5 Budgeting Tips to Keep Your Personal Debt Under Control

Managing personal debt can feel overwhelming, but with a clear plan and smart budgeting strategies, it becomes manageable and even empowering. Debt doesn’t disappear overnight, but with the right tools and consistent effort, you can take control of your finances, reduce stress, and build toward a debt-free future.

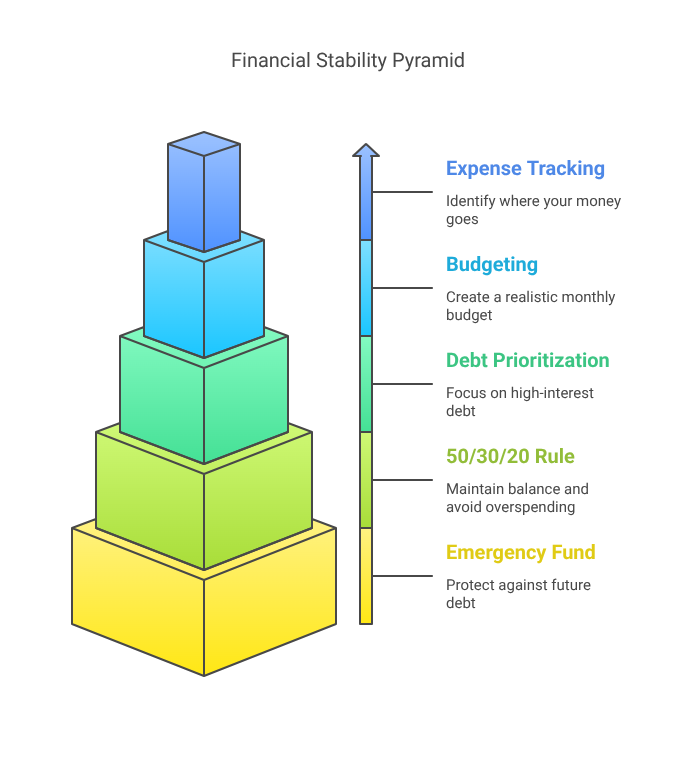

Budgeting is the foundation of financial freedom. It helps you understand your income, manage your expenses, and prioritize what truly matters. Whether you’re struggling with credit card debt, personal loans, or just trying to stretch your paycheck, these five budgeting tips will help you stay on track—and out of the debt spiral.

5 Practical Budgeting Tips:

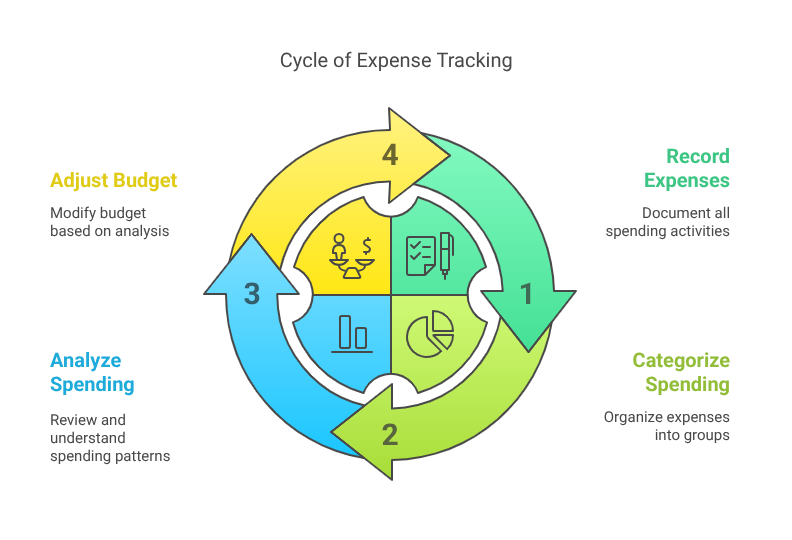

1. Track Every Dollar You Spend

Before you can fix a problem, you need to understand it. Most people are surprised to learn how much they actually spend. That $5 coffee every morning, the occasional food delivery, or those monthly streaming subscriptions add up more than you think.

What to Do:

- Record all expenses for at least one month.

- Use a mobile budgeting app or a simple spreadsheet.

- Categorize your spending (e.g., groceries, transport, entertainment).

Why It Works:

Tracking helps you identify spending leaks—those little expenses that drain your finances without adding much value. Once you know where your money is going, you can redirect it to debt repayments or savings.

Example:

If you find you’re spending $200 a month on takeout, cutting that in half gives you $100 to apply toward credit card debt. That’s $1,200 per year—plus you save on interest.

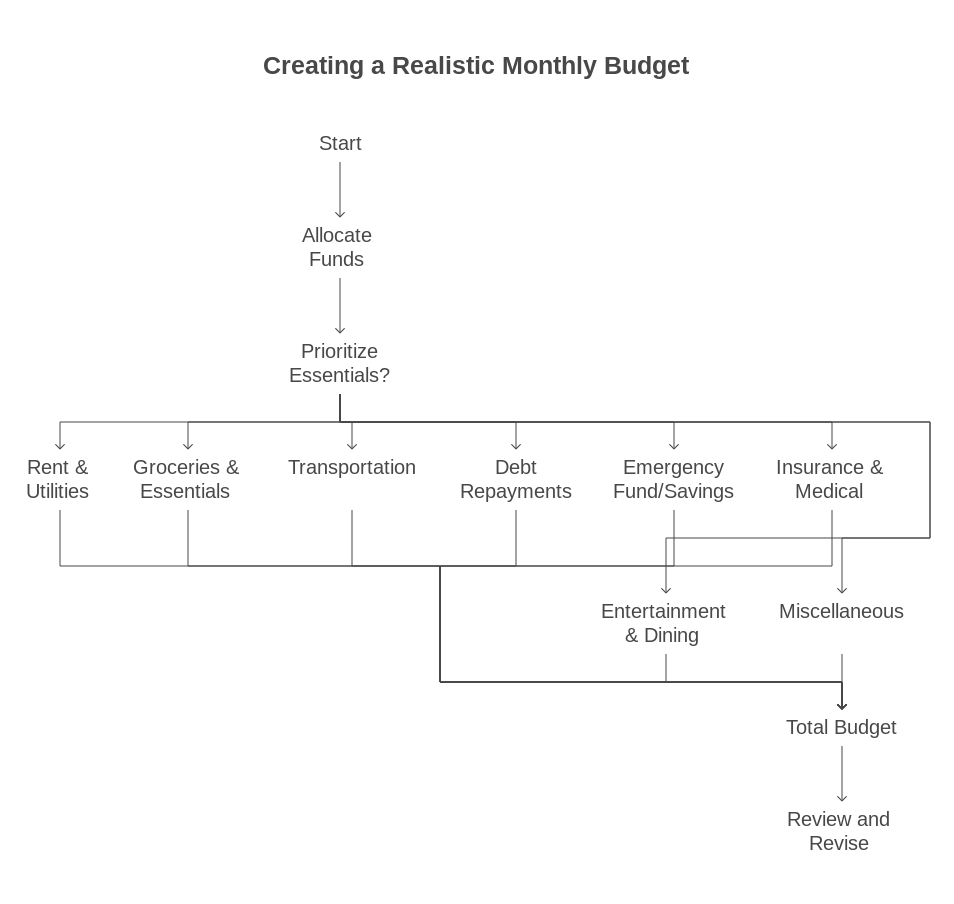

2. Create a Realistic Monthly Budget

A budget isn’t about denying yourself. It’s about giving every dollar a job. The key is to build a budget that reflects your real life, not an idealized version of it.

Example Budget Breakdown (Based on $3,500 Monthly Income):

| Category | Amount | % of Income |

|---|---|---|

| Rent & Utilities | $1,200 | 34% |

| Groceries & Essentials | $400 | 11% |

| Transportation | $300 | 9% |

| Debt Repayments | $500 | 14% |

| Emergency Fund/Savings | $400 | 11% |

| Insurance & Medical | $200 | 6% |

| Entertainment & Dining | $200 | 6% |

| Miscellaneous | $300 | 9% |

| Total | $3,500 | 100% |

This budget ensures essentials and debt payments come first, while still leaving room for fun and flexibility.

Tips for Realism:

- Don’t underestimate costs—round up for things like groceries or fuel.

- Include irregular expenses (e.g., birthdays, vet bills) by setting aside a monthly buffer.

- Review and revise monthly.

3. Prioritize High-Interest Debt

Not all debt is created equal. Some debt grows faster because of high interest rates, which can turn small balances into long-term burdens.

Two Common Payoff Strategies:

1. Avalanche Method:

- Focus on the debt with the highest interest rate first.

- Pay the minimum on all other debts.

- Once one is paid off, move to the next highest rate.

2. Snowball Method:

- Focus on the smallest balance first.

- Build psychological momentum with quick wins.

- Roll the amount into the next smallest debt.

Which Is Better?

An avalanche saves more money in the long run, but a snowball is better for motivation. Choose the one you’ll stick to.

Example:

Suppose you have:

- Credit card: $2,000 at 24% APR

- Personal loan: $3,000 at 10% APR

- Car loan: $8,000 at 6% APR

Using the avalanche method, focus on the credit card first. Paying it off early saves significant interest.

Extra Tip:

Ask lenders if they allow lump sum or additional payments without penalty. Every extra dollar toward principal saves your money.

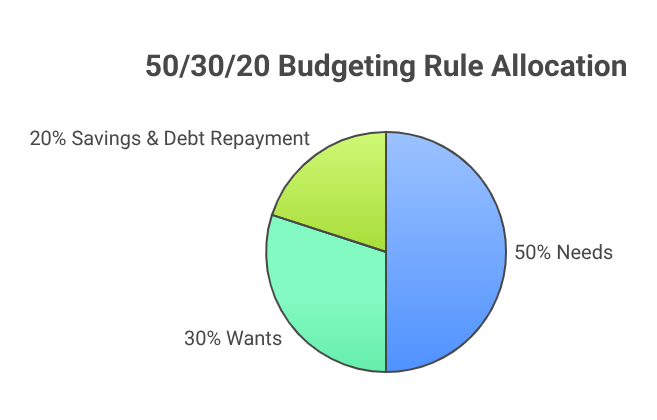

4. Follow the 50/30/20 Budgeting Rule

One of the most practical frameworks for managing money is the 50/30/20 rule. It keeps budgeting simple and focused while allowing flexibility.

- 50% Needs: Essentials like rent, groceries, utilities, insurance, and minimum debt payments.

- 30% Wants: Dining out, subscriptions, hobbies, travel.

- 20% Savings & Debt Repayment: Emergency fund, retirement savings, and additional debt payments.

Here’s How It Works:

Example (Based on $3,000 Monthly Take-Home Pay):

- Needs = $1,500

- Wants = $900

- Savings/Debt Paydown = $600

If you’re dealing with heavy debt, modify the split:

- Wants = 20%

- Savings & Debt = 30%

The goal is to allocate more toward debt repayment and emergency savings until you’re in a healthier financial position.

Why This Works:

It balances lifestyle with responsibility. You’re not denying yourself—you’re just being intentional.

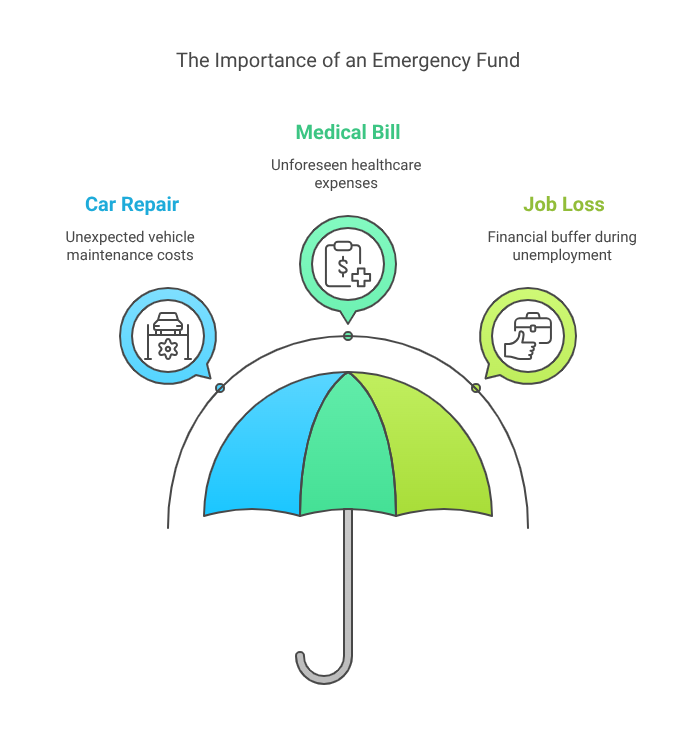

5. Build an Emergency Fund

An emergency fund is your safety net. Without it, unexpected expenses often lead to more debt. Whether it’s a car repair, medical bill, or sudden job loss, having a cushion keeps you afloat.

How Much Should You Save?

- Start with $500–$1,000 as a mini-fund.

- Gradually build up to 3–6 months of living expenses.

Where to Keep It:

- Use a separate high-yield savings account.

- Avoid investing it—it should be accessible but not too easy to spend.

How to Build It:

- Automate savings: $25/week = $1,300/year.

- Use windfalls (tax refunds, bonuses).

- Sell unused items or take up small gigs.

Why It Matters:

Without a fund, emergencies force you to rely on credit cards or loans, setting back your progress.

Bonus Tip: Use a Debt Rating Checker

Your debt rating reflects how lenders view your ability to repay debt. Knowing your score helps you make smarter financial decisions and avoid surprises when applying for loans or credit.

What Affects Your Debt Rating:

- Payment history (on-time or late)

- Total amount of debt

- Types of credit used (credit cards, loans, etc.)

- Length of credit history

- New credit inquiries

Why You Should Check Your Rating Regularly:

- Spot errors or identity theft early

- Track progress as you reduce debt

- Know your eligibility for better rates or refinancing

Example:

Imagine you’ve paid off two credit cards and lowered your credit utilization to 25%. Your score improves, which could help you refinance a personal loan at a lower rate, saving hundreds in interest.

Where to Check:

Use trusted tools that provide your credit score and debt breakdown, preferably without impacting your score or charging hidden fees.

Knowing your rating is like checking your health—it helps you stay informed and make decisions based on facts.

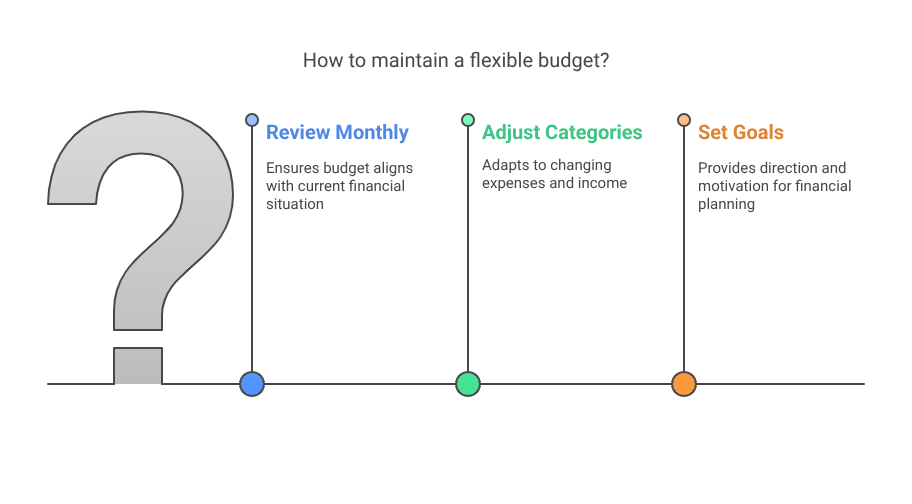

Maintain a Flexible Budget and Review Monthly

A successful budget is not rigid. Life changes—your budget should, too.

Every Month, Ask Yourself:

- Did I overspend in any category?

- Did I reach my debt or savings goals?

- Are any large expenses coming up?

When to Adjust:

- Income changes (raise, job loss, new side gig)

- Major life changes (moving, new baby, medical costs)

- Seasonal changes (holidays, travel, school fees)

Flexibility ensures your budget evolves with your needs and avoids becoming frustrating or unrealistic.

Final Thoughts

Taking control of personal debt isn’t about overnight miracles. It’s about creating a practical, consistent plan—and sticking to it. Budgeting is the roadmap that helps you spend intentionally, save wisely, and reduce debt steadily.

Recap – Your Action Plan:

- Track your expenses to identify where your money really goes.

- Build a realistic monthly budget based on your actual lifestyle and goals.

- Prioritize high-interest debt using either the avalanche or snowball method.

- Apply the 50/30/20 rule to maintain balance and avoid overspending.

- Set up an emergency fund to protect yourself from future debt.

Bonus: Use a debt rating checker to monitor your financial standing and make smarter borrowing decisions.

Consistency and awareness are your strongest allies. Begin by taking small steps—each one builds momentum and confidence. No matter where you’re starting from, you can make progress and take control of your financial future.

Start budgeting today. The sooner you begin, the faster you’ll feel the freedom of financial control.