Debt on Demand: How ‘Buy Now, Pay Later’ Is Quietly Trapping Americans in a New Cycle of Financial Strain

New York, May 2025 —

A financial shift is underway in the United States, and it’s happening quietly—at grocery store checkouts, during food delivery app purchases, and even while paying for toiletries. What was once a convenient tool for spreading out the cost of big-ticket items has now become a lifeline for millions of struggling Americans.

Buy Now, Pay Later (BNPL) platforms like Klarna, Affirm, Afterpay, and Zip are being increasingly used to cover day-to-day expenses, particularly by younger consumers and those with limited financial means. But as their use becomes more widespread, so do the warning signs.

Essentials on Instalments: A Shift in Spending Habits

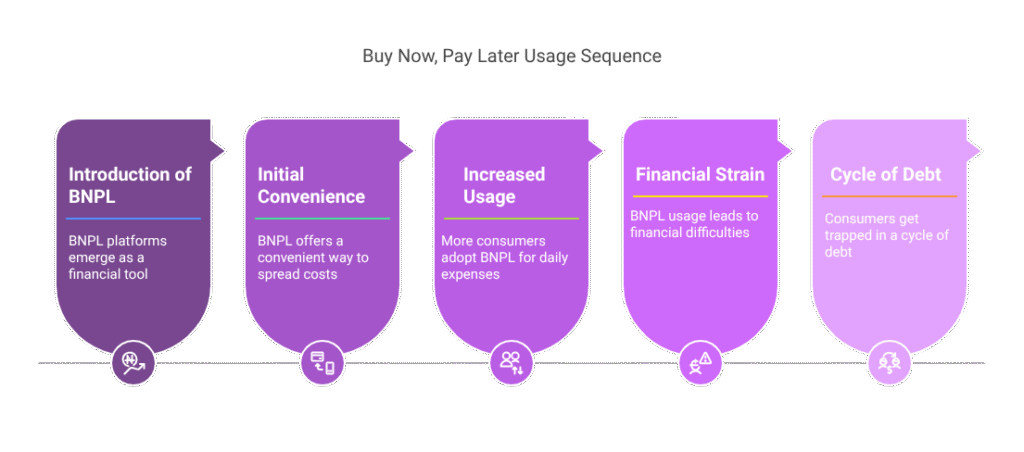

BNPL services were initially marketed as interest-free solutions for planned purchases—new furniture, electronics, and fashion. However, the latest consumer behaviour shows a more troubling trend: Americans are now using these services to break down payments for groceries, household essentials, and even fast food.

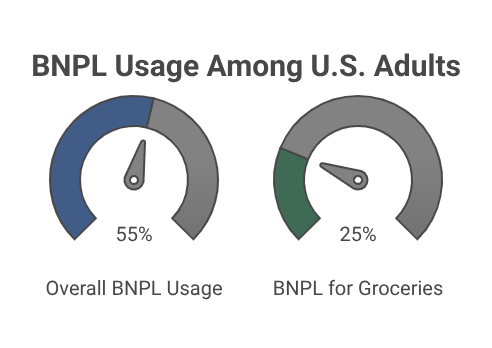

- 55% of U.S. adults say they’ve used a BNPL service at least once.

- 1 in 4 BNPL users have used the service to pay for groceries.

- Everyday items, such as shampoo, pet food, or takeout meals, are now routinely being paid off in instalments.

What was once a tool for managing luxury has evolved into a survival mechanism, suggesting a rising tide of financial instability among middle- and low-income households.

Behind the Flexibility: Financial Warning Signs Grow

Despite their branding as consumer-friendly and interest-free, BNPL services may be fuelling a deeper economic crisis.

According to a Consumer Financial Protection Bureau (CFPB) study, a significant portion of BNPL users have subprime or deep subprime credit scores, indicating that they are already high-risk borrowers.

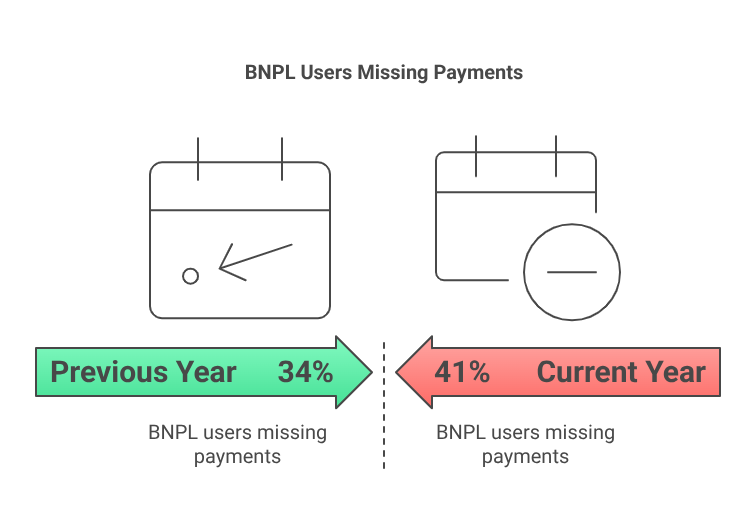

- A LendingTree survey revealed that 41% of BNPL users missed at least one payment—a sharp increase from 34% in the previous year.

- Missed payments can lead to late fees, account freezes, and sometimes debt collection.

- BNPL services do not consistently report positive payment behaviour to credit bureaus, meaning users gain no credit-building benefit even when paying on time.

“The illusion of affordability is dangerous,” said one financial analyst. “If you’re making future payments on a sandwich you’ve already eaten, that’s not budgeting—it’s debt deferment.”

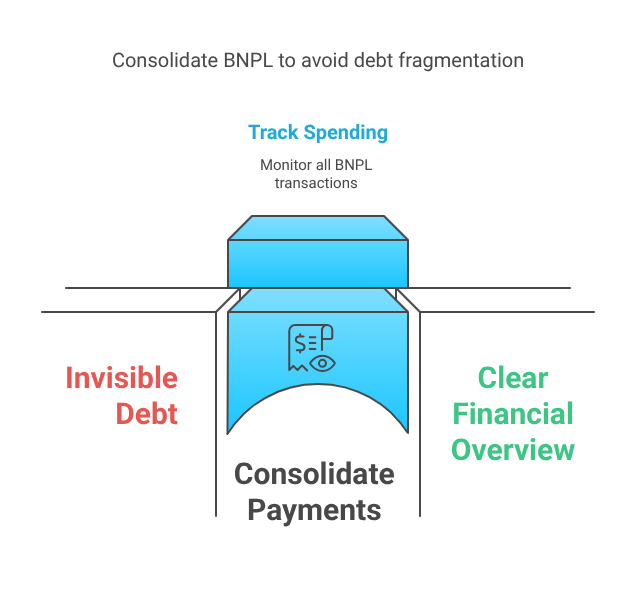

Experts Sound the Alarm: A Growing Risk of Debt Fragmentation

Economists and consumer advocates alike are raising red flags. By enabling users to fragment payments across multiple services and purchases, BNPL platforms are contributing to what experts call “invisible debt”—obligations that consumers don’t track or mentally register the way they would with credit cards or loans.

- Users often juggle multiple BNPL accounts simultaneously, making it difficult to stay organized.

- Because payments are deducted automatically, consumers may lose visibility over how much they owe, leading to overdraft fees or bounced payments.

- The absence of regulation also leaves consumers with few protections, especially compared to traditional credit products.

“BNPL may feel less like borrowing, but the consequences are just as real,” said a spokesperson from a nonprofit debt advisory firm. “And in many cases, the damage is already done before consumers realize they’re in over their heads.”

A Culture of Instant Gratification, Deferred Burden

The rise of BNPL isn’t happening in isolation—it reflects a broader cultural shift toward normalizing financial risk, particularly among Millennials and Gen Z.

- Younger Americans are more likely to engage with speculative financial tools, such as meme stocks, crypto assets, and app-based gambling.

- There’s a growing comfort with short-term rewards at the cost of long-term planning.

- Even financially literate consumers are drawn to BNPL for the convenience, but convenience can come at a cost.

Financial therapists note a generational divide: older generations were taught to save before spending, while today’s consumers are encouraged to spend first and worry later—a mindset that can erode financial stability in the long term.

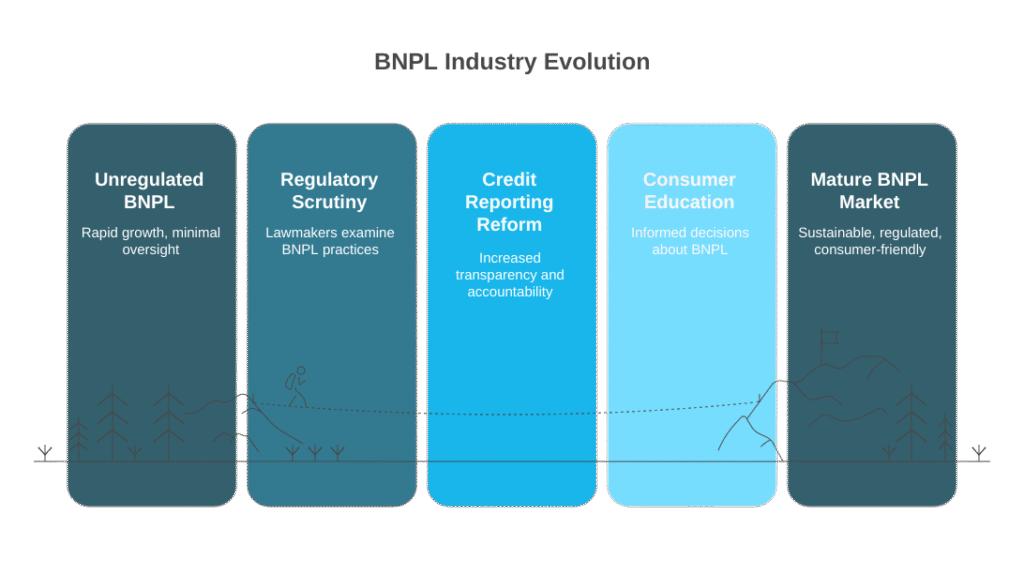

The Road Ahead: Regulation, Recession, and Rising Dependence

With inflation lingering and wage growth stagnating, the reliance on BNPL for everyday needs is expected to rise. Analysts warn that the upcoming year could see even greater dependence on these services if economic conditions do not improve.

- Several BNPL platforms are preparing for IPOs or expansion into banking and credit card services.

- Lawmakers and regulators are beginning to examine BNPL practices more closely, but comprehensive legislation is still pending.

- There are growing calls for credit reporting reform and consumer education around BNPL usage.

“The convenience is real—but so is the cost,” said one policy analyst. “Without intervention, we risk embedding this debt cycle into the foundation of everyday financial life.”

Conclusion: A Debt Crisis in Disguise?

What started as a fintech innovation may now be reshaping the American debt landscape. As more families turn to BNPL just to get through the week, experts fear the emergence of a shadow debt economy—one where the pain is delayed, the risks are hidden, and the damage is silently mounting.

If current trends continue unchecked, Buy Now, Pay Later won’t just change how Americans shop—it may change how they survive.