The Role of a Debt Consultant: How They Can Help You Get Out of Debt

Tackling financial burdens like credit card debt, student loans, or medical bills is a significant hurdle for millions of Americans. The burden of financial debt can feel insurmountable, impacting both mental and financial well-being. A debt consultant provides expert debt solutions, offering personalized debt management strategies to guide you toward financial freedom.

These professionals act as financial advisors, helping you understand your options, negotiate with creditors, and create actionable plans to eliminate debt. This comprehensive guide explores the vital role of a certified debt consultant, compares debt counselling services and debt settlement programs, offers practical tips for selecting a legitimate debt consultant in the US, and details what to expect during your first debt consultation. Additionally, we’ll delve into the broader benefits of debt relief services, common debt-related challenges, and proactive steps to maintain financial stability post-consultation.

Understanding Debt Consultation: A Path to Financial Recovery

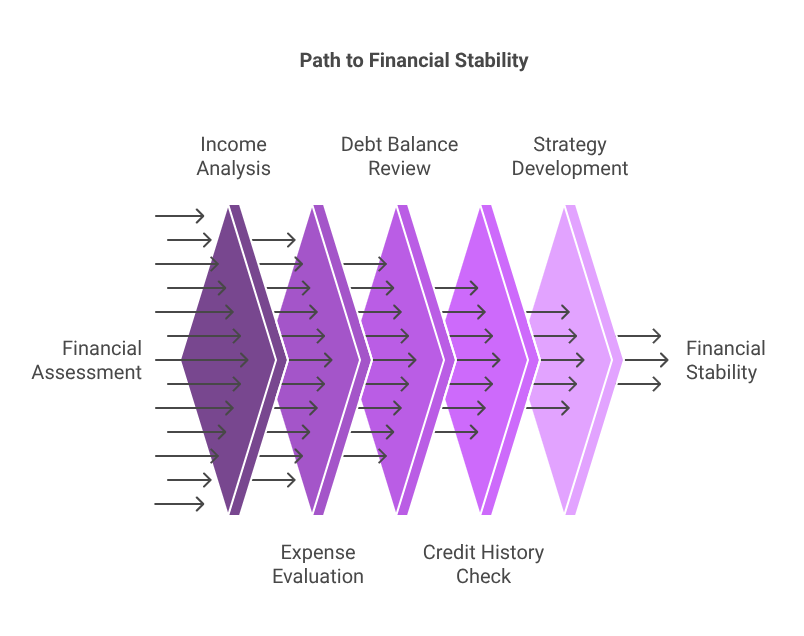

Debt consultation is a professional service where a certified debt consultant evaluates your financial situation to develop a tailored debt management plan. Whether you’re struggling with high-interest credit card debt, overwhelming student loans, or unpaid medical bills, a debt consultant serves as a financial coach. They analyse your income, expenses, debt balances, and credit history to recommend strategies such as budgeting adjustments, debt consolidation loans, or creditor negotiations. The ultimate goal is to empower you with effective debt relief strategies that align with your financial goals and lead to long-term financial stability.

Unlike generic financial advice, debt consultation is highly personalized. Consultants don’t just provide debt reduction tips; they craft strategic debt solutions tailored to your unique circumstances. For example, they may suggest enrolling in a Debt Management Plan (DMP) to streamline payments or explore debt settlement options to reduce your principal debt. By offering expert debt guidance, they help you make informed decisions, avoid common pitfalls, and regain control over your financial future. Working with a debt relief expert can also alleviate the stress of managing complex debt systems, allowing you to focus on rebuilding your financial health.

Debt Counselling vs. Debt Settlement: Choosing the Right Debt Relief Option

Both debt counselling services and debt settlement programs aim to alleviate the burden of debt, but they cater to different needs and financial situations. Understanding their differences is crucial for selecting the best debt relief strategy.

Debt Counselling: Structured Debt Repayment

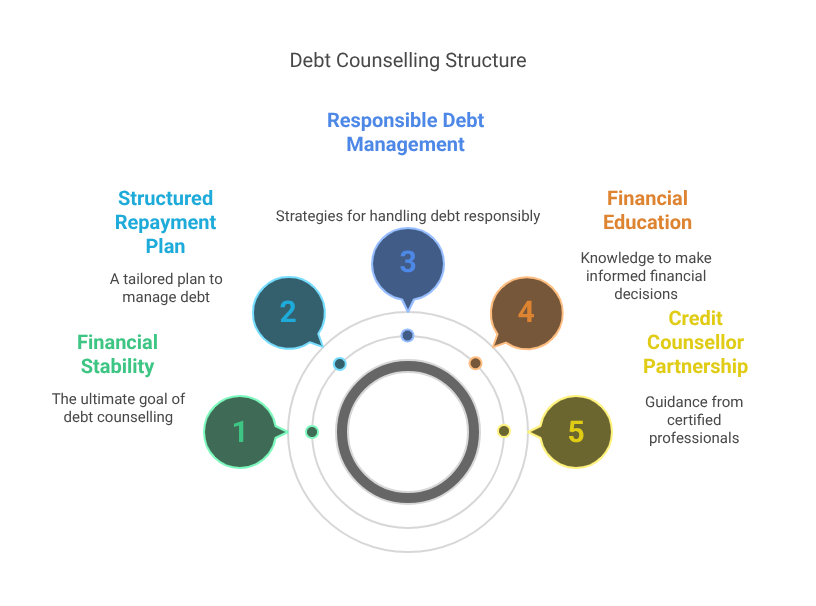

Debt counselling involves partnering with a certified credit counsellor, often from a non-profit credit counselling agency, to create a structured debt repayment plan. This approach focuses on responsible debt management and financial education.

Key components include:

- Budgeting assistance to optimize your monthly expenses

- Negotiating lower interest rates or waived fees with creditors

- Setting up a Debt Management Plan (DMP) to consolidate monthly debt payments into a single, affordable payment

Pros:

- Minimizes damage to your credit score in most cases

- Provides a structured debt repayment framework

- Offers long-term financial education to prevent future debt

- Helps build healthy financial habits

Cons:

- Does not reduce the principal debt balance

- Requires consistent monthly debt payments

- Typically takes 3–5 years to complete

- May involve modest counselling fees

Debt counselling is ideal for individuals who can make regular payments but need help organizing their finances and reducing interest rates. It’s a proactive approach that emphasizes financial discipline and credit score protection.

Debt Settlement: Reducing Total Debt

Debt settlement services focus on negotiating with creditors to settle debts for less than the amount owed. This option is typically recommended for those facing delinquent payments, severe financial hardship, or potential default.

Pros:

- Can significantly reduce total debt (often by 30–50%)

- Faster than debt counselling, often resolving debts in 1–3 years

- It may help avoid bankruptcy

- Provides immediate debt relief for overwhelming balances

Cons:

- Temporarily harms your credit score

- Debt settlement fees can range from 15–25% of the settled amount

- Creditors are not obligated to accept settlement offers

- Settled debts may incur taxable income on the forgiven amount

Debt settlement is suited for those who are behind on payments or unable to meet minimum debt obligations. However, it requires careful consideration due to its credit score impact and potential tax implications.

Which Debt Relief Option Is Right for You?

Choosing between debt counselling and debt settlement depends on your financial circumstances. If you’re struggling to make minimum payments and need immediate debt reduction, debt settlement may be a better choice. Conversely, if you’re committed to repaying your debt in full and want to improve your financial habits, debt counselling offers a structured path to financial recovery. A qualified debt consultant can assess your debt portfolio, explain the pros and cons of each option, and recommend a personalized debt strategy that aligns with your financial goals.

How to Choose a Legitimate Debt Consultant in the US

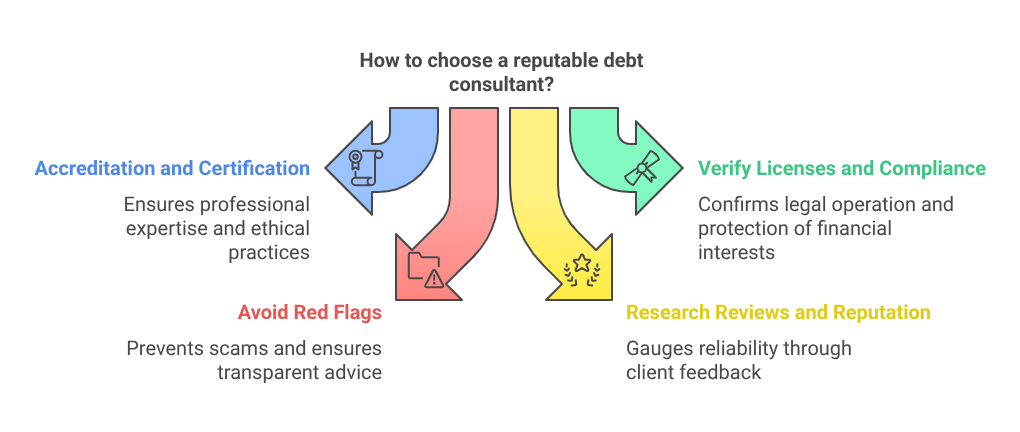

Selecting a reputable debt consultant is critical to achieving effective debt relief and avoiding debt relief scams. With numerous debt relief companies in the market, here’s how to identify a trustworthy debt professional:

- Seek Accreditation and Certification

Ensure the consultant is certified by reputable organizations such as:- National Foundation for Credit Counselling (NFCC)

- Financial Counselling Association of America (FCAA)

- International Association of Professional Debt Arbitrators (IAPDA)

These certifications validate the consultant’s professional debt expertise and adherence to ethical debt relief practices.

- Verify Licenses and Compliance

Some states require debt consultants and debt settlement agencies to hold valid licenses. Contact your state’s Attorney General or financial regulatory authority to confirm the consultant complies with debt relief regulations. This step ensures the consultant operates legally and prioritizes your financial interests. - Avoid Red Flags

Be cautious of consultants or companies that:- Charge high upfront debt relief fees before delivering services

- Guarantee debt elimination or specific outcomes

- Advise you to stop communicating with creditors

- Fail to disclose potential debt relief risks, such as credit score impacts

A legitimate debt consultant will provide transparent debt advice, outline all debt relief options, and avoid high-pressure sales tactics.

- Research Reviews and Reputation

Check debt consultant reviews on independent platforms like the Better Business Bureau (BBB) or Trustpilot. Look for client testimonials and complaint histories to gauge the consultant’s debt relief reputation. Positive feedback and a strong BBB rating indicate reliable debt services. - Request a Free Consultation

Most reputable debt consultants offer a free initial consultation to assess your financial situation. Use this opportunity to evaluate their debt expertise, communication style, and commitment to your financial goals. A trustworthy consultant will prioritize your needs over sales.

By choosing a certified debt professional with a proven track record, you can ensure effective debt management and a smoother path to financial freedom.

What to Expect During Your First Debt Consultation

Your first debt consultation is a critical step toward debt relief. Typically, free or low-cost, this session allows the consultant to assess your financial profile and recommend personalized debt solutions.

Here’s a detailed breakdown of what to expect:

- Comprehensive Financial Assessment

The consultant will gather detailed information about your:- Total debt amount (e.g., credit card balances, loans, medical bills)

- Income sources and monthly expenses

- Credit report and credit score

- Debt repayment history

This financial evaluation helps the consultant understand your debt challenges and tailor debt relief strategies to your needs.

- Exploration of Debt Relief Options

Based on your financial assessment, the consultant may propose several debt management strategies, including:- Debt Management Plans (DMPs) for consolidated payments

- Debt settlement programs to reduce principal debt

- Debt consolidation loans combine multiple debts

- Bankruptcy as a last resort for severe financial distress

They will explain the benefits, risks, and credit score impacts of each option to help you make an informed decision.

- Customized Debt Action Plan

You’ll receive a personalized debt repayment plan outlining:- Budgeting strategies to optimize your cash flow

- A debt repayment timeline to track progress

- Recommendations for financial tools, such as budgeting apps or credit monitoring services

This plan serves as a roadmap to financial freedom, with clear steps to reduce debt burdens.

- Opportunity to Ask Questions

The consultation is a chance to address concerns, such as:- Debt consultant fees and payment structures

- Expected debt relief outcomes

- Credit score implications of different strategies

- Debt repayment timeframes

A reputable debt consultant will provide transparent answers and avoid pressuring you into immediate decisions.

- Next Steps and Ongoing Support

After the consultation, the consultant may offer ongoing debt support, such as monthly check-ins, creditor negotiations, or financial education resources. They’ll guide you through implementing the debt action plan and monitor your progress toward financial stability.

The first debt consultation is designed to provide clarity and confidence, helping you take control of your financial future with expert debt guidance.

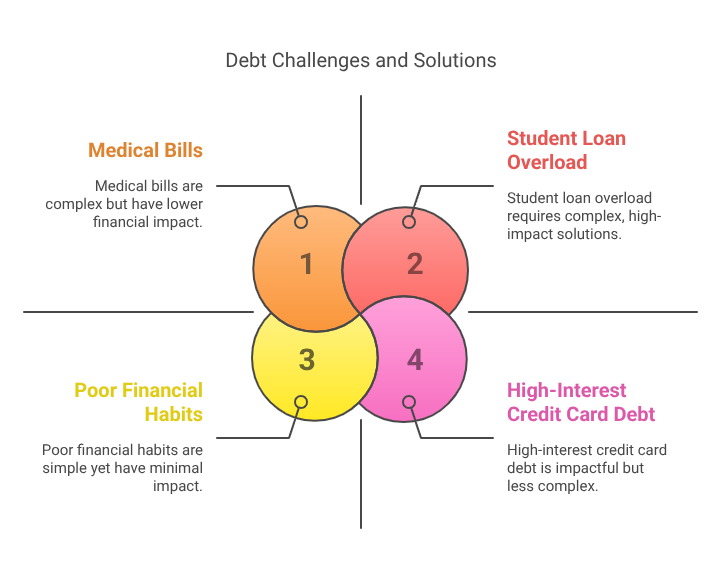

Common Debt Challenges and How Consultants Address Them

Debt can stem from various sources, each presenting unique challenges. A debt consultant is trained to address these issues with targeted debt solutions.

Common debt challenges include:

- High-Interest Credit Card Debt: Debt consultants negotiate lower interest rates or enroll you in a DMP to make payments more manageable.

- Student Loan Overload: Consultants explore income-driven repayment plans or loan consolidation to reduce monthly payments.

- Medical Bills: They may negotiate payment plans or debt settlements to lower outstanding medical debt.

- Job Loss or Income Reduction: Consultants adjust budgets and prioritize essential debt payments to stabilize your finances.

- Poor Financial Habits: Through financial education, they teach budgeting skills and debt prevention strategies to avoid future debt.

By addressing these debt challenges with professional debt expertise, consultants help you overcome obstacles and achieve long-term financial health.

Benefits of Working with a Debt Parsing Consultant

Partnering with a certified debt consultant offers numerous advantages for individuals seeking debt relief. Key benefits include:

- Objective Debt Guidance: Consultants provide unbiased debt advice, helping you make strategic financial decisions without emotional bias.

- Expert Creditor Negotiations: They secure lower interest rates, waived fees, or settled debt balances, reducing your debt burden.

- Time and Stress Savings: Navigating complex debt systems alone can be overwhelming. A consultant streamlines the process with professional debt support.

- Personalized Debt Solutions: Every debt repayment plan is tailored to your financial situation, ensuring effective debt management.

- Financial Education: Consultants teach budgeting techniques, credit management, and debt prevention to promote long-term financial stability.

- Improved Mental Health: Reducing debt stress through structured debt relief can enhance your overall well-being.

These benefits make debt consultation a powerful tool for breaking the debt cycle and achieving financial freedom.

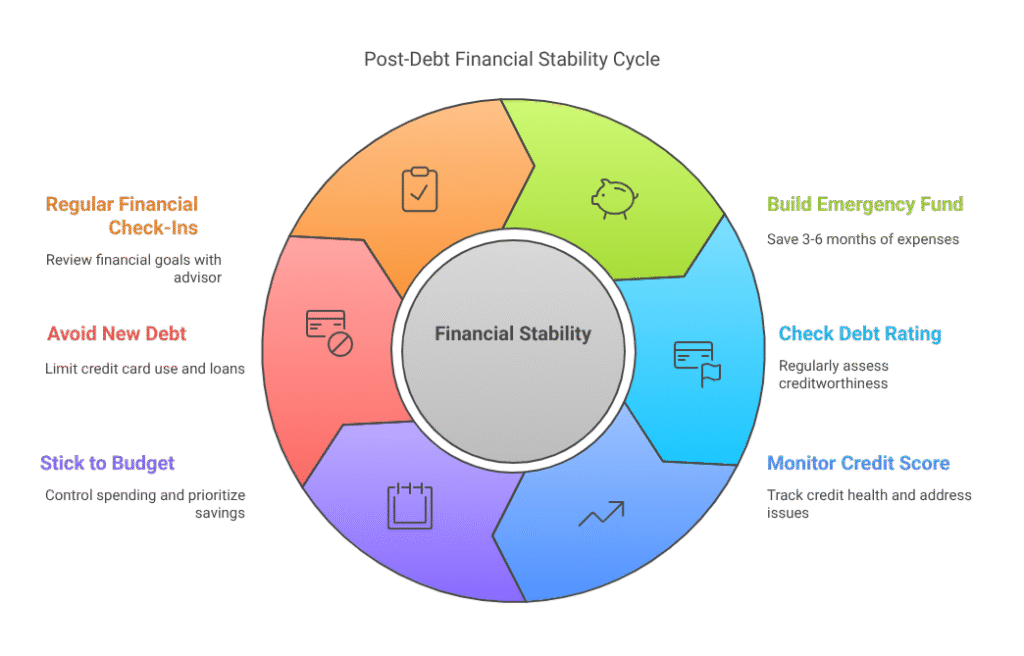

Maintaining Financial Stability After Debt Relief

Achieving debt relief is a significant milestone, but maintaining financial stability requires ongoing effort.

A debt consultant can provide post-debt strategies to help you stay on track, such as:

- Building an Emergency Fund: Save 3–6 months of expenses to avoid relying on credit cards during unexpected events.

- Using a Debt Rating Checker: Regularly check your debt rating using trusted tools or platforms. This helps you understand how lenders may view your creditworthiness and allows you to take corrective actions if necessary.

- Monitoring Your Credit Score: Use credit monitoring tools to track your credit health and address issues promptly.

- Sticking to a Budget: Follow a realistic budget to control spending and prioritize savings.

- Avoiding New Debt: Limit credit card use and avoid unnecessary loans to prevent falling back into debt.

- Regular Financial Check-Ins: Schedule periodic reviews with a financial advisor or debt consultant to stay aligned with your financial goals.

By adopting these financial habits, you can sustain the benefits of debt relief and build a secure financial future.

Final Thoughts: Take Control of Your Financial Future

Debt management doesn’t define your worth, but it significantly impacts your financial future. A certified debt consultant is more than a service provider—they’re a financial partner dedicated to helping you navigate debt counselling services, debt settlement programs, and personalized debt relief plans. With their expert debt guidance, you can transform overwhelming debt burdens into manageable challenges and pave the way to financial freedom.

If you’re feeling trapped by credit card debt, student loans, or medical bills, know that debt relief is within reach. Take the first step by scheduling a free debt consultation with a reputable debt professional. With the right debt relief strategy, you can reclaim control of your finances and build a debt-free future starting today.

Get your Free debt consultation