Food Prices Up 30%: How Canadians Are Using Credit Cards to Survive

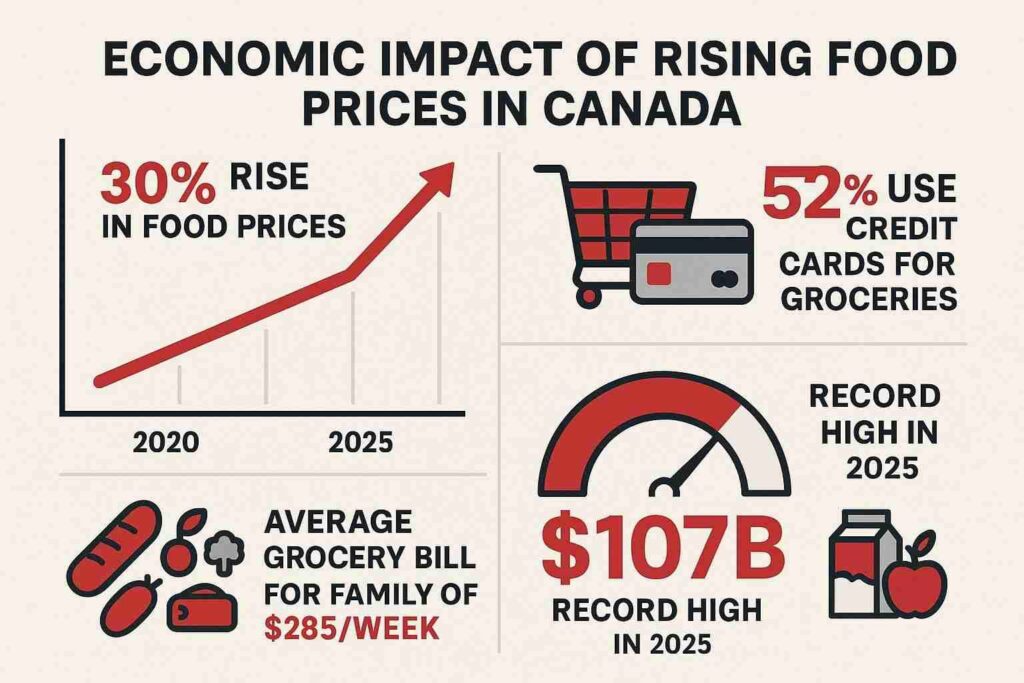

In 2025, Canadians are grappling with a harsh economic reality: food prices have soared by over 30%, putting enormous strain on household budgets. Grocery bills that once seemed manageable have nearly doubled in many regions. From major urban centres to remote communities, Canadians are feeling the pressure. As wages fail to keep up with inflation, many are turning to credit cards just to afford the basics, but the long-term consequences are raising alarm bells.

The Real Impact of Rising Food Costs in Canada

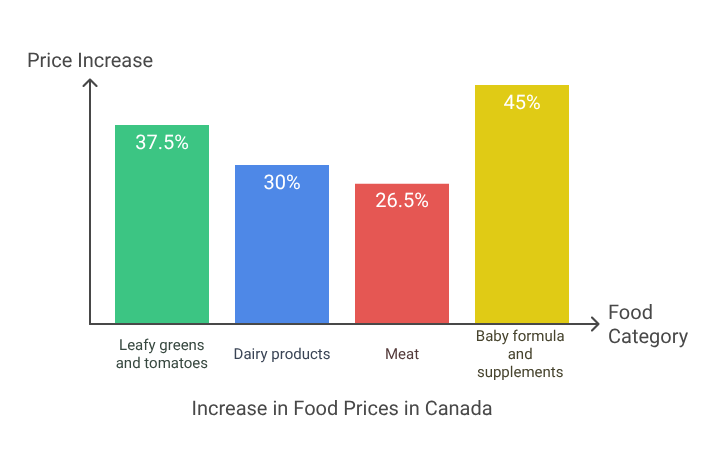

Canada has not escaped the wave of global inflation, but the surge in grocery prices has been especially severe. Essentials such as fruits, vegetables, dairy, and proteins have seen year-over-year increases ranging from 25% to 45%. Some of the most affected categories include:

- Leafy greens and tomatoes: up 35–40%

- Dairy products: milk and cheese prices rose by over 30%

- Meat: chicken and pork saw 25–28% increases

- Baby formula and supplements: up nearly 45%

Factors driving these increases include climate-related disruptions to agriculture, high fuel and shipping costs, labour shortages, and supply chain delays. While these factors may be external, Canadian consumers are left footing the bill.

The average weekly grocery bill for a family of four has surged from $220 to around $285. That’s an extra $260 per month—money many households simply don’t have. As a result, food insecurity is rising, even among middle-class families. Canadians are adjusting by buying in bulk, cutting back on fresh produce, and choosing cheaper, processed alternatives. Unfortunately, this often means sacrificing nutrition in favour of affordability.

Rural and Indigenous communities are disproportionately impacted, where food prices were already elevated due to transportation and limited local supply. In northern regions, the price of staples like milk or bread can be up to three times higher than in urban centres. This makes food affordability not just a matter of inflation, but also one of regional inequity.

The Growing Dependence on Credit Cards

With grocery bills climbing, more Canadians are leaning heavily on credit cards to get through the week. A growing percentage of households report using credit for grocery purchases at least twice per week.

This trend is most visible among low-income families, single-income earners, students, and seniors—those already on tight budgets. In many cases, even those with steady employment are turning to credit just to make ends meet.

What’s especially troubling is that many of these purchases are going on high-interest cards, with annual rates ranging from 19.99% to 24.99%. This means everyday items like milk, bread, and rice end up costing far more once interest is factored in. A $300 grocery trip could end up costing over $360 if paid off over several months.

Families who once used credit as a backup plan are now using it as their first option. With each passing month, it becomes harder to break the cycle. Even small, recurring grocery trips can snowball into long-term debt if left unpaid.

Financial experts warn that the normalization of using credit for essentials is deeply problematic. It signals a dangerous shift where debt becomes the default solution to everyday living—something that was once a red flag for financial instability is now common practice.

Credit Card Debt Surging to Record Levels

The consequence of this reliance is showing up in national statistics. According to recent data, Canadian credit card debt now exceeds $107 billion, a record high. That’s a $15 billion increase in just one year, driven largely by increased usage for essential goods.

Notable trends in 2025:

- Average credit card balance: $4,265

- Average interest rate: 20.99%

- Younger Canadians (18–34): 7% increase in delinquencies year-over-year

- Households carrying month-to-month balances: 63%

Carrying a balance month-to-month means incurring significant interest charges. Even a minimum payment strategy can result in thousands of dollars in interest over time. For families already struggling to pay for food, this becomes a debt trap—easy to fall into, and incredibly hard to escape.

Lenders are reacting by lowering credit limits and tightening eligibility requirements. Those with moderate or poor credit scores are finding it harder to get approved for new credit, leaving them even more financially vulnerable.

Compounding the issue is the rising cost of other living expenses—rent, utilities, and transportation have all gone up. As a result, food-related debt isn’t occurring in isolation. It’s part of a wider pattern of financial pressure that leaves no room for savings or emergencies.

Economic and Social Ripple Effects

The ripple effects of high food costs extend beyond individual households. Communities are seeing increased demand at food banks, which are now reporting historic highs in usage. Nonprofits and food charities are overwhelmed, struggling to keep up with the growing need.

Food banks in cities like Toronto, Vancouver, and Edmonton report serving up to 40% more people than they did in 2023. In some cases, demand has doubled. Volunteers are stretched thin, and donation shelves are often empty before the end of the day.

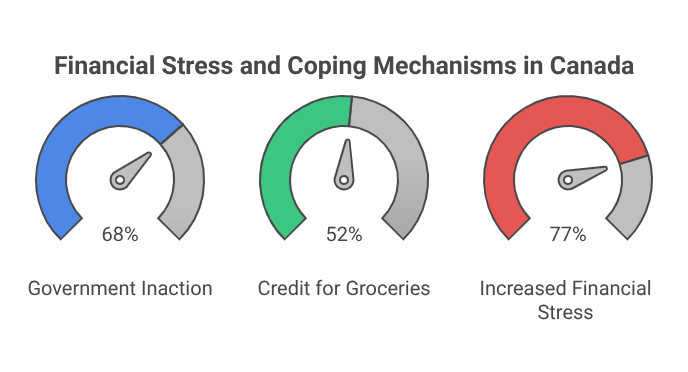

There’s also a concerning mental health aspect. Rising prices and growing debt are contributing to increased stress, anxiety, and depression. A recent poll found:

- 68% believe the government isn’t doing enough

- 52% rely on credit to buy groceries

- 77% feel more financially stressed than during the pandemic

These pressures are manifesting in schools, workplaces, and healthcare settings. Children are showing up to school without lunch, working adults are skipping meals, and doctors are treating more patients for stress-related conditions.

What was once seen as a temporary spike in costs is now viewed by many as a new normal—and it’s wearing Canadians down emotionally as well as financially.

Is Government Help Enough?

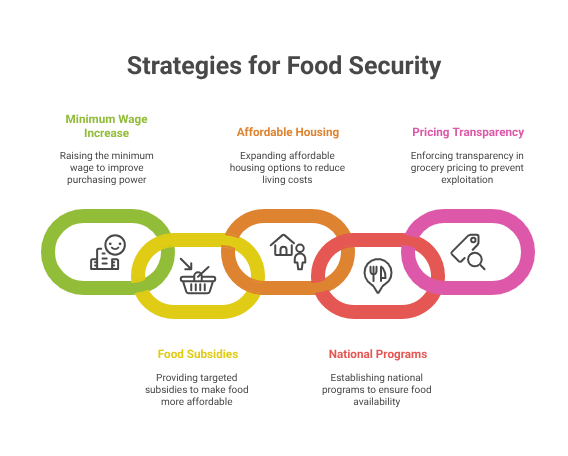

While the federal government has introduced relief measures like grocery rebates and support for food banks, many Canadians feel these steps are temporary and inadequate. One-time payments may offer momentary relief, but they do not solve the larger affordability problem.

What’s needed, many argue, is systemic reform. Suggested solutions include:

- Increasing the minimum wage

- Introducing targeted food subsidies

- Expanding affordable housing

- Creating national food security programs

- Enforcing pricing transparency and accountability among grocery chains

Critics also point out that grocery store profits have soared during the same period. Major supermarket chains have reported record earnings, leading to renewed calls for windfall taxes or price caps on essentials. There is growing public demand for government action to ensure corporations are not profiting at the expense of struggling families.

Without these broader interventions, the affordability crisis will persist—and so will reliance on high-interest credit.

Financial Resilience in Tough Times

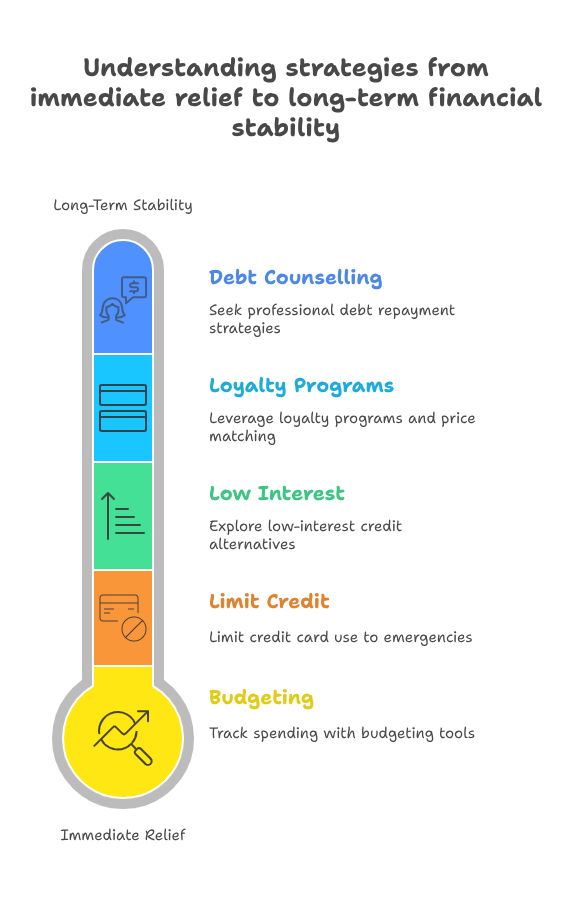

In the meantime, Canadians are being urged to take proactive steps to reduce the financial strain. Some key recommendations include:

• Track spending closely using budgeting tools

• Limit credit card usage to emergencies only

• Explore low-interest alternatives, such as personal lines of credit

• Seek debt counselling for repayment strategies

• Leverage loyalty programs, coupons, and price match apps

• Join or support local food co-ops and community gardens

Check Your Debt Rating & Explore Relief Options

Now is also a good time to take action with these important steps:

• Use a Debt Rate Checker – Understanding your current debt rating can help you make informed financial decisions and spot potential risks early. Use reliable tools to track where you stand.

• Get a Debt Relief Consultation – If debt is becoming unmanageable, speak with a professional. A consultation can help you explore repayment plans, consolidation, or relief programs tailored to your situation. Early guidance can make a big difference.

Community-based solutions, like “food rescue” programs and shared kitchens, are also growing in popularity. These initiatives aim to reduce waste while feeding those in need. Local governments and non-profits are encouraging such grassroots efforts to supplement broader policy responses.

Every dollar saved on groceries is a dollar that doesn’t need to be borrowed. While this may not be a long-term solution, these strategies can provide short-term relief while larger economic changes are pending.

Conclusion

With food prices up 30%, Canadians are in survival mode. What used to be emergency credit card use is now a weekly necessity. This trend, while offering short-term help, has pushed household debt to critical levels, with long-term financial consequences looming.

Unless meaningful policy reforms are implemented to address food affordability and consumer debt, many Canadians risk being locked into a cycle of borrowing for basic survival. This is not about luxury spending. It’s about feeding families.

Credit cards may be keeping the fridge stocked today, but they could create an even greater crisis tomorrow. It’s time for serious action to protect the financial future of millions of Canadians.