Debt Bombshell: $3.8 Trillion Tax Bill Squeaks Through House—Middle America Braces for Fallout

Washington, D.C: In a dramatic and deeply polarizing move, the U.S. House of Representatives narrowly passed a sweeping tax-cut bill championed by former President Donald Trump, by the slimmest of margins: 215 to 214.

The atmosphere on Capitol Hill was tense and chaotic. Two Republicans broke ranks to vote against the bill, and one GOP lawmaker reportedly fell asleep during the intense hours-long session. Despite the drama, the legislation passed and now heads to the Senate for what is expected to be another fiercely contested debate.

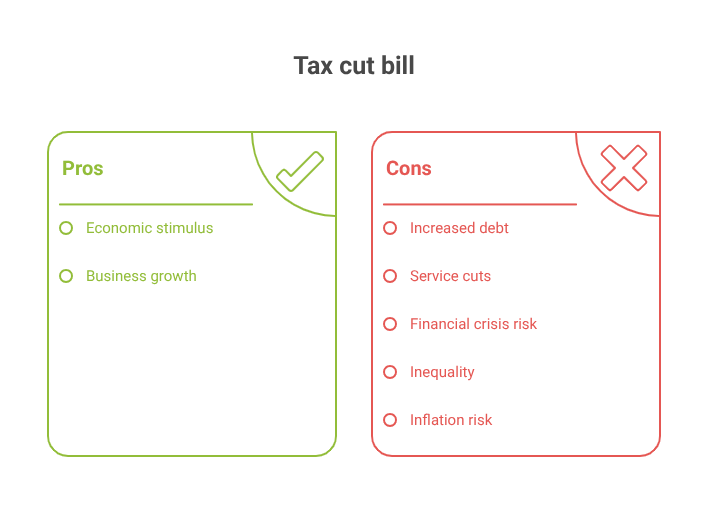

Supporters of the bill hail it as a long-overdue revival of Trump-era fiscal policies designed to stimulate growth and investment. Critics, however, are sounding alarms about its massive cost and potential ripple effects across the economy.

Inside the New Tax-Cut Bill

This bill is among the most consequential pieces of fiscal legislation proposed in the past decade. It introduces:

- Major tax cuts for corporations and high-income earners

- Elimination of a wide array of green energy incentives

- Significant funding increases for immigration enforcement, including deportation programs

While supporters argue it gives businesses the tools they need to thrive and reduces tax burdens for some, the fine print reveals a stark financial reality.

The Cost? A Whopping $3.8 Trillion Addition to U.S. Debt

The Congressional Budget Office estimates that this bill will add $3.8 trillion to the National debt over the next 10 years. That means America’s total debt could soon surpass $40 trillion, pushing borrowing costs to unsustainable levels, and everyday Americans are likely to feel the squeeze.

This spike in federal debt has already spooked investors. Yields on U.S. Treasury bonds surged immediately after the vote, and analysts predict further upward pressure on interest rates. If passed by the Senate, the legislation could profoundly reshape the American economy and the financial well-being of ordinary households.

Wall Street Reacts as Main Street Watches Nervously

The financial markets did not welcome the bill. Long-term bond yields rose sharply, with the 30-year Treasury rate climbing past 5 percent, its highest level in over a decade. The stock market dipped, particularly in sectors tied to consumer finance and housing.

Economists warn that the Federal Reserve may delay or halt expected interest rate cuts, citing fiscal irresponsibility as a core concern. For consumers, that means elevated borrowing costs could become the new normal.

How This Bill Impacts the Average American

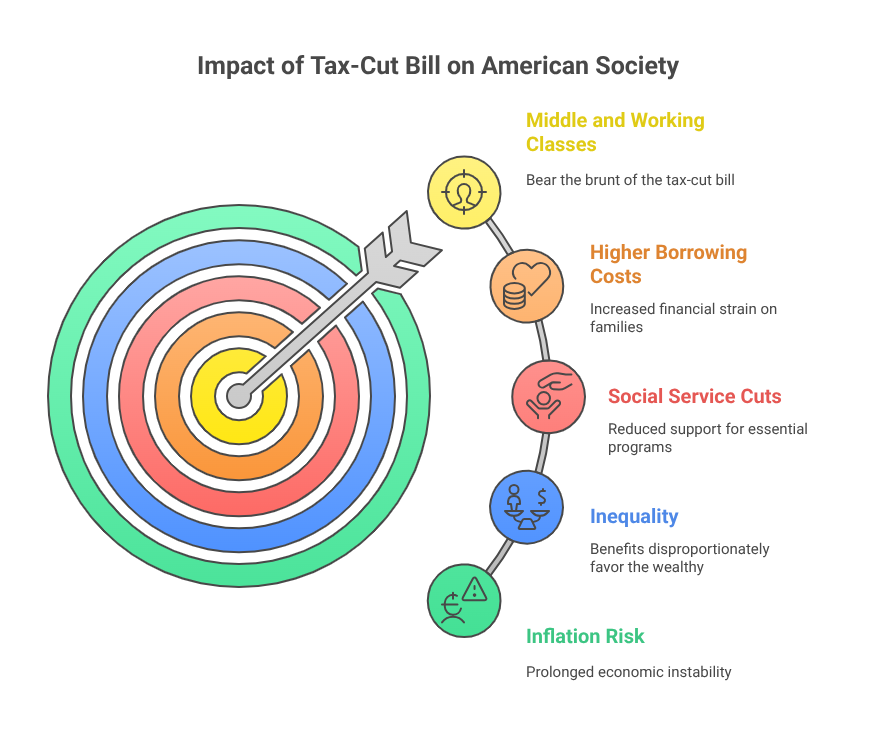

While political leaders argue over the macroeconomics, the real-world consequences are likely to fall squarely on the shoulders of the American middle and working classes. Here’s how:

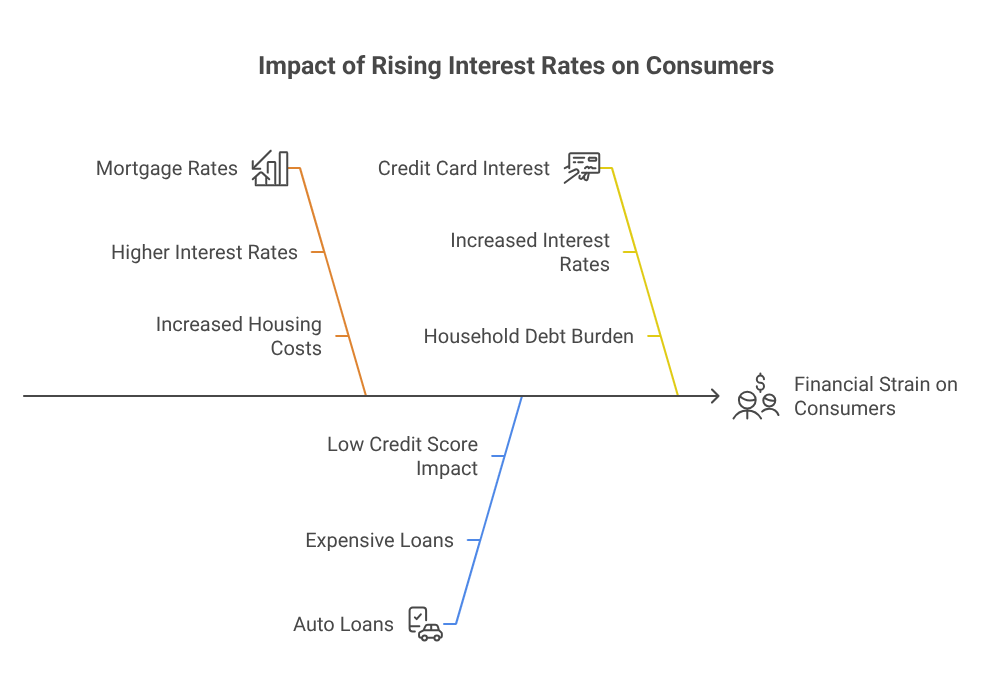

1. Higher Borrowing Costs for Families

With federal debt levels exploding, interest rates across the board are expected to rise. This means:

- Higher mortgage rates for new homebuyers

- More expensive auto loans, especially for borrowers with low credit scores

- Increased credit card interest rates, hurting consumers already struggling with household debt

Even a 1 to 2 percent increase in rates could translate into thousands of dollars in additional payments for families over the course of a loan.

2. Cuts to Essential Social Services

To counterbalance the revenue loss from tax cuts, future Congresses may look to reduce spending. Likely targets include:

- Medicaid, which could see eligibility tightened or funding reduced

- SNAP (food stamps), potentially resulting in millions losing food assistance

- Pell Grants and student aid, making higher education even less accessible

For vulnerable populations and low-income families, such cuts could deepen hardship and inequality.

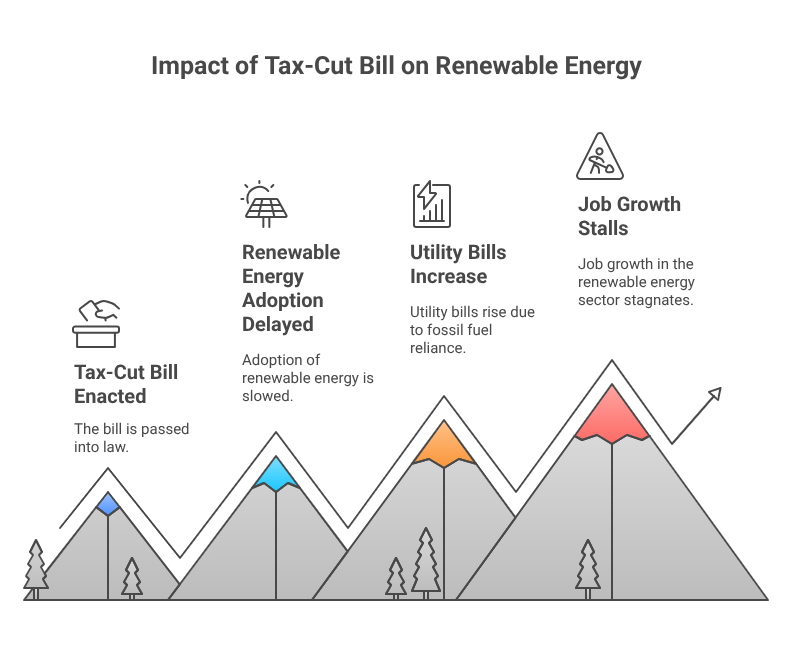

3. Green Energy Incentives Eliminated

The bill rolls back critical tax credits and subsidies that supported solar, wind, and other clean energy initiatives. This move may:

- Delay adoption of renewable energy in homes and businesses

- Increase long-term utility bills as reliance on fossil fuels continues

- Stall job growth in one of the fastest-growing sectors of the U.S. economy

Environmental advocates warn that the decision will hurt not just the planet, but household budgets.

4. Greater Inequality: Benefits for the Wealthy

The lion’s share of the bill’s tax relief benefits large corporations and the top 5 percent of income earners. For middle- and lower-income Americans, the impact is negligible at best and damaging at worst.

Economic inequality, already at record highs, could worsen as the wealthy save on taxes while average Americans deal with service cuts, rising prices, and stagnant wages.

5. Prolonged Inflation Risk

The increase in government debt and a potential slowdown in monetary easing from the Federal Reserve could combine to keep inflation higher for longer. That means:

- More expensive groceries, gas, and utility bills

- A higher cost of living that continues to outpace wage growth

- Little relief for consumers already stretched thin by years of economic instability

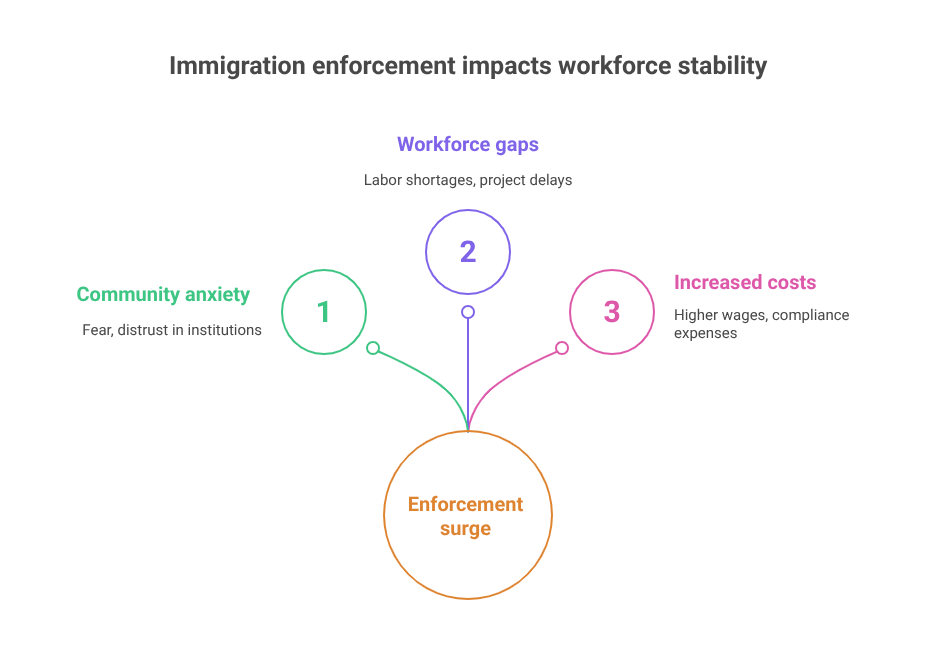

6. Increased Deportation Funding and Social Disruption

The bill allocates billions for expanded border security and deportation efforts. While some see this as necessary enforcement, others fear it will:

- Create anxiety and instability in immigrant communities

- Result in workforce disruptions in sectors like agriculture and construction

- Lead to higher costs in industries already facing Labor shortages

The social and economic consequences could extend far beyond the immigrant population itself.

Senate Showdown Ahead

As the bill moves to the Senate, its future is uncertain. Several moderate Republican senators have already expressed concern about its cost and timing. Democrats have vowed to oppose the bill completely, setting the stage for a high-stakes confrontation.

If the bill passes the Senate, the long-term consequences could be irreversible.

Expert Warning: “A Fiscal Time Bomb”

“This is not just a tax cut—it’s a fiscal time bomb. Injecting this much debt into the economy while primarily benefiting the top tier will inevitably harm the working class.”

“It sets the stage for deeper deficits, painful cuts to essential services, and the risk of another financial crisis in the future.”

Trump’s new tax-cut bill may please corporations and political donors, but it risks triggering a storm of economic consequences for the average American. With the national debt poised to explode and core support services likely on the chopping block, Main Street is bracing for impact.

This is more than a piece of legislation. It’s a fundamental reshaping of fiscal priorities in America, and everyday citizens may soon find themselves footing the bill.