Federal Reserve Holds Rates: What It Means for Credit Card & Mortgage Debt in 2024

The Federal Reserve’s decision to hold interest rates steady in 2024 has stirred a wave of interest across households, markets, and the financial community. After a cycle of aggressive hikes in the past two years to battle inflation, the central bank has paused, for now.

This pause doesn’t lower borrowing costs, but it does signal a shift in tone. With inflation showing signs of cooling and recession risks lingering, Americans are now assessing what this means for their finances. Two of the most critical areas impacted by interest rate policy are credit card debt and mortgage borrowing, and in 2024, both remain under pressure.

Understanding the implications of the Fed’s decision is crucial for managing household debt effectively. Let’s explore how the pause affects interest rates, credit cards, mortgages, the global debt clock, and the importance of credit awareness.

Why Did the Federal Reserve Hold Rates in 2024?

After raising interest rates consistently throughout 2022 and 2023 to combat inflation, the Federal Reserve adopted a wait-and-see approach in 2024. Several factors influenced this strategic pause.

Key Reasons for the Rate Hold:

- Inflation Stabilization: Consumer prices have cooled compared to the previous two years, trending closer to the Fed’s 2% target.

- Slower Job Growth: The Labor market remains solid, but employment growth is slowing, indicating a potential economic cooling.

- Recession Risks: Economists warned that continued hikes could lead to a sharp economic contraction.

How the Federal Funds Rate Affects Borrowers

Though consumers don’t directly borrow at the federal funds rate, it influences nearly all other forms of interest, especially on credit cards, mortgages, auto loans, and personal loans.

- Variable-rate products, such as credit cards and adjustable-rate mortgages, respond quickly to Fed decisions.

- Fixed-rate mortgages, on the other hand, are influenced more by market expectations and the bond market, though still indirectly tied to the Fed’s overall outlook.

Credit Card Debt in 2024: High Rates Are the New Normal

Rates Remain Elevated

Despite the Fed’s pause, interest rates on credit cards remain extremely high in 2024. Most credit cards have variable APRs that closely follow the Fed’s movements. After two years of hikes, average APRs have soared to 20%–24%, the highest levels seen in decades.

What This Means for Consumers

- No Relief from High Interest: Monthly minimum payments are expensive, and balances grow quickly with compound interest.

- Slower Debt Payoff: A $5,000 balance could cost over $1,000 annually in interest if only minimum payments are made.

- Challenging Environment for New Borrowing: Those looking to finance purchases via credit cards face steep interest costs.

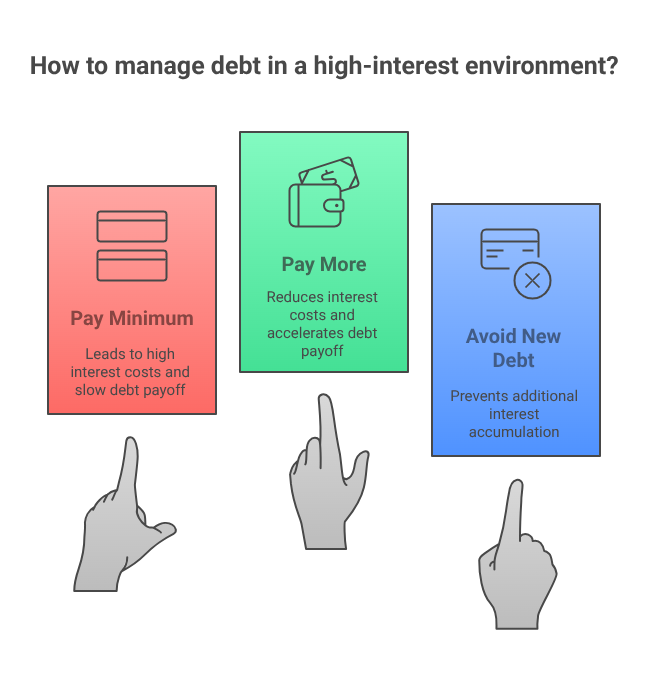

How to Manage Credit Card Debt in 2024

- Use Balance Transfers Wisely: Consider 0% introductory APR offers to consolidate and pay off high-interest debt faster.

- Prioritize Payments: Focus on high-interest balances using either the avalanche or snowball method.

- Cut Unnecessary Expenses: Free up funds to pay down revolving debt before interest eats into your budget.

Mortgage Debt in 2024: Still Pricey but More Stable

While credit card debt is directly affected by the Fed’s decisions, mortgage rates are shaped by a wider range of factors, including bond yields, inflation expectations, and investor sentiment.

Current Mortgage Rate Trends

- 30-year fixed-rate mortgages: Range from 6.5% to 7.2%

- 15-year fixed-rate mortgages: Between 5.9% and 6.5%

- Adjustable-rate mortgages (ARMs): Roughly 6.8%, subject to market fluctuations

Impact of the Fed Pause on Mortgages

- Predictability for Homebuyers: With no imminent hikes, buyers have more clarity when locking in rates.

- Mild Downward Pressure: If inflation keeps falling, mortgage rates could gradually decline over time.

- No Major Decline Yet: Until the Fed starts cutting rates, dramatic drops in mortgage interest are unlikely.

Should You Buy or Refinance?

- Prospective Buyers: If you’ve found the right home and can afford current rates, locking in now could be prudent, especially if refinancing becomes an option later.

- Homeowners with ARMs or High Fixed Rates: Explore refinancing only if it offers clear savings. Those with sub-4% fixed rates should likely hold off.

Comparing Credit Card and Mortgage Debt Impact

| Debt Type | Average Interest Rate (2024) | Effect of Fed Hold | Suggested Strategy |

|---|---|---|---|

| Credit Cards | 20%–24% APR | No increase, still very high | Transfer balances, pay aggressively |

| Fixed-Rate Mortgages | 6.5%–7.2% | Stabilized | Lock rate if buying, wait to refi |

| ARMs | ~6.8% | Unchanged but can adjust | Monitor closely, refi if needed |

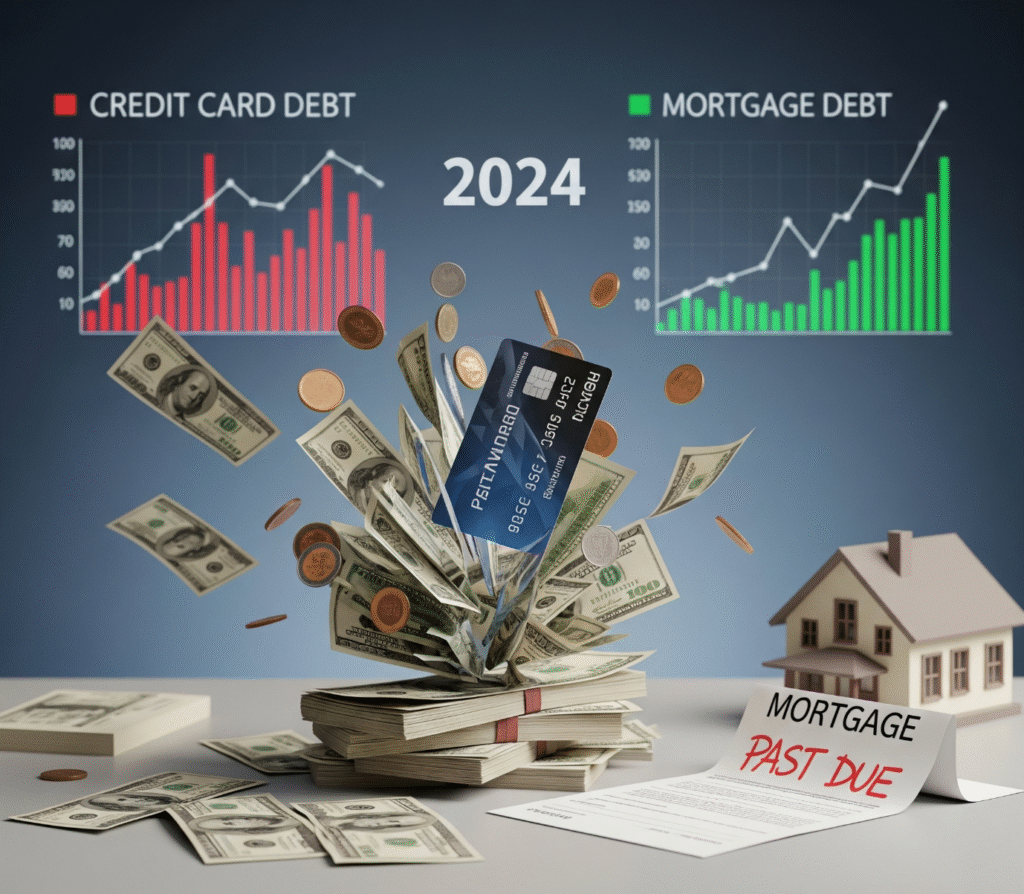

Consumer Debt in 2024: A National Snapshot

Credit Card Balances Hit All-Time High

American households are carrying more revolving debt than ever before. According to the New York Fed, credit card debt surpassed $1.3 trillion in Q1 2024. High inflation over the past few years pushed many to rely on credit, and with elevated APRs, many are now struggling to dig out of it.

Mortgage Demand Rebounding Slowly

After a sharp decline in 2022 and 2023, mortgage activity is stabilizing in 2024. While affordability is still a concern due to higher interest rates and home prices, buyers are adjusting to the “new normal.” More are entering the market with the expectation of refinancing down the line if and when rates ease.

How the Debt Clock Can Help Individuals

The U.S. Debt Clock is a real-time display of the country’s total outstanding debt. While primarily focused on national economic data, it also features valuable consumer metrics like debt per citizen, credit card debt, and student loan debt per capita.

Why It’s Useful for You:

- Compare Personal Debt: Understand how your personal debt stacks up against national averages.

- Track Economic Trends: Rising public or household debt levels may indicate inflation, interest rate moves, or credit tightening.

- Stay Informed: Use the clock’s insights to plan smarter spending, saving, and borrowing strategies.

By observing trends in the debt clock, individuals can make more informed decisions about their own finances, including whether to consolidate, pay off high-interest loans, or reduce discretionary spending.

Smart Money Moves in a High-Rate Environment

Navigating 2024’s rate landscape requires discipline, awareness, and planning. Whether you’re managing debt or planning a large purchase, here are some strategies to stay financially resilient:

1. Know Your Numbers

Keep track of interest rates on all debts. Identify which balances are the most expensive and prioritize them.

2. Consider Debt Consolidation

Personal loans with lower fixed rates may help simplify and reduce high-interest obligations.

3. Improve Your Credit Score

A stronger credit score qualifies you for better loan and card offers, which can lower your long-term costs.

4. Use a Debt Rating Checker

Check your credit score regularly to track your financial standing and ensure you’re eligible for the best available rates. This helps you plan ahead for refinancing or new credit needs.

5. Strengthen Your Emergency Fund

Economic uncertainty remains. Build a cushion to avoid relying on credit in emergencies.

6. Delay Major Purchases If Possible

If a large expense can wait until borrowing conditions improve, consider holding off to avoid locking in high-interest rates.

Final Thoughts

The Federal Reserve’s rate hold in 2024 brings a moment of stability, but not relief. Credit card holders are still facing steep interest charges, and mortgage rates, while no longer climbing, remain well above pre-pandemic levels.

Consumers must adjust to this environment with proactive debt management and strategic financial planning. From leveraging balance transfer offers to using tools like the Debt Clock and Debt Rating Checkers, staying financially sharp is essential. As the year progresses, remaining informed and adaptable will be the key to financial resilience in a high-interest economy.