Credit Card Debt Hits Record High Amid Rising Inflation

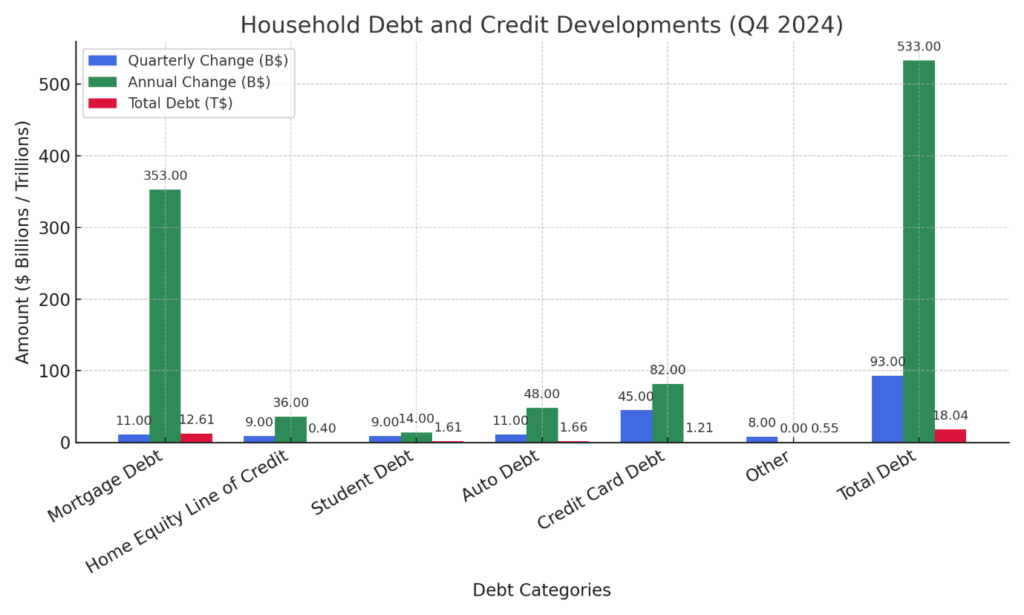

Credit card debt in the U.S. has skyrocketed to a jaw-dropping $1.13 trillion in 2024, according to the Federal Reserve Bank of New York. This record-breaking figure comes as inflation continues to squeeze household budgets, pushing Americans to rely on credit cards for everything from groceries to gas. Rising interest rates and stagnant wages aren’t helping, trapping many in a vicious cycle of debt. Financial experts warn that without action, this credit crisis could spiral further, threatening both personal finances and the broader economy.

This article breaks down the key drivers behind surging credit card debt—persistent inflation, high APRs, wage stagnation, and post-pandemic spending shifts. It also explores the consequences and offers practical debt management solutions. Whether you’re drowning in credit card bills or just curious, here’s what you need to know about this escalating financial emergency.

Source: Federal Reserve Bank of New York, Household Debt and Credit Report

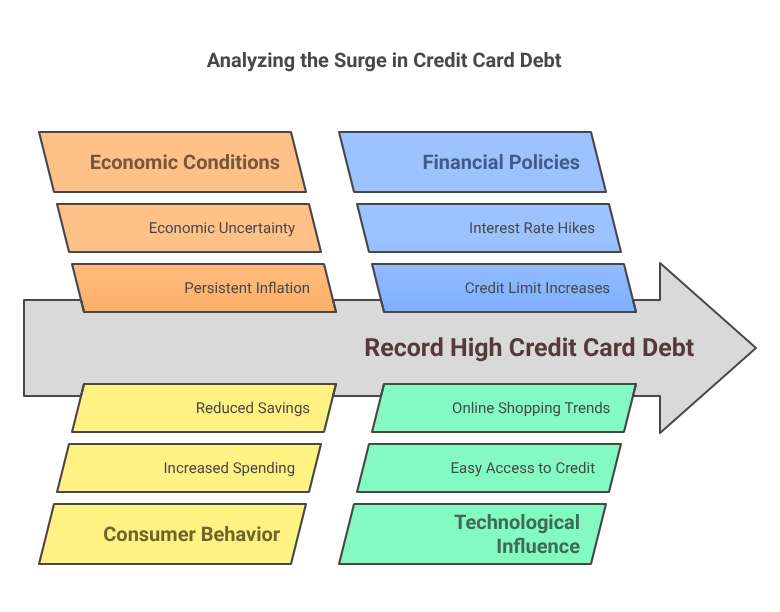

1. Key Factors Driving Credit Card Debt to Record Levels

1.1 Persistent Inflation Squeezes Household Budgets

Inflation refuses to relent. The Consumer Price Index (CPI) rose 3.2% year-over-year by February 2024, per the U.S. Bureau of Labor Statistics. While it’s cooled from 2022’s peak, everyday costs keep climbing, leaving families scrambling.

- Rising Costs: Essentials like housing, healthcare, and groceries are pricier than ever. A dozen eggs jumped from $1.50 in 2020 to $2.80 in 2024—small hikes that add up fast.

- Credit Reliance: A TransUnion report shows that 50% of Americans now use credit cards for daily necessities, a direct response to inflation’s bite.

- Borrowing Costs: Federal Reserve rate hikes have made credit card debt more expensive, with APRs soaring past 24%.

- Energy Prices: Gas prices spiked 12% in the last year, averaging $3.80 per gallon, hitting commuters hard.

With wallets stretched thin, credit cards have become a lifeline. But that lifeline comes with a catch: growing balances and a tougher climb out of debt.

1.2 Rising Interest Rates Increase Debt Burden

The Federal Reserve’s fight against inflation has jacked up borrowing costs. Bankrate pegs the average credit card APR at 24.6%—a decades-high level that’s crushing cardholders.

- High Interest: Only 45% of users pay their balance monthly, per CNBC, leaving most stuck with hefty interest charges.

- Costly Balances: A $5,000 balance at 24.6% APR racks up over $1,200 in interest if you stick to minimum payments—money that could’ve gone elsewhere.

- Fewer Options: Lenders tightened rules, making debt consolidation loans or 0% APR balance transfers harder to snag.

High interest rates turn small debts into monsters. For many, swiping the card feels like a quick fix—until the bill arrives.

1.3 Stagnant Wage Growth vs. Rising Costs

Inflation’s up, but paychecks? Not so much. The Economic Policy Institute says real wages grew just 0.2% annually since 2020—way below inflation’s pace.

- Income Gap: A $40,000 salary from 2020 should be $47,000 today to keep up. Most workers aren’t there, so credit cards fill the void.

- Gig Struggles: Gig workers face inconsistent pay and no benefits, leaning on credit to smooth the bumps.

- Housing Crunch: Rent and mortgages now eat 30%+ of income, per the Census Bureau, leaving little for savings or debt repayment.

Without wage growth, credit card debt keeps piling up. It’s a Band-Aid for a wound that won’t heal.

1.4 Post-Pandemic Spending Habits & Reduced Savings

Pandemic savings are history. Stimulus checks and locked-down lifestyles once padded bank accounts, but those days are gone.

- Emergency Funds: Bankrate’s 2024 survey says 57% of adults can’t cover a $1,000 surprise without borrowing.

- Spending Spree: Credit cards now fund travel and dining, with J.P. Morgan noting robust discretionary spending despite debt woes.

- BNPL Traps: Buy Now, Pay Later services promise relief but often hit users with 25%+ interest after teaser periods.

No savings plus loose spending equals trouble. Unexpected costs—like a $200 car repair—mean more swipes and bigger balances.

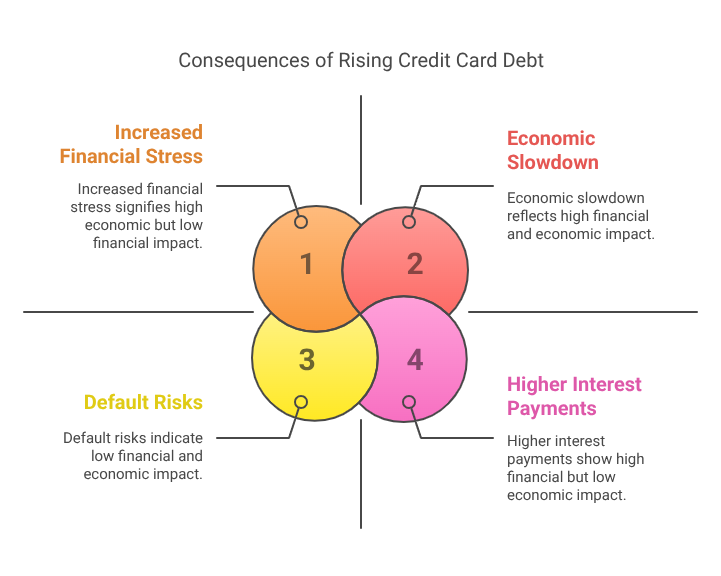

2. The Consequences of Rising Credit Card Debt

2.1 Increased Financial Stress & Default Risks

Debt’s taking a toll. The New York Fed reports serious delinquencies (90+ days late) at 6.4%—the highest since 2012.

- Payment Struggles: More Americans can’t keep up, especially Gen Z and Millennials, whose debt outpaces earnings.

- Credit Hits: Defaults tank scores, jacking up future loan costs or blocking approvals entirely.

- Mental Strain: Financial stress spikes anxiety and depression, per health studies, feeding a cycle of poor choices.

Missed payments aren’t just numbers—they’re sleepless nights and shrinking options.

2.2 Higher Interest Payments Drain Household Income

Interest is eating wallets alive. The Consumer Financial Protection Bureau says households spend over $1,000 yearly on credit card interest alone.

- Debt Load: The average family carries $8,000 in revolving debt—way up from pre-2020 levels.

- Lost Cash: That $1,000 could fund groceries or savings, but it’s padding bank profits instead.

- Wealth Gap: Less money for investments keeps families treading water, not building futures.

Interest payments are a silent thief, siphoning cash from strapped households.

2.3 Potential Economic Slowdown

Big debt could mean big trouble for the economy. When consumers sink, so does spending power.

- Bank Risks: Rising defaults might force banks to tighten lending, choking off credit access.

- GDP Threat: Less retail and service spending could stall growth, raising recession fears.

- Bubble Watch: Some experts see a debt bubble brewing—unsustainable levels that could pop.

A debt-heavy nation isn’t just a personal crisis—it’s an economic warning sign.

3. Expert Recommendations to Manage Credit Card Debt

3.1 Prioritize High-Interest Debt Repayment

Tackle debt smartly. Experts suggest proven strategies to chip away at balances.

- Avalanche Method: Pay off the highest APPR cards first to save on interest.

- Snowball Method: Clear the smallest debts for quick wins and momentum.

- Balance Transfers: Shift debt to 0% APR cards—watch for fees (3-5%) and post-promo rates.

- Extra Payments: Add $50 or $100 monthly to high-interest debt to shrink it faster.

Focus on the costliest cards first. Every dollar counts.

3.2 Cut Unnecessary Spending & Budget Strictly

Reign in spending. Small changes can free up cash for debt repayment.

- Track It: Apps like Mint or YNAB reveal where the money’s going—cut that $5 latte habit.

- Trim Excess: Skip dining out or streaming subscriptions; redirect funds to debt.

- Plan Ahead: Budget with high-interest debt as priority one.

A tight budget isn’t fun, but it’s freedom’s first step.

3.3 Seek Professional Help If Overwhelmed

Don’t go it alone. Experts can lighten the load.

- Credit Counselling: Nonprofits like the National Foundation for Credit Counselling offer free plans and creditor talks.

- Debt Settlement: Pros might negotiate lower balances—beware of fees and credit score dings.

- Ask Early: Get help before defaults pile up.

Swallowing pride for advice can save your finances.

4. Conclusion: The Urgent Need for Financial Responsibility

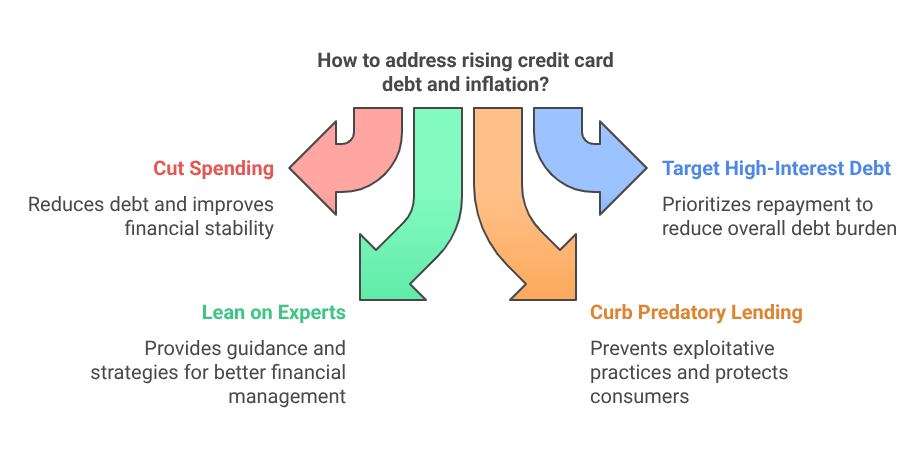

Credit card debt is at $1.13 trillion, and inflation’s not backing down. Americans must act now—cut spending, target high-interest debt, and lean on experts. Policymakers should curb predatory lending and boost financial literacy too. The stakes? Personal stability and economic health.

Debt management isn’t easy, but it’s doable. Smart moves today break the cycle, paving the way for a debt-free tomorrow.

Key Takeaways:

- Inflation and 24.6% APRs fuel credit card debt’s rise.

- Stagnant wages and drained savings keep reliance high.

- Defaults threaten wallets and the economy.

- Budgeting and repayment strategies are your escape hatch.