Summer Shock 2025: Tariffs to Skyrocket Prices on Kids’ Essentials – Parents Brace for Budget Blow!

April 2025 – USA — As summer approaches, families across the United States are traditionally busy preparing for school breaks, vacations, and outdoor activities. But this year, the joy of the season is being overshadowed by escalating costs tied to sweeping tariff hikes—an economic shift that is hitting parents particularly hard.

From children’s clothing to bikes, strollers, toys, and car seats, essential goods are seeing sharp increases in price due to recently announced trade policies. Economists are warning that the financial burden is already beginning to show and may grow heavier in the coming months.

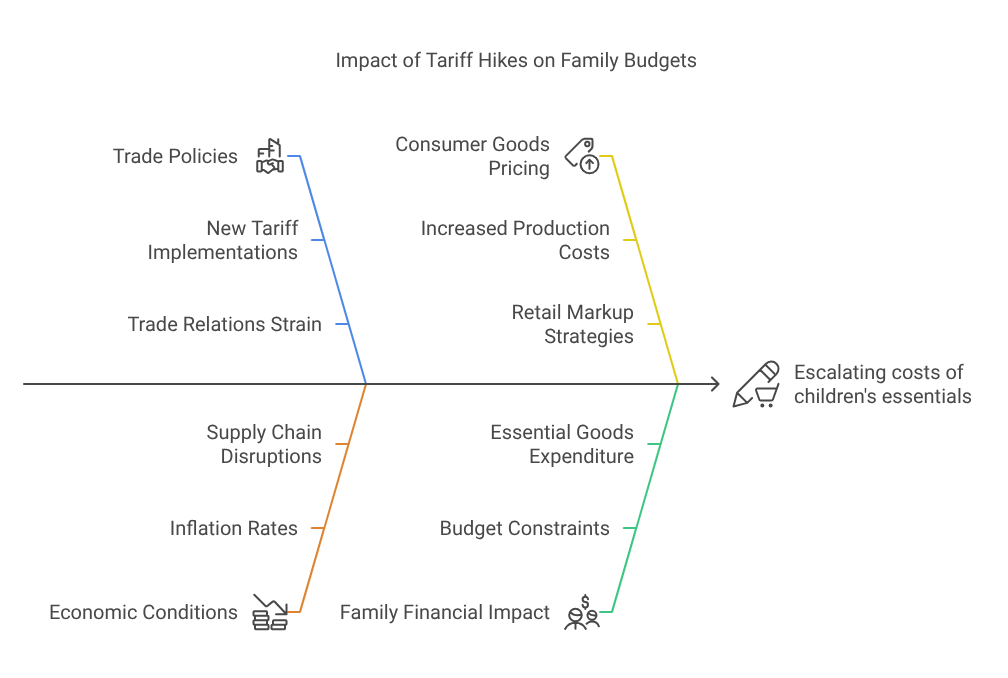

Tariffs Take Centre Stage

A series of new tariffs introduced this spring are reshaping household spending. The most notable impact has come from the dramatic rise in tariffs on imported goods from China, which have been raised to an eye-watering 145%, up from the earlier 20%. Meanwhile, other countries temporarily saw tariffs reduced to 10%, but that relief may be short-lived. If the reduced rates expire in 90 days, costs are expected to climb even higher across the board.

This volatility in trade policy is fuelling uncertainty among both consumers and businesses. The situation is particularly troubling for families, where household budgets are already stretched thin due to ongoing inflation and rising costs of living.

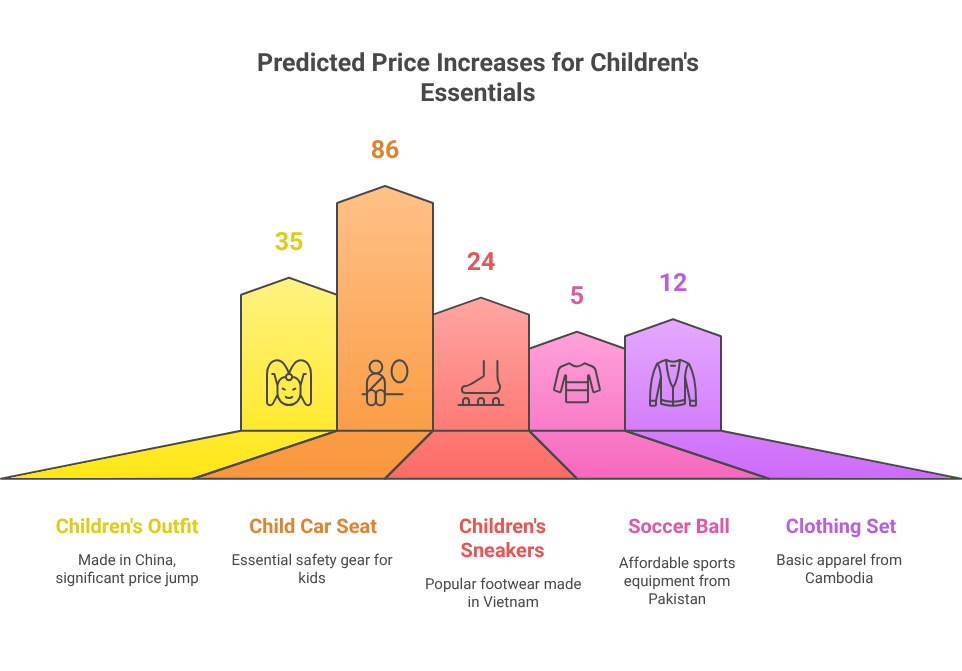

Everyday Essentials Now Luxury Items?

Basic child-related items, once considered affordable, may soon be priced out of reach for many families.

A breakdown of predicted price increases paints a sobering picture:

- Children’s outfit (made in China): $24 → $59

- Child car seat (made in China): $59 → $145

- Children’s sneakers (made in Vietnam): $52 → $76

- Soccer ball (made in Pakistan): $18 → $23

- Clothing set (made in Cambodia): $24 → $36

Even these figures may be optimistic if broader tariffs return or new ones are introduced later this year. The industries most impacted include apparel, footwear, sporting goods, juvenile products, and toys—all staples for young families during the summer season.

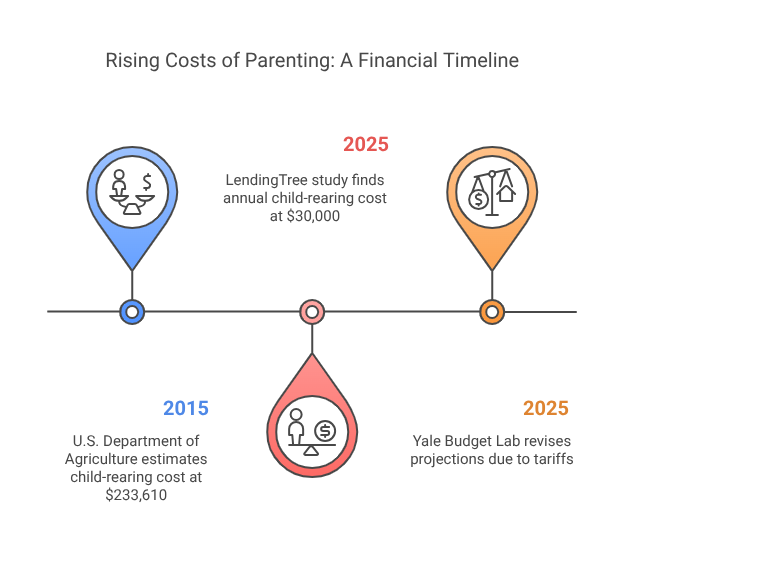

The cost of Childhood Keeps Climbing

Parenting has never been a low-cost Endeavor, but data shows it is now reaching unprecedented levels. According to recent reports, the average cost of raising a child in the U.S. has jumped significantly. While the U.S. Department of Agriculture’s last full estimate placed the cost at $233,610 for children born in 2015, today’s inflation-adjusted expenses are much higher.

A 2025 study by LendingTree found that families now spend nearly $30,000 per year per child—a staggering 35% increase from just two years ago.

The impact of tariffs will only intensify this trend. The Yale Budget Lab revised its household economic projections following the tariff announcements, estimating that American families will lose an average of $4,400 annually due to trade-related price increases—an increase of $600 from previous forecasts.

Low-Income Families Hit Hardest

While all households will feel the pinch, experts warn that the consequences will be most severe for low-income families. These groups often rely on affordable imports for everyday goods and are less able to absorb sharp increases in prices.

Economic analysts and think tanks have sounded the alarm. A senior policy expert from a leading economic research group stated, “Families can expect to pay a lot more for almost everything they can buy. Price increases due to tariffs are practically unavoidable.”

This reality is compounded by a financial environment in which many Americans are already “barely hanging on.” Stagnant wages, rent hikes, and the high cost of healthcare have left families vulnerable. Now, tariff-induced inflation threatens to push household budgets to the breaking point.

Safety Concerns on the Rise

It’s not just about price tags. Advocates and industry leaders have voiced concerns that families may begin cutting corners on safety—choosing to purchase second-hand or outdated products like car seats, strollers, or cribs that may not meet current safety standards.

The potential consequences are dire. Industry groups warn that without access to affordable, regulation-compliant juvenile products, parents might resort to makeshift or unsafe alternatives. “The results can be devastating when American families are forced to rely on second-hand or older products that do not meet current safety standards,” stated One Child Product Association in a letter to government officials.

The letter also warned that some families might forgo protective items entirely, leaving children vulnerable to injury or worse.

Parental Stress Peaks Amid Economic Uncertainty

Parents are already grappling with the emotional and financial toll of modern child-rearing. According to a recent BabyCenter survey, 1 in 8 mothers expressed deep concerns about the impact of rising tariffs on their ability to afford essential items for their children.

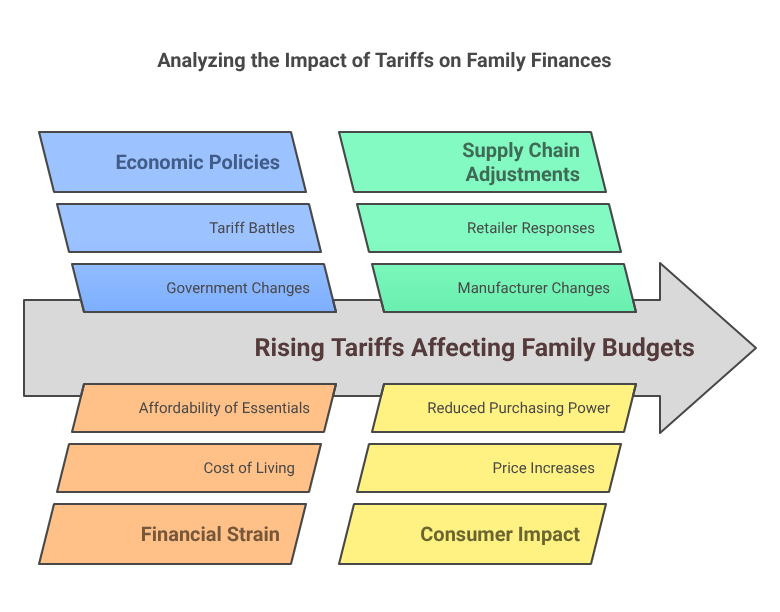

The same survey found that anxiety is growing over “economic implications of government changes,” “risk of recession,” and “already high cost of daily goods.”

These worries are not unfounded. Analysts have warned that prolonged tariff battles could tip the economy into a recession. Retailers, manufacturers, and supply chains are all being forced to adapt to higher costs—costs that will ultimately be passed down to consumers.

Toys, Sports Gear, and Summer Fun in Jeopardy

Summer fun may also come at a higher price this year. The majority of toys and sports equipment sold in the U.S. are manufactured abroad—particularly in China. With tariffs driving up import costs, even seemingly inexpensive items like pool floaties, action figures, and camping gear could soon carry a premium price.

The symbolic innocence of summer—bikes in the driveway, sprinklers on the lawn, kids in colourful swimsuits—may soon be replaced by a far more sobering reality: families having to skip or scale back seasonal activities due to rising expenses.

Grocery Bills to Follow?

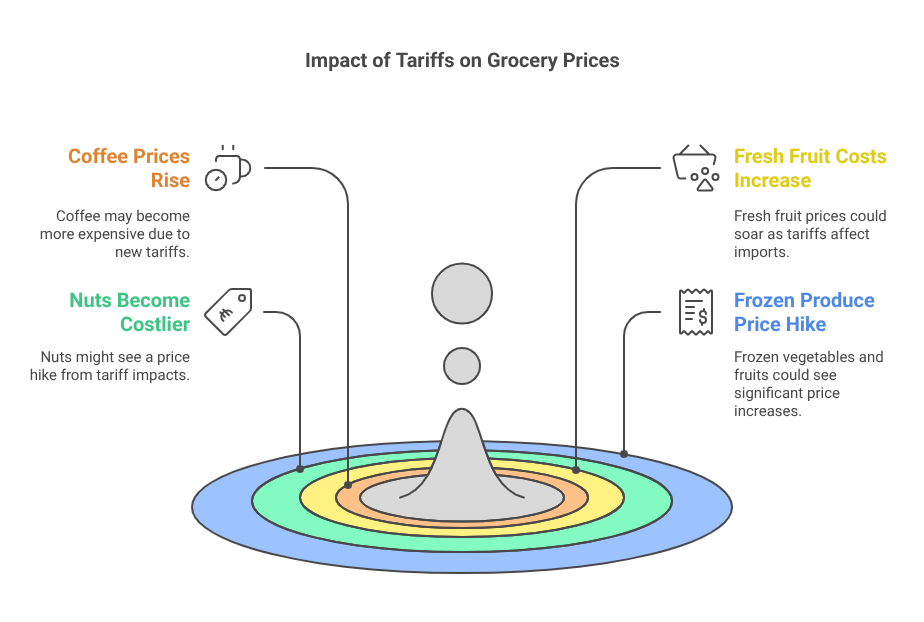

And it doesn’t stop at clothing and toys. While tariffs have so far targeted non-perishable consumer goods, broader categories may soon be affected. Experts caution that products like coffee, fresh fruit, nuts, and frozen produce—much of which is imported—could become the next casualties in the trade conflict.

For families already paying more at the grocery store due to inflation, these changes may prove overwhelming.

A Call for Stability Amid Uncertainty

The shifting nature of trade policy and the rapid introduction (and retraction) of tariffs has created an atmosphere of unpredictability. Economists and trade analysts agree that consistency is key to calming markets and protecting consumers.

With 90-day windows on reduced tariffs ticking away, manufacturers, retailers, and families alike are left in limbo—wondering what goods will become more expensive next.

While official statements have urged the public to “stay calm” and “trust the process,” economic forecasts and household budget analyses tell a different story: the pain of tariffs is real, and it’s already being felt.

What Can Families Do Now?

As families prepare for summer, financial planners are recommending that parents:

- Plan Ahead: Anticipate price increases and purchase big-ticket items early if possible.

- Look for Local Alternatives: Buying U.S.-made goods may help avoid tariff-driven costs.

- Join Parenting Communities: Online groups and forums may offer discounts, tips, and second-hand item exchanges.

- Advocate: Contact representatives and share concerns. Public pressure can influence trade policies.

But the reality is, that many families will have few options. For them, this summer will not be about what to buy—but about what to sacrifice.