The Mortgage Renewal Bloodbath: 1.2M Canadians Face 50% Payment Hikes (2025 Rate Reset Wave)

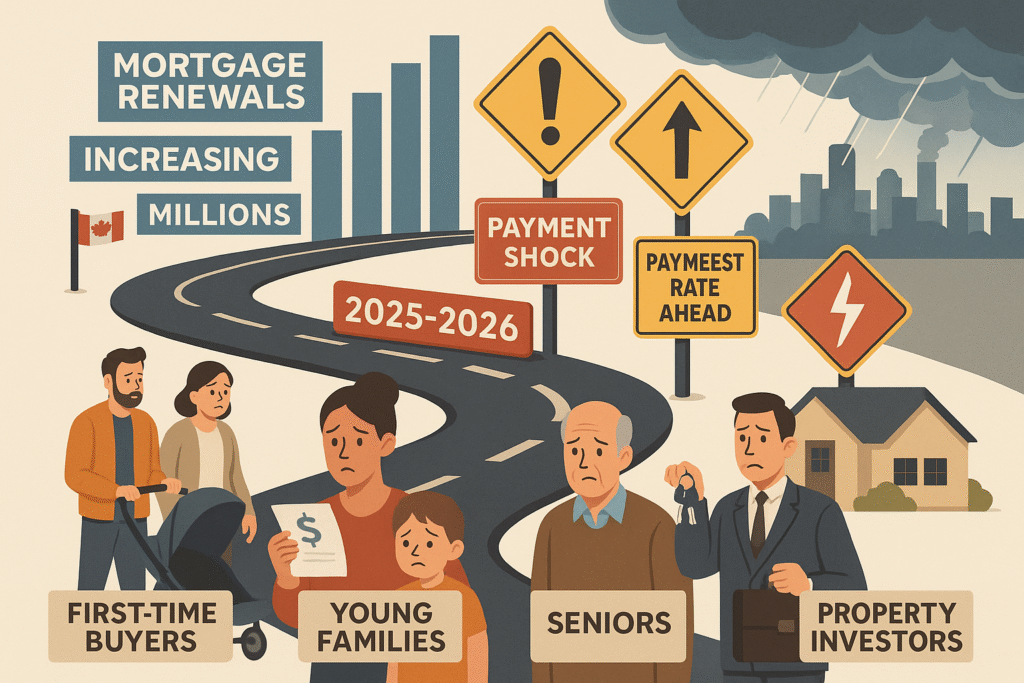

June 2025 | Toronto — A financial storm is brewing for Canadian homeowners as over 1.2 million fixed-rate mortgages are set to renew in 2025, triggering what economists and policy experts are calling a “mortgage renewal bloodbath.” Many of these mortgages, secured during the ultra-low-interest-rate era of 2020–2021, are now facing renewal at rates nearly double or more, resulting in payment increases of up to 50%.

This rate reset wave, one of the largest in Canadian history, threatens to upend household budgets, reshape the housing market, and deepen concerns about affordability and financial stability across the nation.

The Rate Reset Crunch: What’s Happening?

At the heart of the issue is a simple but devastating shift in interest rates. Between 2020 and 2021, during the COVID-19 pandemic, the Bank of Canada slashed its benchmark interest rate to an emergency low of 0.25%. Millions of Canadians took advantage of these historically low rates, locking in 5-year fixed mortgages with interest rates hovering between 1.5% and 2.5%.

Fast-forward to 2025: after a series of aggressive rate hikes to combat inflation, the Bank of Canada’s benchmark rate now stands at 5%. As these fixed mortgages come up for renewal, borrowers are being offered rates in the 5.5% to 6.5% range — a dramatic increase.

Example: A household that locked in a $500,000 mortgage at 1.75% in 2020 was paying around $2,050 per month. Upon renewal in 2025 at 6.25%, that same household will now pay over $3,000 — a 50% increase in monthly payments.

Households Under Pressure

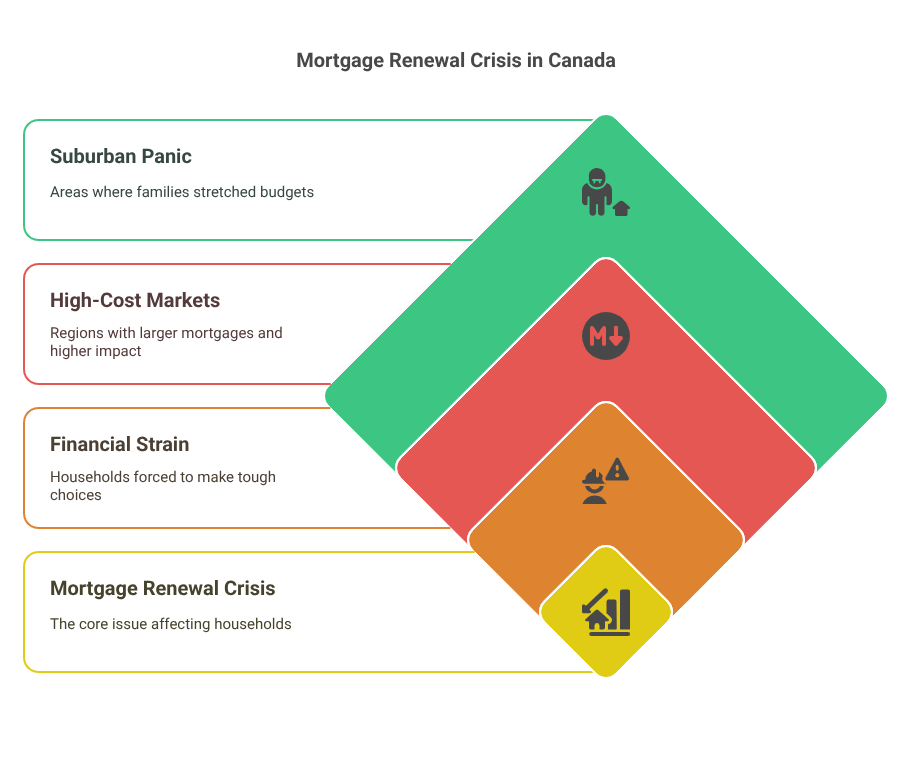

The numbers are staggering. According to the Canadian Mortgage and Housing Corporation (CMHC), approximately 1.2 million fixed-rate mortgages will come due in 2025. A large proportion of these were set at pandemic-era lows. For the average Canadian family, this renewal represents a financial shock akin to a second mortgage.

““We’re seeing middle-class households — many of them dual-income — forced to choose between paying the mortgage or cutting back on essentials,” noted a senior housing analyst at the CMHC. “This isn’t just a squeeze — it’s a crisis in motion.”

The impact is most acute in expensive housing markets such as Toronto, Vancouver, and parts of Alberta, where larger mortgages were common. In suburban areas, where families stretched their budgets to enter the market in 2020 and 2021, the renewal shock is triggering panic.

A Nationwide Domino Effect

Economists warn that this mortgage renewal wave is not an isolated pocket of pain. Instead, it’s setting off a domino effect throughout the economy.

- Consumer Spending Decline: With more disposable income going toward mortgage payments, household spending is expected to plummet. Retailers, service industries, and restaurants are already reporting early signs of pullback.

- Credit Delinquencies Rising: Equifax Canada reports a sharp uptick in missed payments on credit cards and auto loans in Q2 2025 — a signal that mortgage stress is spilling into other areas of household finance.

- Housing Market Slowdown: The real estate sector is bracing for a wave of forced sales and reduced buying power. Listings are increasing, while buyer demand is softening under rate pressure.

“We’re not just seeing affordability stress — we’re now entering territory where systemic risk is being priced into the market,” warned an economist at a leading Canadian financial institution.

“Delinquencies on renewals could rise sharply in late 2025 and 2026 unless interest rates ease significantly.”

Government & Bank Response: Too Little, Too Late?

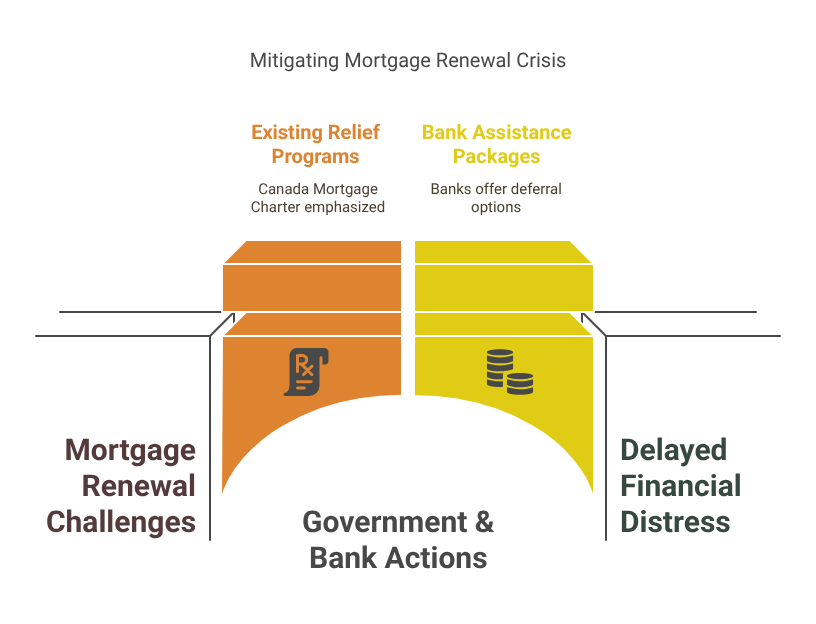

The federal government and the Bank of Canada have come under growing pressure to intervene, but so far, responses have been cautious.

In early May, Finance Minister Chrystia Freeland acknowledged the mortgage renewal challenge, calling it “a very serious issue,” but stopped short of offering new fiscal relief programs. The federal government has emphasized existing tools like the Canada Mortgage Charter, which mandates banks to offer relief options such as amortization extensions or temporary interest-only payments.

However, critics argue that these measures are reactive and lack the scale required to prevent widespread financial distress.

“This is a policy time bomb that’s been ticking since 2021,” says housing policy expert Thomas Liu. “We knew this wave of renewals was coming. The lack of preparedness is inexcusable.”

Meanwhile, Canada’s big six banks are beginning to roll out renewal assistance packages. RBC and TD have quietly expanded hardship deferral options, while CIBC is reportedly offering 30–40-year amortization resets to prevent foreclosures.

But these measures may only delay the inevitable.

The Human Toll: Real Families, Real Struggles

The financial figures paint a bleak picture, but it’s the personal stories that underscore the depth of the crisis.

Sarah and Daniel Morris, a young couple in Mississauga, purchased their home in 2020 with a $620,000 mortgage at 1.89%. Their monthly payment was $2,300. Now, their renewal offers stands at 6.19% — pushing their payments to nearly $3,800.

“We’ve cut back on everything — subscriptions, dining, even daycare,” says Sarah, who works in marketing. “We’re both working full time, and we still don’t know how we’re going to make it.”

Similar stories are echoing across online forums, Facebook groups, and neighbourhood chats. The anxiety is palpable, and financial stress is seeping into Canadians’ mental health and family life.

Who Is Most at Risk?

The renewal crisis does not affect all Canadians equally. The hardest-hit groups include:

- First-time buyers from 2020–2021: Especially those with high-ratio insured mortgages and little equity.

- Young families in major metro areas: With large principal balances and stretched budgets.

- Variable-rate mortgage holders who switched to fixed terms: Many did so when rates had already begun climbing in 2022–2023.

- Real estate investors: Especially those with multiple properties or short-term rental income that’s dropped post-pandemic.

Meanwhile, renters are also affected. Landlords facing higher mortgage costs are increasingly passing on the burden through steep rent hikes, driving even those who never owned a home into affordability crises.

Could Interest Rates Fall in Time?

All eyes are now on the Bank of Canada. While inflation has cooled from its 2022 peak, core inflation remains sticky, preventing the Bank from easing rates aggressively.

In its latest guidance, the Bank signalled a possible rate cut in Q3 or Q4 2025 — but analysts say it may be too late for many households already facing renewal deadlines in the spring and summer.

“A cut from 5% to 4.5% is meaningful, but it won’t magically return us to 2% mortgages,” explains mortgage strategist Lauren Bates. “Even in a best-case scenario, borrowers are renewing at a much higher cost for the foreseeable future.”

What Comes Next?

The 2025 mortgage renewal wave is just the beginning. Analysts estimate that an additional 2.5 million mortgages will come due by the end of 2026. If interest rates remain elevated, this could trigger a prolonged affordability squeeze lasting years.

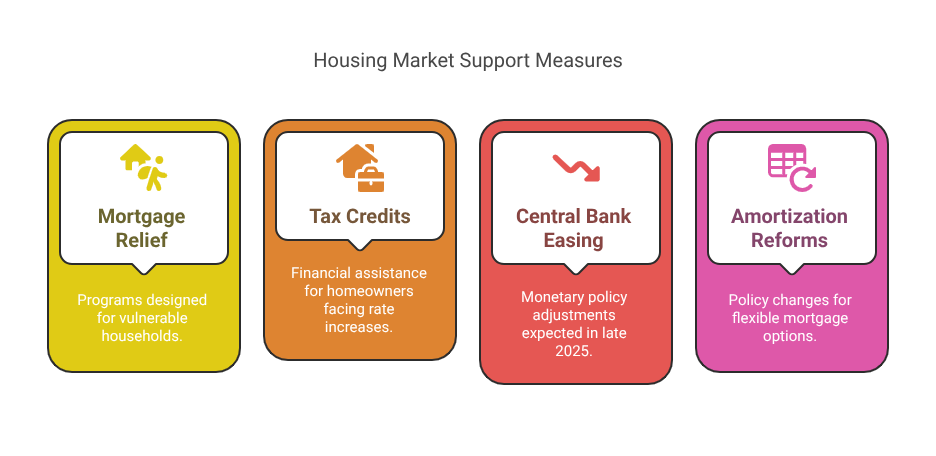

Real estate boards, mortgage associations, and consumer advocacy groups are now calling for urgent national dialogue. Proposed measures include:

- Mortgage relief programs target vulnerable households.

- Tax credits for homeowners facing renewal rate shocks.

- Central bank easing in the second half of 2025.

- Amortization policy reforms to offer more flexible long-term options.

Without swift, coordinated action, the mortgage renewal bloodbath of 2025 may become a long-term economic drag, eroding consumer confidence, slowing housing starts, and widening the gap between owners and renters.

Final Word

Canada’s mortgage renewal crisis is no longer a forecast — it’s here. For 1.2 million Canadians, the shift from ultra-low interest rates to the current high-rate environment is not just a financial adjustment. It’s a seismic economic event that threatens housing stability, financial health, and consumer behaviour for years to come.

Whether Ottawa, the Bank of Canada, and private lenders can offer meaningful relief in time remains to be seen. But one thing is clear: the era of cheap debt is over, and millions of Canadians are now paying the price.