IMF Sounds the Alarm: U.S. Debt Explosion Could Trigger Global Economic Quake

The IMF’s alarm, delivered in its 2025 Fiscal Monitor Report, outlines a grim forecast: global public debt is expected to rise sharply, reaching 95.1% of global GDP in 2025, reversing gains made in the post-pandemic years. The bulk of this projected rise, the IMF says, is being driven by the world’s largest economy — the United States, which continues to operate on massive fiscal deficits with no clear path to stabilization.

A Mounting Crisis: U.S. Debt-to-GDP Nears 100%

The United States’ debt-to-GDP ratio has reached 98%, up from 73% just ten years ago. “That’s an unsustainable path,” said Gita Gopinath, the IMF’s First Deputy Managing Director. “Fiscal policy needs to shift gears — now.”

The IMF is particularly concerned about the structural nature of the U.S. deficits. Unlike temporary stimulus spending in times of crisis, current deficits are being driven by entrenched tax policies, entitlement expenditures, and politically motivated spending increases.

One of the IMF’s chief concerns is the proposed extension of the 2017 Trump-era tax cuts, which, if enacted in full, could cost an estimated $3.5 to $4 trillion over the next decade. These tax cuts, aimed at stimulating growth, have been criticized for disproportionately benefiting the wealthy while significantly reducing federal revenues.

“We are urging the U.S. to avoid adding more fiscal fuel to the fire,” said Gopinath. “Now is the time for corrective action, not expansion.”

Interest Payments Skyrocket Past $1 Trillion

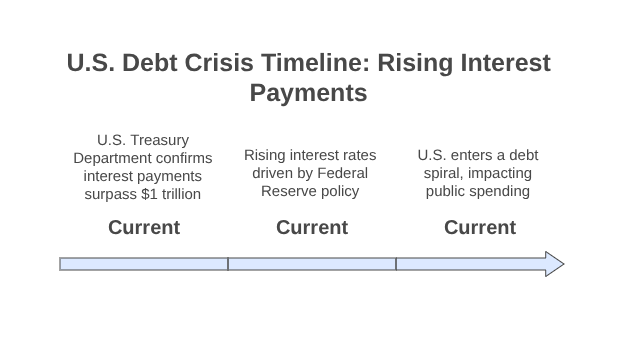

Perhaps most alarming is the exploding cost of servicing the debt. The U.S. Treasury Department confirmed that annual interest payments surpassed $1 trillion this year, exceeding federal spending on defense and nearing the cost of Medicare.

Rising interest rates, driven by the Federal Reserve policy to combat inflation, have dramatically increased the cost of borrowing. The result: even without adding new debt, the government is spending record amounts just to manage the interest on existing obligations.

“The United States is now in a debt spiral,” said a senior IMF official. “Every year, more tax dollars are consumed by interest, leaving less for infrastructure, education, healthcare, or economic resilience.”

⚠️ Global Ripple Effects

The IMF’s warning isn’t just about the U.S. economy — it’s about global stability. Because of the dollar’s role as the world’s reserve currency and the centrality of U.S. Treasuries to global finance, American fiscal instability reverberates worldwide.

The IMF has flagged the risk of capital flight from emerging markets, higher global borrowing costs, and weaker currencies in developing economies due to the United States’ expansive borrowing.

“The current trajectory raises systemic risks,” Gopinath noted. “Emerging economies, especially those with dollar-denominated debt, will face intense pressure as U.S. borrowing pushes up global interest rates.”

Already, several nations have reported significant capital outflows as investors flock to U.S. Treasuries despite growing concerns over sustainability.

Market Volatility Builds

While the IMF stressed that U.S. bond markets remain “orderly,” the cracks are beginning to show. Recent Treasury auctions have witnessed declining demand, particularly from foreign buyers like China and Japan, long the biggest holders of U.S. debt.

On May 23, a $69 billion auction of two-year notes saw a record-low bid-to-cover ratio, a key indicator of investor appetite. This has raised fears that America may soon face higher costs to sell its debt, or worse, encounter difficulty finding buyers altogether.

Wall Street has responded with unease. The Dow Jones Industrial Average fell 2.4% this week amid investor concerns about long-term fiscal stability and growing expectations of continued Fed rate hikes.

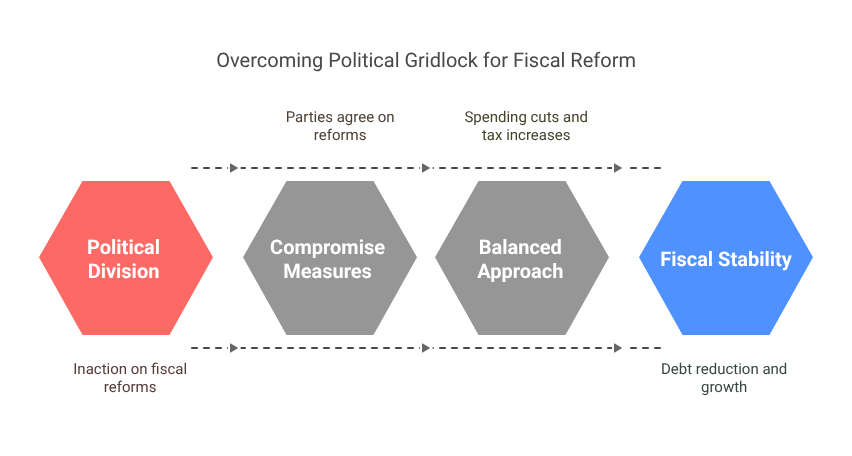

Political Paralysis: A Roadblock to Reform

The IMF’s call for action comes at a time of deep political division in the U.S. Congress. Efforts to rein in spending or raise taxes have stalled, with both parties reluctant to confront politically unpopular measures ahead of the 2026 midterms.

President Trump has doubled down on tax cuts and tariffs as key elements of his economic strategy, arguing they are essential for “American renewal.” However, critics say these moves are aggravating the debt crisis and straining international trade relations.

“It’s a game of fiscal chicken,” said an analyst at Moody’s. “Neither party wants to blink, and the debt keeps climbing.”

IMF’s Recommendations: What Needs to Change

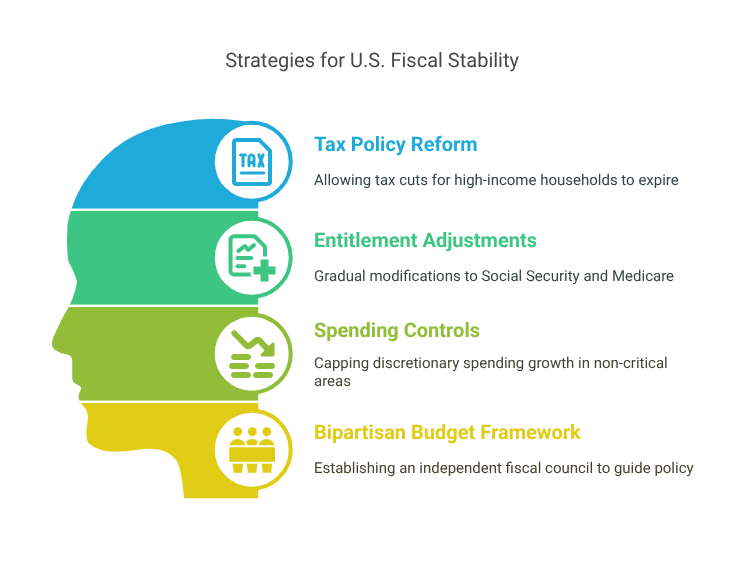

The IMF has proposed a series of immediate and long-term reforms for U.S. policymakers to consider:

- Tax Policy Reform: Allowing the 2017 tax cuts to expire for high-income households.

- Entitlement Adjustments: Gradual modifications to Social Security and Medicare to ensure solvency.

- Spending Controls: Capping discretionary spending growth in non-critical areas.

- Bipartisan Budget Framework: Establishing an independent fiscal council to guide policy.

“Bold, bipartisan action is the only way forward,” said Gopinath. “Delay will only magnify the cost.”

🌍 The World Watches

With global debt now set to exceed 100% of GDP by 2030, largely due to the fiscal trajectory of a few major economies, the IMF is urging the U.S. to take responsibility as a global leader.

“America’s fiscal house is on fire,” one international policymaker warned. “And if Washington doesn’t put it out, the world may burn with it.”