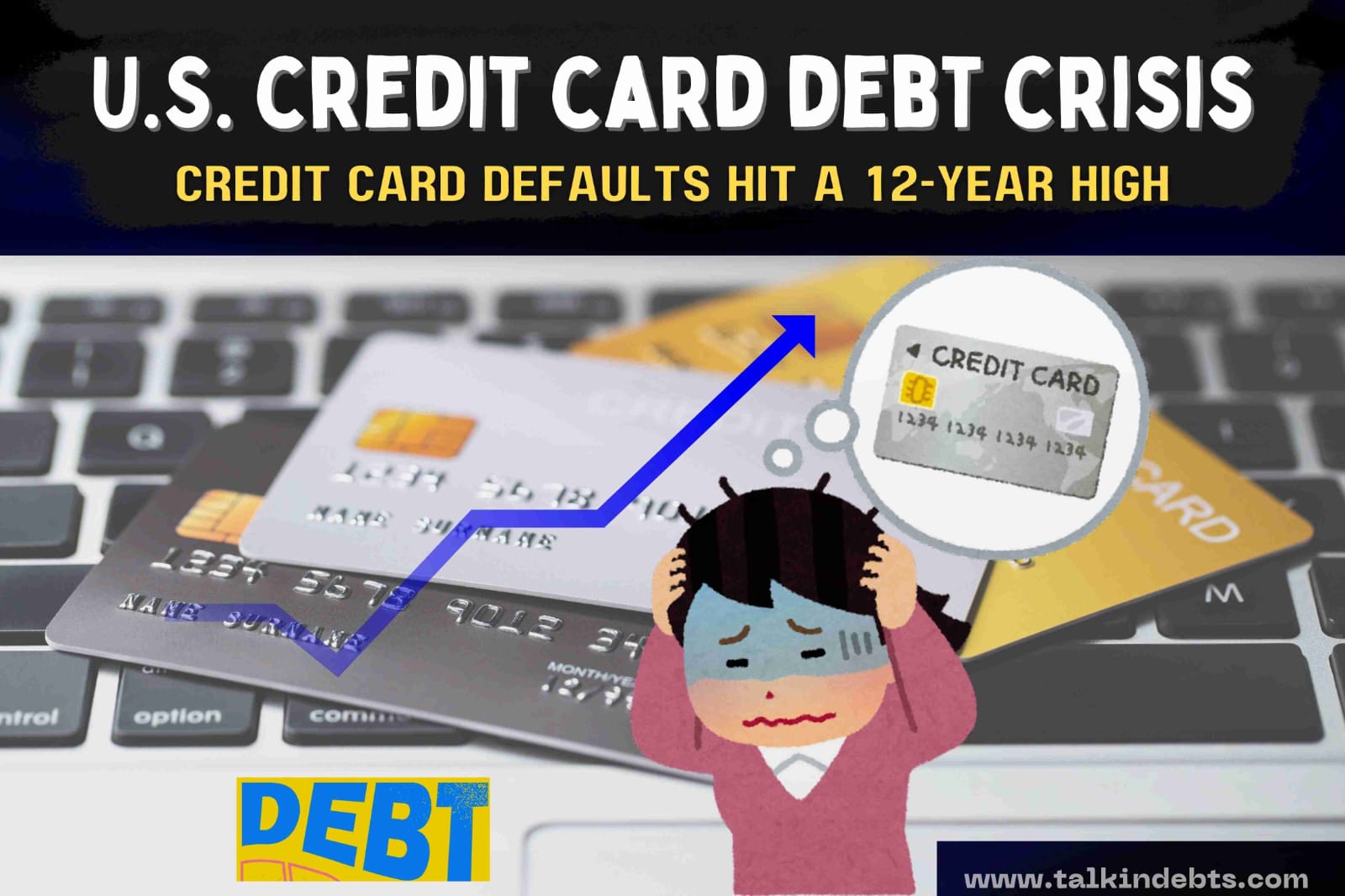

Americans Are Drowning in Debt: Credit Card Defaults Hit a 12-Year High—Are You at Risk?

While the stock market continues to break records, a darker financial reality is unfolding for millions of Americans. A new report from the Philadelphia Federal Reserve reveals that U.S. consumers are drowning in debt, with credit card defaults hitting a 12-year high. The numbers paint a grim picture: rising inflation, soaring interest rates, and dwindling savings are pushing households to their financial limits.

The Alarming Numbers

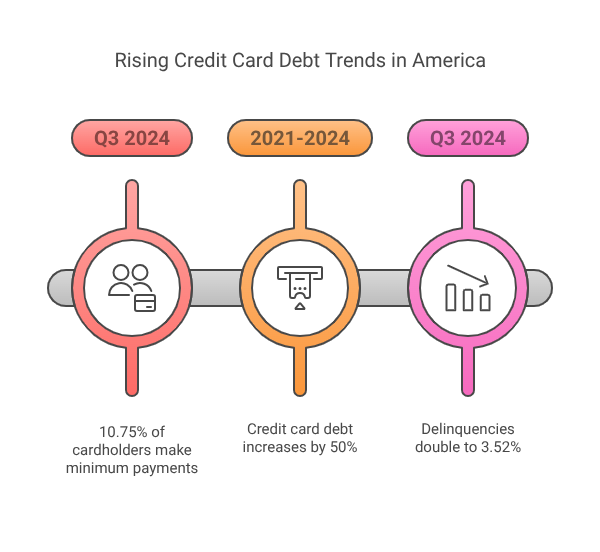

- Minimum Payments on the Rise: In Q3 2024, 10.75% of credit card holders made only the minimum payment on their bills—the highest rate in over a decade.

- Record-Breaking Debt Levels: Total credit card debt has skyrocketed to 914 billion, with revolving balances(unpaid debt carried month−to−month) reaching 645 billion—a staggering 50% increase since 2021.

- Delinquencies Double: Balances more than 30 days past due have surged to 3.52%, more than double the 1.57% rate seen in mid-2021.

The Perfect Storm: Inflation, Interest Rates, and Depleted Savings

The Fed’s report points to a “nasty combination” of high inflation and rising interest rates as the driving forces behind this crisis. With the cost of living climbing, many Americans are relying on credit cards to cover everyday expenses. But there’s a catch: the average credit card interest rate hovers around 20%, making it increasingly difficult for borrowers to escape the debt cycle.

Adding to the problem, households have exhausted the excess savings they built up during the COVID-19 pandemic. Previous Fed research shows that many families no longer have a financial cushion to fall back on, leaving them vulnerable to economic shocks.

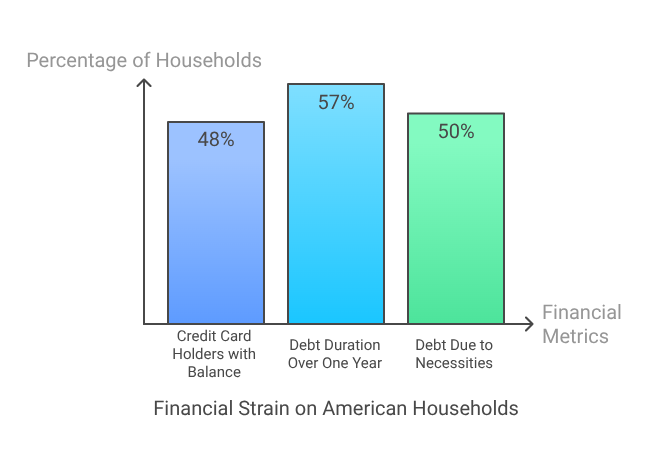

A Growing Burden on Households

The impact of this debt crisis is far-reaching. According to Bankrate, 48% of credit card holders carry a balance, and 57% of those in debt have been stuck in it for at least a year. Meanwhile, NerdWallet reports that nearly half of Americans with credit card debt cite necessities like food and housing as reasons for their balances. Despite a 21% increase in income since 2019, the cost of food has risen by 27%, and housing costs are up 26%, squeezing budgets even further.