Government Announces New Debt Relief Program for Small Businesses

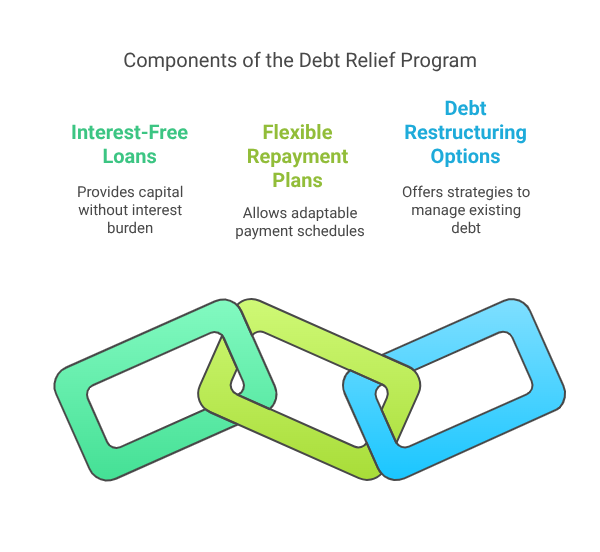

In response to the ongoing financial struggles faced by small businesses, the government has launched a comprehensive debt relief program aimed at mitigating financial distress and promoting economic recovery. This initiative introduces interest-free loans, flexible repayment plans, and debt restructuring options for qualifying small businesses. The program aims to reduce bankruptcy rates and provide crucial support to businesses still recovering from the economic effects of the COVID-19 pandemic.

Understanding the New Debt Relief Program

The newly introduced debt relief program is designed to provide targeted financial support to small businesses that continue to face economic hardships. The program will operate under strict eligibility criteria to ensure that those most in need receive support.

Key Features of the Program

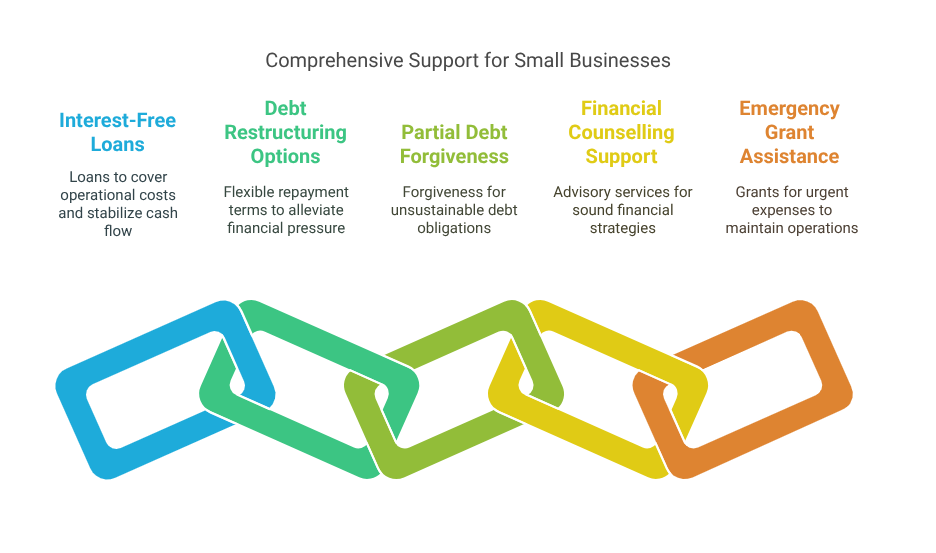

The debt relief program offers several key features that aim to provide financial stability to small businesses:

- Interest-Free Loans: Eligible businesses can access interest-free loans to cover operational costs such as rent, payroll, and inventory. These loans are expected to help stabilize cash flow, ensuring that businesses can maintain day-to-day operations.

- Debt Restructuring Options: Businesses with existing debt may qualify for flexible repayment terms, including extended repayment periods and reduced monthly installments. This is intended to alleviate immediate financial pressure.

- Partial Debt Forgiveness: In certain cases, businesses demonstrating long-term financial instability may be eligible for partial debt forgiveness. This measure will ensure businesses are not burdened with unsustainable debt obligations.

- Financial Counselling Support: The program will also connect businesses with financial advisors to help them develop sound financial strategies, ensuring they remain viable and sustainable.

- Emergency Grant Assistance: As part of the initiative, businesses facing immediate cash flow concerns may qualify for emergency grants to cover urgent expenses such as utility bills, maintenance costs, and essential supplies.

Eligibility Criteria

To ensure the program’s resources are directed toward those in greatest need, the government has outlined specific eligibility requirements:

- Businesses must demonstrate a significant decline in revenue since the pandemic.

- Companies must employ fewer than 50 full-time staff members.

- Businesses in industries heavily impacted by the pandemic, such as hospitality, retail, and entertainment, will be given priority.

- Applicants must submit financial statements proving their need for assistance and outlining their recovery plans.

- Businesses with a strong community impact, such as those providing vital local services, may be prioritized for additional support.

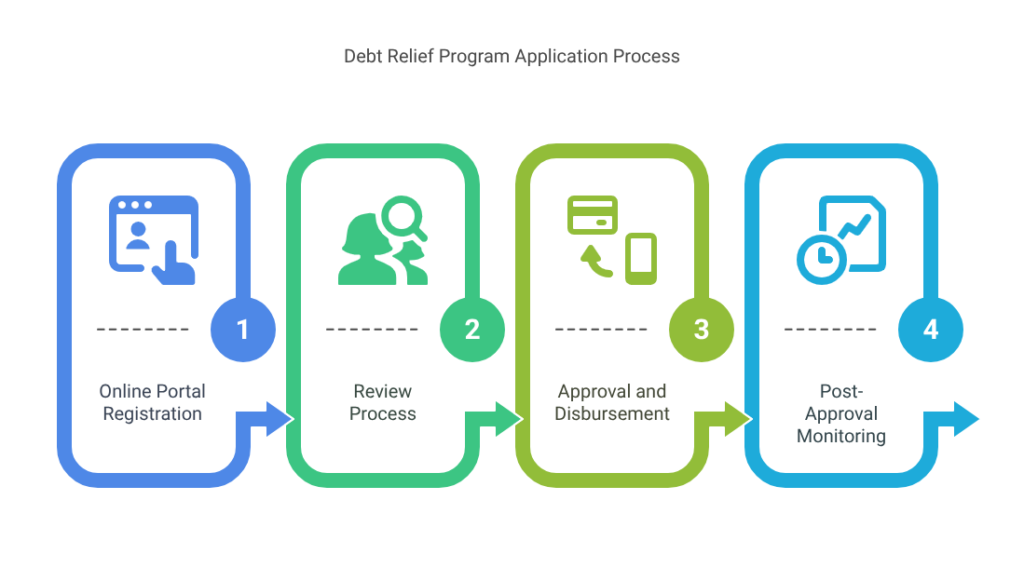

Application Process

The application process is designed to be straightforward to ensure quick access to financial aid:

- Online Portal: Businesses must register through the dedicated government portal where they will provide essential business information, financial records, and details of their debt obligations.

- Review Process: Applications will be reviewed by financial experts to assess eligibility and determine the most suitable support option.

- Approval and Disbursement: Once approved, funds will be disbursed directly to the business’s registered bank account to ensure immediate access.

- Post-Approval Monitoring: Approved businesses may need to provide periodic financial updates to ensure funds are used effectively and meet program requirements.

Impact on Small Businesses

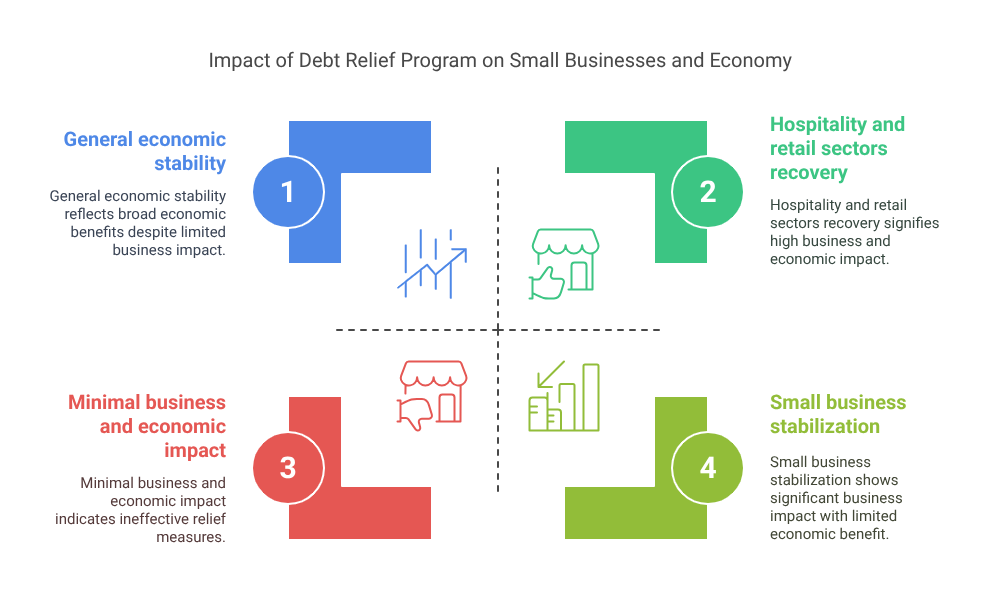

The new debt relief program is expected to have a significant impact on struggling small businesses. By offering interest-free loans and flexible repayment options, businesses can stabilize their cash flow, maintain employee wages, and continue serving their communities.

The hospitality and retail sectors, in particular, are expected to benefit greatly. Many businesses in these industries have faced unprecedented challenges, with reduced foot traffic, supply chain disruptions, and rising operational costs. The new relief measures aim to alleviate these pressures and provide businesses with a fighting chance to regain financial stability.

Additionally, the program’s focus on debt forgiveness and financial counseling aims to encourage long-term financial planning. By equipping businesses with the knowledge and tools to manage their finances effectively, the program seeks to create lasting economic stability.

Economic Benefits

In addition to aiding individual businesses, the debt relief program is expected to contribute positively to the broader economy. By preventing closures and bankruptcies, the program will help preserve jobs, sustain consumer spending, and maintain the vibrancy of local economies. Furthermore, by offering debt restructuring options, the government aims to stabilize the financial sector by reducing the risk of loan defaults.

The anticipated increase in consumer confidence is also expected to contribute to economic growth. As businesses regain stability, they are more likely to invest in expansion, innovation, and workforce development, ultimately strengthening the economy as a whole.

Challenges and Concerns

Despite the positive outlook, some experts have raised concerns about the program’s effectiveness. Potential challenges include:

- Application Backlog: Due to high demand, there may be delays in processing applications.

- Exclusion of Larger Businesses: While the focus on small businesses is essential, some argue that larger enterprises in struggling sectors may also require additional support.

- Sustainability of Debt Forgiveness: Ensuring that debt forgiveness measures are sustainable without placing undue strain on public finances remains a key concern.

- Risk of Misuse: Authorities have emphasized the need for strong oversight to prevent misuse of funds, ensuring that relief is granted only to businesses in genuine need.

Future Outlook

The government has indicated that it will monitor the program’s impact closely and make adjustments as necessary. Additional funding may be allocated if demand exceeds initial projections. Moreover, policymakers are exploring complementary measures, such as targeted tax incentives and workforce development programs, to support long-term business recovery.

To further support small businesses, the government is also considering partnerships with financial institutions to provide tailored banking solutions, such as specialized loan packages and investment advice, ensuring businesses have comprehensive financial support.

Conclusion

The new debt relief program represents a significant step in supporting small businesses still grappling with the economic fallout of the pandemic. By providing interest-free loans, flexible repayment options, and financial counseling, the government aims to reduce bankruptcy rates and help businesses thrive once again. Small business owners are encouraged to review the eligibility criteria and apply promptly to take full advantage of the support available. With sustained commitment and proper implementation, the debt relief program has the potential to rebuild economic resilience, support communities, and strengthen the nation’s economic landscape.