Bankruptcy Filings Plummet 75% – The Shocking Truth Behind the Decline & Smarter Debt Solutions!

Financial distress often pushes individuals to consider bankruptcy as a way to manage overwhelming debt. However, recent trends show a significant shift—bankruptcy filings have declined dramatically over the past decade. What does this mean for consumers, and why are fewer people choosing bankruptcy? Let’s break down the data and explore expert insights to help you make the right financial decision.

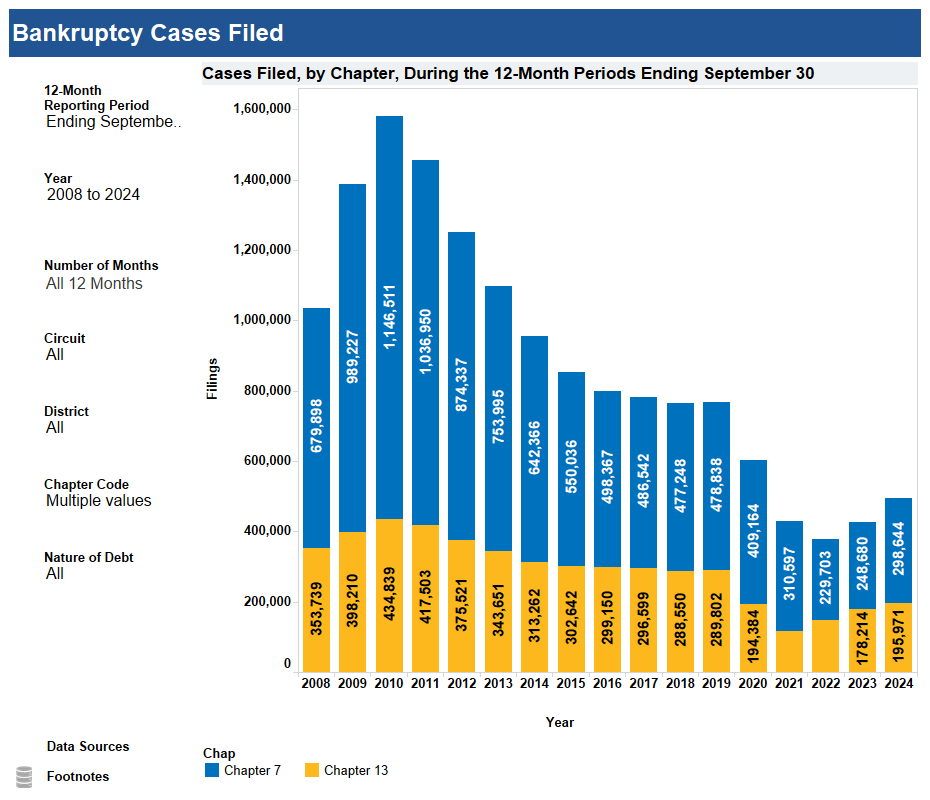

Bankruptcy Filings: A Decade-Long Decline

A decade ago, bankruptcy was the primary recourse for those overwhelmed by debt. As the chart shows, filings peaked in 2010, with over 1.14 million Chapter 7 cases and 434,283 Chapter 13 cases. However, since then, the numbers have steadily dropped, reaching a low of 298,644 total filings in 2024—a 75% decrease from the peak.

Source: U.S. Courts Bankruptcy Filings (uscourts.gov)

Why the Decline?

Several factors explain this dramatic reduction:

- Tougher Bankruptcy Laws: The 2005 Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) made it harder to qualify for Chapter 7 bankruptcy, pushing more consumers toward Chapter 13 repayment plans or alternative solutions.

- Long-Term Financial Consequences: A bankruptcy remains on credit reports for up to 10 years, affecting credit scores, employment opportunities, and access to loans.

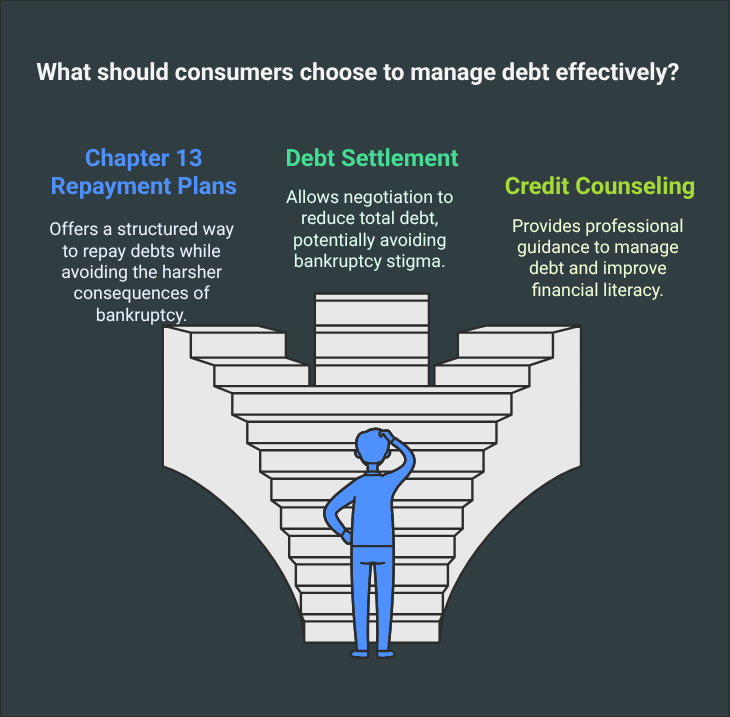

- Increased Awareness of Alternatives: More consumers are seeking alternatives like debt settlement, credit counseling, and structured repayment plans, hoping to avoid the stigma and legal implications of bankruptcy.

Expert Advice: A Smarter Way Forward

When facing financial distress, neither bankruptcy nor debt settlement is a one-size-fits-all solution. Experts recommend a strategic approach tailored to your financial goals and long-term impact. Here’s how you can navigate your options, considering the decline in bankruptcy filings and the challenges of debt settlement:

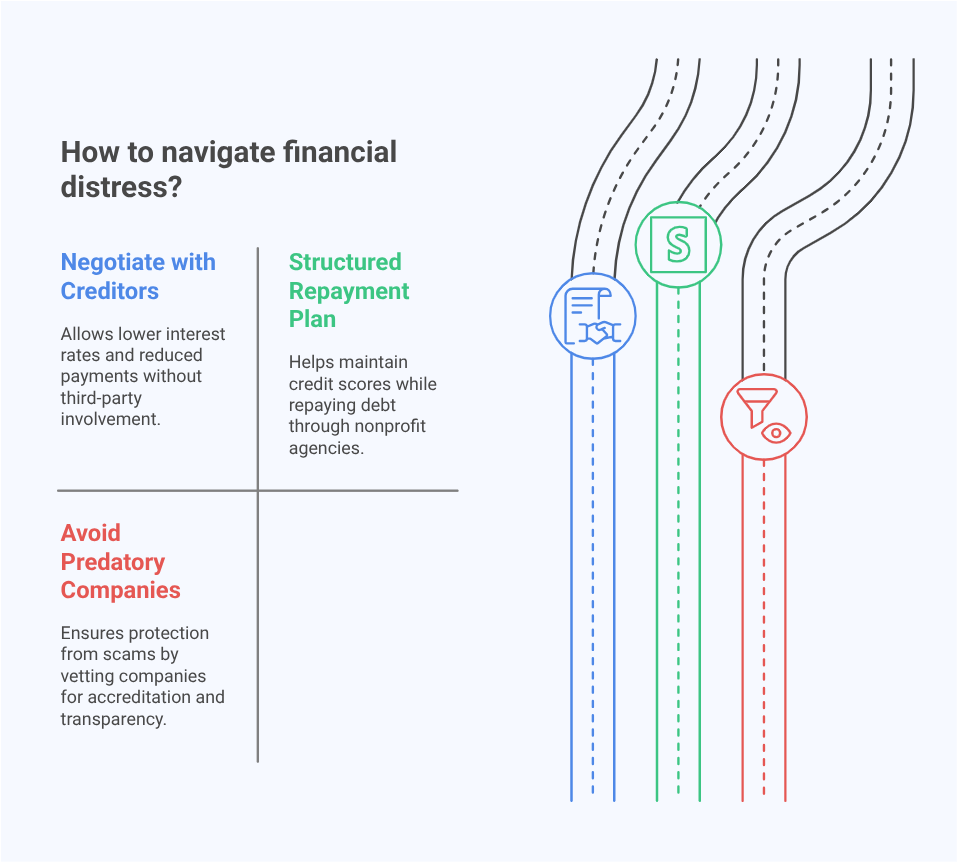

1. Directly Negotiating with Creditors

Many lenders offer hardship programs that allow lower interest rates, reduced payments, or extended terms without the need for a third party. Proactively reaching out to creditors can prevent financial deterioration.

2. Considering a Structured Debt Repayment Plan

Instead of engaging in risky settlement schemes, consumers can work with nonprofit credit counseling agencies to develop structured repayment plans that won’t severely damage their credit scores.

3. Avoiding Predatory Debt Settlement Companies

With consumer complaints rising, it’s essential to thoroughly vet debt settlement companies. Look for:

- Accreditation from agencies like the American Fair Credit Council (AFCC).

- No upfront fees (legitimate firms do not demand payments before results).

- Transparency in settlement timelines and success rates.

4. Seeking Professional Financial Guidance

Before making a decision, consulting a financial advisor or bankruptcy attorney is highly recommended. They can assess the situation and suggest alternatives that might be less damaging than bankruptcy or settlement.

Why Bankruptcy Decline Matters for Your Decision

The 75% drop in bankruptcy filings since 2010 highlights a broader trend: consumers are increasingly seeking less drastic and more strategic solutions to manage debt. While bankruptcy was once the go-to option for those overwhelmed by debt, its long-term consequences and stricter eligibility requirements have pushed people toward alternatives like debt management plans and creditor negotiations.

Your Path to Financial Recovery: Smarter Alternatives to Bankruptcy

The decline in bankruptcy filings signals a shift toward smarter, less damaging debt relief strategies. By exploring alternatives like creditor negotiations, structured repayment plans, and professional guidance, you can regain financial stability without the long-term consequences of bankruptcy or the risks associated with debt settlement. Take control of your financial future—weigh your options carefully and choose the path that aligns best with your goals.