Post-Election Debt Fallout: How the New Administration’s Policies Will Affect Student Loans & Mortgages

June 13, 2025 |USA.

With the dust finally settling on one of the most closely followed U.S. elections in recent history, the financial world is finally starting to change, particularly for borrowers. Now that the new administration has taken office, Americans with student loans and mortgages are preparing for far-reaching changes in how those debts are serviced, forgiven, and managed.

The administration’s budget agenda holds out hope for reform, relief, and in some instances, regulatory reversal. But whereas some borrowers might be able to breathe a little easier, others worry that new policies could make credit harder to get or lower protections.

This report goes deep into the meaning of the new government’s debt-related policies—and what they portend for millions of Americans.

A Nation Under Debt

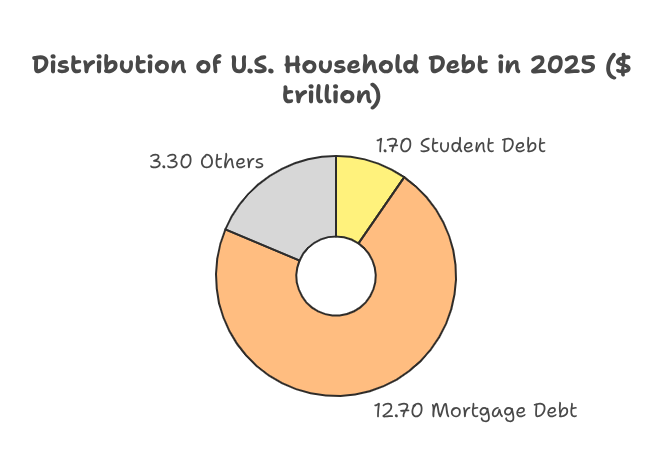

At the heart of economic argument is a harsh truth: the United States is a borrowing-based nation. U.S. household debt stood at a historic high of $17.7 trillion in early 2025, with student loans and mortgages accounting for the two largest shares, the Federal Reserve reported.

- Student debt: More than 44 million Americans together owe over $1.7 trillion.

- Mortgage debt: About $12.7 trillion is associated with home loans, a total that is growing alongside home prices and interest rates.

The new administration inherited not just these numbers but also the economic consequences of soaring inflation, higher interest rates, and expanding wealth disparities. The question is now how they intend to deal with the burden of this debt, and what it will do to the average American.

Student Loans: Forgiveness, Reform, or Retrenchment?

Perhaps the most contentious issue in the campaign was the future of federal student loan forgiveness. The outgoing administration took major steps to erase parts of federal student loan debt, but many of these efforts were thwarted by the courts or undone by opposition in Congress.

Now, with a new President and a reconfigured but slightly differently configured Congress, the future of student loan forgiveness hangs in the balance, but differently.

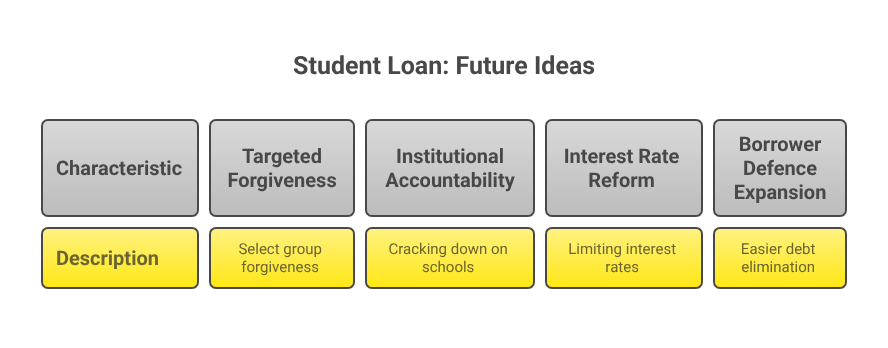

Top Ideas on the Table:

1. Targeted Forgiveness Instead of Blanket Cancellation

The new administration has already made clear its plan to dial back blanket loan forgiveness in Favor of targeted forgiveness for select groups: low- and moderate-income borrowers, those who work in public service, and those who were defrauded by for-profit schools.

Instead of mass cancellation, anticipate adjustments to the Income-Driven Repayment (IDR) and Public Service Loan Forgiveness (PSLF) programs. The Department of Education is expected to roll out new regulations over the summer, perhaps streamlining enrolment procedures and broadening eligibility.

2. Reviving Accountability for Institutions

There is also a new emphasis on cracking down on schools that leave students with high debt and low earning capacity. The administration will likely pressure for a “gainful employment” regulation, compelling colleges to demonstrate their graduates can secure employment whose value warrants the price of their degree.

3. Interest Rate Reforms

One of the most anticipated reforms is a proposed student loan interest cap, potentially limiting federal loan interest rates to 3% or lower. Advocates argue this would save borrowers thousands over the life of their loans, but critics warn it could place more strain on the federal budget.

4. Borrower Defence Expansion

Borrowers who assert they were deceived by their colleges may have a smoother road to eliminating their debt. Look for revisions to the Borrower defence to Repayment rule, potentially opening up again previously rejected claims under past policies.

Mortgage Market: Reluctance between Relief and Risk

While student loans fill a majority of the headlines, homeowners and potential buyers are observing with similar apprehension. The post-election economic climate, along with the Federal Reserve’s recent rate halts, has nurtured a weakened housing situation.

Here’s what mortgage holders and seekers should anticipate:

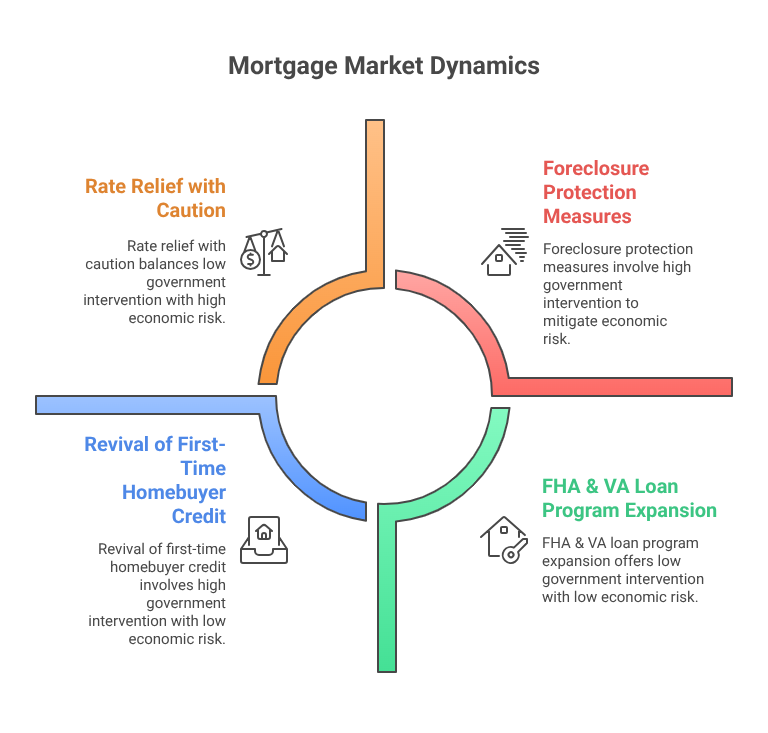

1. Rate Relief—But with Caution

The government has indicated its desire to benefit middle-class homeowners through the push for less expensive housing and collaboration with the Fed to level out interest rates. Though mortgage rates are high (at 6.8% for a 30-year fixed loan), the expectation is that inflation-fighting efforts will enable phased-down rate reductions later in 2025.

But financial experts caution that if inflation is redoubled, any rate relief plans will be put on the back burner, pricing out yet more first-time homebuyers.

2. FHA & VA Loan Program Expansion

To help low- and moderate-income households, the Department of Housing and Urban Development (HUD) is likely to expand access to FHA-insured loans and simplify VA loan qualification. The programs have a long history of providing lower down payments and more lenient credit score requirements.

3. Revival of First-Time Homebuyer Credit

The new government is looking to bring back a federal first-time homebuyer tax credit, potentially as much as $15,000. If passed, it would largely negate closing costs or down payments for new buyers, although Congressional approval would be necessary for it to go into effect.

4. Foreclosure Protection Measures

In reaction to a spike in mortgage delinquencies early in 2025, a plan to extend foreclosure shields and mortgage modification initiatives is being drafted. These measures could cover simpler refinancing for underwater mortgages and a refurbishing of forbearance programs that lapsed amid the pandemic.

Economic Risks & Political Gridlock

Not all of these proposals will sail through Congress, though many are designed to benefit borrowers.

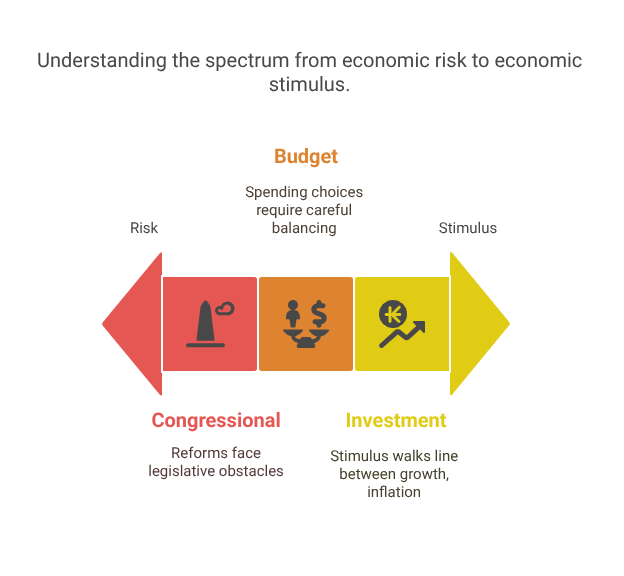

1. Congressional Resistance

With a split Congress, sweeping reforms could be in for an uphill battle. Some lawmakers are already slamming as “fiscally irresponsible” proposed debt relief plans, contending that more federal involvement will increase the national deficit.

2. Budget Restraints

The federal government is already budgeting a deficit expected to exceed $1.8 trillion in 2025. As lawmakers balance new education and housing spending, difficult choices await on what to spend—and what to put off.

3. Inflation vs. Investment

There is a razor-thin margin between spurring economic rebound and accelerating inflation. Stimulus-like initiatives—like blanket loan forgiveness or housing credits—hypothetically might drive prices higher, particularly in constrained real estate markets. The administration will have to tread carefully so as not to repeat 2022–2023’s inflationary spiral.

Public Voices

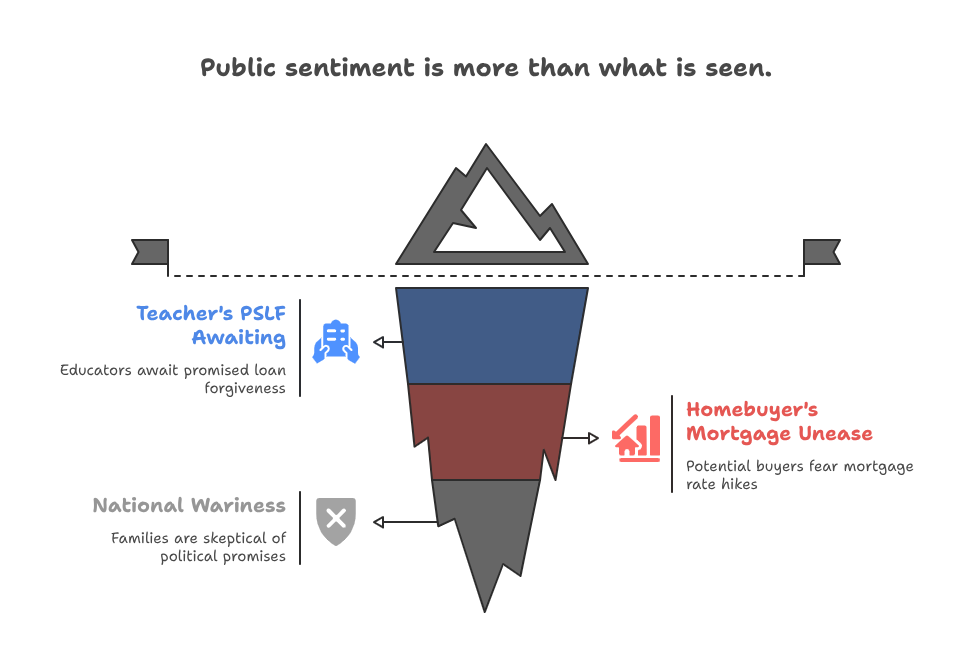

In the midst of political manoeuvring, plain Americans are eagerly waiting for some clarity.

One public school teacher who has been in the education system for almost a decade hoped that the revised PSLF regulations would be in their Favor. With more than $40,000 still to be forgiven, they fear delays or policy shifts will again shift the goalposts.

Meanwhile, a potential first-time homebuyer who has been conserving for a down payment expressed unease about volatile mortgage rates. Having delayed homeownership in 2023 because of high expenses, they now have some hope, but are still guarded until the promised credits and aid are actually administered.

These are sentiments found in homes across the nation—families willing to act, yet wary to believe in political assurances.

What Borrowers Should Do Now

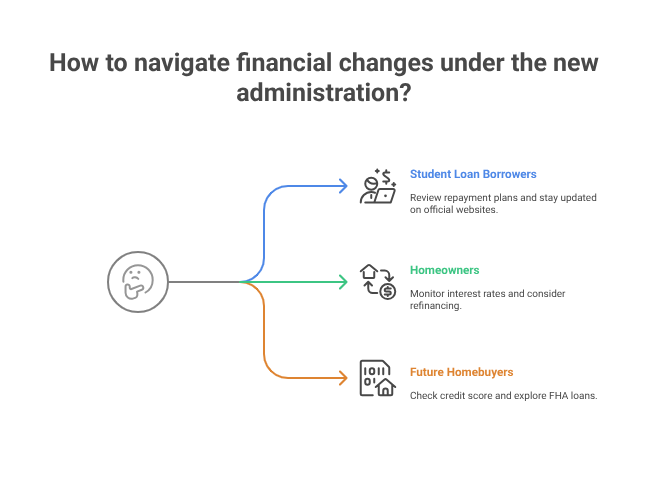

While the complete effects of the new administration’s policies will be revealed in the months ahead, financial analysts recommend that borrowers take proactive measures today:

- Student loan borrowers: Review repayment schedules, specifically IDR plans. Follow any updates through the official StudentAid.gov website.

- Homeowners: Keep an eye on interest rate changes and talk to lenders regarding refinancing options when rates decline.

- Future homebuyers: Check your credit score and savings. Opportunities for programs like FHA loans might become more available.

A Debt-Centric Presidency?

With tens of millions of Americans burdened by expensive education and housing debt, the first year of the new administration will probably be characterized by what it does to address these concerns. While reform promises are encouraging, results will hinge on the course of the economy, political will, and Congressional support.

Borrowers nationwide are optimistic—but watchful—as they wait to determine whether this post-election chapter will finally bring relief.