US Household Debt Hits New High — What It Means for Consumers Worldwide

Record-Breaking Debt Levels Signal Global Ripple Effects

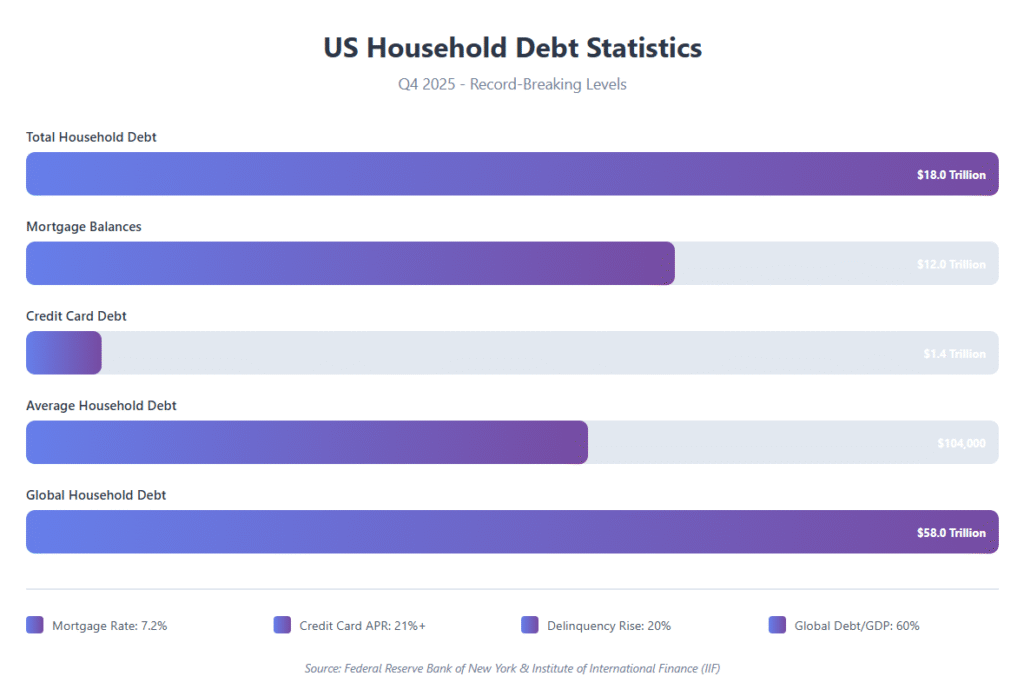

The latest data from the Federal Reserve reveals that U.S. household debt has surged to an all-time high, surpassing $18 trillion in Q4 2025, fueled by rising mortgage balances, auto loans, and credit card spending. Economists warn that this milestone is more than just a domestic concern—it’s a signal that global borrowing patterns are entering a dangerous new phase.

While American consumers struggle under the weight of record obligations, the rest of the world is watching closely. The U.S. debt trend, analysts say, could influence global interest rates, lending policies, and even the pace of economic recovery in emerging markets.

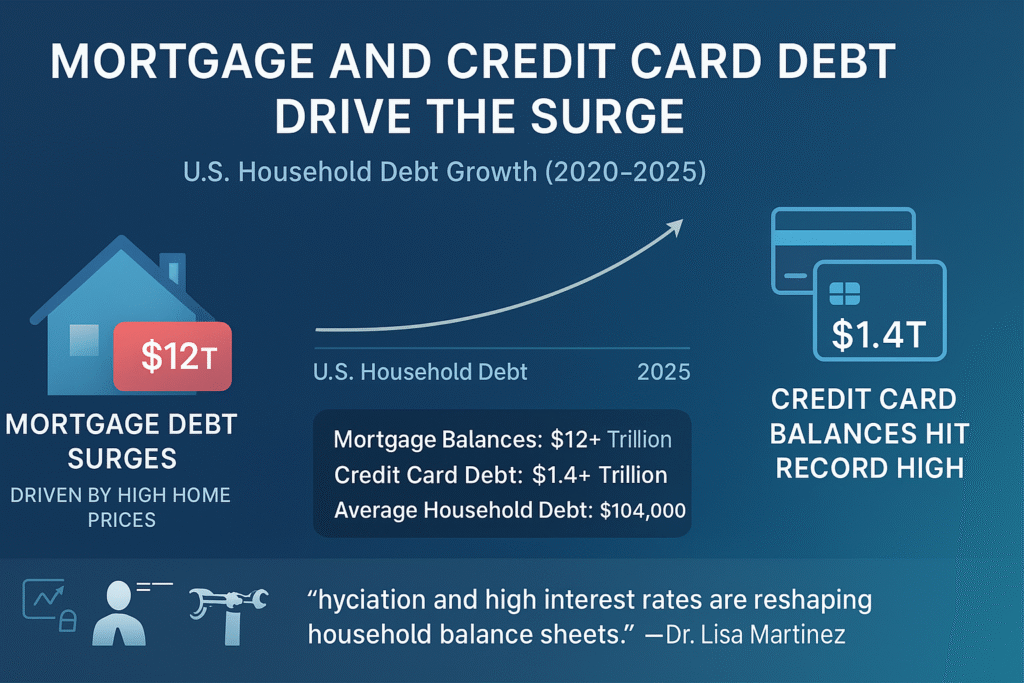

Mortgage and Credit Card Debt Drive the Surge

According to the Federal Reserve Bank of New York, mortgage balances make up the lion’s share of household debt, now exceeding $12 trillion—a jump driven by high home prices and limited housing supply. Credit card debt, meanwhile, has climbed past $1.4 trillion, reflecting persistent inflation and stagnant wage growth.

The average American household now carries roughly $104,000 in total debt, including mortgages, auto loans, and credit cards. For many, this is the highest level of indebtedness since before the 2008 financial crisis.

“We’re witnessing the impact of sticky inflation and elevated interest rates on consumer balance sheets,” said Dr. Lisa Martinez, a senior economist. “Households are borrowing more just to maintain their standard of living.”

Higher Interest Rates Are Amplifying the Pain

The Federal Reserve’s aggressive rate hikes, aimed at cooling inflation, have made borrowing significantly more expensive. Mortgage rates are hovering near 7.2%, while credit card APRs average above 21%—the highest in more than three decades.

As a result, delinquency are on the rise. The New York Fed reports that credit card and auto loan delinquencies have increased by nearly 20% compared to last year, particularly among younger borrowers and low-income households.

“For many families, the financial strain is reaching a breaking point,” said Janet Holloway, a financial analyst. “The combination of high living costs and soaring interest rates is eroding consumer resilience.”

Global Borrowing Costs May Follow

The U.S. is not an isolated case. Because the U.S. dollar serves as the world’s reserve currency, American monetary policy often sets the tone for borrowing costs worldwide.

Central banks from Canada to the European Union and Australia typically adjust their own rates in response to the Federal Reserve’s decisions to avoid capital flight and inflationary pressure.

That means as the U.S. keeps rates higher for longer, global borrowing costs are likely to remain elevated, making it harder for both households and businesses across the world to access affordable credit.

“When the Fed tightens, the world tightens,” said Paul Vickers, a market strategist. “Emerging economies feel the squeeze first, especially those dependent on dollar-denominated debt.”

The Domino Effect on Global Economies

Economists are already seeing ripple effects in global markets:

- Europe: Eurozone consumers face record-high credit card interest rates, exceeding 20% in some countries. Household debt-to-GDP ratios are climbing fast, especially in Spain and Italy.

- Asia-Pacific: In Australia and South Korea, mortgage holders are experiencing severe repayment stress as central banks mirror U.S. rate moves.

- Developing Nations: Countries with dollar-denominated debt, such as Argentina and Turkey, are facing sharp increases in debt-servicing costs.

As global debt piles up, the IMF has warned of an emerging “household debt trap” that could stifle economic growth if not addressed through coordinated fiscal and monetary policies.

Rising Defaults Could Test Financial Stability

Analysts are increasingly concerned that rising default rates may test the resilience of financial institutions worldwide. In the U.S., delinquency rates on credit cards and auto loans have already surpassed pre-pandemic levels.

If this trend continues, banks could tighten lending standards further—slowing down consumer spending and corporate investment. That could, in turn, trigger a slowdown across multiple economies.

“We are seeing early warning signs of debt fatigue,” said David Lin, an economic researcher. “When household leverage outpaces income growth, systemic risk becomes unavoidable.”

Consumer Behavior Is Changing

American consumers are cutting back on discretionary spending, shifting priorities toward essential goods and debt repayment. E-commerce platforms and retail chains report that consumers are increasingly turning to buy-now-pay-later (BNPL) services and personal loans to manage expenses.

Globally, a similar shift is taking place. Households in Canada, the UK, and Japan are showing signs of “debt adaptation”—altering their financial behaviours to cope with higher costs.

“Household budgets are being rewritten,” said Emily Crawford, a behavioral economist. “People are saving less, borrowing more, and postponing major purchases. The psychological impact of debt is profound and growing.”

Policymakers Face a Delicate Balancing Act

The Federal Reserve now faces one of its toughest challenges yet: how to curb inflation without collapsing household finances. If it cuts rates too soon, inflation could rebound. If it keeps them high for too long, consumer defaults could spike further.

Meanwhile, international policymakers are grappling with similar dilemmas. In the UK, the Bank of England has signalled a cautious approach to rate cuts, citing persistent inflation in services. In Canada, mortgage resets are expected to test household solvency through 2026.

The OECD has urged central banks to improve communication and coordination to prevent “policy fragmentation” that could amplify global financial instability.

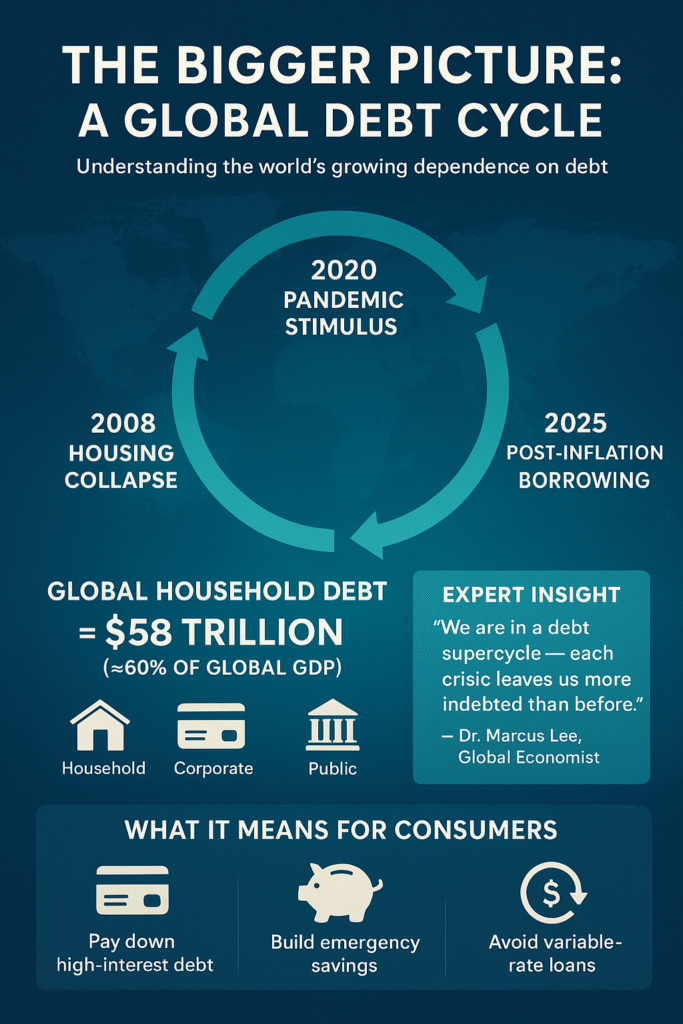

The Bigger Picture: A Global Debt Cycle

The current debt surge underscores a deeper structural issue: the world’s overreliance on credit-driven growth. From the 2008 housing collapse to the 2020 pandemic stimulus and now post-inflation borrowing, the global economy has repeatedly leaned on debt as a lifeline—and each cycle has ended with greater financial strain.

Today, global household debt has surpassed $58 trillion, according to the Institute of International Finance (IIF). That’s a record high, representing nearly 60% of global GDP.

“We are in a debt supercycle,” said Dr. Marcus Lee, a global economist. “Each crisis leaves consumers and governments more indebted than before. The question now is not whether the system can handle it—but for how long.”

What It Means for Consumers

For ordinary consumers, the message is clear: debt is becoming more expensive, and financial flexibility is shrinking. Experts recommend focusing on:

- Paying down high-interest debt before taking on new loans

- Building emergency savings to withstand income shocks

- Avoiding variable-rate loans as interest rate volatility persists

In short, financial prudence is the new survival strategy.

Could the Debt Boom End in a Bust?

Some economists believe that while high debt levels are concerning, systemic risk is still contained. U.S. banks remain well-capitalized, and regulators are keeping a close eye on potential contagion risks.

However, if consumer defaults accelerate and credit conditions tighten globally, the world could face a slow-moving financial shock—not a sudden crash, but a prolonged squeeze on consumption, growth, and investment.

“It’s less likely to be a 2008-style crisis,” said Jennifer Liu, a financial strategist. “But it could be a drawn-out period of stagnation and strain, especially for middle-income households.”

The Road Ahead

As 2026 approaches, economists predict that U.S. debt growth will moderate—but not decline. With inflation easing slowly and rate cuts still uncertain, the next year will test the resilience of both consumers and policymakers.

Globally, countries tied to the U.S. financial system may continue to experience elevated borrowing costs, making debt management a top priority across economies.

The central question remains: can the world adjust to a higher-debt environment without triggering another financial crisis?

Only time—and policy discipline—will tell.