FTC Takes Action Against Phantom Debt Collector That Collected Millions In Bogus Debt From Consumers

The Federal Trade Commission (FTC) recently took decisive action against Global Circulation, Inc. (GCI) and its owner, Kenneth Redon III, after uncovering an extensive fraudulent debt collection scheme. This operation defrauded consumers of millions of dollars through intimidation tactics and deceptive practices, bringing heightened public attention to the risks consumers face in debt collection scams.

Background of the Case

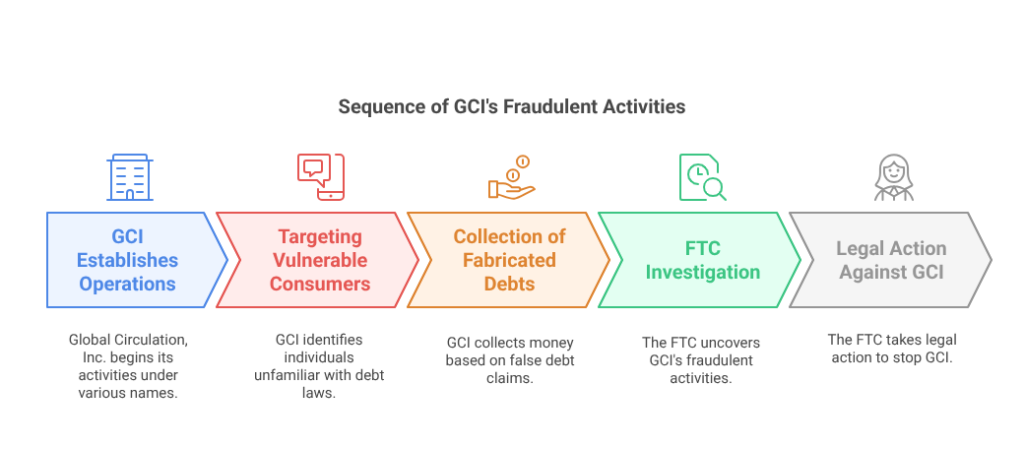

Global Circulation, Inc. had been operating under various business names and targeted unsuspecting individuals with fabricated debt claims. According to the FTC’s findings, GCI collected up to seven million dollars from consumers using aggressive and illegal tactics. These actions violated federal regulations designed to protect consumers from abusive debt collection methods.

GCI’s methods exploited weaknesses in consumer knowledge regarding debt laws. By targeting those unfamiliar with financial regulations, they increased their chances of extracting money from unsuspecting individuals. Victims often lacked the resources or legal knowledge to challenge these false claims, leaving them vulnerable to deception.

Deceptive Practices Employed by GCI

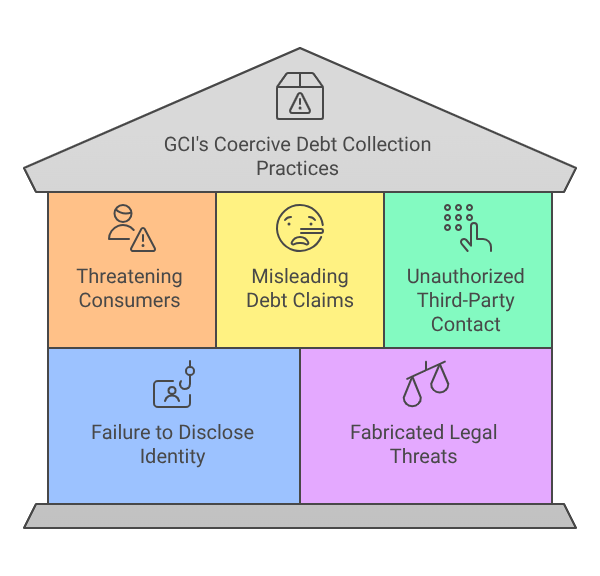

The FTC reported that GCI employed a range of coercive and misleading strategies to extract money from consumers. Among these tactics were:

- Threatening Consumers: GCI’s representatives used intimidating language to pressure consumers into making payments, even when no legitimate debt existed. These threats included warnings of legal action, property seizures, and potential arrest.

- Misleading Consumers About Debt Status: The company targeted individuals regardless of whether their accounts were in good standing. In several instances, GCI claimed consumers owed substantial debts when no such obligations existed.

- Contacting Relatives and Third Parties: In violation of the Fair Debt Collection Practices Act (FDCPA), GCI reached out to relatives, employers, and third parties to pressure consumers into paying. This not only violated privacy regulations but also caused emotional distress to those targeted.

- Failure to Identify as a Debt Collection Agency: Under the FDCPA, debt collection agencies must clearly disclose their identity during communications. GCI routinely ignored this requirement, misleading consumers about who was contacting them and the purpose of the calls.

- Fabricating Legal Threats: GCI’s agents falsely claimed they had filed lawsuits against consumers or that court judgments had been issued. This created fear and panic among those who believed legal consequences were imminent.

Consumer Impact and Financial Harm

The FTC’s investigation revealed that thousands of consumers fell victim to GCI’s fraudulent practices. Many paid fabricated or legally uncollectable debts under duress, fearing legal consequences or reputational harm. The financial impact amounted to approximately seven million dollars in fraudulent collections.

The scam disproportionately affected vulnerable individuals, such as elderly consumers, people facing financial hardship, and those unfamiliar with debt collection laws. GCI’s tactics created anxiety, stress, and financial strain for countless families.

Victims reported significant disruption to their lives. Some were forced to borrow money, liquidate savings, or forego essential expenses to pay these fraudulent debts. Others experienced emotional trauma after repeated threats and harassment.

FTC’s Legal Actions and Court Ruling

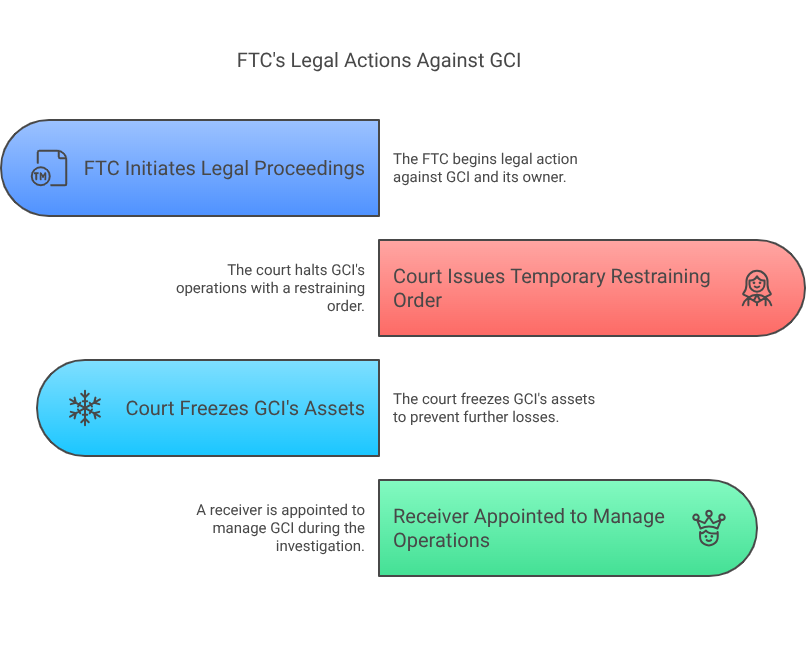

In response to GCI’s unethical practices, the FTC initiated legal proceedings against the company and its owner, Kenneth Redon III. The court issued a temporary restraining order, effectively halting GCI’s operations. Additionally, the court implemented the following actions:

- Asset Freezing: The court froze GCI’s assets to prevent further financial losses to consumers and to ensure potential restitution for those affected.

- Appointment of a Receiver: A court-appointed receiver was tasked with managing GCI’s operations during the investigation, ensuring that any remaining assets were handled responsibly.

These measures marked a significant step in curbing fraudulent debt collection practices and signaled the FTC’s commitment to consumer protection.

The court’s decision highlighted the severity of GCI’s actions and the importance of accountability in the debt collection industry. By swiftly imposing these measures, the court demonstrated its resolve to protect consumers and deter future misconduct by other firms.

Implications for the Debt Collection Industry

This case holds particular significance as it marks one of the FTC’s major actions against a debt collection firm utilizing coercive tactics. The decision highlights the increasing scrutiny on companies engaging in deceptive financial practices and underscores the legal risks involved in violating federal regulations.

Debt collection agencies are now under heightened pressure to adopt transparent and ethical methods when recovering unpaid debts. This case has set a powerful precedent, reinforcing that firms must comply with federal laws or face severe penalties.

Industry analysts predict that this case will lead to stricter oversight and increased consumer awareness. Regulatory bodies are expected to refine enforcement strategies, ensuring consumer protection remains a priority.

Strengthened Consumer Protections

The FTC’s proactive stance emphasizes the importance of consumer awareness regarding debt collection practices. The agency has advised consumers to remain vigilant against suspicious calls demanding immediate payments or threatening legal actions.

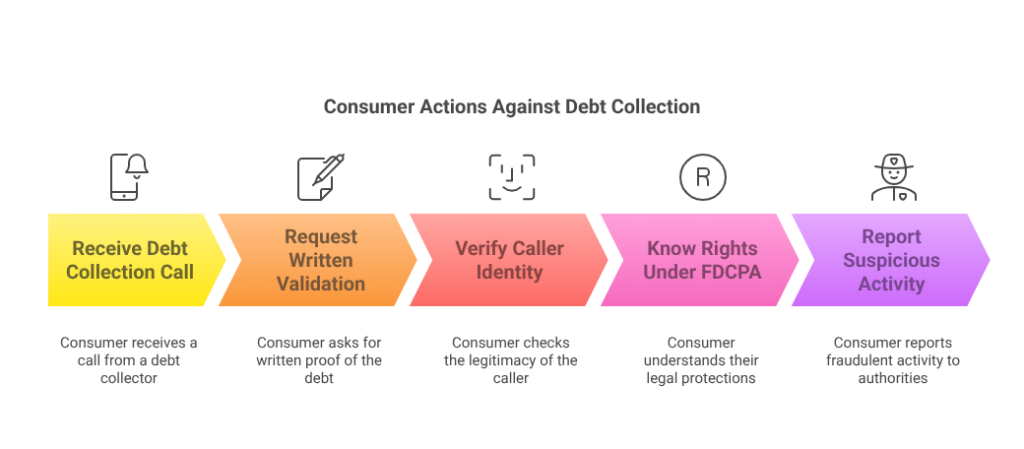

Key recommendations include:

- Request Written Validation of Debt: Consumers should always ask for written documentation confirming the legitimacy of the debt in question.

- Verify the Identity of the Caller: Genuine debt collectors are legally required to identify themselves and provide accurate information about their agency.

- Know Your Rights Under the FDCPA: Consumers are protected against harassment, deception, and unfair practices under federal law.

- Report Suspicious Activity: The FTC urges consumers to report any suspected fraudulent debt collection efforts to federal and state authorities for investigation.

The Ongoing Investigation

While the FTC’s legal action against GCI is significant, the case remains ongoing. The agency continues to investigate additional elements of the operation to determine the full scope of its misconduct. Further penalties may be imposed on GCI and Kenneth Redon III as the proceedings develop.

In addition to the ongoing investigation, the FTC is working with consumer advocacy groups and legal professionals to provide further guidance for those affected. Resources have been made available to help victims recover their losses and understand their rights moving forward.

The outcome of this case is expected to set a strong precedent for future debt collection regulations and ensure better safeguards for consumers. The FTC remains committed to monitoring industry practices to protect the public from similar schemes.

Conclusion

The FTC’s action against Global Circulation, Inc. and Kenneth Redon III highlights the persistent threat posed by fraudulent debt collection practices. By freezing assets, halting operations, and appointing a receiver, the FTC has demonstrated its commitment to protecting consumers from coercion and deceit. Moving forward, this case serves as a powerful reminder for debt collectors to adhere to legal standards and for consumers to remain informed about their rights in financial dealings.

Consumers are encouraged to stay educated about debt collection practices and report any suspicious activity to regulatory authorities. The FTC’s efforts in this case reinforce that fraudulent tactics will not go unpunished, ensuring stronger consumer protection in the future.

To learn more check out FTC’s official website resource: https://www.ftc.gov/news-events/news/press-releases/2024/11/ftc-takes-action-against-phantom-debt-collector-collected-millions-bogus-debt-consumers