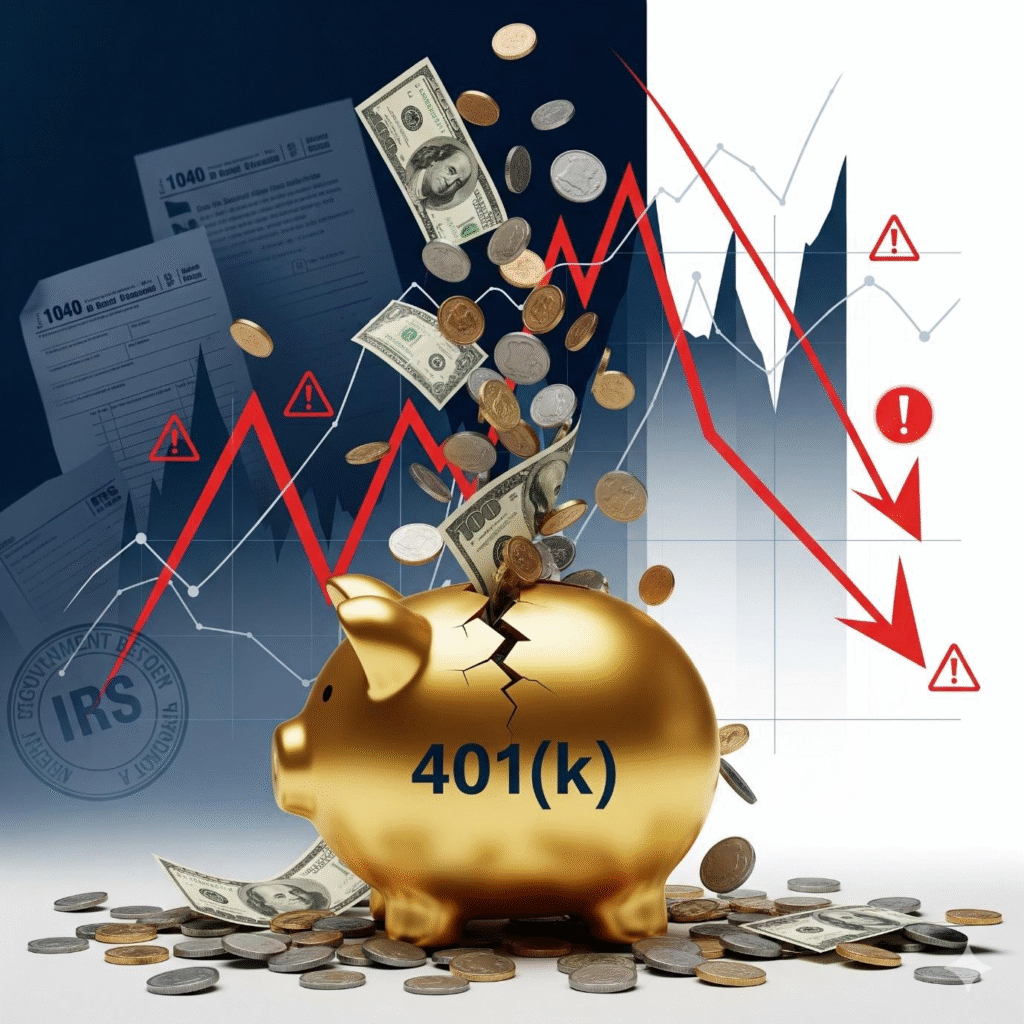

The 401(k) Loan Crisis: Millions Can’t Repay Retirement Borrowing as IRS Rule Changes Take Effect

Washington, D.C. — A new wave of financial strain is hitting American workers as millions of people who borrowed against their 401(k) retirement plans now struggle to repay. The growing defaults are being described by analysts as a looming 401(k) loan crisis, one that threatens long-term retirement security while new IRS rule changes reshape how workers can access their retirement savings.

401(k) Loan Crisis: Rising Defaults in Retirement Accounts

For decades, 401(k) plans were meant to be the backbone of retirement savings. However, a little-known feature of many plans allows participants to borrow against their balances. In theory, it is a safe way to access cash without leaving the retirement system. In practice, millions are unable to repay these loans, leading to what experts call “leakage” — money permanently lost from retirement accounts.

Studies have shown that nearly one in five plan participants has a loan outstanding at any given time. Over a five-year span, close to 40 percent of savers will borrow from their account at least once. While many repay successfully, a significant portion defaults. The annual loss is estimated in the billions, weakening both personal retirement security and the larger system designed to support aging Americans.

The problem intensifies when workers change jobs. Most plans require borrowers to repay any outstanding loan balance within a short time frame, often 60 to 90 days. If they cannot, the unpaid balance is classified as a deemed distribution, subject to income taxes and, for those under age 59½, an additional 10 percent penalty. For workers already facing financial distress, this becomes an impossible burden.

Why Americans Can’t Repay

The crisis is not the result of one factor but a combination of economic, structural, and personal challenges.

- Job Transitions: The modern workforce is mobile. Workers change jobs more frequently, and each transition brings a risk of loan default if repayment deadlines cannot be met.

- Financial Hardship: Borrowers often turn to their 401(k) when dealing with emergencies like medical bills, housing costs, or debt repayment. These same hardships make repayment unlikely.

- Lack of Awareness: Many employees are unaware of the strict repayment rules and the heavy tax consequences of default. Financial literacy gaps leave them blindsided when penalties arrive.

- Plan Features: Some plans allow multiple concurrent loans or longer repayment schedules, which increase both debt levels and default risk.

- Economic Pressures: Rising living costs, inflation, and stagnant wages push more households toward their retirement savings as a lifeline, compounding the crisis.

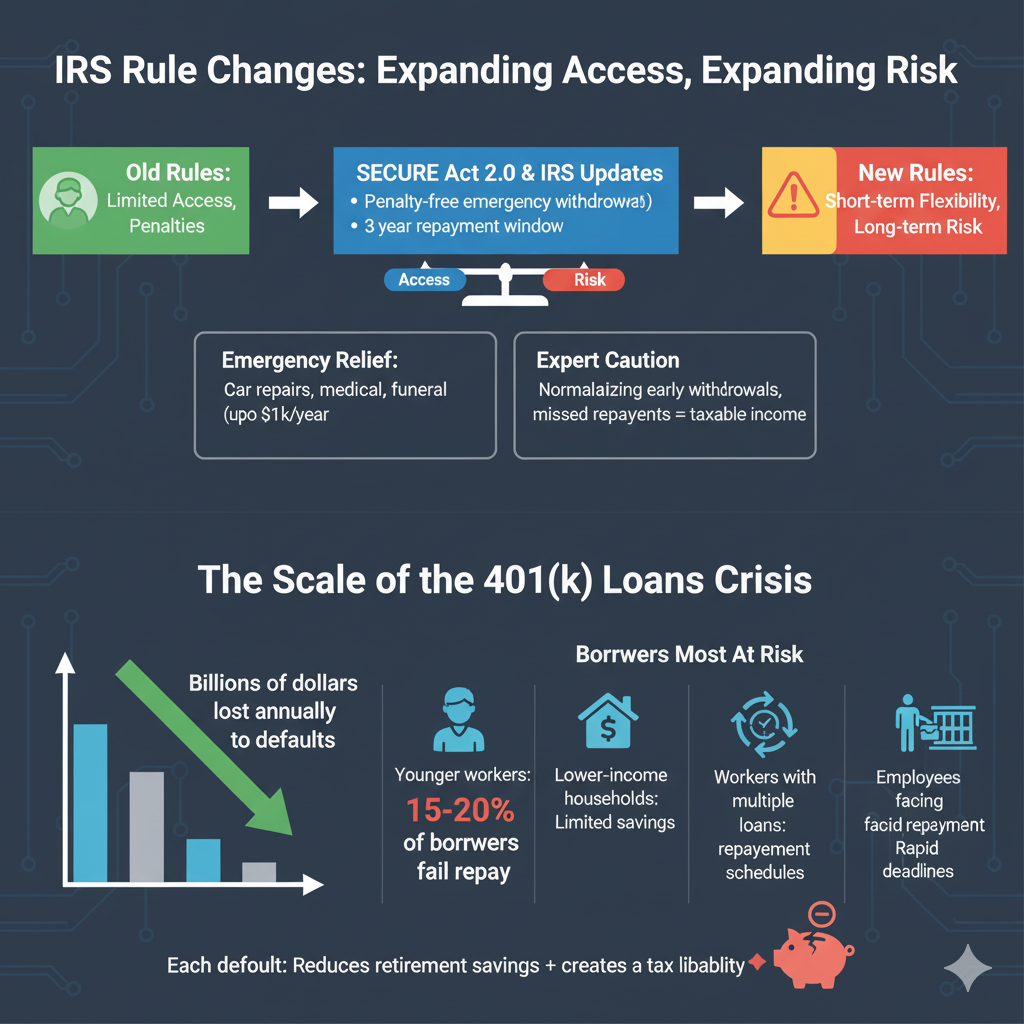

IRS Rule Changes: Expanding Access, Expanding Risk

Recent IRS rule changes and new provisions under the SECURE Act 2.0 were designed to provide workers with greater flexibility in accessing their retirement savings. Among the most significant updates are new options for penalty-free withdrawals in cases of emergency.

Workers can now take limited emergency distributions — for example, up to $1,000 annually—without paying the early-withdrawal penalty, provided the amount is repaid within three years. For those facing sudden expenses such as car repairs, medical emergencies, or funeral costs, this change offers much-needed relief.

Yet experts caution that these adjustments may unintentionally fuel the crisis. By normalizing early withdrawals and loans, the rules could encourage more participants to tap retirement funds prematurely. If repayments are missed, the withdrawals turn into taxable income, adding another layer of financial stress.

In effect, the IRS changes offer short-term flexibility but increase the possibility of long-term losses.

The Scale of the Crisis

While the numbers vary year to year, analysts estimate that defaults on 401(k) loans drain billions of dollars annually from the retirement system. In some reports, as much as 15 to 20 percent of borrowers fail to repay their loans in full.

The borrowers most at risk include:

- Younger workers are more likely to borrow early in their careers and face frequent job changes.

- Lower-income households, with limited savings outside retirement accounts, have few alternatives in emergencies.

- Workers with multiple loans who juggle repayment schedules that are difficult to maintain.

- Employees facing layoffs or job changes often cannot meet the rapid repayment deadlines.

Each default not only reduces retirement savings but also creates a tax liability in the present, a double blow for households already under financial stress.

The Consequences for Retirement Security

The ripple effects of the 401(k)-loan crisis are long-lasting:

- Lost Compounding: Money borrowed or withdrawn stops earning investment returns. Even if repaid, the missed years of growth leave permanent gaps in retirement balances.

- Tax Burdens: Defaults create immediate taxable income, pushing some workers into higher tax brackets. Younger borrowers face an additional 10 percent penalty.

- Reduced Contributions: Workers with loans often lower or stop their regular 401(k) contributions while focusing on repayment, slowing future savings.

- Psychological Strain: Borrowing against retirement savings creates a false sense of security, encouraging repeated loans and weakening long-term planning.

For many Americans, the cumulative effect is devastating: smaller retirement accounts, unexpected tax bills, and the prospect of working longer or retiring with less security.

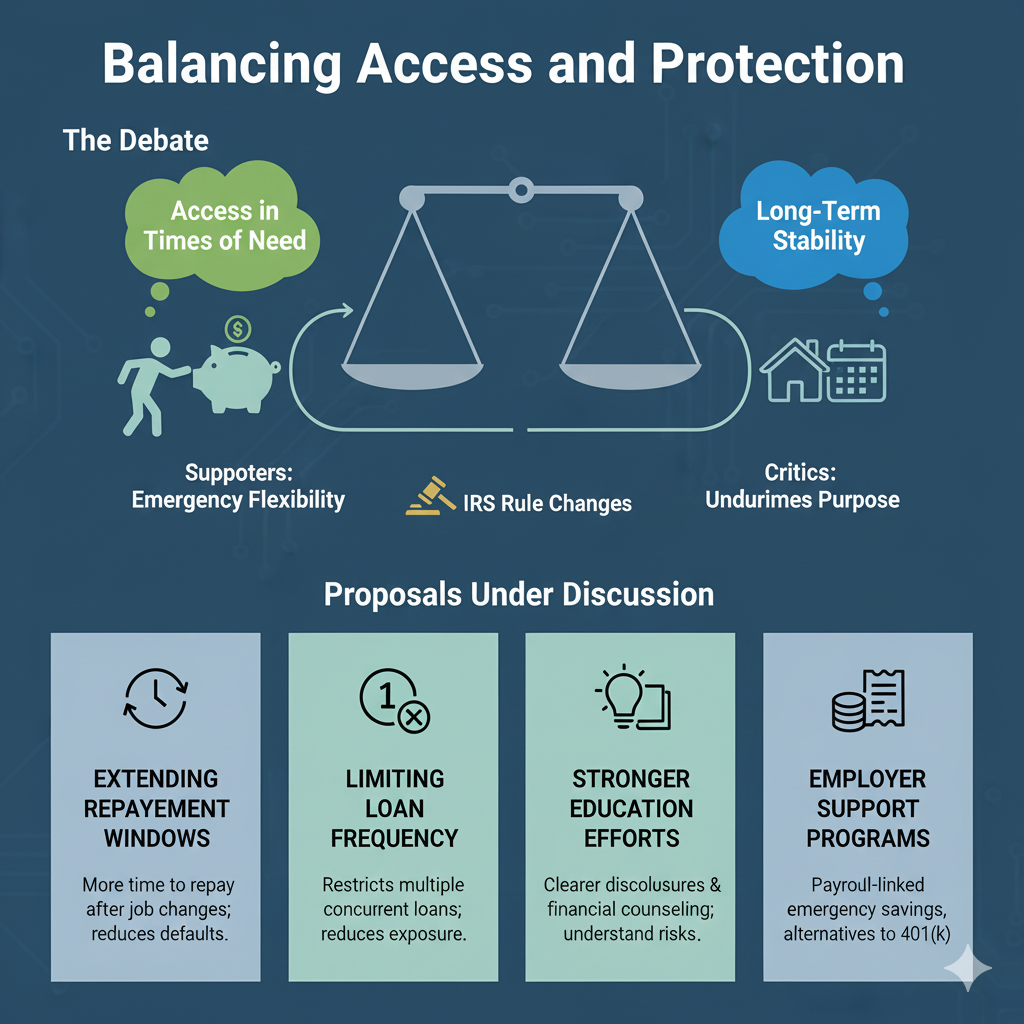

Balancing Access and Protection

The debate around 401(k) loans has intensified since the IRS rule changes. Policymakers face a delicate balance: how to give workers access to their own savings in times of need without jeopardizing long-term financial stability.

Supporters of the rule changes argue that life is unpredictable, and retirement savings should provide emergency flexibility. Critics counter that retirement accounts are designed for old age, not short-term crises, and that easy access undermines their purpose.

Proposals under discussion include:

- Extending Repayment Windows: Allowing more time for workers to repay after job changes could significantly reduce defaults.

- Limiting Loan Frequency: Restricting multiple concurrent loans would reduce exposure.

- Stronger Education Efforts: Clearer disclosures and financial counseling could help workers understand the risks before borrowing.

- Employer Support Programs: Some companies are exploring payroll-linked emergency savings accounts as alternatives, reducing the need to tap 401(k) funds.

A System Under Pressure

The broader retirement system in the United States was already under strain before the loan crisis. Fewer workers have traditional pensions, and many households rely almost entirely on 401(k) accounts or IRAs for retirement income. Rising healthcare costs, longer lifespans, and economic volatility add to the pressure.

In this environment, loan defaults represent more than individual hardship — they threaten to undermine the effectiveness of the defined-contribution system as a whole. Billions lost each year in defaults mean billions less in retirement security for the nation’s workforce.

Looking Ahead

The 401(k) loan crisis is not likely to fade quickly. With inflation squeezing household budgets and new IRS rules broadening access, borrowing from retirement accounts may increase in the coming years. Unless repayment challenges are addressed, defaults could climb further, eroding future retirement wealth for millions.

Experts warn that individuals need to weigh the risks carefully before tapping into their accounts. Borrowing against retirement may seem like a lifeline, but the long-term costs often outweigh the short-term benefits. For policymakers and plan sponsors, the challenge is clear: design systems that allow flexibility without sacrificing the core purpose of retirement savings.