CFPB Delays Medical Debt Advisory Opinion to January 2025 Following ACA Legal Challenge

Washington, D.C. –

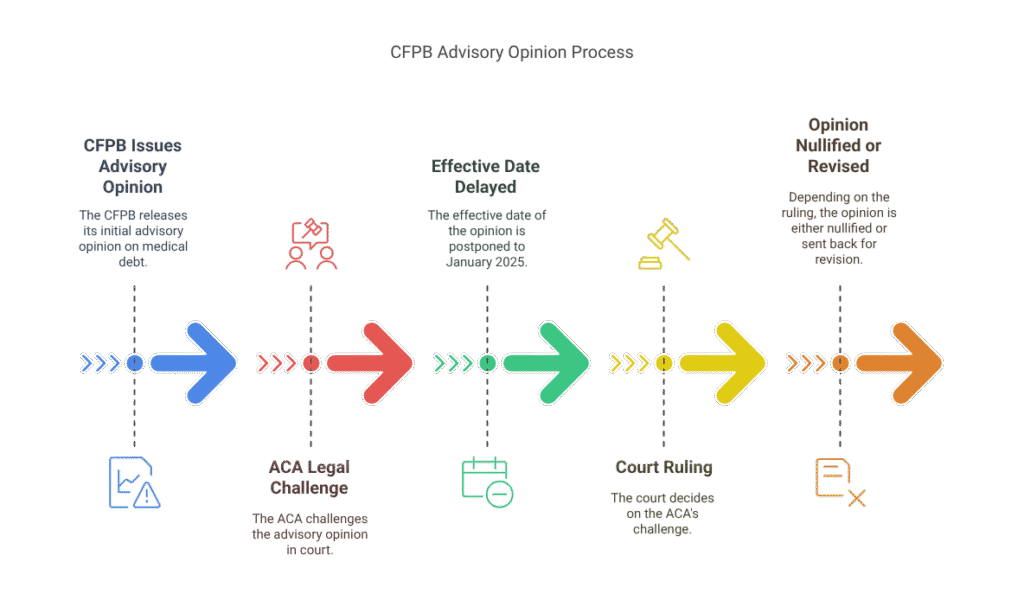

In a significant development for the debt collection and credit industries, the Consumer Financial Protection Bureau (CFPB) has announced a delay in the implementation of its controversial advisory opinion on medical debt. Originally set to take effect immediately, the guidance will now become effective on January 2, 2025. The decision comes in response to an emergency motion filed by ACA International (ACA) as part of an ongoing legal battle.

The Background

The CFPB’s advisory opinion, issued earlier this year, addresses how medical debt is reported and collected under the Fair Debt Collection Practices Act (FDCPA). It includes a strict interpretation that many in the credit and collection industry argue significantly limits how agencies can operate, particularly in relation to the use of convenience fees and communication practices involving medical debt.

ACA International, the leading trade association representing credit and collection professionals, filed a lawsuit challenging the opinion. The organization asserts that the CFPB not only exceeded its statutory authority but also failed to follow formal rulemaking procedures required by the Administrative Procedure Act (APA).

“The CFPB’s voluntary delay in the effective date is a significant win for ACA and its members,” said Scott Purcell, CEO of ACA International. “We are committed to ensuring any regulatory changes undergo the proper legal and procedural review, rather than unilateral reinterpretation of existing laws.”

Why This Matters

The advisory opinion is seen by critics as a form of “regulation by guidance”, bypassing the public comment process and legal checks that typically accompany new rules. ACA argues that the opinion could have far-reaching consequences not only for debt collectors but also for healthcare providers, credit reporting agencies, and consumers.

Legal experts have weighed in, noting that the delay is a strategic move by the CFPB to avoid an injunction or an unfavorable court ruling while the case proceeds.

Industry Impact

With the new effective date set for early January 2025, credit and collection agencies have gained a temporary reprieve. However, uncertainty remains. If the court rules in ACA’s favor, the opinion could be nullified altogether or sent back to the CFPB for revision through formal rulemaking.

The case has sparked broader conversations in the financial services industry about the CFPB’s authority and the importance of procedural compliance when issuing binding interpretations of federal law.

What’s Next?

The federal court handling the case has yet to issue a final ruling, and the CFPB has not publicly commented beyond the delay notice. Legal observers expect more developments over the next several weeks, particularly if the court chooses to weigh in before the new effective date.

Stakeholders are advised to closely monitor the case and prepare for possible compliance shifts depending on how the litigation unfolds.

For ongoing updates and expert analysis on this and other key debt policy developments, visit TalkinDebts.com — your trusted source for consumer debt news and regulatory insights.