Common Mistakes to Avoid When Negotiating Debt Settlements

Debt settlement is a financial strategy that allows borrowers to reduce their total debt burden by negotiating directly with creditors. While this approach can offer significant relief, it also carries potential risks if not handled properly. Avoiding common pitfalls can make the difference between successful debt resolution and further financial distress. Below are five key mistakes to watch out for when negotiating debt settlements and how to overcome them effectively.

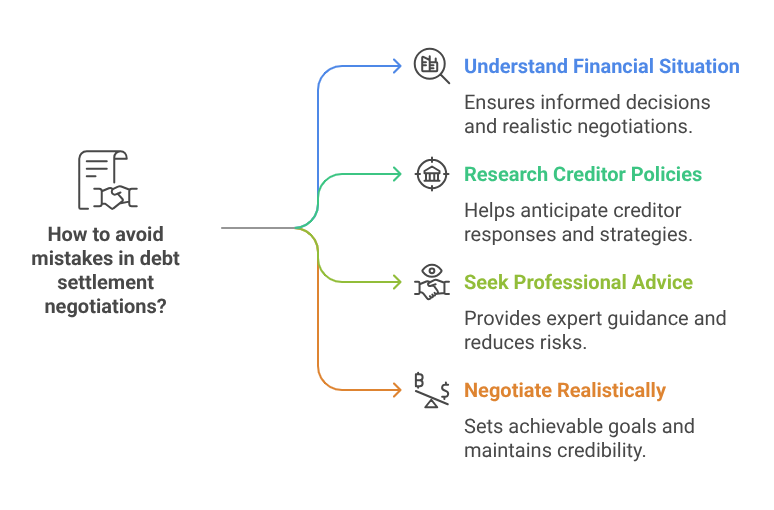

1. Failing to Understand Your Financial Situation

One of the most common errors borrowers make is entering negotiations without a clear understanding of their financial position. Without a detailed view of your income, expenses, and outstanding debts, you may accept terms that are unaffordable or fail to negotiate effectively.

How to Avoid:

- Create a comprehensive budget that outlines all sources of income and fixed expenses.

- Assess your total debt load, including interest rates, minimum payments, and outstanding balances.

- Identify the maximum amount you can reasonably afford to pay as a lump sum or through structured payments during settlement discussions.

By being fully aware of your financial standing, you’ll be better equipped to present realistic offers and avoid overcommitting to payments you cannot sustain.

Additional Insight:

- Consider using budgeting tools or apps to track your spending habits. These tools provide clear insights into where your money is going and help you identify areas to reduce expenses, allowing you to allocate more towards debt repayment.

- Review your credit report to ensure there are no inaccuracies or debts that have already been resolved. Mistakenly negotiating a settled debt could waste time and resources.

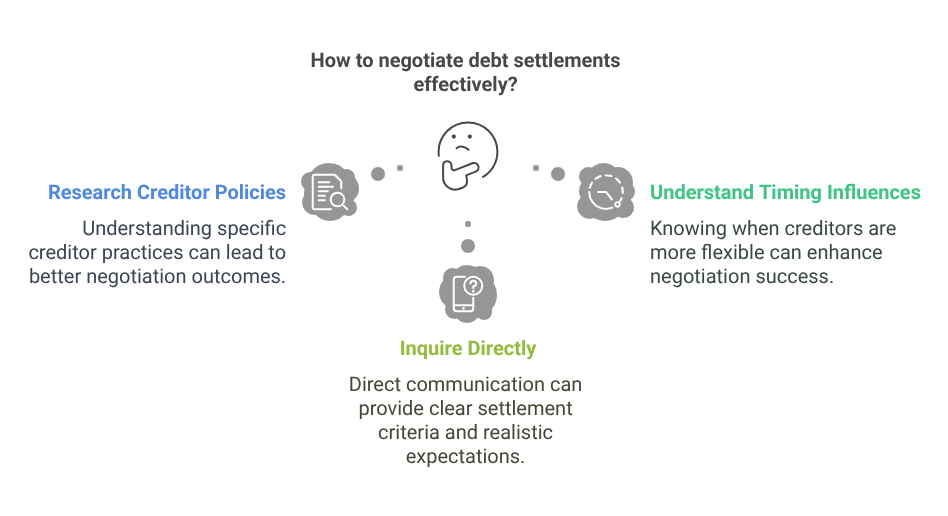

2. Neglecting to Research Creditor Policies

Each creditor may have unique policies and procedures regarding debt settlements. Assuming that all creditors will follow the same rules or strategies can result in poor negotiation outcomes.

How to Avoid:

- Research each creditor’s typical settlement practices. Some may be open to reducing principal balances, while others may focus more on reducing interest or fees.

- Understand the timing that influences creditors’ decisions. Creditors may be more flexible at specific points in their fiscal year or when debts are nearing charge-off status.

- Contact creditors directly to inquire about their settlement criteria, ensuring you enter discussions with realistic expectations.

This proactive approach helps you tailor your negotiation strategy to align with each creditor’s preferences and improve the chances of reaching a favorable agreement.

Additional Insight:

- Review consumer protection laws, such as the Fair Debt Collection Practices Act (FDCPA), to understand your rights and ensure creditors adhere to legal requirements during negotiations.

- If you’re unsure about the best approach, consider seeking guidance from debt counselors who are familiar with various creditor practices.

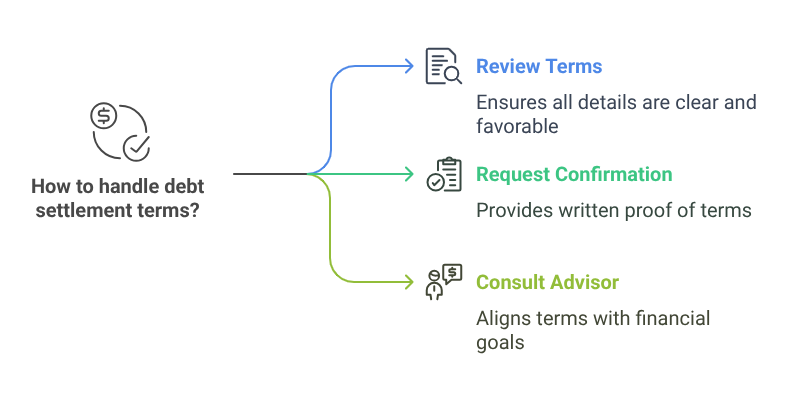

3. Agreeing to Unfavourable Terms Without Review

Borrowers often make the mistake of accepting settlement offers without thoroughly reviewing the terms. Agreements may include hidden fees, unreasonable payment deadlines, or terms that can negatively impact your credit profile.

How to Avoid:

- Carefully read the settlement agreement before signing. Ensure all negotiated terms, including the payment amount, timeline, and credit reporting status, are clearly documented.

- Request written confirmation of the settlement offers before committing to any payments.

- Consult with a financial advisor or debt counselor to review the terms and ensure they align with your long-term financial goals.

Taking time to understand the fine print can prevent unpleasant surprises and ensure you benefit from the settlement as intended.

Additional Insight:

- Be aware of the terms that could affect your credit score. Some settlements may be reported as “paid in full,” while others may be marked as “settled for less than the full amount,” which could impact future borrowing opportunities.

- Ensure deadlines are reasonable and feasible within your financial plan. Unachievable timelines can increase the risk of defaulting on the agreed terms.

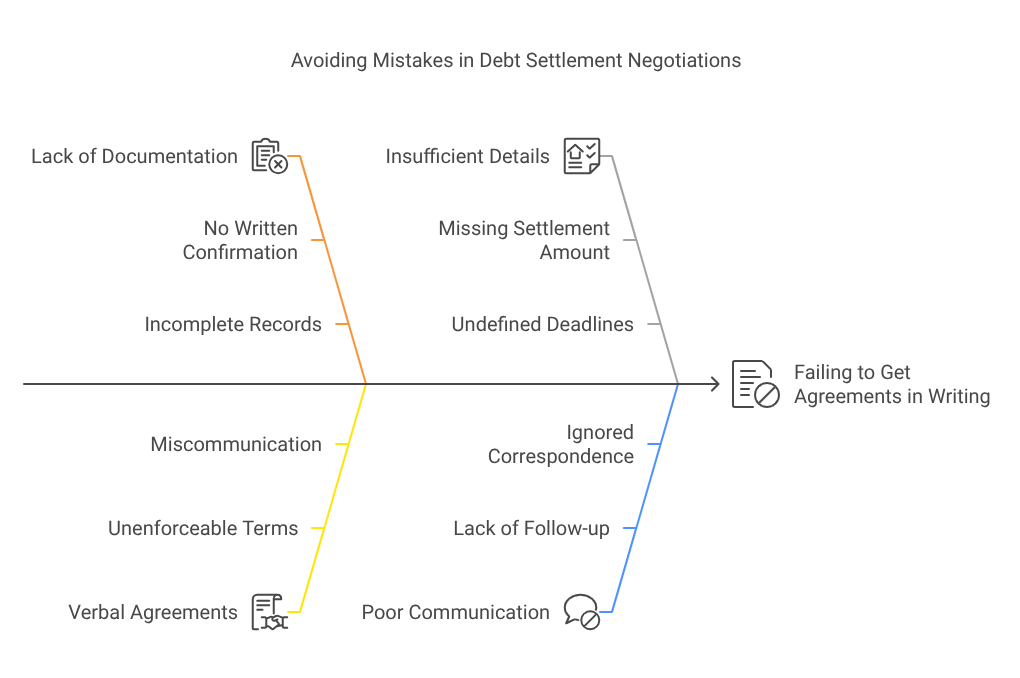

4. Failing to Get Agreements in Writing

Verbal agreements in debt settlements are risky and often unenforceable. Without documented proof of the agreed terms, creditors may deny the settlement arrangement or continue to pursue the full balance.

How to Avoid:

- Insist on written confirmation of all agreed terms before making any payments.

- Ensure the document specifies the total settlement amount, payment deadlines, and confirmation that the debt will be marked as “paid” or “settled in full.”

- Maintain copies of all correspondence, including emails, letters, and receipts of payments made.

Proper documentation provides a record of the agreement and protects you in case disputes arise later.

Additional Insight:

- Consider sending all written communication via certified mail or requesting email receipts to ensure there is a documented trail of the negotiation process.

- Maintain organized records, including timelines and payment details, to ensure you can provide evidence of compliance if disputes arise later.

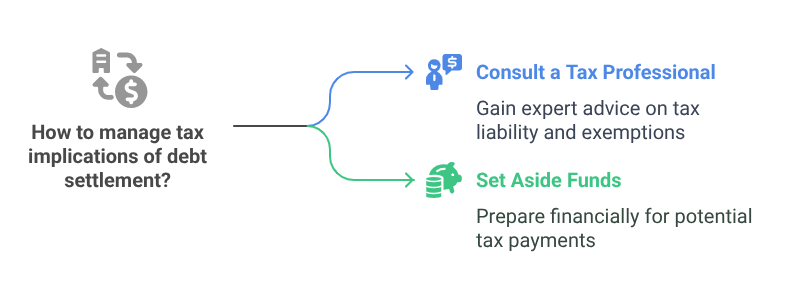

5. Ignoring Tax Implications of Debt Settlement

Many borrowers are unaware that forgiven debt may be considered taxable income by the IRS. Failing to prepare for this tax responsibility can create unexpected financial burdens.

How to Avoid:

- Understand that canceled debt exceeding $600 may be reported to the IRS via Form 1099-C.

- Consult a tax professional to assess your liability and explore potential exemptions, such as insolvency, which may reduce or eliminate your tax obligation.

- Set aside funds to cover any anticipated tax payments to avoid future financial stress.

Being aware of tax implications ensures that you account for all potential costs tied to debt settlement.

Additional Insight:

- If you are insolvent — meaning your debts exceed your total assets — you may qualify for tax relief on canceled debt. A tax professional can help you determine eligibility and complete the required paperwork.

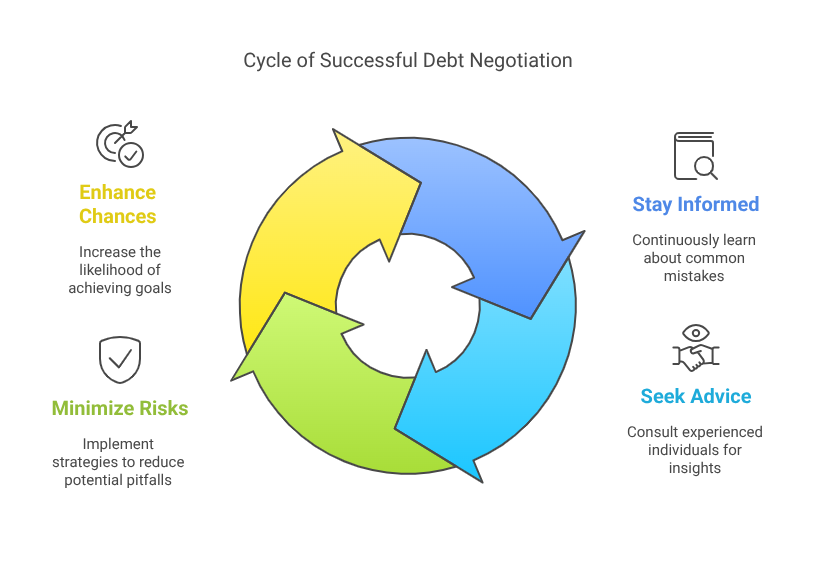

Additional Tips for Successful Debt Settlement

Beyond avoiding mistakes, there are proactive steps you can take to improve your chances of reaching a favorable settlement:

- Communicate Proactively: Keep open communication with creditors and demonstrate your commitment to resolving the debt. Providing a clear explanation of your financial hardship may encourage creditors to offer more favorable terms.

- Prioritize Debts Strategically: Focus on settling high-interest debts or accounts at risk of legal action first.

- Consider Professional Assistance: Debt settlement companies or credit counseling services may help guide negotiations effectively. However, research these services carefully to ensure they are reputable and follow ethical practices

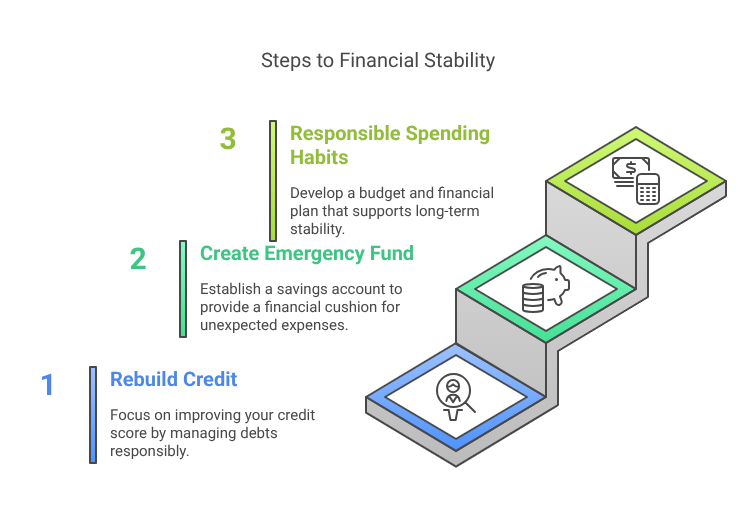

Building a Strong Financial Future After Settlement

Successfully settling debt is a major achievement, but it’s equally important to build lasting financial stability afterward. Consider these steps to improve your financial well-being:

- Rebuild Your Credit: After a settlement, work on improving your credit score by paying bills on time, reducing credit card usage, and monitoring your credit report regularly.

- Create an Emergency Fund: Establishing an emergency savings account can prevent you from relying on credit during future financial difficulties.

- Adopt Responsible Spending Habits: Create a long-term financial plan that aligns with your income, savings goals, and necessary expenses.

Final Thoughts

Debt settlement can be a powerful tool for regaining financial stability, but success requires careful planning and awareness of common mistakes. By understanding your financial position, researching creditor policies, reviewing all terms thoroughly, documenting agreements in writing, and preparing for tax implications, you can navigate the debt settlement process confidently. With a strategic approach, you can secure favorable outcomes that ease your financial burden and set the stage for long-term financial well-being.