Breaking Down US Household Debt: Key Insights from the Debt Clock

US household debt has reached alarming levels, becoming a critical concern for families, policymakers, and economists. According to the US Debt Clock, household borrowing is rising at an unprecedented pace, driven by mortgages, student loans, credit cards, auto loans, and personal borrowing. But what do these numbers truly reveal? And how do they affect the average American household?

In this article, we break down the latest numbers from the US Debt Clock and explore the growing crisis of US household debt. We’ll look into the most significant debt categories, why debt levels are rising, and how individuals can protect themselves in today’s borrowing-heavy environment.

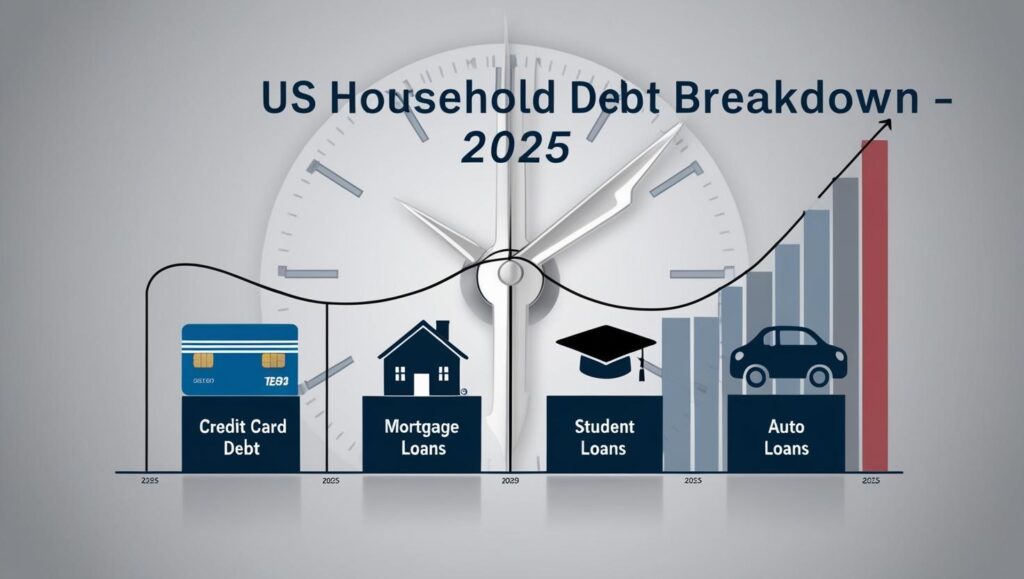

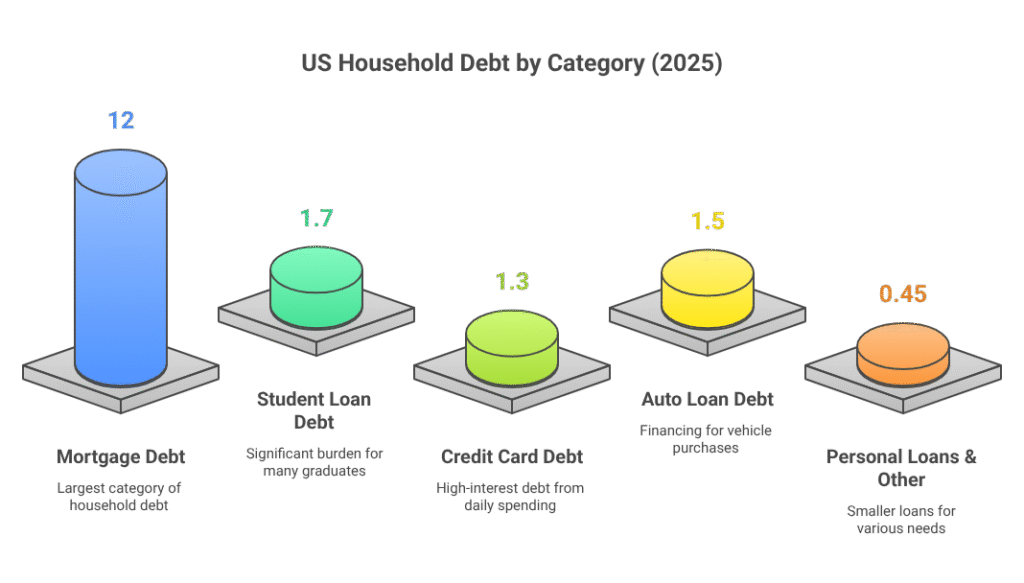

Total US Household Debt at a Glance

As of 2025, US household debt has surpassed $18 trillion, a figure that continues to grow by the second, according to real-time data from the US Debt Clock. The total includes all major consumer debt types such as mortgages, student loans, credit card balances, auto loans, and personal loans.

| Debt Category | Total Amount (Approx.) |

|---|---|

| Mortgage Debt | $12+ Trillion |

| Student Loan Debt | $1.7 Trillion |

| Credit Card Debt | $1.3 Trillion |

| Auto Loan Debt | $1.5 Trillion |

| Personal Loans & Other | $450+ Billion |

These figures reflect the financial weight that millions of households carry every day, affecting both short-term cash flow and long-term wealth-building potential.

Mortgage Debt: The Dominant Factor in US Household Debt

Mortgage debt is the single largest component of US household debt, accounting for over two-thirds of the total.

Key Insights:

- The average household with a mortgage owes over $200,000.

- Rising property values have forced new buyers into larger loans.

- Homeowners are refinancing to lock in lower rates or tap into home equity, adding to total debt levels.

The trend shows that while homeownership remains a goal for many Americans, it’s also becoming one of the most significant financial burdens they carry.

Student Loan Debt: Weighing Down Younger Generations

Student loans are now a defining feature of American household debt, especially among millennials and Gen Z.

Key Insights:

- Over 43 million Americans carry student loan debt.

- The average student borrower owes approximately $38,000.

- Total student debt has more than doubled in the last 15 years.

This kind of debt often delays key life milestones, such as buying a home or starting a family, and limits overall economic mobility for younger generations.

Credit Card Debt: High-Interest Trouble

Credit card balances are among the most financially dangerous types of debt due to their high interest rates, often exceeding 20% APR.

Key Insights:

- Total credit card debt now exceeds $1.3 trillion.

- The average American holds over $6,000 in revolving credit card balances.

- Many households are using credit cards to cover rising costs of essentials like groceries and gas.

Minimum payments and compounding interest make it extremely difficult for consumers to get ahead of their balances without a strict payoff strategy.

Auto Loan Debt: Long-Term Loans, Higher Risks

Auto loans have also grown significantly, driven by record-high car prices and longer loan terms.

Key Insights:

- The average new car price now exceeds $47,000.

- Auto loan debt has risen to $1.5 trillion.

- Many loans now extend 72–84 months, which increases the total interest paid over time.

With many buyers now owing more than their car is worth (being “underwater”), the risk of financial loss in the event of repossession or depreciation is high.

Personal Loans and Other Debts

While not as large as mortgage or auto loans, personal loans, payday loans, and buy-now-pay-later schemes also contribute significantly to household debt.

Key Insights:

- Personal loans are frequently used to consolidate higher-interest debts.

- The average personal loan balance exceeds $10,000 per borrower.

- New online lending platforms have made borrowing faster, but sometimes less transparent.

Used responsibly, personal loans can help manage debt, but without careful budgeting, they can worsen financial instability.

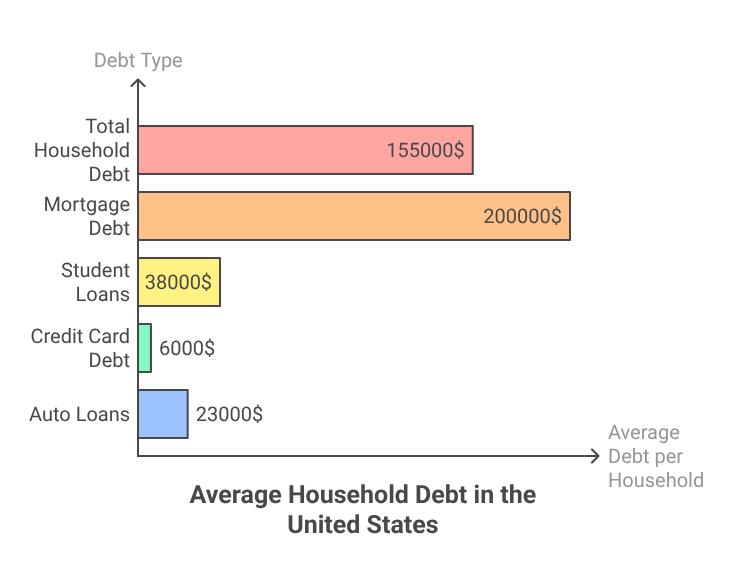

Average Household Debt in the United States

Here’s a closer look at average household debt levels across various types:

| Debt Type | Average per Household |

|---|---|

| Total Household Debt | $155,000+ |

| Mortgage Debt (with loans) | $200,000+ |

| Student Loans | $38,000+ |

| Credit Card Debt | $6,000+ |

| Auto Loans | $23,000+ |

These averages illustrate the breadth of debt exposure for the typical American household, often consuming large portions of monthly income.

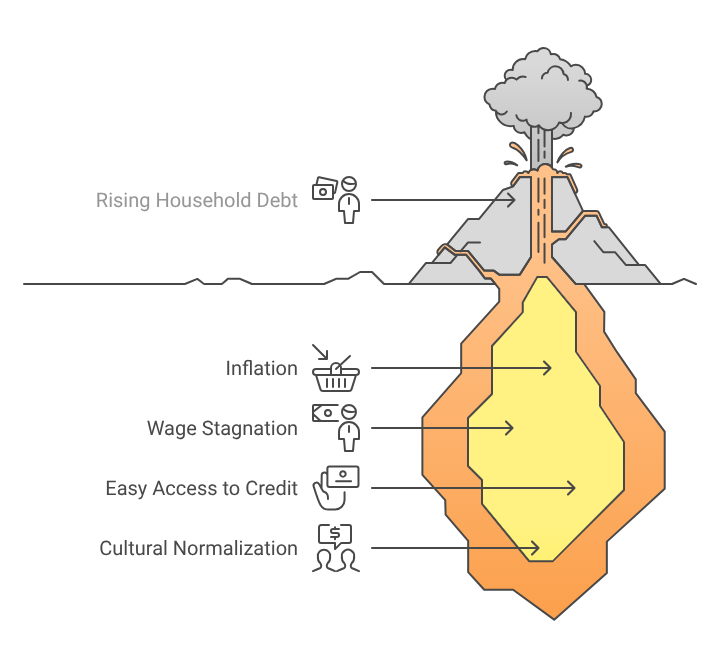

Why Is US Household Debt Increasing?

Several economic and cultural factors are driving the consistent rise in household debt:

1. Inflation

The cost of living—including essentials like housing, groceries, and healthcare—has climbed, forcing many to rely on credit.

2. Wage Stagnation

Despite rising prices, wage growth has remained sluggish for most workers over the last two decades.

3. Easy Access to Credit

Credit cards, payday loans, and personal loan offers are widely available, making it easier than ever to accumulate debt.

4. Cultural Normalization

Debt, especially for education and housing, is now seen as a normal part of life—even a necessity—rather than a last resort.

What the Debt Clock Reveals About Financial Health

The real-time data from the US Debt Clock paints a vivid picture of how debt affects everyday Americans. It reflects:

- The rapid growth of personal and household debt.

- How interest and borrowing costs continue to rise.

- A society is increasingly dependent on credit to maintain basic standards of living.

This isn’t just a personal finance issue—it’s a national economic concern. Household debt levels this high can drag down consumer spending, delay retirement, and cause ripple effects throughout the economy.

Using the Debt Clock as a Personal Finance Tool

While designed to show national and collective debt, individuals can also use the Debt Clock to:

- Compare their debt levels to national averages.

- Understand trends in borrowing and interest rates.

- Motivate action to reduce debt and increase savings.

By putting your own financial picture in context, the numbers become more than statistics—they become a call to action.

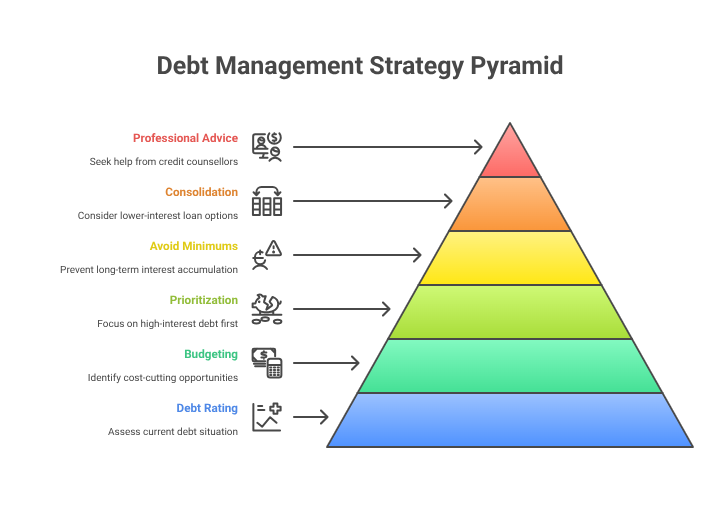

How to Manage and Reduce Your Household Debt

If you feel overwhelmed by debt, you’re not alone. Here are practical steps you can take:

1. Check Your Debt Rating

Start by using a debt rating checker to see where you stand. It gives you a snapshot of your current debt situation and helps you plan smarter repayment strategies.

2. Build a Budget

Start with a realistic look at your income and expenses. Identify where you can cut costs to free up money for debt payments.

3. Prioritize High-Interest Debt

Use the debt avalanche method to pay off high-interest balances first, saving the most money over time.

4. Avoid the Minimum Payment Trap

Making only the minimum on credit cards leads to years of payments and thousands in interest.

5. Explore Consolidation Options

Consider consolidating debt into a single loan with a lower interest rate, but beware of fees and terms.

6. Seek Professional Advice

Certified credit counsellors and nonprofit debt management programs can help you create a sustainable payoff plan.

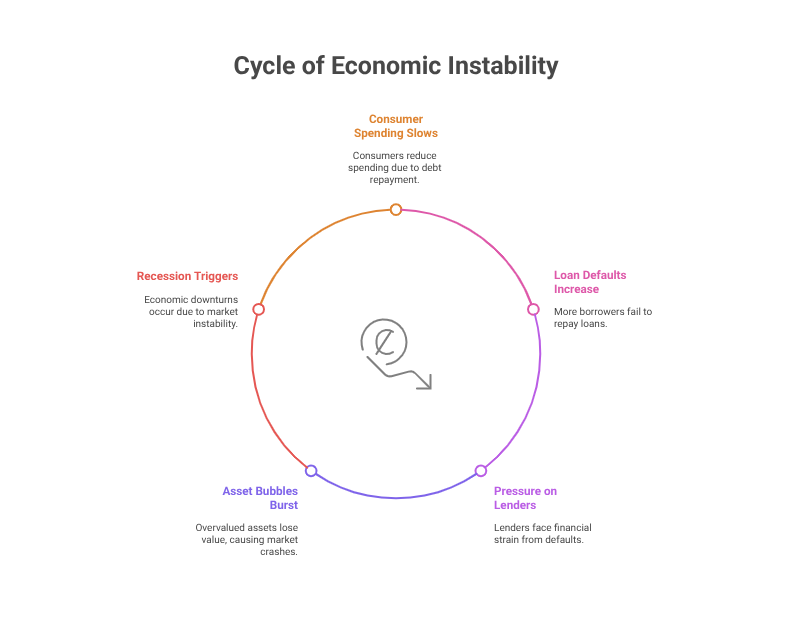

Household Debt and the US Economy: A Dangerous Link

Rising household debt isn’t just a personal burden—it poses systemic risks to the US economy.

- Consumer spending slows when large portions of income go to debt repayment.

- Loan defaults increase, putting pressure on lenders and investors.

- Asset bubbles, especially in real estate, can trigger recessions when they burst.

Monitoring and managing household debt is critical not just for individuals but for the economic health of the country.

The US Debt Clock is more than a tool—it’s a reflection of the financial pressures that millions of Americans face every day. With US household debt surpassing $18 trillion, it’s clear that personal finance habits, economic policies, and social norms must evolve to prevent a deeper crisis.

Whether you’re struggling with a mortgage, burdened by student loans, or living paycheck to paycheck with high credit card balances, now is the time to take control. Use the insights from the Debt Clock to assess your own financial situation and make informed, proactive decisions.

Take Control Today

Want to better understand your place in the debt landscape? Compare your personal debt levels with national trends using tools like the US Debt Clock and a reliable debt rating checker. Knowing where you stand is the first step to making smarter financial choices.

Start by tracking your debt, setting realistic goals, and creating a payoff strategy that works for your income and lifestyle. Whether you’re tackling credit card balances, student loans, or mortgage payments, the key is to stay informed and proactive.

Don’t wait for your debt to spiral out of control—take action now to regain financial stability and build a more secure future.