California Enacts New Debt Collection Legislation

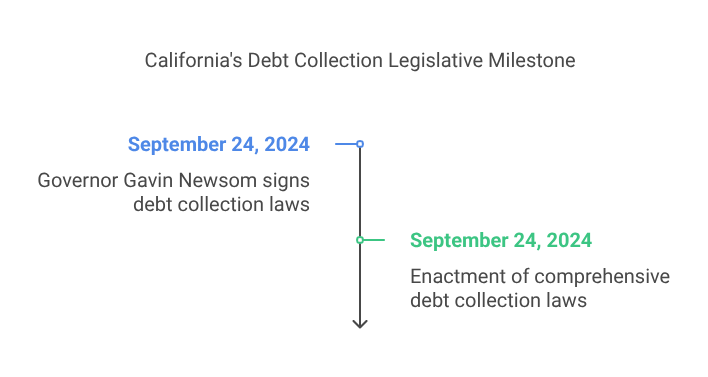

California has recently enacted a comprehensive set of debt collection laws designed to enhance consumer protection and promote fair practices in debt collection. On September 24, 2024, Governor Gavin Newsom signed into law a package of legislative measures aimed at strengthening protections for individuals and businesses involved in debt-related matters. This legislative move introduces critical changes to existing frameworks, enhancing the state’s commitment to safeguarding consumer rights and ensuring responsible collection practices. The new laws are part of California’s ongoing effort to address financial vulnerabilities faced by residents and businesses alike.

Key Legislative Changes in Debt Collection Practices

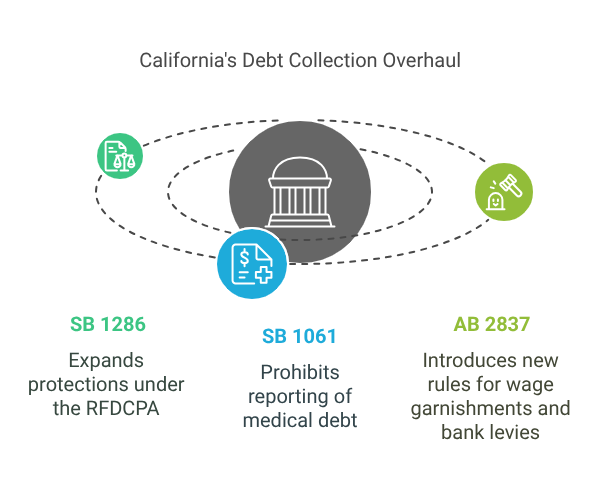

Three significant legislative acts have been introduced to reshape the landscape of debt collection in California:

- Senate Bill 1286 (SB 1286): Expansion of the Rosenthal Fair Debt Collection Practices Act (RFDCPA)

- Senate Bill 1061 (SB 1061): Prohibition of Medical Debt Reporting

- Assembly Bill 2837 (AB 2837): New Requirements for Wage Garnishments and Bank Levies

Detailed Overview of Key Changes

1. SB 1286 – Expansion of the Rosenthal Fair Debt Collection Practices Act (RFDCPA)

The Rosenthal Fair Debt Collection Practices Act (RFDCPA) has historically provided crucial protections to California consumers by regulating debt collection practices. With the introduction of SB 1286, the RFDCPA now extends its coverage to include certain commercial debts up to $500,000. This expansion is particularly notable as it introduces significant safeguards for small businesses and individuals engaged in commercial financial obligations.

Previously, the RFDCPA focused on consumer debt, leaving small business owners with limited protection when faced with aggressive collection practices. Under SB 1286, small businesses are now entitled to similar safeguards that protect individual consumers, including protections against harassment, misrepresentation, and unfair practices.

The bill also enhances identity theft protection measures for small businesses. Identity theft is an increasingly common concern, and SB 1286 ensures that small businesses can assert their rights and avoid liability for fraudulent debts. By expanding these consumer-like protections to commercial debts, California aims to promote fairness in debt collection practices for businesses facing economic challenges.

2. SB 1061 – Ban on Medical Debt Reporting

Medical debt can have significant consequences on individuals’ credit scores, often impacting their ability to secure housing, employment, or financial support. Recognizing this concern, California has now become the eighth state to prohibit medical debt from being reported on credit reports or used in credit decisions.

This move reflects a growing national trend to separate medical debt from traditional credit considerations, acknowledging that medical expenses often arise from unforeseen emergencies rather than financial irresponsibility. Under SB 1061, credit bureaus are now restricted from factoring medical debt into credit reports, providing relief to thousands of Californians burdened by healthcare costs.

This legislative change is expected to have a positive impact on consumers who have struggled to rebuild their credit after facing unexpected medical expenses. By excluding medical debt from credit reports, California aims to prevent individuals from facing long-term financial disadvantages caused by circumstances beyond their control.

3. AB 2837 – New Requirements for Wage Garnishments and Bank Levies

Wage garnishments and bank levies have long been tools used by creditors to recover outstanding debts. However, concerns over aggressive collection tactics have prompted California lawmakers to introduce new restrictions and guidelines to protect consumers from undue hardship.

AB 2837 introduces multiple safeguards to ensure that wage garnishments and bank levies are conducted fairly and with appropriate consideration for debtors’ financial stability.

Key changes include:

- Verification of Debtor Addresses: Before enforcing wage garnishments or bank levies, creditors must now take steps to confirm the accuracy of a debtor’s address. This requirement reduces the risk of individuals being unfairly targeted or mistakenly subjected to enforcement actions.

- Limits on Enforcement Frequency: Creditors are now restricted in how frequently they can initiate garnishments or levies. This change is intended to prevent excessive financial strain caused by multiple enforcement actions within a short period.

- Protection of Exempt Funds: AB 2837 also enhances protections for exempt funds. This includes funds allocated for essential living expenses, ensuring that vulnerable individuals are not deprived of necessary financial resources.

Implications for Consumers and Businesses

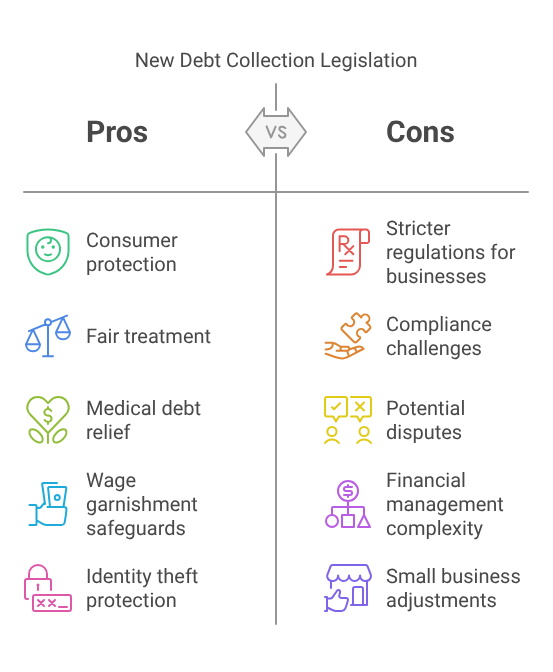

The introduction of these legislative measures carries significant implications for both consumers and businesses in California.

For consumers, these changes offer increased protection against aggressive collection practices, ensuring fair treatment when addressing outstanding debts. The prohibition of medical debt reporting will be especially beneficial for individuals facing financial hardship due to medical expenses, while the improved safeguards for wage garnishments and bank levies will prevent undue financial distress.

For businesses, the expanded RFDCPA coverage presents both challenges and opportunities. While businesses must now comply with stricter regulations when attempting to collect commercial debts, they also benefit from stronger identity theft protections and clearer guidelines to prevent disputes. Small businesses, in particular, will gain confidence in managing their financial obligations without the threat of unfair practices.

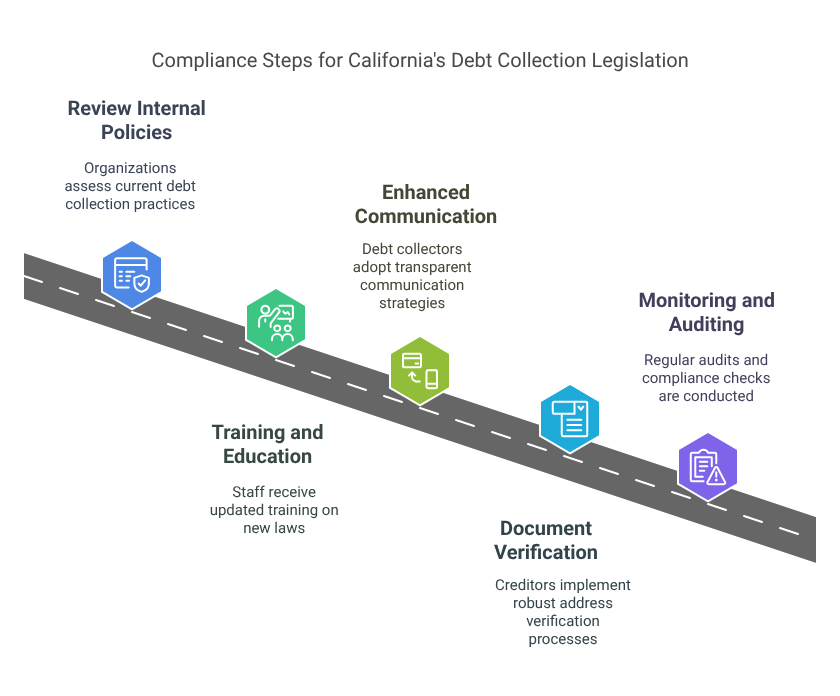

Steps for Compliance and Implementation

To align with these legislative changes, debt collectors, creditors, and financial institutions must take several key steps to ensure compliance:

- Review Internal Policies: Organizations should thoroughly assess their current debt collection practices to ensure alignment with the new laws.

- Training and Education: Staff involved in debt collection activities should receive updated training to understand the expanded RFDCPA provisions, medical debt exclusions, and new enforcement guidelines.

- Enhanced Communication: Debt collectors must adopt transparent communication strategies when interacting with debtors, ensuring clarity about payment obligations and available protections.

- Document Verification: Creditors must implement robust address verification processes to comply with AB 2837’s requirements before initiating garnishments or levies.

- Monitoring and Auditing: Regular audits and compliance checks can help businesses avoid inadvertent violations and ensure adherence to California’s evolving regulatory landscape.

Key Takeaways

The enactment of SB 1286, SB 1061, and AB 2837 marks a significant advancement in consumer protection for California residents and businesses. By expanding debt collection protections to small businesses, prohibiting medical debt reporting, and introducing fairer enforcement measures, these new laws demonstrate California’s commitment to fostering equitable financial practices.

For consumers facing debt challenges, these reforms offer essential safeguards that reduce the risk of financial instability. Meanwhile, businesses and creditors must prioritize compliance and adapt their practices to align with these new legal standards. Ultimately, these changes contribute to a more transparent, fair, and responsible debt collection environment that benefits all stakeholders involved.