Credit Card Delinquencies Rising in North America

Credit card delinquencies in North America have surged to their highest levels since the 2008 financial crisis, raising alarms among economists, banks, and consumer rights groups. As households grapple with rising living costs, higher interest rates, and stagnant wages, financial advisors are warning that the region may be entering a dangerous cycle of household debt instability.

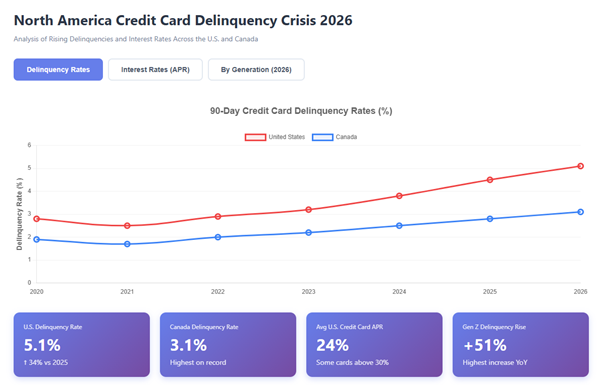

According to new 2026 data released by major credit bureaus, serious credit card delinquencies—payments overdue by 90 days or more—have risen by over 34% year-on-year. This sharp increase is being seen across the United States and Canada, affecting both middle-income and low-income households.

Rising Costs and Rate Hikes Push Consumers Past Their Limits

Economists say the spike in delinquencies is largely fuelled by the prolonged high-interest-rate environment. After several rate hikes throughout 2024 and 2025 aimed at cooling inflation, many consumers now find themselves trapped in expensive revolving debt.

In the U.S., the average credit card APR has crossed 24%, with some retail cards climbing above 30%. Canadian consumers are also experiencing record-high borrowing costs, with typical credit card rates now sitting around 21%.

At the same time, inflation—although lower than pandemic highs—continues to pressure household budgets. Essentials such as groceries, rent, and fuel remain elevated relative to pre-2020 levels.

Financial advisors say this combination has created a dangerous equation: consumers are spending more on necessities while accumulating debt at higher interest rates, forcing many into missed payments for the first time in years.

More Households Turning to Credit for Basic Needs

Historically, credit card usage spikes around the holiday season or during major spending cycles. But 2026 data show an alarming trend: consistent month-over-month growth in credit card balances, even during traditionally slower spending periods.

Analysts say this suggests that consumers are using credit cards not for discretionary purchases, but to cover:

- Groceries

- Utilities

- Rent gaps

- Medical expenses

- Emergency car repairs

A leading North American financial insights firm reported that nearly one in four households now uses credit cards to cover at least one essential living cost each month.

This shift marks a significant behavioural change in the region’s consumer economy—and a warning sign of deeper financial strain.

Young Adults and Lower-Income Families Hit Hardest

While delinquencies are rising across all age groups, the steepest increases are among Millennials and Gen Z. Many young adults entered the workforce during inflation-heavy years and never built substantial emergency savings. As a result, they are more likely to rely on credit cards to fill budget gaps.

Additionally:

- Gen Z saw a 51% rise in 90-day delinquencies in the past year.

- Low-income households are now experiencing two times the delinquency rate of middle-income households.

Financial advisors warn that this widening gap could create a long-term financial divide, especially as credit score drops limit future borrowing ability.

A Perfect Storm for Banks and Lenders

The jump in late payments has not gone unnoticed by lenders. Several major North American banks have increased their loan-loss reserves—the funds set aside to cover expected defaults. In recent earnings reports, banks mentioned that credit card portfolios show “early signs of stress” and that further deterioration may be expected throughout 2026.

Some lenders are also tightening approval criteria for new credit accounts, making it harder for consumers to refinance debt or access balance-transfer promotions that were once routine tools to manage rising balances.

This shift could deepen the consumer debt crisis by limiting options for borrowers seeking relief.

Financial Advisors Warn: “The Crisis Is Preventable, But Action Must Be Immediate”

Financial advisors across the region are urging households to take immediate steps to avoid falling deeper into delinquency. While each situation differs, experts highlight several key strategies that can provide immediate relief and long-term protection.

1. Prioritize Minimum Payments to Protect Your Credit Score

Missing even one payment can drop a credit score by 80–120 points. Advisors say households should make minimum payments their top priority—even if it means cutting other non-essential expenses temporarily.

2. Contact Lenders Early

Banks are more open than consumers think to offering:

- Temporary interest reductions

- Short-term hardship arrangements

- Payment deferrals

- Structured payment plans

But these options are most effective when consumers act before accounts fall 60–90 days behind.

3. Avoid Taking on New High-Interest Debt

Taking new loans or additional credit cards to “solve” existing debt only worsens the problem. Advisors emphasize focusing on repayment and budgeting instead of expansion of credit lines.

4. Consider a Credit Counselor

Non-profit credit counseling agencies across the U.S. and Canada offer Debt Management Plans (DMPs) that reduce interest rates and combine multiple payments into one. These programs have seen increased demand in 2025–2026.

5. Build an Emergency Buffer, Even If Small

Advisors note that even $300–$500 reserved for emergencies can drastically reduce reliance on credit for unexpected expenses.

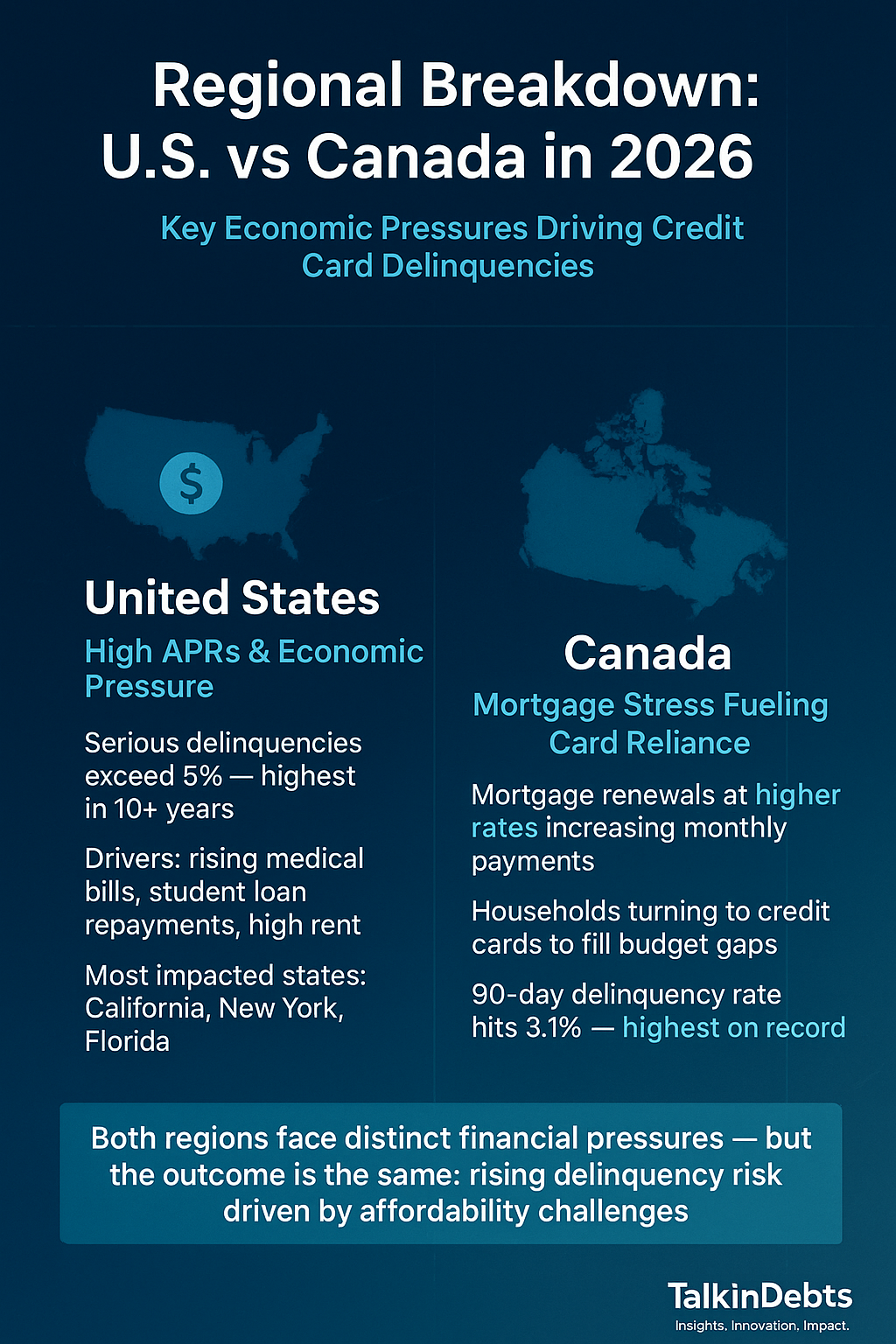

Regional Breakdown: U.S. vs Canada in 2026

United States: High APRs and Economic Pressure

The U.S. remains the epicenter of the delinquency spike, with serious delinquencies climbing to over 5% of total credit card balances—the highest in more than a decade. Rising medical debt, high student loan payments, and soaring rent prices are major contributors.

Certain states with higher living costs—such as California, New York, and Florida—are reporting the largest increases in late payments.

Canada: Mortgage Stress Driving Credit Card Reliance

Canadian households face a different but equally severe problem: mortgage renewals at significantly higher interest rates. Many Canadians renewing mortgages in 2025–2026 are seeing monthly payments rise by hundreds of dollars, leaving little room in their budgets for credit card bills.

As a result, Canada’s 90-day credit card delinquency rate has climbed to 3.1%, its highest point since records began.

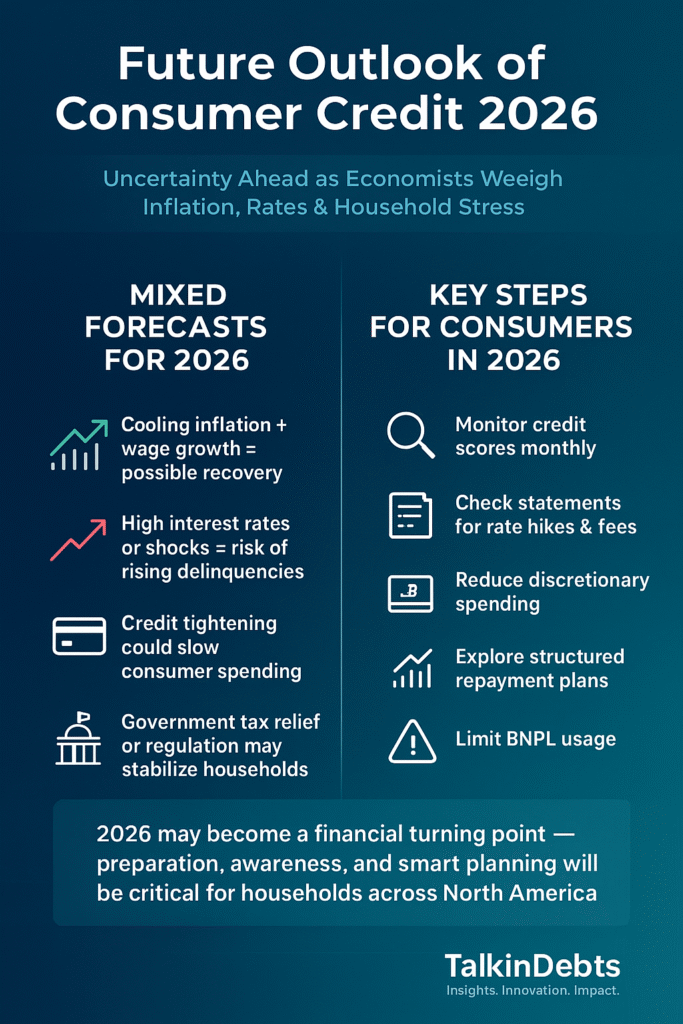

Experts Say 2026 Could Be a Turning Point

Economists are divided on what comes next.

If wage growth improves and inflation continues to cool, households may regain control. But if interest rates remain elevated or another economic shock hits, delinquencies could rise even further—potentially triggering a broader consumer credit downturn.

Some analysts warn that continued increases in delinquencies may push lenders to sharply restrict credit availability, which could slow consumer spending and impact overall economic growth.

In contrast, optimists believe government policies—such as tax relief programs or targeted credit regulations—could stabilize households before delinquencies escalate into a full-blown financial crisis.

What Consumers Should Expect Going Forward

For consumers in North America, the road ahead in 2026 will require careful financial planning. Experts recommend:

- Monitoring credit scores monthly

- Reviewing statements for hidden fees or rate increases

- Reducing discretionary spending

- Exploring structured repayment options

- Avoiding reliance on buy-now-pay-later (BNPL) services, which often hide high penalties

Banks, meanwhile, are expected to launch new digital tools, financial literacy programs, and early-warning systems to help customers stay on track before falling behind.

A Warning—and an Opportunity

Although the rise in delinquencies is alarming, experts say it also presents an opportunity for households to reset financial habits. With proper budgeting, timely action, and awareness of available support programs, many consumers can avoid long-term damage to their financial health.

But inaction could be costly—in lost credit opportunities, higher future interest rates, and spiraling debt.

For now, one thing is clear: credit card delinquencies are not just a banking problem—they are a household crisis, and North America must address them before they grow into something far more destructive.