Court Rulings Provide New Protections for Consumers Against Aggressive Debt Collectors

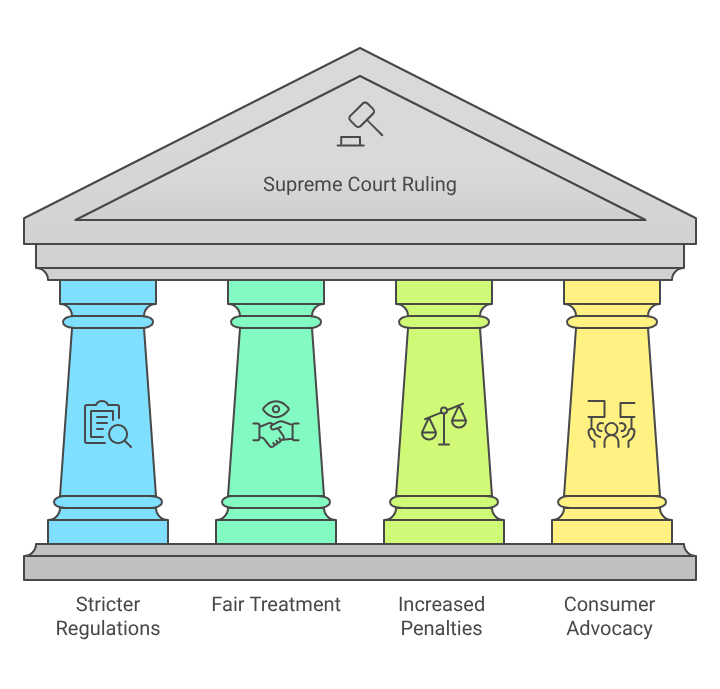

In a landmark decision that has reshaped the financial and legal landscape, the Supreme Court recently issued a ruling that significantly strengthens protections for consumers against aggressive and unethical debt collection practices. This ruling establishes stricter regulations for debt collectors, ensuring that individuals facing financial difficulties are treated with fairness and respect. By imposing clear boundaries on collection tactics and increasing penalties for harassment, the decision marks a major victory for consumer rights advocates and provides much-needed relief for those burdened by predatory debt recovery efforts.

Background on Debt Collection Practices

Debt collection is an integral part of the financial ecosystem, allowing creditors to recover unpaid debts through third-party agencies. While legitimate debt collection serves an important economic function, some agencies have long engaged in abusive tactics that inflict undue stress on consumers. Aggressive practices—such as incessant phone calls, deceptive threats, public shaming, and false legal intimidation—have left many individuals feeling helpless and overwhelmed.

For years, consumer protection groups have highlighted the psychological and financial toll of these practices, advocating for stronger legal safeguards. The recent Supreme Court ruling addresses these concerns by setting firm legal standards to curb harassment and ensure ethical conduct in the debt collection industry.

Key Aspects of the Supreme Court Ruling

The Supreme Court’s decision introduces several critical reforms designed to protect consumers from predatory debt collection tactics. These include:

1. Stricter Communication Guidelines

Debt collectors are now subject to strict limitations on how and when they can contact consumers. The ruling prohibits excessive calls, restricting agencies to a set number of attempts per week. Additionally, collectors may no longer contact individuals outside of designated hours (typically 8 a.m. to 9 p.m.) or use misleading or deceptive language in their communications.

2. Enhanced Transparency Requirements

To prevent fraudulent or inflated debt claims, collectors must now provide clear, written documentation detailing the debt’s origin, amount, and terms. This documentation must include:

- The name of the original creditor

- The total amount owed, including any interest or fees

- Instructions on how to dispute the debt if the consumer believes it is inaccurate

This measure ensures that consumers are fully informed before making any payments, reducing the risk of coerced settlements.

3. Increased Penalties for Harassment

The ruling imposes harsher penalties on agencies that engage in harassment, including:

- Significant fines for repeated violations

- License suspensions for severe misconduct

- Potential lawsuits from affected consumers

These stricter consequences serve as a deterrent against abusive behavior and hold agencies accountable for unethical practices.

4. Strengthened Consumer Rights to Dispute Debts

Consumers now have stronger legal backing to challenge questionable debts. If a debt is disputed, collection efforts must pause until the dispute is resolved, preventing undue pressure on individuals who may not actually owe the claimed amount. This provision protects consumers from being forced into payments for unverified or incorrect debts.

5. Regulations on Digital Communication

With the rise of digital communication, the ruling also addresses how debt collectors may contact consumers via email, text messages, and social media. These communications must:

- Be professional and non-threatening

- Include clear opt-out options

- Comply with the same frequency restrictions as phone calls

This ensures that digital harassment does not replace traditional forms of intimidation.

Implications for Consumers

The Supreme Court’s decision is a major win for consumers, offering robust legal protections against aggressive debt collection. Key benefits include:

- Reduced Harassment: Consumers no longer have to endure relentless calls or threats at all hours.

- Greater Transparency: Clear documentation requirements prevent fraudulent or inflated debt claims.

- Stronger Legal Recourse: Victims of harassment can now seek justice through fines, lawsuits, or regulatory complaints.

- Peace of Mind: Knowing their rights are legally protected allows consumers to address debts without fear of intimidation.

For individuals struggling with debt, this ruling provides a sense of security and empowers them to engage with collectors on fairer terms.

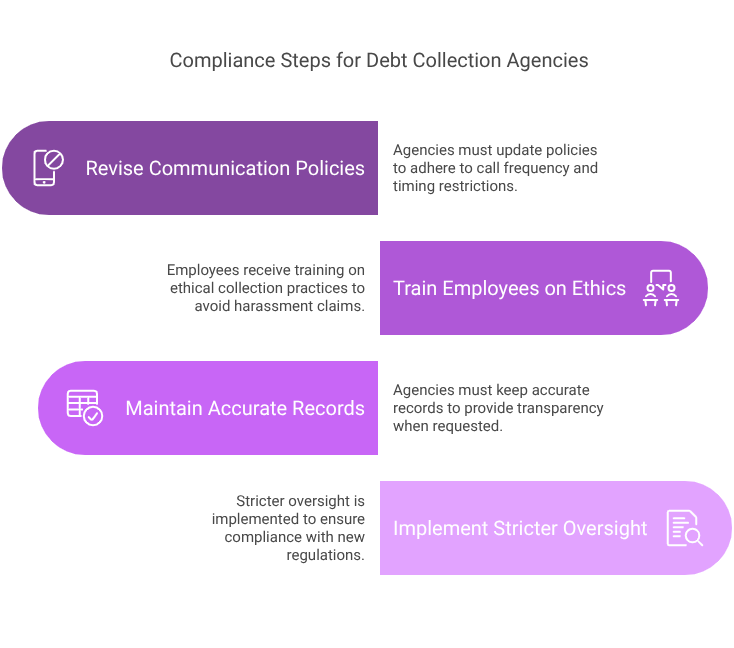

Implications for Debt Collection Agencies

While the ruling prioritizes consumer protection, it also sets new expectations for debt collection agencies. To remain compliant, agencies must:

- Revise their communication policies to adhere to call frequency and timing restrictions.

- Train employees on ethical collection practices to avoid harassment claims.

- Maintain accurate records to provide full transparency when requested.

- Implement stricter oversight to ensure compliance with the new regulations.

Agencies that adapt to these changes can build better relationships with consumers, reducing hostility and improving recovery rates through ethical means.

The Role of Financial Institutions and Creditors

Banks, credit card companies, and other creditors also bear responsibility under the new ruling. They must:

- Partner only with reputable collection agencies that follow legal guidelines.

- Offer flexible repayment options before escalating to collections.

- Ensure that debts sold to third-party collectors are accurate and verifiable.

By taking a proactive approach, creditors can minimize legal risks and maintain positive customer relationships.

Broader Impact on Consumer Financial Well-being

Beyond immediate legal protections, this ruling promotes long-term financial stability for consumers by:

- Encouraging responsible debt resolution rather than fear-driven payments.

- Reducing stress and mental health strain caused by harassment.

- Increasing trust in financial systems through fairer collection practices.

Additionally, consumers may feel more confident seeking financial counseling, debt consolidation, or other assistance without the fear of aggressive collectors.

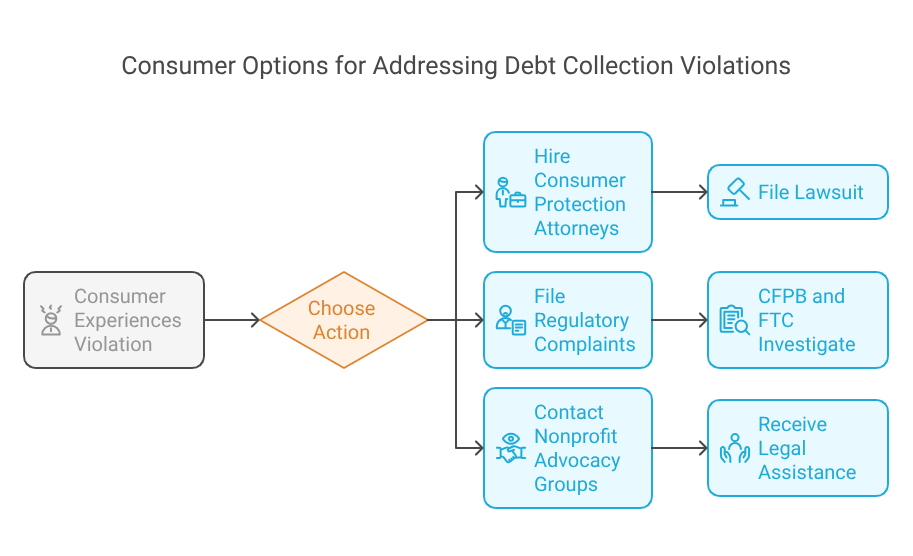

Legal Support for Consumers

Consumers who experience violations of the new protections have several options:

- Consumer Protection Attorneys: Specialized lawyers can help victims file lawsuits against abusive agencies.

- Regulatory Complaints: Agencies like the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) investigate and penalize unlawful debt collection.

- Nonprofit Advocacy Groups: Organizations such as the National Consumer Law Centre (NCLC) offer free or low-cost legal assistance.

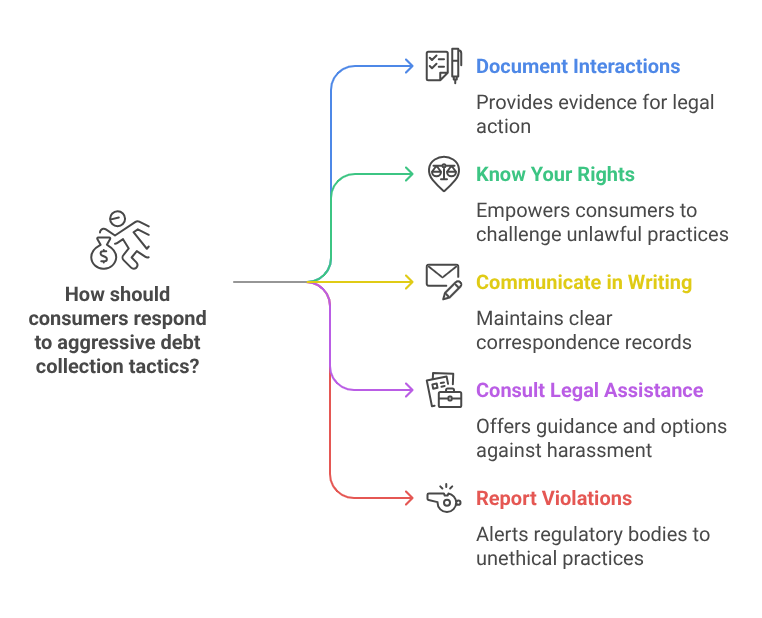

Steps for Consumers to Take if Harassed by Debt Collectors

Consumers facing aggressive debt collection tactics can take several proactive steps to defend their rights:

- Document All Interactions: Keeping detailed records of phone calls, emails, and written correspondence with debt collectors can provide crucial evidence if legal action becomes necessary.

- Know Your Rights: Understanding the new regulations empowers consumers to confidently challenge unlawful practices. The Consumer Financial Protection Bureau (CFPB) offers educational resources and support for individuals seeking guidance.

- Communicate in Writing: Requesting written communication from debt collectors can help consumers maintain a clear record of all correspondence and minimize the risk of verbal harassment.

- Consult Legal Assistance: If harassment continues, seeking legal counsel can ensure consumers understand their options and pursue appropriate action against unethical debt collectors.

- Report Violations: Consumers can file complaints with regulatory bodies such as the CFPB or the Federal Trade Commission (FTC) if they believe a debt collector is violating the new regulations.

Conclusion

The Supreme Court’s ruling represents a transformative shift in debt collection practices, prioritizing consumer rights over aggressive recovery tactics. By enforcing stricter communication rules, enhancing transparency, and increasing penalties for harassment, the decision empowers individuals to address debts without fear of abuse.

For debt collection agencies and creditors, this ruling serves as a call to adopt ethical practices that align with legal standards. For consumers, it offers long-overdue protections that promote financial dignity and security.

As these changes take effect, the financial industry must embrace a more respectful and transparent approach to debt recovery—one that balances the needs of creditors with the rights of consumers. Through continued advocacy and enforcement, this ruling can pave the way for a fairer and more just financial system.