AI Credit Scoring Nightmare: Why Immigrants Get Denied Loans in 2025 (Algorithmic Bias Scandals)

In 2025, artificial intelligence (AI) has transformed nearly every industry — and the financial sector is no exception. From robo-advisors to AI-powered fraud detection, technology promises faster, fairer, and more data-driven decisions. But for many immigrants, the dream of a more inclusive financial system has turned into a nightmare.

Across the United States, Canada, the UK, and Australia, immigrants are facing an alarming trend: loan rejections triggered by flawed AI credit scoring algorithms. While banks and fintech lenders champion automation for its efficiency, watchdog groups and civil rights organizations are raising red flags over algorithmic bias, especially against non-citizens and minority populations.

Denied by the Algorithm: A Widening Credit Gap

In June 2025, 29-year-old Nigerian software engineer Adebola Yusuf was denied a car loan from a major online lender despite a six-figure salary, no existing debt, and a stable employment history with a Fortune 500 company.

“I checked all the boxes,” Yusuf recalls. “But the system flagged me as ‘high risk.’ When I asked why, they said it was a ‘system-level decision’ made by their AI credit model.”

Yusuf is one of thousands caught in the widening AI credit scoring gap, where immigrants with limited local credit histories or ‘non-standard’ data profiles are being denied access to basic financial services.

The Rise of AI Credit Scoring in 2025

With the explosion of big data and machine learning, AI-based credit scoring models have largely replaced traditional FICO scores. These systems analyse thousands of data points — from mobile usage and social media activity to utility payments and even grammar used in loan applications — to assign a creditworthiness score.

However, critics argue that these models often reinforce systemic biases that are already present in historical data.

“AI is only as fair as the data it’s trained on,” says Dr. Laila Kumar, a digital ethics researcher at the University of Toronto. “If historical credit data reflects racial or socio-economic bias, the algorithm will learn and perpetuate that bias — at scale.”

Immigrant Profiles Misread by Machines

A 2025 report from the Global Fair Finance Coalition (GFFC) found that immigrants were 47% more likely to be denied a personal loan by AI-based credit scoring systems compared to native-born citizens with comparable financial profiles.

Why?

- Thin credit files or no local credit history

- Frequent changes of address (common for new arrivals)

- Foreign education and employment credentials not recognized

- Remittance activity misread as “unusual” transaction behaviour

- Multiple surnames or naming conventions flagged as anomalies

“This is digital redlining,” says Maria Fernandez, head of policy at Immigrant Access Now. “Instead of being judged on who you are and your financial behaviour, you’re judged on patterns that the system doesn’t understand or misinterprets.”

Algorithmic Black Boxes and No Human Oversight

The biggest concern for affected borrowers is the lack of transparency. Many fintech lenders rely on black-box AI systems that do not provide clear reasons for loan denials.

In traditional lending, applicants could appeal or speak to a loan officer. Today, AI-driven platforms offer little recourse.

“I asked for an explanation,” says Yusuf. “They just said ‘the model said no.’ There was no one I could talk to. No appeals process. Just rejection.”

This automated opacity is now under investigation in several jurisdictions.

Lenders Under Scrutiny

In May 2025, the U.S. Consumer Financial Protection Bureau (CFPB) opened a probe into three leading fintech lenders for suspected violations of the Equal Credit Opportunity Act after AI-generated credit decisions disproportionately affected immigrants, minorities, and recent college graduates.

Similarly, the UK’s Financial Conduct Authority (FCA) has launched a consultation paper on the ethical use of AI in credit scoring, with a focus on transparency, fairness, and appeal mechanisms.

Industry Defenders: “Bias Is Being Addressed”

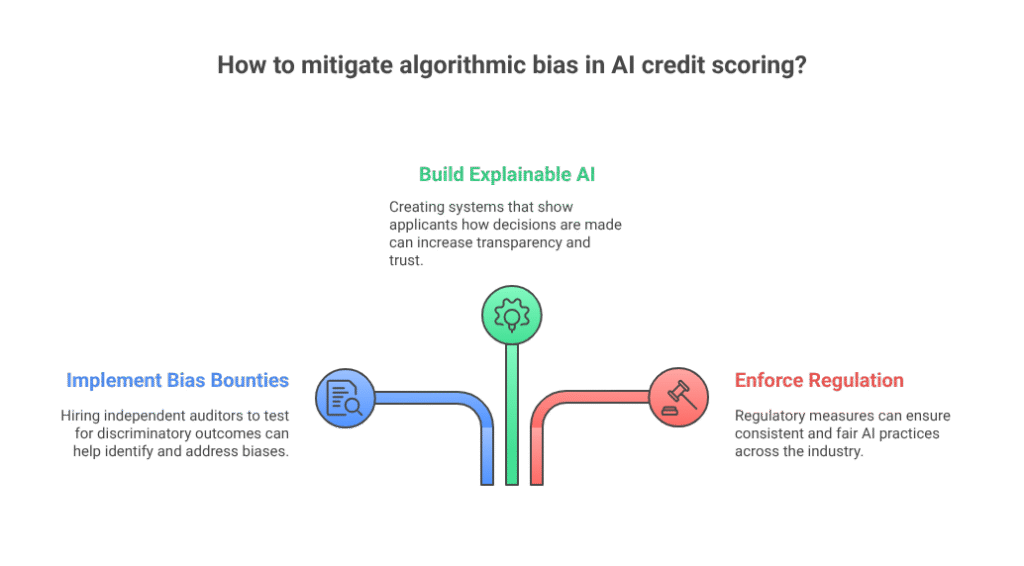

Tech experts and financial insiders insist they are taking steps to mitigate algorithmic bias. Some are implementing “bias bounties,” hiring independent auditors to test for discriminatory outcomes. Others are building “explainable AI” systems that show applicants how decisions are made.

“We’re aware of the challenges,” says a Chief AI Officer at a leading digital lending platform. “But we’re working toward inclusive data models that better reflect today’s diverse population.”

Still, critics argue that until these changes are enforced through regulation, AI will continue to entrench financial exclusion.

Stories from the Frontlines

Case 1: Indian PhD Student in Australia

Ritika Sharma, a PhD student at the University of Melbourne, was denied a rental application after an AI-powered tenant screening app flagged her as “unstable.” Her visa status and shared utility bills were misinterpreted as financial instability.

“I had excellent academic standing, a scholarship, and money in the bank,” Sharma says. “But the app rejected me — no questions asked.”

Case 2: Syrian Refugee in Canada

Ahmed Almasri, a Syrian refugee and small business owner in Toronto, was denied a small business loan despite three years of stable income and no defaults.

“The lender used an AI-based scoring tool,” he says. “Because I didn’t have a long credit history or Canadian bank records, I was automatically scored as low risk. No one even looked at my actual business performance.”

The Push for Reform

With public pressure mounting, lawmakers are taking action.

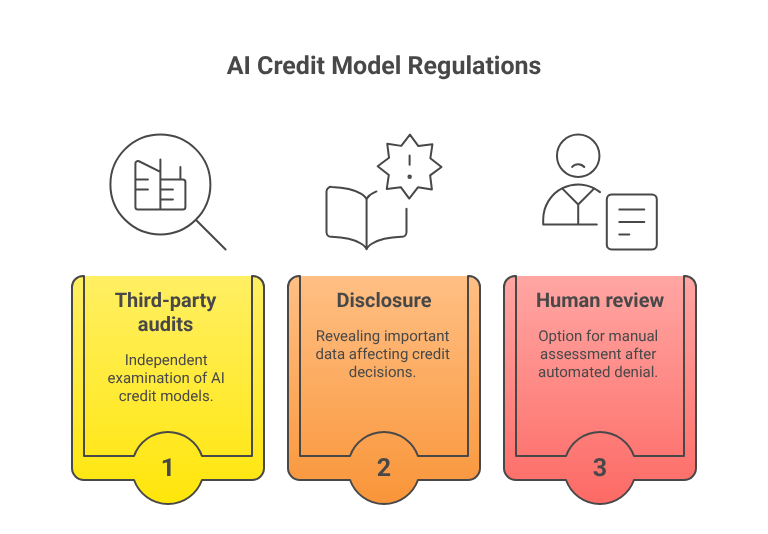

In the U.S., a bipartisan bill titled the “Algorithmic Fairness in Lending Act (AFLA) of 2025” has been introduced, requiring:

- Third-party audits of AI credit models

- Disclosure of key data points influencing decisions

- Right to human review of any automated loan denial

The European Union has already passed similar provisions under the AI Act, mandating high-risk AI systems in finance to meet strict transparency and accountability standards.

What Consumers Can Do

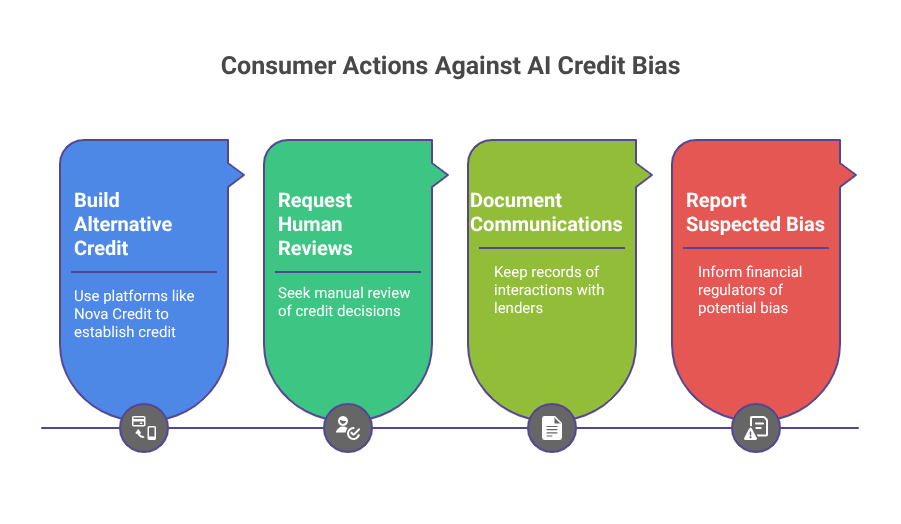

Until policy catches up, consumer advocates urge applicants to:

- Build alternative credit using platforms like Nova Credit or Experian Boost

- Request human reviews wherever possible

- Document communications with lenders

- Report suspected bias to financial regulators

Organizations such as AI Bias Watch, Credit Justice International, and Digital Rights Now also provide free legal support and advocacy for victims of algorithmic discrimination.

A Test for AI Ethics in Finance

AI is not inherently biased — but without safeguards, oversight, and inclusive design, it can automate discrimination at scale. For immigrants, the promise of a fairer financial future is at risk of being denied — not by humans, but by code.

As governments race to regulate and companies scramble to respond, one thing is clear: AI in credit scoring is no longer just a tech issue — it’s a human rights issue.