Canada’s Debt Clock Ticks Faster Post-COVID: Are We Headed for Austerity?

Ottawa, September 2025 – Canada’s debt clock is racing forward at an alarming pace, sparking fears that the country is edging closer to a period of austerity. Pandemic-era spending, rising interest costs, and slowing economic growth have collided, leaving Ottawa with some of the toughest fiscal choices in decades.

COVID Spending: The Debt Legacy

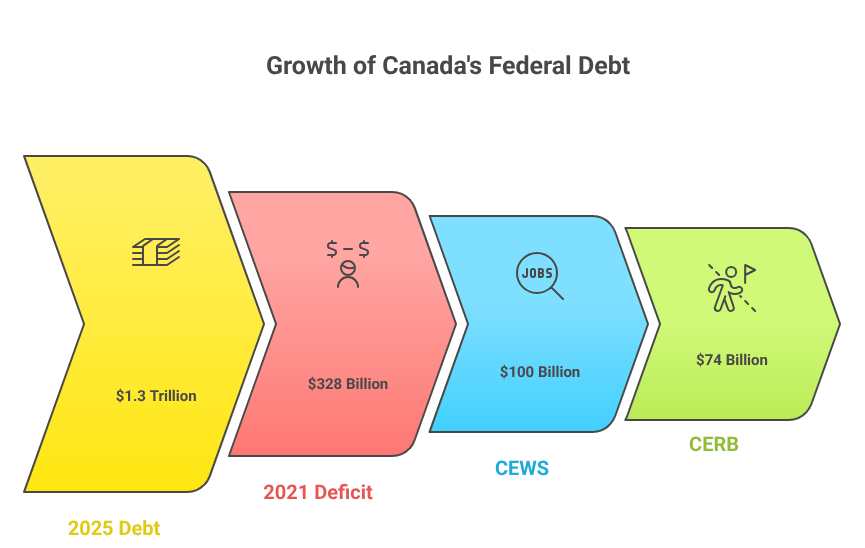

When the pandemic hit in 2020, the federal government rolled out massive emergency programs:

- Canada Emergency Response Benefit (CERB) paid out more than $74 billion to over 8.9 million Canadians.

- Canada Emergency Wage Subsidy (CEWS) supported 5 million jobs and cost nearly $100 billion.

- Additional small business loans, rent subsidies, and health transfers added to the tab.

By the end of 2021, Canada’s deficit had ballooned to a record $328 billion. While economists agree the measures were necessary, the long-term cost has left a deep fiscal scar.

As of mid-2025, Canada’s federal debt has surpassed $1.3 trillion, nearly double its pre-pandemic level. On a per capita basis, every Canadian now carries over $33,000 in federal debt alone.

“The pandemic measures were life-saving,” says economist Linda Grant. “But Ottawa is now dealing with the hangover—higher borrowing costs and less fiscal room to maneuver.”

Interest Rates: The Hidden Burden

The Bank of Canada’s aggressive rate hikes, aimed at controlling inflation, have made debt repayment far costlier. Interest payments, once a modest line item in federal budgets, are now consuming a significant portion of revenues.

- In 2019: $24 billion was spent on interest.

- In 2025: projected to exceed $55 billion.

That figure is now larger than annual federal spending on national defense and close to matching what Ottawa allocates to Indigenous Services and Employment Insurance benefits combined.

“Interest is the silent budget killer,” warns RBC analyst Michael Hughes. “It’s money that delivers no new services or infrastructure—it’s simply paying for past borrowing.”

Provinces in the Red

The fiscal crunch is not limited to Ottawa. Provinces, which bear the bulk of healthcare and education spending, are under equal pressure:

- Ontario: Debt has climbed past $450 billion, giving it one of the highest debt-to-GDP ratios among sub-national governments worldwide.

- Quebec: Projects balanced budgets but warns rising healthcare costs could tip it back into deficit by 2027.

- Alberta: Oil price volatility threatens revenues, even as the province tries to diversify its economy.

- British Columbia: Running back-to-back deficits, partly due to wildfire recovery and infrastructure spending.

The Conference Board of Canada estimates that combined provincial debt could hit $900 billion by 2027, a figure that would rival federal debt levels.

The Austerity Question

The word “austerity” remains politically toxic, but fiscal experts say the signs are unavoidable. What could austerity in Canada look like?

- Healthcare: Slower hospital expansions, longer wait times, and hiring freezes for nurses and doctors.

- Education: Tuition increases, fewer grants, caps on university operating budgets.

- Infrastructure: Delays in housing, transit, and climate adaptation projects.

- Social Programs: Potential reforms to Old Age Security and Employment Insurance.

“Canadians are accustomed to strong social supports,” says Carleton University policy professor Marc Dupuis. “If austerity comes, it will be felt most in households already struggling with affordability.”

Political Divide Deepens

The fiscal debate is now front and center in Ottawa.

- Liberals argue that continued investments in green energy, innovation, and housing are vital for long-term growth, even if they push debt higher in the short term.

- Conservatives want strict limits on spending and have floated the idea of balanced budget legislation, similar to laws in some U.S. states.

- NDP leaders oppose cuts, advocating instead for wealth taxes and higher corporate levies to protect workers and social programs.

A recent Abacus Data survey shows Canadians are divided: 46% support reducing deficits even if services are cut, while 42% prefer maintaining social spending even if debt grows further.

Debt Clock: A Symbol of Anxiety

The Canadian Taxpayers Federation’s giant Debt Clock parked on Wellington Street in Ottawa has become a rallying point for fiscal hawks. Its digital counter, rising by thousands every second, shows the stark reality of the country’s growing obligations.

In July 2025, the clock ticked past $1.3 trillion, prompting the Federation to issue a blunt warning: “Every day we delay, the interest bill grows, and future generations pay the price.”

Lessons From Abroad

Canada’s dilemma draws parallels with Europe’s post-2008 experience. Nations like Greece, Spain, and Portugal imposed strict austerity to satisfy creditors, but the result was double-digit unemployment and prolonged recessions.

The U.K.’s austerity drive after 2010 also slashed public services, contributing to long wait times in the National Health Service and crumbling local infrastructure.

“Canada should learn from Europe,” says economist Grant. “Excessive austerity risks slowing growth and deepening inequality. But ignoring debt risks, credit downgrades, and investor flight.”

The Household Debt Factor

Complicating matters further is Canada’s household debt crisis. Canadians carry one of the highest household debt-to-income ratios in the world—over 180%. With mortgage rates climbing, many households face financial stress, particularly in Toronto and Vancouver.

- Average mortgage payments in Toronto are up 41% since 2020.

- Consumer insolvencies rose 18% year-over-year in 2024, according to the Office of the Superintendent of Bankruptcy.

“Households are tapped out,” warns economist David Rosenberg. “If government austerity adds more pressure, consumer spending could collapse.”

Are Tax Hikes Inevitable?

While politically risky, many analysts believe tax increases will be part of the solution.

- Raising the GST: A one-point increase could generate over $7 billion annually.

- Wealth Tax: A 1% levy on fortunes over $10 million could bring in $5–7 billion.

- Corporate Reforms: Closing loopholes could add $10 billion in revenue.

Yet polls suggest Canadians are wary. An Ipsos survey in August found 58% oppose new federal taxes, fearing they would worsen affordability pressures.

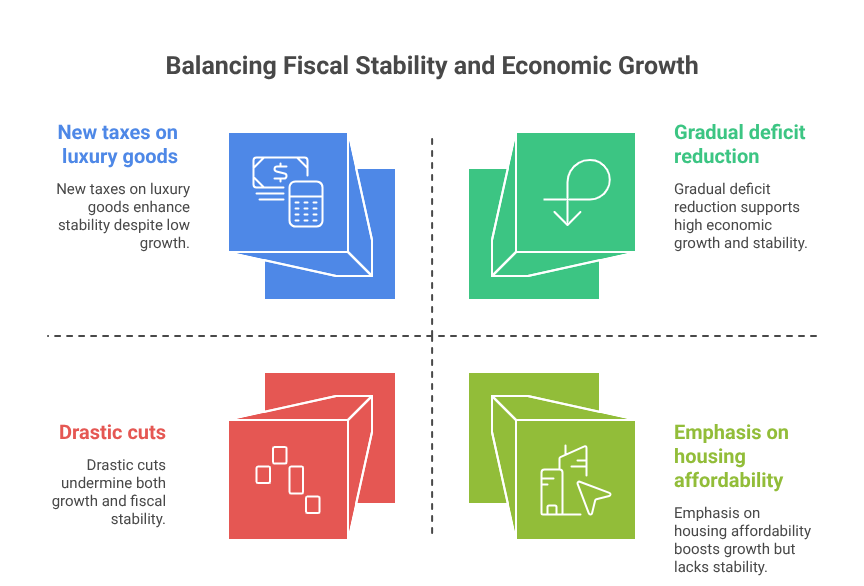

Business Community on Edge

The Canadian Chamber of Commerce has warned Ottawa that fiscal tightening must be balanced with economic growth policies. “Businesses already face high borrowing costs, labor shortages, and trade disruptions,” said President Perrin Beatty. “The last thing they need is tax hikes or drastic cuts that undermine confidence.”

What to Expect in the Fall Budget

Finance Minister Chrystia Freeland is expected to deliver a budget blueprint in October that outlines a path to fiscal stability. Sources suggest it may include:

- Gradual deficit reduction targets.

- New taxes on luxury goods and excess corporate profits.

- Limited new spending, with emphasis on housing affordability.

- A framework for long-term healthcare funding reform.

Still, questions remain whether these measures will be enough to slow the debt clock’s relentless pace.

Conclusion: A Nation on the Brink

Canada’s debt debate is no longer abstract—it’s tangible, visible, and unavoidable. With debt costs climbing, provinces straining, and households already overextended, the country faces difficult choices.

Whether Ottawa opts for austerity, targeted tax hikes, or a growth-first strategy, one reality is clear: the era of cheap borrowing is over.

As the debt clock ticks louder, Canadians are left to wonder—how much longer before the bill comes due, and who will pay the price?