First-Time Home Buyers: How to Avoid Massive Debt Traps

Buying your first home is an exciting step, but it can quickly turn into a financial disaster if you’re not prepared. With rising property prices, hidden costs, and aggressive loan offers, many first-time buyers unknowingly fall into debt traps that can take years to escape.

Massive mortgages, ballooning EMIs, and overlooked expenses have left thousands struggling to keep up with monthly payments. What was meant to be a dream home becomes a long-term financial burden. But it doesn’t have to be that way.

This guide breaks down the most common traps and the smart financial moves to avoid them—so you can step into homeownership with confidence, not regret.

Understanding the Debt Trap in Home Buying

A debt trap in real estate usually occurs when the buyer takes on more mortgage or associated financial responsibilities than they can afford. This can stem from:

- Taking out a high-interest loan

- Overestimating your repayment capacity

- Underestimating hidden costs

- Ignoring long-term affordability

Once you’re in this trap, your monthly payments might stretch your income so thin that it becomes difficult to cover even basic expenses.

1. Don’t Rely Solely on Loan Pre-Approvals

Getting pre-approved for a mortgage might give you confidence, but it doesn’t necessarily reflect what you can comfortably afford. Lenders often calculate your eligibility based on gross income, not taking into account personal spending, debts, or lifestyle needs.

Pro Tip: Use the 28/36 rule—your mortgage should not exceed 28% of your gross income, and total debts should not go beyond 36%.

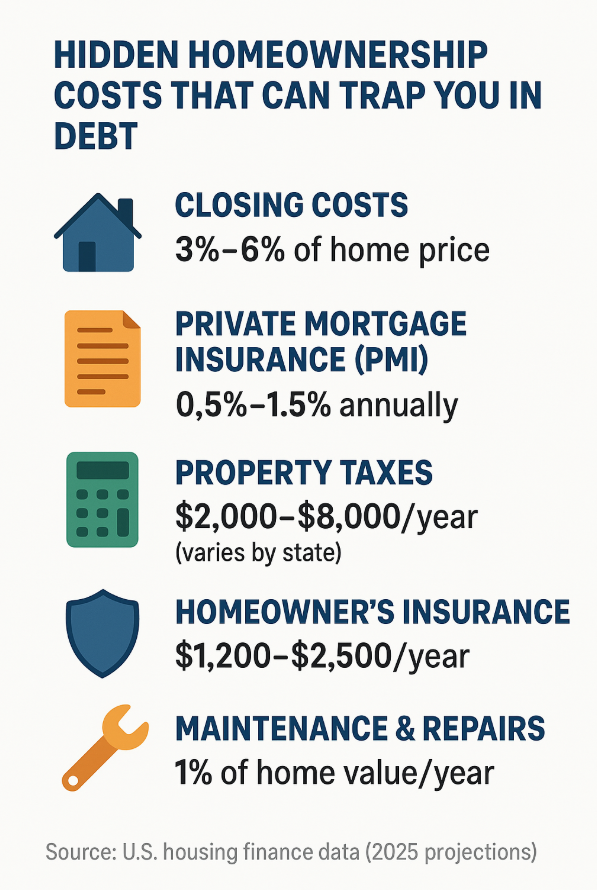

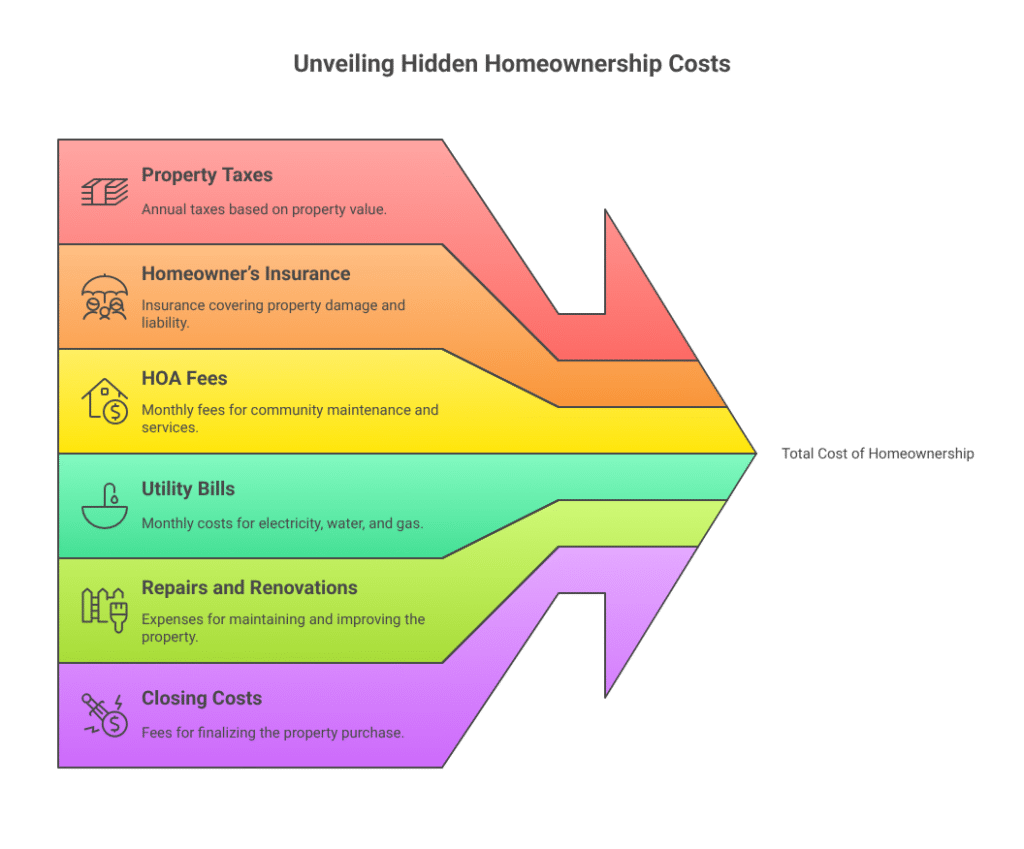

2. Know the True Cost of Homeownership

Most first-time buyers focus on the purchase price and the monthly EMI (Equated Monthly Instalments). However, the real cost includes:

- Property taxes

- Homeowner’s insurance

- HOA or maintenance fees

- Utility bills

- Repairs and renovations

- Closing costs and legal fees

Ignoring these expenses can create a snowball effect, pushing you into high-interest credit card debt to make up for shortfalls.

3. Avoid Stretching Your Budget to the Limit

Many first-time buyers fall in love with a property that’s just a little above their budget and stretch their finances thin to afford it. This often leads to:

- Increased monthly repayments

- Reduced emergency savings

- Delayed long-term goals like retirement or education

Smart Strategy: Set a hard cap on your home-buying budget—and stick to it.

4. Don’t Skip the Down Payment

While low-down-payment home loan options might sound attractive, they increase your debt burden significantly. A smaller down payment means a bigger loan, higher EMIs, and more interest over time.

Why it matters:

- Increases loan-to-value ratio

- Higher interest paid over the loan tenure

- Greater risk of going underwater if the property value drops

Aim for at least 20% down payment to avoid private mortgage insurance (PMI) and reduce long-term debt.

5. Factor in Interest Rate Fluctuations

If you’re opting for a floating interest rate home loan, be aware that your monthly payments could increase dramatically if market rates rise. Always calculate affordability based on worst-case scenarios, not current rates.

Quick Tip: Use home loan calculators to simulate payments at different interest rates before committing.

6. Beware of Variable Income Assumptions

Assuming future promotions, bonuses, or business growth to justify buying a more expensive property is risky. Life and income can be unpredictable, and debt is certain.

Realistic Planning: Base your loan repayments on your current guaranteed income and make sure you have a financial buffer for 6–12 months of expenses.

7. Avoid High-Interest Bridge Loans or Personal Loans

Some buyers use short-term loans to make up for down payments or registration costs. These loans usually come with high interest rates and short repayment windows, increasing debt pressure just as you begin your mortgage journey.

Alternative: Save aggressively for your home-buying fund or consider financial assistance from family if feasible.

8. Don’t Ignore Your Credit Score

Your credit score determines not just your loan eligibility, but also your interest rate. A lower credit score can result in significantly higher EMIs.

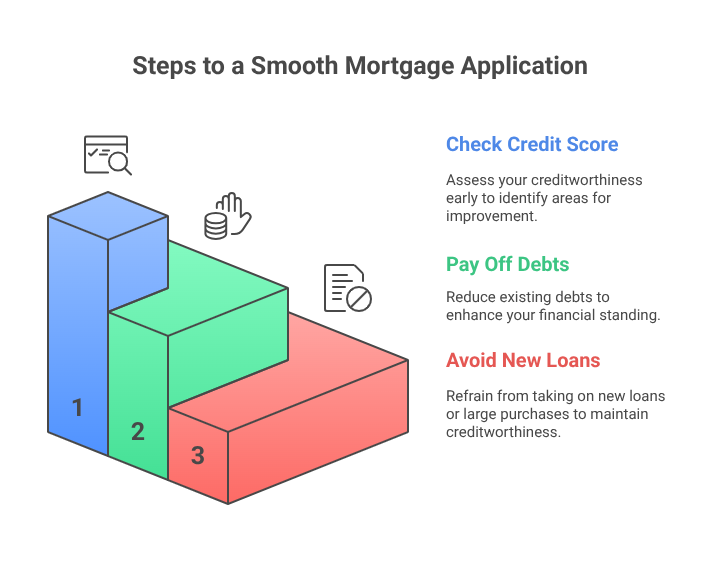

Action Steps:

- Check your credit score well in advance

- Pay off existing debts

- Avoid new loans or large purchases before applying for a mortgage

9. Get the Property Inspected

Skipping property inspections to save money upfront can lead to expensive surprises like water damage, electrical faults, or structural issues. These repairs can easily lead to tens of thousands in unexpected debt.

Recommendation: Always opt for a professional home inspection and ensure the seller addresses major issues before closing.

10. Work With a Trusted Real Estate Agent

An experienced real estate agent can save you from poor decisions, identify overpriced properties, and negotiate better deals. But be cautious—not all agents prioritize your financial well-being.

Tip: Choose an agent with experience in helping first-time buyers and who is transparent about all costs involved.

11. Don’t Fall for Developer or Builder Traps

Many developers offer discounts, gifts, or EMI-free schemes to attract first-time buyers. While they look appealing, they often hide inflated base prices, higher interest rates, or legal issues tied to the property.

Always read the fine print and get a legal review before committing.

12. Keep an Emergency Fund Intact

Your entire savings should not go into buying the home. If any unexpected expense arises—job loss, health issue, or urgent repair—you’ll be forced to take high-interest loans or use credit cards, deepening your debt.

Pro Tip: Have at least 3–6 months of expenses set aside in an emergency fund before you make the down payment.

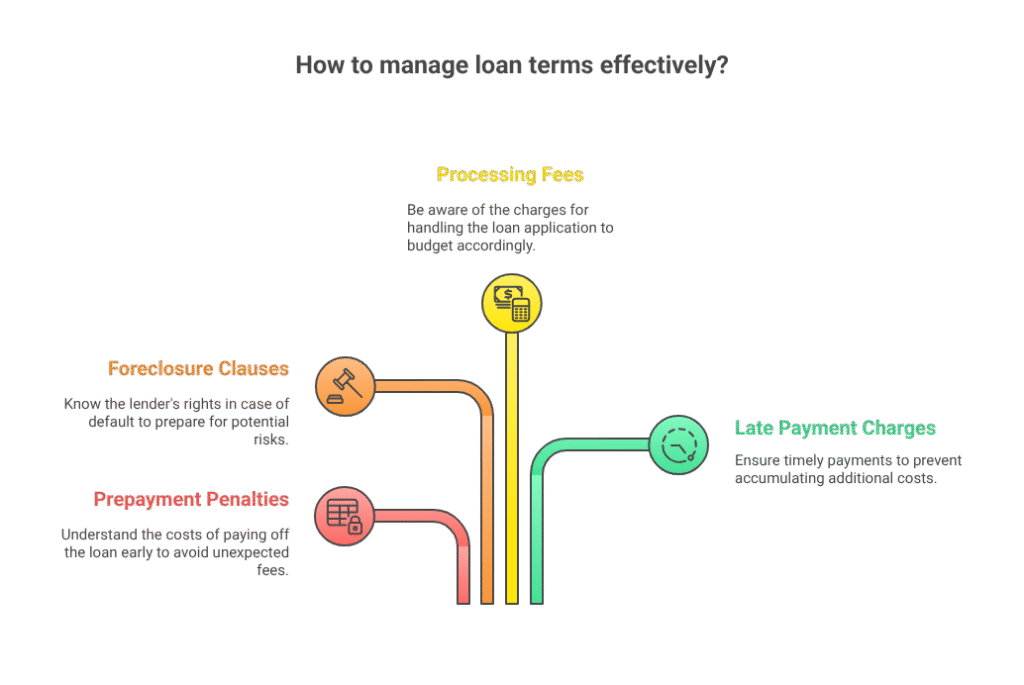

13. Review Your Loan Agreement Carefully

Loan documents are often full of jargon and hidden clauses. Ensure you understand:

- Prepayment penalties

- Foreclosure clauses

- Processing fees

- Late payment charges

Hire a financial advisor or legal consultant if needed. The small cost now can save a huge debt later.

14. Don’t Rush the Process

Buying a home is an emotional journey. But rushing into a purchase due to FOMO (Fear of Missing Out) or social pressure can lead to lifetime debt stress.

Take your time to:

- Compare multiple home loans

- Visit several properties

- Understand all associated costs

- Plan for long-term affordability

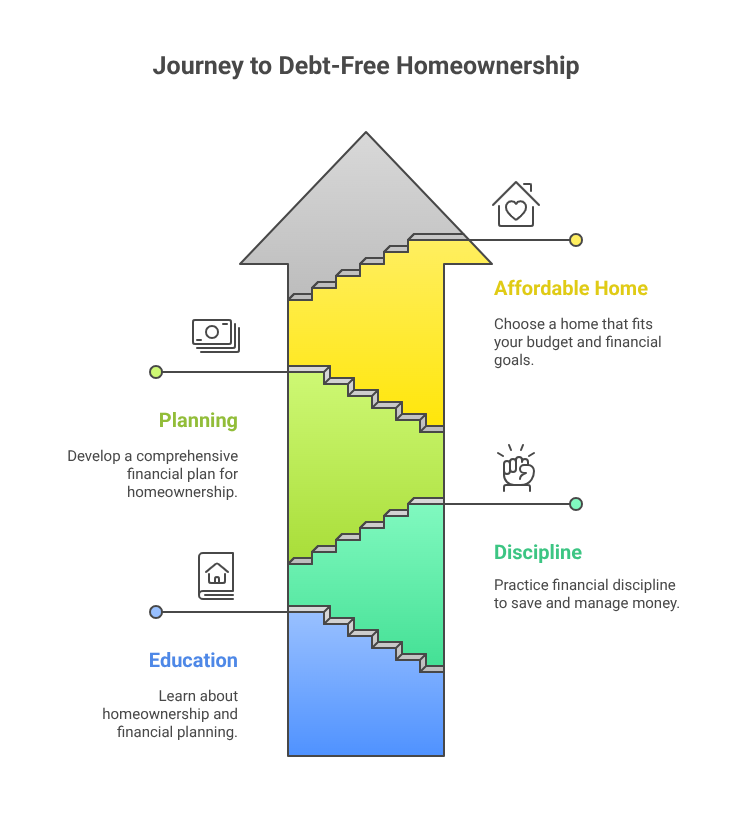

Debt-Free is the Best Way to Begin Your Homeownership Journey

Becoming a homeowner should bring joy, not sleepless nights. The key to avoiding massive debt traps is education, discipline, and planning. A dream home can become a nightmare if your finances are not in place.

Remember: A smaller home that fits your budget is better than a luxurious one that breaks the bank.