How Government Debt Relief Programs Work & Who Qualifies

In recent years, rising living costs, job insecurity, and unexpected financial burdens have pushed millions of Americans into overwhelming debt. From unpaid student loans to back taxes and missed mortgage payments, these financial challenges can feel impossible to escape. Fortunately, government debt relief programs exist to provide structured support and, in some cases, a way out. But how do these programs actually work—and who qualifies for them?

This comprehensive guide breaks down the structure, purpose, and qualifications for key government debt relief programs, helping individuals better understand their options and take steps toward financial recovery.

What Are Government Debt Relief Programs?

Government debt relief programs are initiatives—usually at the federal or state level—that help eligible individuals reduce, restructure, or eliminate certain types of debt. These programs aim to ease the financial burden on individuals while promoting overall economic stability.

Unlike private debt settlement services, which may involve negotiation with creditors for a fee, government programs are typically free to apply for and come with clear eligibility guidelines.

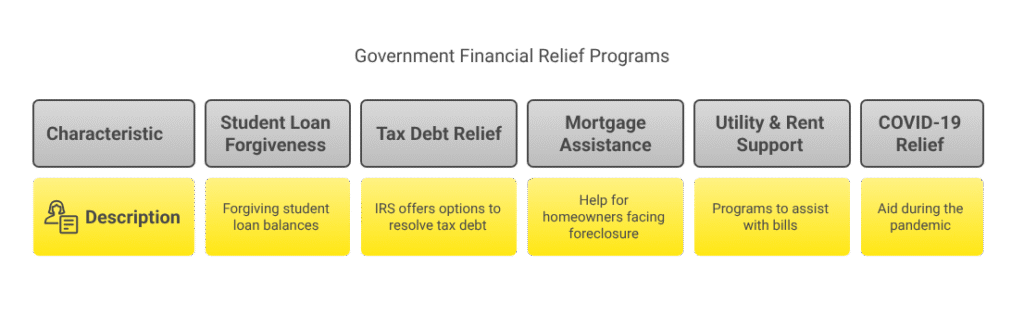

The most common types of government debt relief include:

- Student loan forgiveness and repayment plans

- Tax debt relief through the IRS

- Mortgage and foreclosure prevention assistance

- Utility and rent support

- COVID-19-related relief measures

How Do These Programs Work?

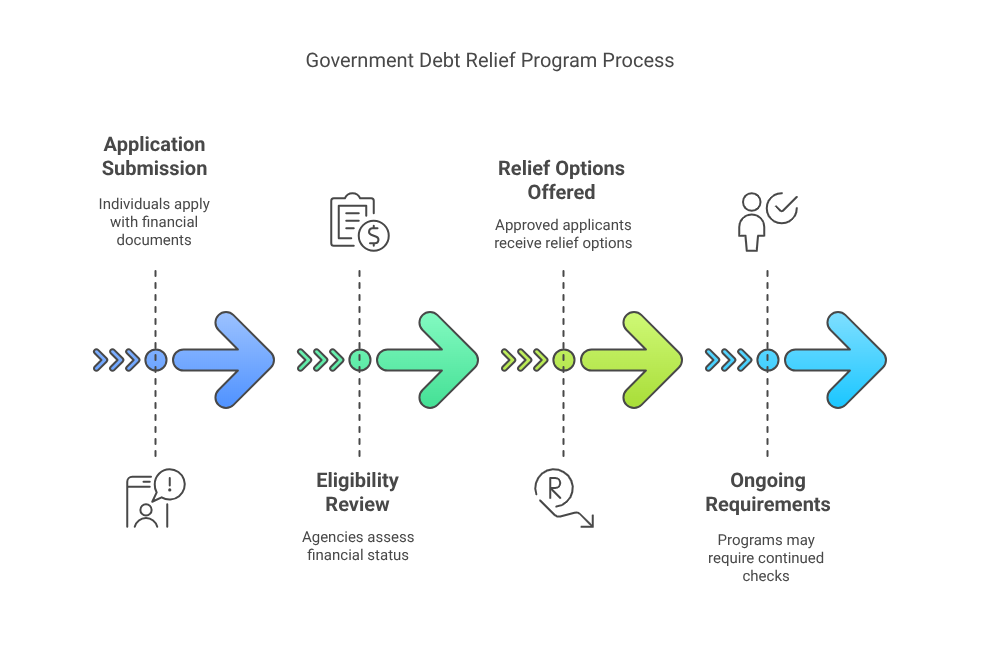

Each government debt relief program operates under its own rules, but most follow a similar structure:

- Application-Based: Individuals must formally apply and provide financial documentation.

- Eligibility Review: Agencies assess income, employment, family size, and debt type.

- Relief Options Offered: If approved, the applicant may receive reduced payments, deferment, partial forgiveness, or full cancellation.

- Ongoing Requirements: Some programs require continued eligibility checks or regular payments.

Let’s explore how each major category of government debt relief functions.

1. Student Loan Relief Programs

The federal government offers various options to help student borrowers manage or eliminate their debt:

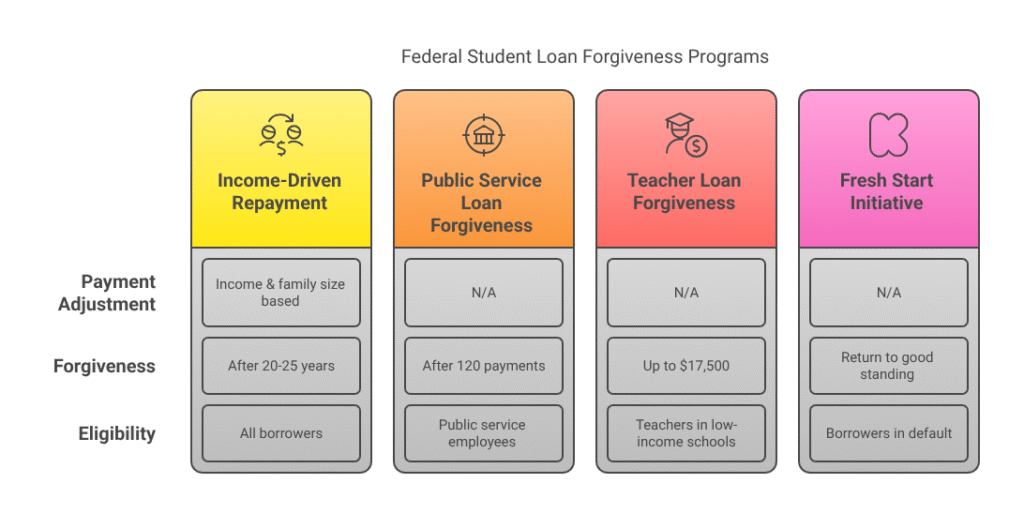

- Income-Driven Repayment (IDR) Plans: Adjust monthly payments based on income and family size. Any remaining balance is forgiven after 20–25 years of qualifying payments.

- Public Service Loan Forgiveness (PSLF): Offers total loan forgiveness for those working in qualifying public service jobs after 120 qualifying monthly payments.

- Teacher Loan Forgiveness: Allows eligible teachers in low-income schools to have up to $17,500 of their federal loans forgiven.

- Fresh Start Initiative (Post-COVID Relief): Helps borrowers in default return to good standing and re-enter repayment plans.

How it works: Borrowers submit applications and must provide income and employment details. Approved applicants either enter a new repayment plan or begin working toward forgiveness.

2. IRS Tax Debt Relief

Owing money to the IRS can be stressful and costly due to penalties and interest. Fortunately, several relief options exist:

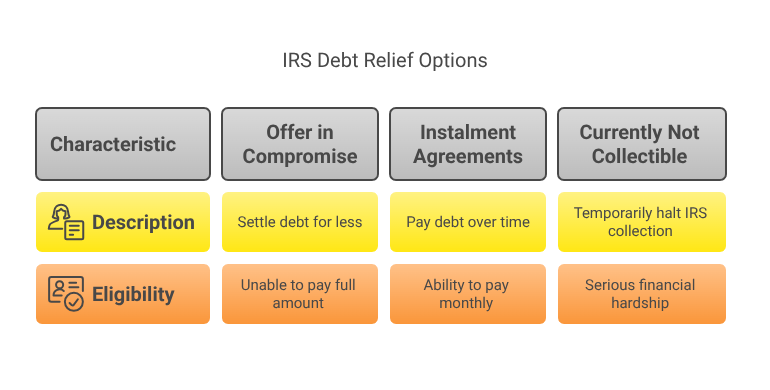

- Offer in Compromise (OIC): Settle your tax debt for less than you owe if you can prove you’re unable to pay the full amount.

- Instalment Agreements: Pay off tax debt over time through monthly instalments.

- Currently Not Collectible (CNC) Status: Temporarily halts IRS collection efforts if you’re in serious financial hardship.

How it works: Taxpayers apply through the IRS website or by submitting IRS Form 656 (OIC) or 9465 (instalments). Supporting documents such as income, assets, and expense records are required.

3. Mortgage and Housing Relief

Homeowners struggling with payments or facing foreclosure may qualify for help through state or federal programs:

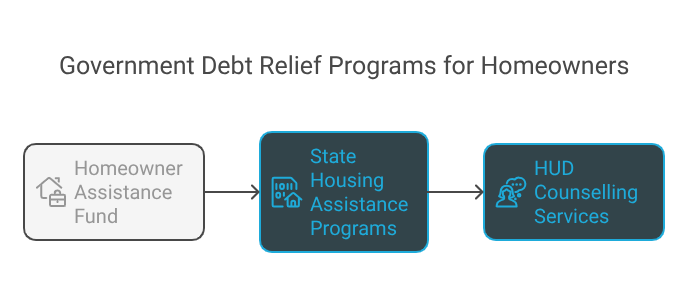

- Homeowner Assistance Fund (HAF): Provides money to help pay mortgages, utility bills, property taxes, and more.

- State Housing Assistance Programs: Vary by state but typically include grants, loan modifications, or direct payments to lenders.

- HUD Counselling Services: The U.S. Department of Housing and Urban Development (HUD) offers free counselling to help homeowners understand their options.

How it works: Applicants must prove they experienced financial hardship, such as loss of income or increased expenses, and that they are at risk of foreclosure or housing instability.

4. Utility and Rental Debt Relief

During emergencies or economic downturns, the government also provides support for rent and utility payments:

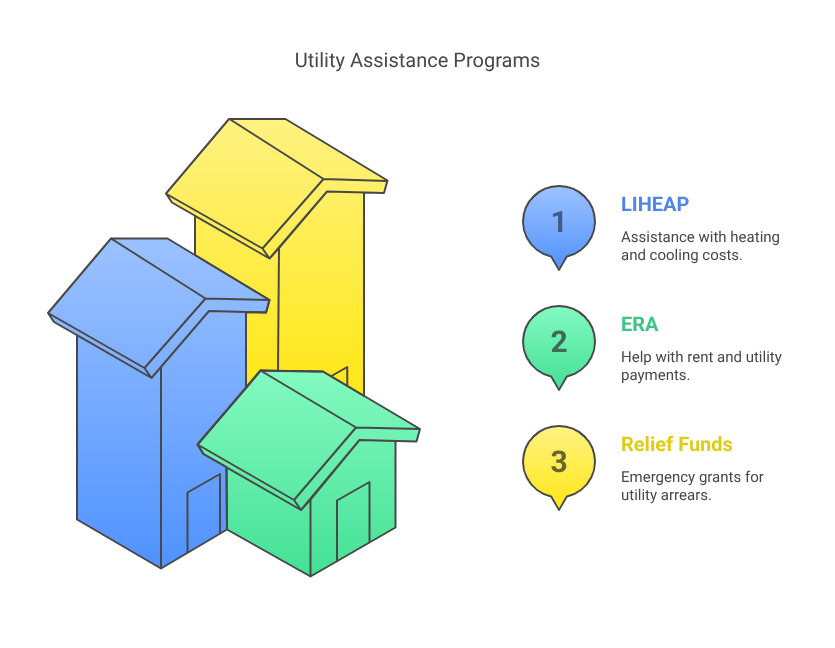

- Low-Income Home Energy Assistance Program (LIHEAP): Assists with heating and cooling costs for eligible households.

- Emergency Rental Assistance (ERA): Offers help with rent and utility payments for renters affected by financial hardship.

- State or Local Relief Funds: Many states and municipalities distribute emergency grants to assist with utility arrears or prevent eviction.

How it works: Applicants must contact their local housing or energy assistance office. Proof of income and housing status is usually required.

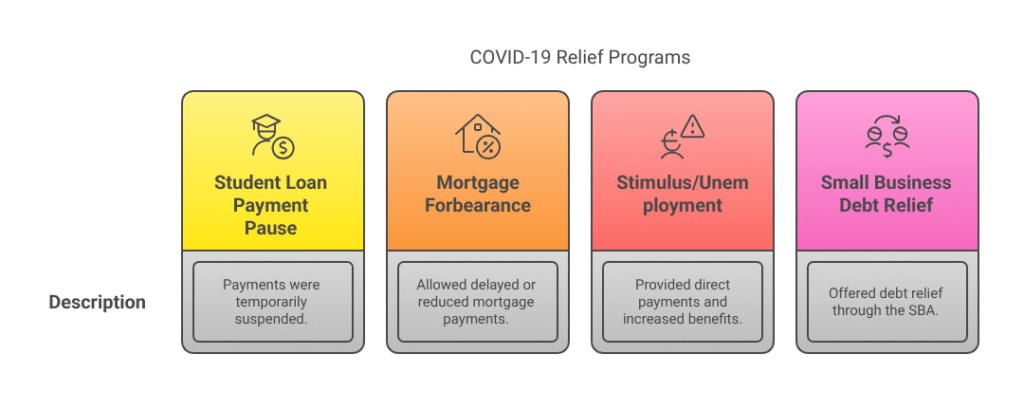

5. COVID-19 Debt Relief Programs (Now Phased Out or Modified)

In response to the pandemic, many temporary programs were launched, including:

- Student Loan Payment Pause (now ended)

- Mortgage Forbearance through the CARES Act

- Stimulus checks and expanded unemployment benefits

- Small Business Debt Relief via the SBA

While many of these have ended or evolved, some new relief programs or extensions may still be available at the state level.

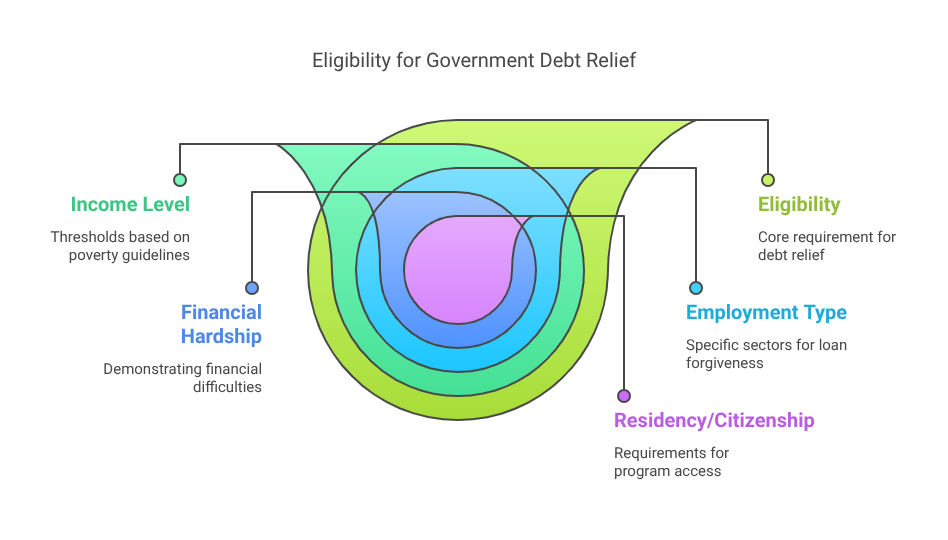

Who Qualifies for Government Debt Relief?

Eligibility requirements vary by program, but here are the most common factors that determine whether someone qualifies:

1. Income Level

Most programs use income thresholds based on federal poverty guidelines or area median income (AMI). Lower-income individuals often qualify for deeper relief.

2. Employment Type

Some student loan forgiveness programs require employment in specific sectors, like government, nonprofit, teaching, or healthcare.

3. Financial Hardship

To qualify for IRS or housing relief, applicants must demonstrate financial hardship. This can include job loss, high medical expenses, or sudden income reduction.

4. Type of Debt

Only specific debts qualify. For example:

- Federal student loans (not private)

- IRS tax debt

- Federally backed mortgages

- Rent or utilities tied to COVID-19 hardship

5. Residency or Citizenship

Many programs require applicants to be U.S. citizens or permanent residents, though some local relief funds may be available regardless of immigration status.

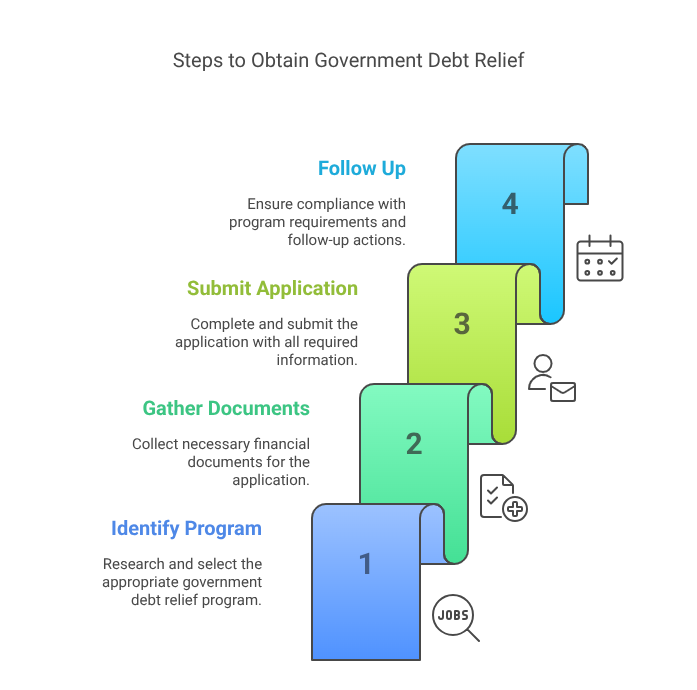

How to Apply for Government Debt Relief

If you think you may qualify for any of these programs, follow these general steps:

- Identify the Right Program: Research available government programs through official sources such as federal agencies or your state’s housing office.

- Gather Financial Documents: These typically include income statements, bank records, tax returns, and expense reports.

- Complete and Submit Application: Carefully follow instructions, provide accurate information, and submit any supporting documents.

- Follow Up and Comply with Requirements: After approval, stay on top of any follow-up certifications or repayment schedules.

Watch Out for Scams

Unfortunately, debt relief scams are common. Scammers often promise immediate forgiveness or ask for upfront fees. Always remember:

- Government programs do not charge application fees.

- Only apply through official websites ending in .gov.

- Be wary of unsolicited calls or emails claiming to offer instant debt relief.

If in doubt, contact your loan servicer, the IRS, or a HUD-approved housing counsellor for guidance.

Final Thoughts

Government debt relief programs can offer a crucial lifeline to those drowning in debt. Whether you’re burdened by student loans, behind on taxes, or struggling to keep up with your mortgage or rent, these programs are designed to provide structure, support, and hope.

Understanding how they work—and knowing whether you qualify—is the first step toward regaining financial control. With the right information and proactive steps, you can reduce your debt burden and take meaningful strides toward long-term stability.