How to Save Money and Invest Wisely (Even on a Small Budget)

Want to grow your wealth without feeling restricted?

You don’t need a big salary or a fancy financial advisor to start building wealth. With just a few smart habits and consistent effort, you can save more, invest smarter, and watch your money grow — even on a small budget.

Here are five simple habits that can help you save money and invest wisely 👇

1️⃣ Use a Savings Account or Saving Apps

If you’re serious about saving, start by separating your money. Open a high-interest savings account or use automated saving apps like YNAB, Mint, or PocketGuard. These tools help you track expenses, set savings goals, and automatically move small amounts into your savings every week.

💡 Pro Tip: Treat your savings like a fixed monthly bill — something that must be “paid” before you spend on anything else.

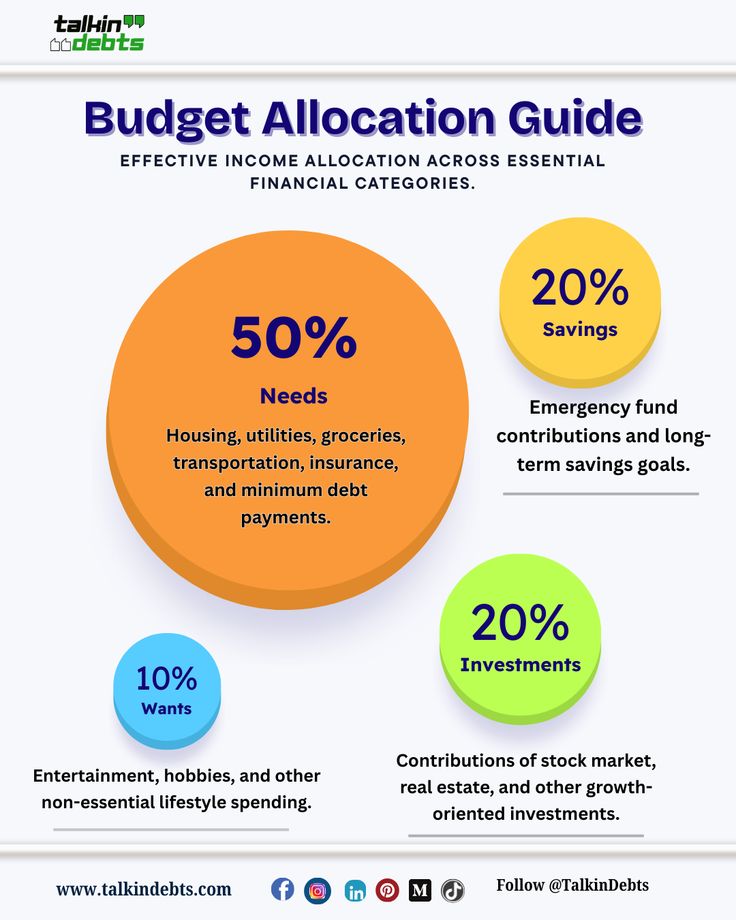

2️⃣ Create a Budget and Stick to It

A budget is your financial roadmap. It helps you understand where your money goes and how you can redirect it toward your goals.

Start with the 50/30/20 rule:

- 50% for needs (rent, bills, groceries)

- 30% for wants (entertainment, shopping)

- 20% for savings and investments

Using budgeting tools or simple spreadsheets can make this process much easier. The goal isn’t to restrict yourself — it’s to make sure your money works for you, not the other way around.

3️⃣ Avoid Debt and Spend Wisely

Debt can be one of the biggest barriers to saving and investing. If you’re carrying high-interest debt (like credit cards or payday loans), make it your priority to pay that off first.

Practice mindful spending:

- Ask yourself before every purchase: Do I really need this?

- Compare prices online before buying.

- Wait 24 hours before making non-essential purchases.

By cutting unnecessary expenses, you’ll free up more money to save or invest.

4️⃣ Save at Least 20% of Your Income

This is the golden rule of financial success. Even if you can’t save 20% right away, start small — save 5% or 10% of your income and increase it gradually.

💰 Example:

If you earn $1,000 a month, saving just $100 consistently can grow to over $1,200 a year — without any investment return. Add interest or investment growth, and that number climbs higher.

Consider setting up automatic transfers from your checking to your savings account each payday — this ensures saving becomes effortless and consistent.

5️⃣ Learn the Basics of Investing

Saving money is just the first step — investing is what helps it grow. You don’t need thousands of dollars to start; even small, consistent investments can make a big difference over time.

Here are some beginner-friendly investment options:

- Index funds or ETFs – Low-cost, diversified, and ideal for long-term growth.

- Retirement accounts (401k, IRA, NPS, or EPF) – Save for your future while getting tax benefits.

- Robo-advisors – Automated platforms that invest your money based on your goals and risk level.

🎯 Key Tip: Start early and stay consistent. The magic of compound interest means your money earns more money the longer you invest.

Final Thoughts

Building wealth isn’t about making huge sacrifices or earning a massive income. It’s about being intentional — saving smart, spending wisely, and investing consistently.

Start small, stay patient, and remember: every smart money decision you make today shapes your financial freedom tomorrow.

💬 Your Next Step

Ready to take control of your finances?

➡️ Visit TalkinDebts.com for more personal finance insights, debt management tips, and investment guides to help you make confident money decisions.