Americans Are Ditching Debt Traps and Taking Control of Their Finances!

U.S. Trend: From Debt Traps to Financial Freedom

Managing unexpected expenses has become a challenge for many Americans, including middle-class families and even high-income earners. While more people are living paycheck to paycheck, the good news is that they are finding innovative and cost-effective ways to bridge financial gaps without falling into overwhelming debt.

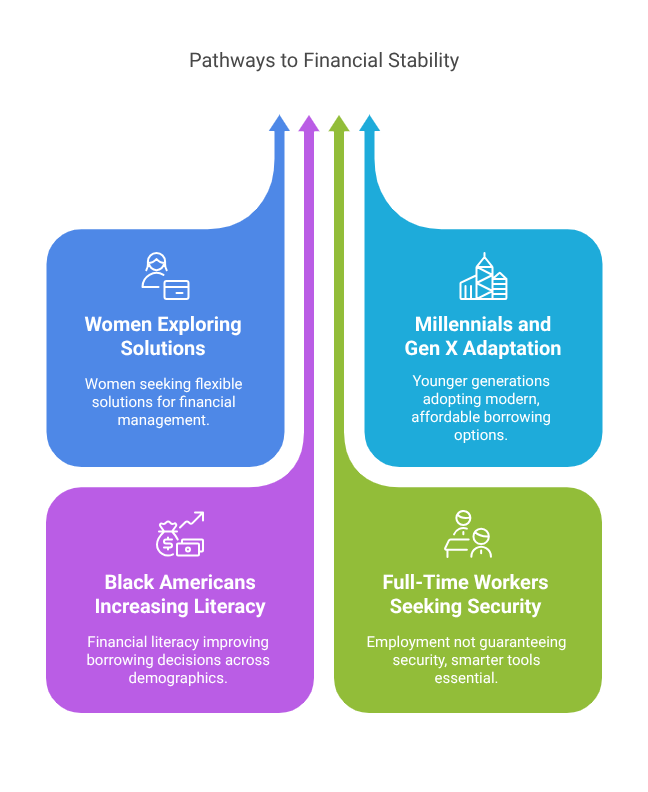

A Diverse Group Adapting to Financial Changes

Financial challenges impact a wide range of people across different demographics:

54% of cash-poor Americans are women – Women are increasingly exploring flexible financial solutions to manage expenses efficiently.

Two-thirds of cash-poor individuals are Millennials and Gen X – These generations are adapting by utilizing modern borrowing options that offer more convenience and affordability.

14% of cash-poor Americans are Black – Increased awareness of financial literacy is helping individuals from all backgrounds make better borrowing choices.

40% work full-time – Having a steady job doesn’t always mean financial security, but smarter financial tools are helping people stay on track.

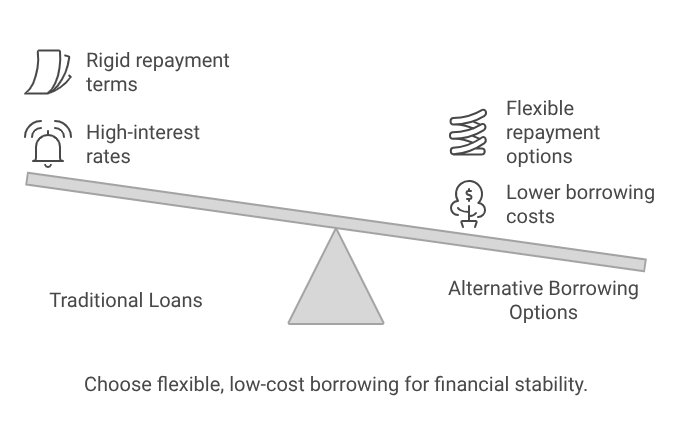

More Affordable Borrowing Options on the Rise

Instead of relying on high-interest loans, Americans are turning to lower-cost borrowing options that offer flexibility and better repayment terms. Here’s how different loan types compare:

Buy Now, Pay Later (BNPL): A convenient option that allows users to split payments into manageable installments. With low upfront costs (2%), this method is growing in popularity, especially for essential purchases.

Earned Wage Access: Employees can access a portion of their wages before payday, reducing reliance on payday loans. With average borrowing costs at just 13%, this option is becoming a game-changer for many.

Bank Small-Dollar Loans: A rising trend among banks, these loans provide structured repayment plans with costs averaging 25%, making them a more reliable option for emergency expenses.

Peer-to-Peer (P2P) Lending: This alternative offers a community-based approach to borrowing, with competitive rates and flexible repayment terms.

Friends & Family Support: More Americans (43%) are relying on personal networks for financial assistance, up from 38% in 2023, allowing them to borrow without high fees.

Moving Toward a Financially Secure Future

With greater awareness and access to cost-effective financial tools, Americans are making better borrowing decisions to stay financially stable. By choosing lower-interest options, instalment-based payments, and community-driven lending, they are taking control of their finances and building a more secure future!