Why Am I Getting Debt Calls for Someone Else? – Misidentification, Wrong Numbers, and What to Do

It’s a stressful feeling — your phone rings, you answer, and a debt collector immediately starts asking for someone you’ve never even heard of. The name is unfamiliar, the account details mean nothing to you, and yet, the calls keep coming.

You’re not alone. Every year, thousands of people face wrong-number debt collection calls. It’s frustrating, time-consuming, and sometimes even intimidating — especially when calls turn persistent or aggressive.

The good news? There are clear reasons this happens and proven steps you can take to make it stop. This detailed guide explains why you might be getting debt calls for someone else, how to protect yourself, and what to say to debt collectors so you can resolve the situation quickly.

Why Debt Collectors Might Be Calling You About Someone Else’s Debt

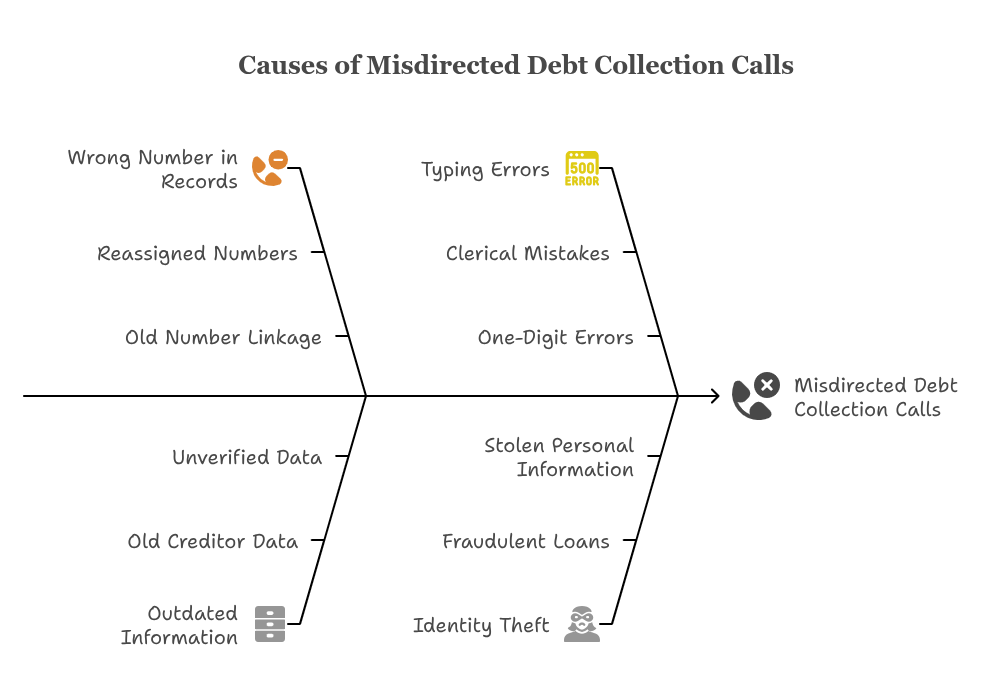

Debt collection agencies rely heavily on contact data provided by creditors, credit bureaus, skip tracing tools, and public databases. But this information is not always accurate — and when it’s wrong, innocent people can end up in the crossfire.

Here are the most common reasons:

1. Wrong Number in the Records

Mobile and landline numbers get reassigned regularly. If your phone number once belonged to someone with unpaid debts, that number might still be linked to their accounts in a creditor’s database. Debt collectors simply call the number they have — unaware that it now belongs to you.

Example:

You just activated a new mobile number. Six weeks later, you start getting calls for “Michael R.” You’ve never met Michael, but his unpaid credit card bill is still linked to your number.

2. Outdated or Inaccurate Information

Debts often get sold to third-party collectors. The older the debt, the more likely the contact information is outdated. Some agencies work off data that hasn’t been verified in years.

Example:

The original creditor had the debtor’s old work phone number. When the account was sold, the number was still listed — and now that number belongs to you.

3. Typing Errors in Databases

One wrong digit in a phone number can send calls to the wrong person. In large databases, a simple clerical mistake can cause repeated misdirected calls.

Example:

The actual debtor’s number is 555-123-4567. The collector’s file shows 555-123-4568 — your number.

4. Similar Names or Mixed-Up Files

If you share a similar name with the debtor, especially a common one, your records might accidentally get merged.

Example:

You’re John A. Smith in Chicago. The actual debtor is John B. Smith in Boston. If identifiers like Social Security numbers are missing, databases can confuse you for the other person.

5. Identity Theft

Sometimes the debt really is in your name — but it’s not yours. If someone has stolen your personal information and taken out loans, you could be contacted for repayment.

Example:

A fraudster opens a credit card using your name and old address. You never see the bills, but eventually, collectors track down your phone number.

Why You Shouldn’t Ignore These Calls

Even if the debt isn’t yours, wrong-number calls can still cause real problems:

- Stress and harassment: Frequent calls disrupt your day and cause anxiety.

- Risk to your credit score: If your personal details get linked to the debt, it could appear on your credit report.

- Potential scams: Some fake debt collectors use wrong-number calls to trick people into giving personal information.

- Loss of productivity: Dealing with repeated calls wastes time and energy.

The sooner you act, the better your chances of stopping the calls for good.

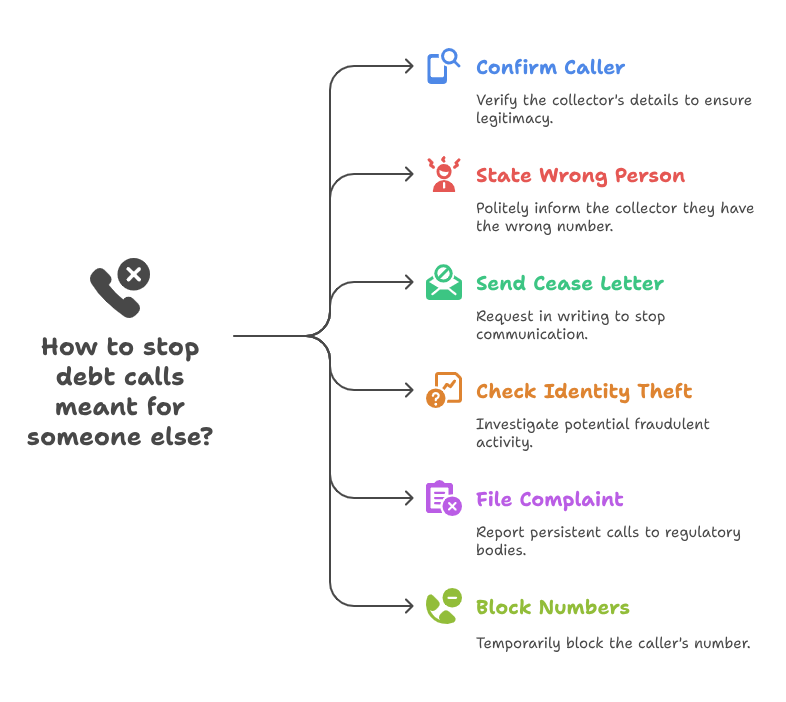

How to Stop Debt Calls Meant for Someone Else

When the phone rings and it’s a debt collector asking for a stranger, you have options. Here’s what to do step by step.

Step 1: Confirm Who’s Calling

Before saying anything, verify:

- The collector’s company name

- Their contact number

- The name of the person they’re trying to reach

- The original creditor and account reference

Write everything down. You’ll need it for future correspondence.

Step 2: Politely State They Have the Wrong Person

Calmly tell them:

“I am not the person you’re looking for. I do not owe this debt. Please update your records and remove my number.”

Avoid confirming personal information (address, date of birth, Social Security number) unless you’ve verified the caller is legitimate.

Step 3: Send a Written “Cease Communication” Letter

In many countries — including under the U.S. Fair Debt Collection Practices Act (FDCPA) — you have the right to request in writing that the collector stop contacting you.

Your letter should:

- State clearly that you are not the debtor.

- Request the removal of your number from their records.

- Ask for written confirmation.

Tip: Send the letter via certified mail and keep a copy.

Step 4: Check for Identity Theft

If you suspect the debt might be falsely linked to you:

- Get a free copy of your credit report from all major bureaus.

- Look for unfamiliar accounts or inquiries.

- If you find fraudulent activity, file an identity theft report and contact the creditors immediately.

Step 5: File a Complaint

If the calls continue despite your requests:

- In the U.S., file a complaint with the Consumer Financial Protection Bureau (CFPB) or Federal Trade Commission (FTC).

- In the UK, contact the Financial Ombudsman Service.

- In Australia, report to the Australian Financial Complaints Authority (AFCA).

Step 6: Block Numbers (Temporary Fix)

You can block the caller’s number, but collectors often use multiple numbers. While it’s not a long-term solution, it can give you short-term relief.

Your Rights When Dealing with Debt Collection Calls

Debt collection laws protect you — even if the debt isn’t yours. Under the FDCPA and similar laws worldwide, collectors cannot:

- Call before 8 a.m. or after 9 p.m. (unless you agree)

- Use threats, profanity, or harassment

- Misrepresent the debt

- Continue calling after receiving a cease communication request

- Contact you at work if you’ve asked them not to

Knowing your rights gives you confidence to handle the situation firmly.

Red Flags the Call Might Be a Scam

Not all debt calls are genuine. Some are scams designed to pressure you into paying money you don’t owe.

Watch for:

- Refusal to provide company details

- Requests for payment via gift cards, wire transfers, or cryptocurrency

- Threats of arrest, jail time, or immigration action

- Urgent demands to pay without providing written proof

If you suspect a scam, hang up and report it.

Sample Script to Tell a Collector They Have the Wrong Person

If you find it hard to know what to say, here’s a word-for-word example:

“My name is [Your Name]. You have contacted me regarding [Debtor’s Name]. I do not know this person, and I am not responsible for this debt. Please remove my phone number from your records immediately and confirm in writing that you have done so.”

Preventing Wrong-Number Debt Calls in the Future

You can’t always prevent debt collectors from getting your number, but you can reduce the chances:

- Keep your contact details updated with banks and service providers.

- Check your credit report annually for errors.

- Limit how often you post your phone number online.

- If you get a new number, ask your provider if it was recently reassigned.

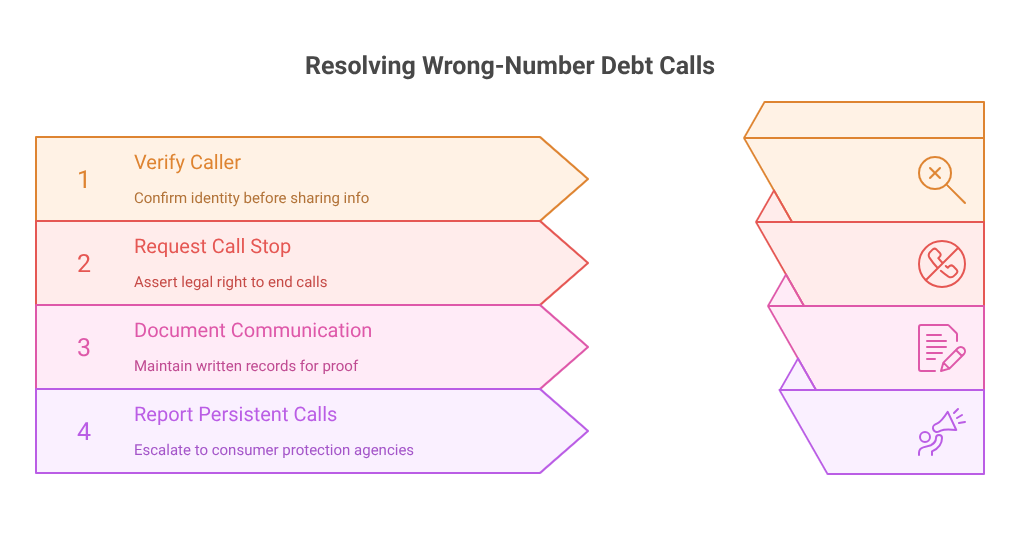

Key Takeaways

- Wrong-number debt calls happen due to recycled numbers, outdated data, typos, similar names, or identity theft.

- Always verify the caller before sharing information.

- You have the legal right to request that calls stop.

- Written communication is key to proving your case.

- Persistent unwanted calls can be reported to consumer protection agencies.

Getting debt collection calls for someone else is not just an inconvenience — it can be stressful and disruptive. By understanding why it happens, asserting your rights, and taking decisive action, you can stop the calls and protect yourself from credit or identity issues. Remember, you do not have to pay for a debt that isn’t yours.