Smart Borrowing in 2025: Turning Debt into Financial Leverage

In 2025, Americans are rethinking how they borrow, spend, and invest. The old idea that all debt is bad no longer fits in an economy driven by innovation and financial opportunity. Smart Borrowing in 2025 has become a cornerstone of financial success in the United States, allowing individuals to use good debt to build wealth, gain assets, and achieve long-term financial independence.

Instead of avoiding loans altogether, financially savvy Americans are learning how to make debt work for them — not against them. The concept of Smart Borrowing in 2025 focuses on leveraging low-interest loans, managing repayments strategically, and aligning every borrowing decision with clear financial goals.

When used intelligently, smart borrowing transforms debt from a liability into a source of financial leverage, helping individuals grow their net worth and achieve stability in a competitive U.S. economy.

The Evolution of Smart Borrowing in the United States

Over the past decade, the American financial landscape has changed dramatically. Access to credit is easier than ever, yet so is the temptation to borrow recklessly. That’s why Smart Borrowing in 2025 matters more than ever — it’s about balancing opportunity with responsibility.

With economic uncertainty, rising education costs, and fluctuating housing prices, Americans must understand how to differentiate good debt from bad debt. Smart borrowers in 2025 recognize that every loan must serve a purpose — to build, grow, or create long-term value.

Whether it’s a mortgage for a first home, a student loan to earn a degree, or business credit to expand a company, smart borrowing gives Americans the power to use debt as a financial tool rather than a financial trap.

Defining Smart Borrowing in 2025

So, what does Smart Borrowing in 2025 really mean? It’s the practice of borrowing money intentionally and intelligently — ensuring that every dollar borrowed contributes to financial growth or income potential.

The foundation of Smart Borrowing in 2025 includes:

- Borrowing for investments that appreciate in value or increase earning potential.

- Managing interest rates and repayment terms efficiently.

- Building and protecting credit history.

- Avoiding impulsive spending and unnecessary credit usage.

- Maintaining financial discipline even when money is available to borrow.

In short, smart borrowing means using debt as a strategy to create financial leverage, not as a quick fix for lifestyle inflation.

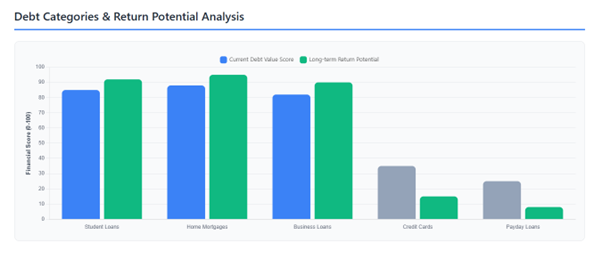

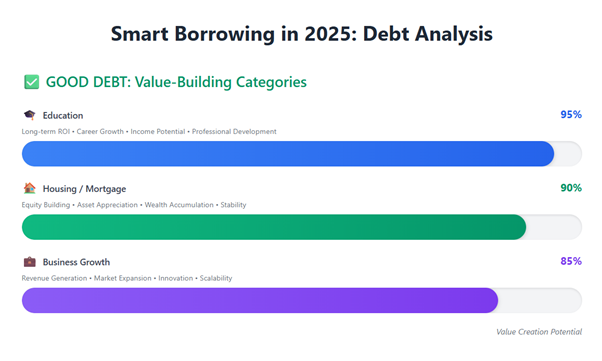

Good Debt vs. Bad Debt in 2025

Understanding the difference between good debt and bad debt is at the heart of Smart Borrowing in 2025. Good debt helps you generate future income or long-term value, while bad debt drains your cash flow and limits financial freedom.

Good Debt Examples:

- Student Loans: When used to fund education or professional certifications that lead to better-paying careers.

- Home Mortgages: Loans that help build property equity and long-term wealth.

- Business Loans: Borrowing that enables growth, expansion, and innovation.

Bad Debt Examples:

- High-interest Credit Cards: Often used for non-essential purchases with little to no return value.

- Payday Loans: Extremely high-interest short-term loans that trap borrowers in cycles of repayment.

- Overfinancing for Lifestyle: Borrowing to fund vacations or luxury items without financial returns.

By recognizing and managing these differences, Americans in 2025 can use Smart Borrowing to advance, not struggle.

Smart Borrowing for Education in 2025

Education remains one of the smartest investments for future financial success. However, it’s also one of the most common sources of debt in the U.S. The secret is knowing how to borrow smartly.

Smart Borrowing in 2025 for education means choosing degrees and programs that offer strong career potential and stable earnings. It also involves minimizing borrowing by combining scholarships, grants, and part-time income.

Students who practice smart borrowing:

- Borrow only what’s necessary for tuition and essential costs.

- Compare loan terms and interest rates before signing.

- Prioritize federal loans over private ones when possible.

- Plan repayment before graduation using online calculators and budgeting tools.

By approaching education as a long-term investment, Smart Borrowing in 2025 ensures that student debt becomes a stepping stone to greater opportunity, not a lifelong burden.

Smart Borrowing in Housing: The American Dream Reimagined

Homeownership continues to symbolize financial stability and success in the U.S., and Smart Borrowing in 2025 has reshaped how Americans approach mortgages.

Rather than stretching finances for oversized homes or risky adjustable-rate loans, today’s smart borrowers choose fixed-rate, affordable options aligned with their income. They build equity steadily, refinance wisely, and protect their credit score.

Smart Borrowing Tips for Housing:

- Borrow within your budget — not beyond it.

- Keep your debt-to-income ratio below 36%.

- Choose stable interest rates for predictability.

- Reinvest home equity into productive assets.

This approach transforms a mortgage from a lifelong obligation into a strategic financial leverage tool that builds wealth over time.

Smart Borrowing for Business Growth

For entrepreneurs, Smart Borrowing in 2025 is a lifeline. Whether you’re running a small online business or scaling a startup, access to capital is vital for growth. But smart borrowing means knowing when and how to take on debt.

A well-planned business loan can fuel innovation, hire staff, or expand into new markets. However, unplanned borrowing can lead to insolvency.

To master Smart Borrowing in 2025 for business:

- Use borrowed funds for revenue-generating activities.

- Keep detailed cash flow records.

- Avoid mixing personal and business debts.

- Maintain clear repayment timelines.

When executed properly, business loans don’t just sustain operations — they amplify potential. Smart entrepreneurs treat debt as financial leverage, allowing them to grow faster while maintaining control.

Technology’s Role in Smart Borrowing in 2025

The rise of digital finance in the U.S. has made Smart Borrowing in 2025 more accessible than ever. Apps and financial dashboards give users real-time insights into their spending, credit utilization, and debt obligations.

Artificial intelligence and predictive analytics help consumers identify the best interest rates and repayment options. Personalized alerts warn borrowers before they miss payments, and credit health tools track their progress toward financial goals.

With these innovations, smart borrowing is no longer limited to financial experts — it’s a practical, data-driven skill available to every American.

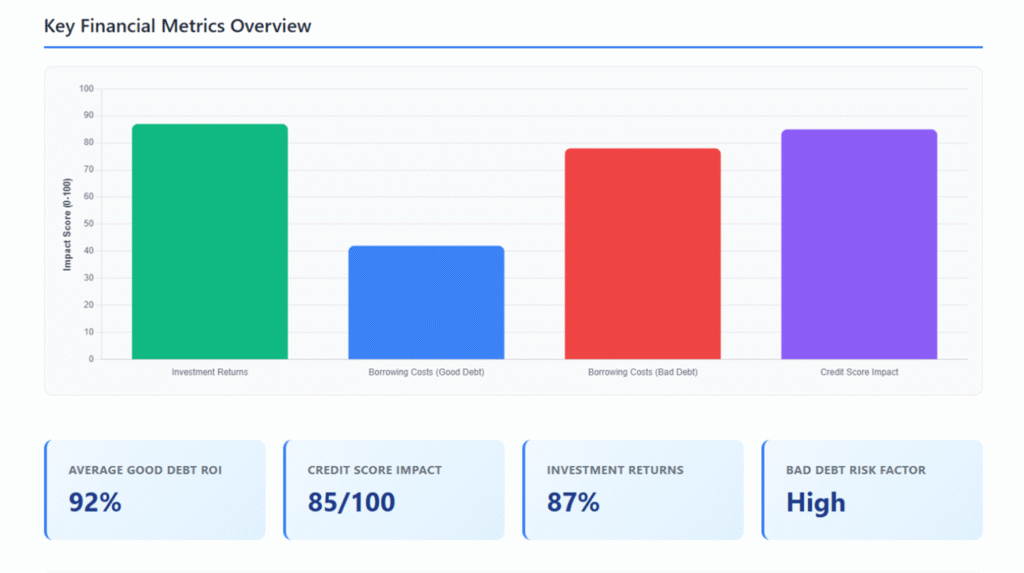

Building and Maintaining Strong Credit

Credit is the foundation of Smart Borrowing in 2025. A strong credit score not only improves access to loans but also determines how affordable those loans are. Every smart borrowing strategy should include steps to build, maintain, and protect credit.

Key habits include:

- Paying bills and loans on time.

- Keeping credit utilization below 30%.

- Avoiding frequent credit inquiries.

- Monitor credit reports regularly.

Good credit opens doors to lower interest rates, higher approval chances, and stronger financial leverage. It is a silent but powerful ally in your borrowing strategy.

The Mindset Behind Smart Borrowing

Smart borrowing isn’t just about numbers — it’s about mindset. Successful borrowers in 2025 see debt as a resource to be managed, not feared. They borrow with intention, confidence, and foresight.

This mindset involves three core beliefs:

- Every dollar borrowed should produce greater value in the future.

- Borrowing decisions must align with clear financial goals.

- Debt management is a continuous process of monitoring and discipline.

By adopting this mentality, Americans can transform their relationship with debt and create a solid foundation for financial independence.

Managing Risks with Smart Borrowing in 2025

Even the best borrowing strategies carry risks. Interest rates can rise, job markets can fluctuate, and personal emergencies can occur. That’s why Smart Borrowing in 2025 emphasizes risk management.

Every borrower should build an emergency fund, review their debt portfolio annually, and avoid overleveraging. Balancing optimism with caution ensures that smart borrowing remains sustainable and profitable.

By maintaining financial resilience, borrowers turn uncertainty into opportunity.

The Future of Smart Borrowing in America

In the U.S., Smart Borrowing in 2025 is not about avoiding debt — it’s about mastering it. Americans who borrow strategically are using debt as a force for growth, education, housing, and entrepreneurship.

When used wisely, smart borrowing transforms obligations into opportunities. It builds credit, strengthens financial health, and turns every loan into a calculated step toward independence.

Debt isn’t inherently negative — mismanagement is. The true financial winners in 2025 will be those who understand how to borrow smartly, repay responsibly, and transform every dollar of debt into meaningful financial leverage for a stronger future.