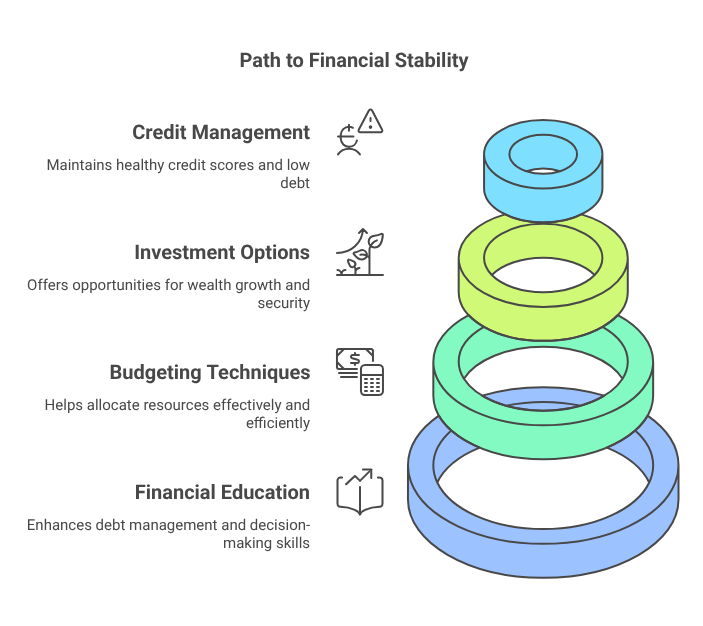

Investing in Financial Education

Improving your financial literacy can enhance your debt management efforts. Reading financial books, attending workshops, or consulting financial advisors can help you make informed decisions. Understanding budgeting techniques, investment options, and credit management strategies can equip you with the skills to maintain long-term financial stability.

Achieving Financial Freedom

Effectively prioritizing and repaying debts requires dedication, planning, and persistence. By taking calculated steps, managing your spending, and staying disciplined, you can regain financial stability and achieve long-term financial freedom. Remember, small consistent efforts lead to significant financial progress, helping you build a secure and debt-free future.