RETAIL MELTDOWN 2025: Store Closures Trigger Bankruptcy Wave and Soaring Household Debt Across the U.S.

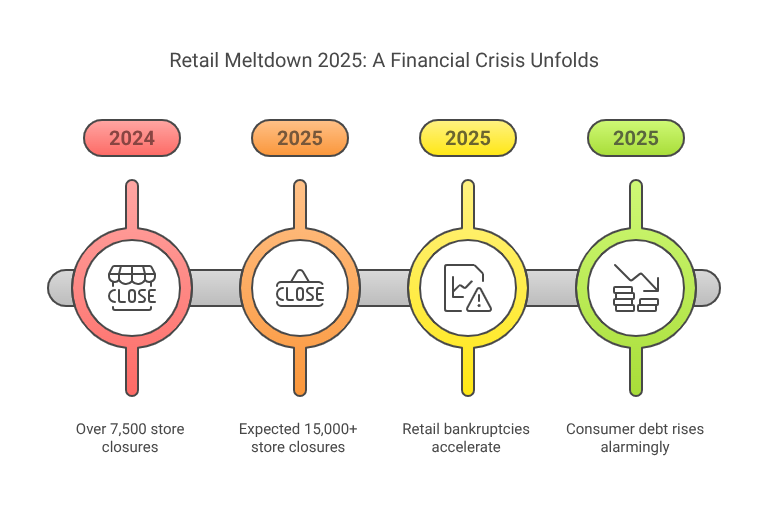

UNITED STATES — A nationwide crisis is unfolding in 2025 as the American retail sector faces one of its most severe collapses in modern history. With over 15,000 store closures expected before year-end—more than double the number in 2024—the ripple effects are being felt far beyond shopping malls.

What began as a downturn in consumer demand has morphed into a full-blown financial emergency. Retail bankruptcies are accelerating, consumer debt is rising at alarming levels, and thousands of workers are being pushed into economic uncertainty.

Major Retailers Declare Bankruptcy

Multiple national retail chains have filed for bankruptcy in the first quarter alone. Chains specializing in pharmacy, apparel, and home goods have begun liquidating stores across states, citing spiralling costs, weakening demand, and an unforgiving financial environment.

Traditional department stores have also begun downsizing operations and closing underperforming locations, leading to a wave of layoffs and job displacements. The store footprint across the U.S. is shrinking rapidly, leaving communities without essential services and employment.

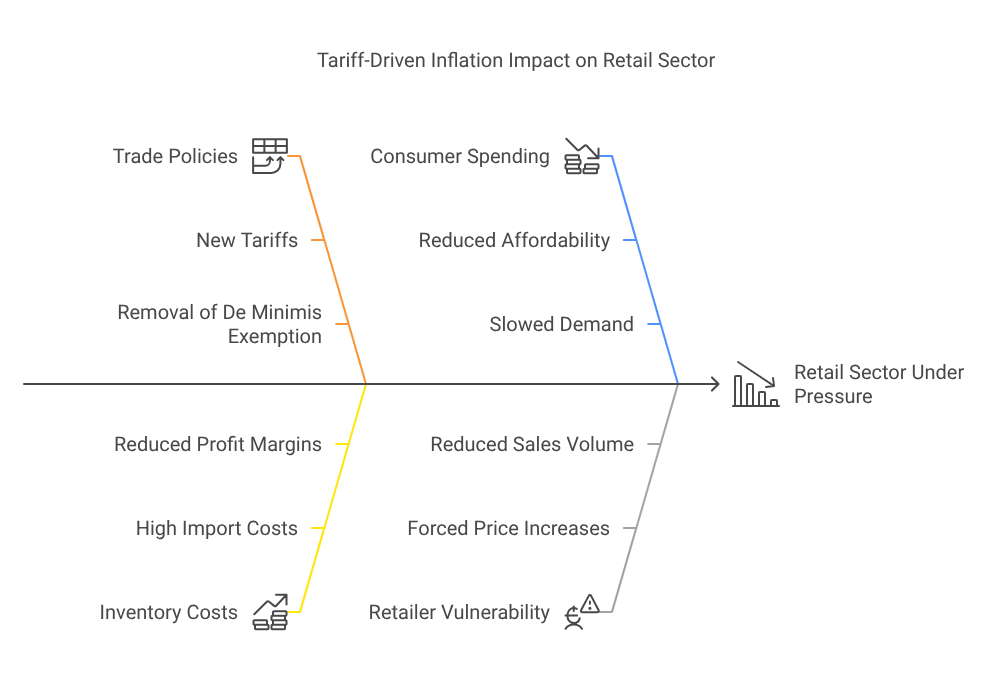

Tariff-Driven Inflation Pushes Sector Over the Edge

Much of the pressure on the retail sector stems from new trade policies introduced in late 2024. Steep tariffs of up to 145% on Chinese imports, aimed at reshaping global trade dynamics, have severely impacted inventory costs for U.S. retailers. The removal of the de minimis exemption for shipments under $800 has further constrained small and mid-sized importers.

As a result, retailers are being forced to raise prices significantly. Everyday items, once considered affordable, are now out of reach for many families. Consumer spending has slowed in response to this surge in costs, putting additional strain on already-vulnerable retailers.

Americans Turn to Credit to Keep Up

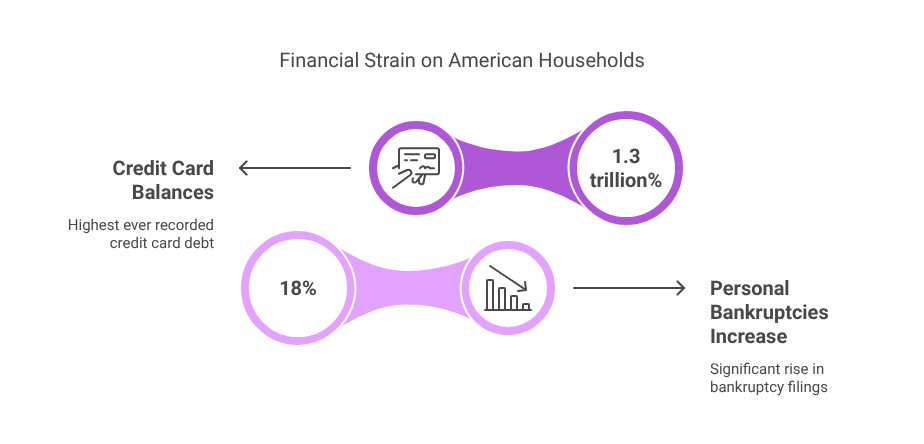

The rise in prices is pushing American consumers deeper into debt. Credit card balances have surpassed $1.3 trillion—the highest ever recorded. With wages stagnant and prices rising, many households are increasingly relying on borrowed money for essentials such as groceries, fuel, and rent.

Delinquency rates are spiking across credit segments. Many middle-income households are now struggling with minimum payments, while lower-income families face growing threats of default and foreclosure.

Reports show a marked increase in personal bankruptcies, with an 18% rise over the past year alone. Financial counselling services are overwhelmed as people seek solutions to mounting obligations.

Funding Disappears as Private Equity Retreats

Compounding the crisis is the retreat of private equity firms from retail investments. After years of supporting distressed retailers, many firms are exiting the sector altogether, citing market volatility and declining returns.

Without access to capital, struggling brands are unable to innovate or restructure, accelerating their path to insolvency. Retailers reliant on digital transformation and supply chain improvements are particularly affected, unable to secure the funding needed for recovery.

Unemployment on the Rise in Retail Hubs

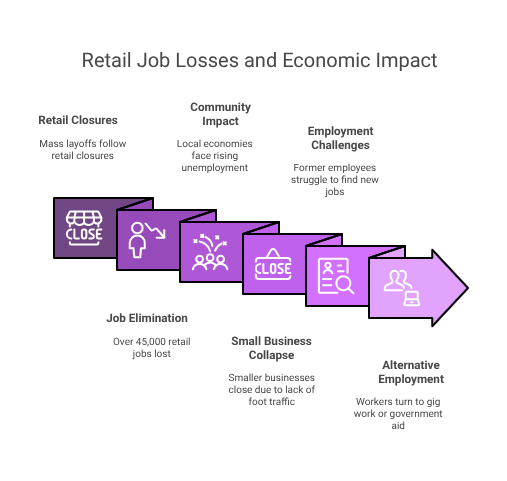

Mass layoffs have followed the wave of closures. In the first three months of 2025, more than 45,000 retail jobs were eliminated. Communities that once depended on retail employment are now grappling with rising unemployment and the collapse of local economies.

This employment vacuum is especially severe in small towns and suburbs, where major stores were anchor tenants in local malls and shopping centres. With those stores gone, smaller businesses that depended on customer foot traffic are also folding.

Former employees report difficulty securing new jobs, especially those who lack formal education or technical skills. Many are turning to gig work or relying on government aid to stay afloat.

America’s Malls Go Dark

Commercial real estate is taking a major hit as malls lose tenants at an unprecedented rate. A growing number of shopping centres now sit largely empty, with national reports warning that hundreds of malls face permanent closure.

Vacancy rates in many locations have surpassed 45%, and commercial landlords are struggling to repurpose spaces. Once-lively community hubs are becoming modern-day ghost towns, and local governments are now facing budget shortfalls due to lost tax revenue.

The Human Toll: Debt, Desperation, and Uncertainty

Behind every shuttered store is a worker without income, a family with growing debt, and a community with fewer resources. In countless towns, retail workers have found themselves suddenly unemployed and unprepared for the cascading financial challenges that follow.

Car payments are going unpaid, mortgages are defaulting, and savings are being drained just to cover monthly expenses. Many are unable to access emergency loans or refinancing options, pushing them toward bankruptcy.

The broader financial system is beginning to feel the strain as well. Defaults are increasing not just in consumer loans but also in commercial real estate financing tied to failing malls and shopping centres.

Experts Warn of Long-Term Economic Fallout

Economists caution that the retail crisis may mark the beginning of a deeper, longer-lasting financial shock if corrective measures are not taken. If inflation continues and access to credit tightens, the combined impact on businesses and consumers could lead to a prolonged recession.

Rising interest rates and low consumer confidence are fuelling pessimism across markets. Without a rebound in spending or new sources of affordable goods, analysts warn that debt burdens will become unsustainable for a growing portion of the population.

Still, some experts suggest the collapse could force innovation and reform. The crisis may prompt a transition toward leaner retail models, domestic production strategies, and enhanced digital platforms.

Conclusion: A Nation at the Crossroads

The collapse of the U.S. retail sector in 2025 is not simply an economic event—it is a social reckoning. The fallout from widespread bankruptcies, tariff-induced inflation, and massive job losses is driving households to the brink.

As debt continues to rise and consumer stability weakens, questions mount over how long the system can sustain such pressure. Whether through policy intervention, industry reform, or financial relief programs, the need for immediate action has never been more urgent.

The storefronts may be dark, but the spotlight is now firmly on America’s leaders, industries, and communities to chart a path forward—before the economic cracks become irreversible fault lines.