American Credit Card Debt Hits a Shocking $1.21 Trillion – Is Financial Chaos Ahead?

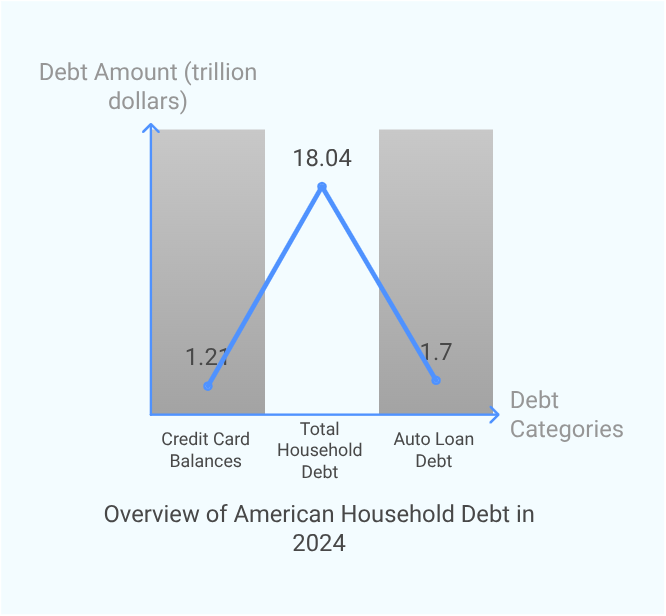

American credit card debt has hit an all-time high of $1.21 trillion, pushing total household debt to a staggering $18.04 trillion, according to a report released by the Federal Reserve Bank of New York. The surge is attributed to high interest rates and increased holiday spending.

In the last quarter of 2024 alone, overall debt rose by $93 billion, with nearly half of this increase coming from new credit card debt. Delinquencies, or missed payments, have also gone up, reflecting growing financial pressure on households.

Auto loan debt has reached $1.7 trillion, with higher delinquencies linked to rising new and used car prices. According to New York Federal Reserve researchers, these high delinquency rates are affecting borrowers across all credit scores and income levels.

By The Numbers: Spiralling Credit Card Debt

- $1.21 Trillion in credit card balances – highest on record.

- $18.04 Trillion in total household debt, including mortgages, auto loans, and student loans.

- $93 Billion increase in overall debt in the last quarter of 2024.

- $1.7 Trillion in auto loan debt, with rising delinquencies.

Researchers noted that credit card balances typically increase at the end of the year due to holiday spending, but they expect balances to decline as consumers pay down debt in the new year. However, high interest rates are making it more challenging for Americans to manage their credit card balances.

Income levels are rising alongside debt, suggesting a resilient economy. However, analysts are closely monitoring the situation as delinquencies continue to rise, particularly in auto loans.