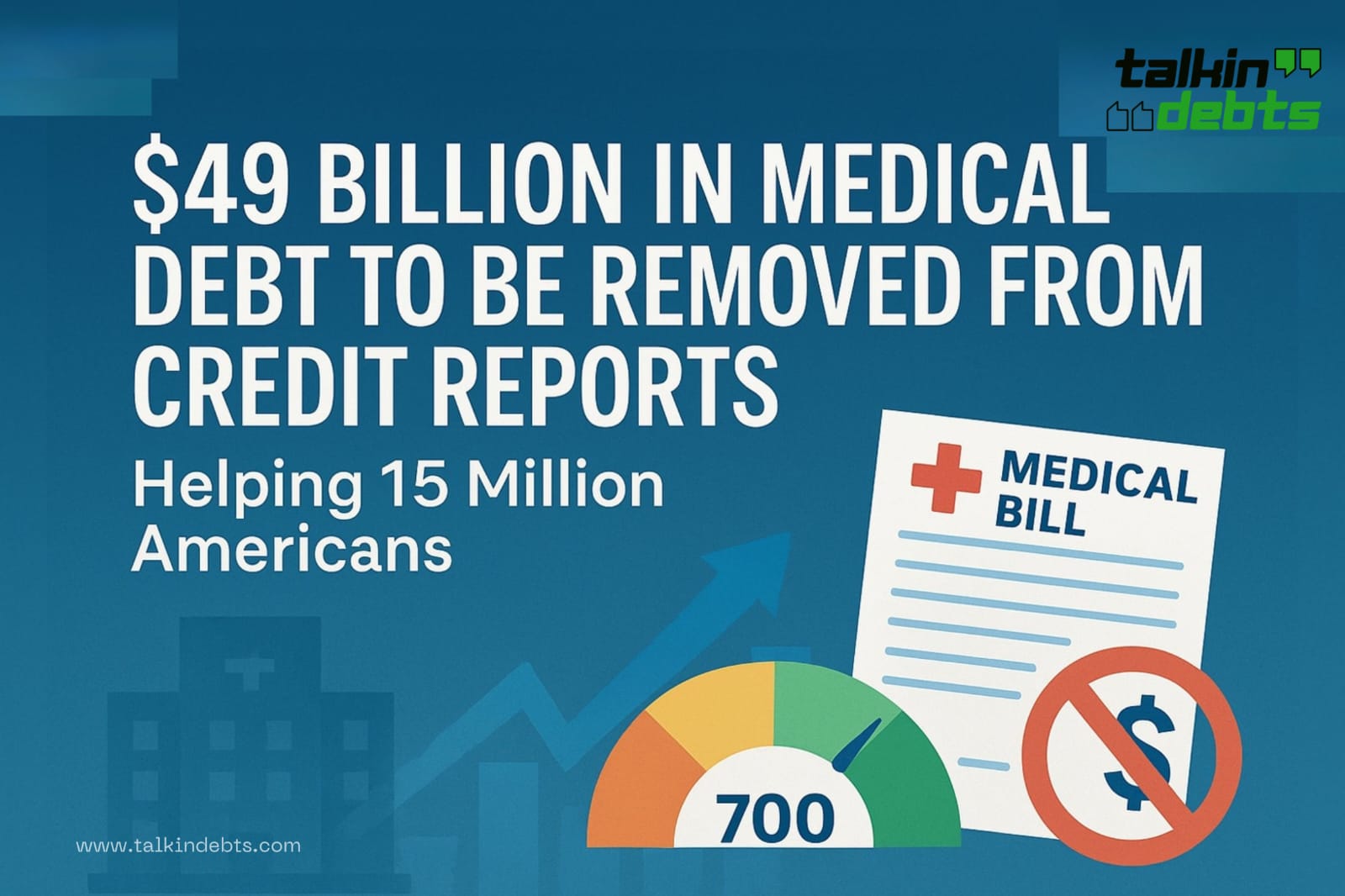

$49 Billion in Medical Debt to Be Removed from Credit Reports Under New Rule

WASHINGTON, D.C. – A newly finalized federal rule is set to eliminate an estimated $49 billion in medical bills from credit reports, providing relief to approximately 15 million Americans. The landmark decision bans the inclusion of medical bills on credit reports used by lenders and prohibits lenders from factoring such debts into their lending decisions.

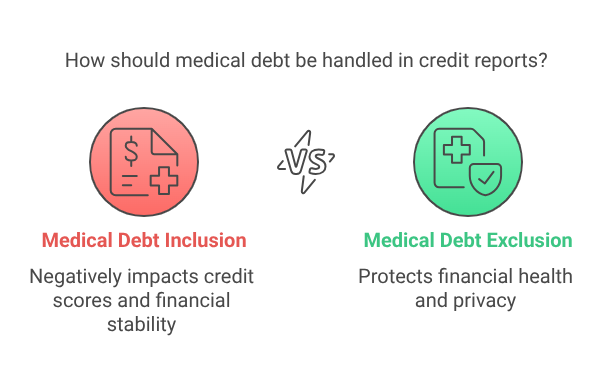

This transformative step will also increase privacy protections and stop debt collectors from leveraging credit reports to pressure individuals into paying inaccurate or unfair medical bills.

“People who get sick shouldn’t have their financial future upended,” stated a senior official. “This rule puts an end to practices that forced patients to pay bills they didn’t owe just to protect their credit.”

Why It Matters:

- Medical debt is often erroneous and should be covered by insurance or aid.

- Medical debt is a poor predictor of loan repayment ability.

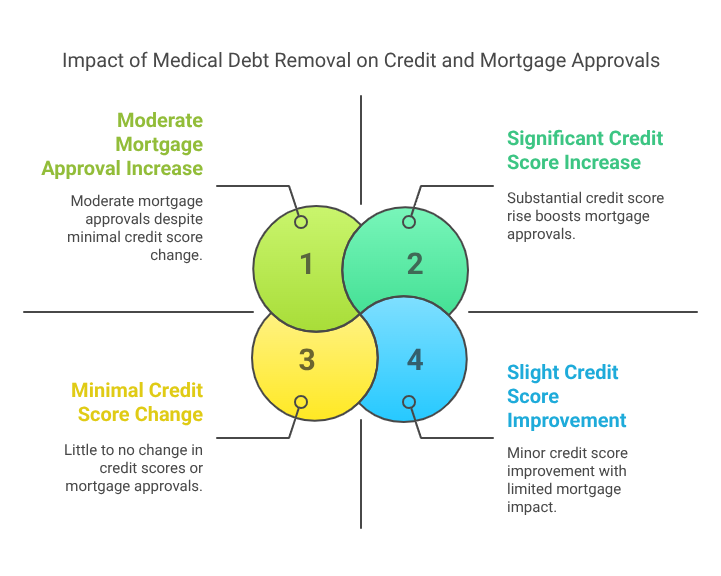

- 22,000 additional affordable mortgage approvals are expected each year.

- Credit scores could rise by an average of 20 points for affected individuals.

In recent years, credit reporting agencies have already started removing some forms of medical debt, especially collections under $500. Credit scoring companies also reduced the weight of medical debt in score calculations.

This final rule aligns federal regulations with the goal of consumer privacy and fairer lending. It effectively reverses a prior exception that allowed lenders to use medical data in credit decisions — an exception that had led to widespread use of the credit system as a tool for medical debt collection.

Key Takeaways from the New Rule:

- Medical bills will no longer appear on credit reports used by lenders.

- Lenders are barred from considering any medical information, including medical devices or treatment history, when making lending decisions.

- Legitimate medical-related verifications (e.g., medical forbearances or proving income from certain benefits) are still permitted.

This rule is part of a broader push to shield consumers from the financial harm of medical debt and abusive collection practices. Previous actions have clarified that collecting on invalid or inaccurate medical bills violates federal law.

The rule takes effect 60 days after its publication in the Federal Register.

📌 Learn more and stay informed at TalkinDebts.com — your trusted source for debt news, credit updates, and financial rights.