Debt Management Apps: Are They Worth the Hype?

Managing debt has always been a challenge for individuals and families alike. With rising living costs, unexpected expenses, and the complexities of juggling multiple loans, it’s no surprise that many people struggle to keep their financial obligations under control. Fortunately, technology is transforming debt management with the introduction of specialized apps designed to help users track, manage, and ultimately reduce their debt burden. But how effective are these apps? Are they worth the investment of your time and effort? Let’s delve deeper into the world of debt management apps and assess their true value.

Understanding Debt Management Apps

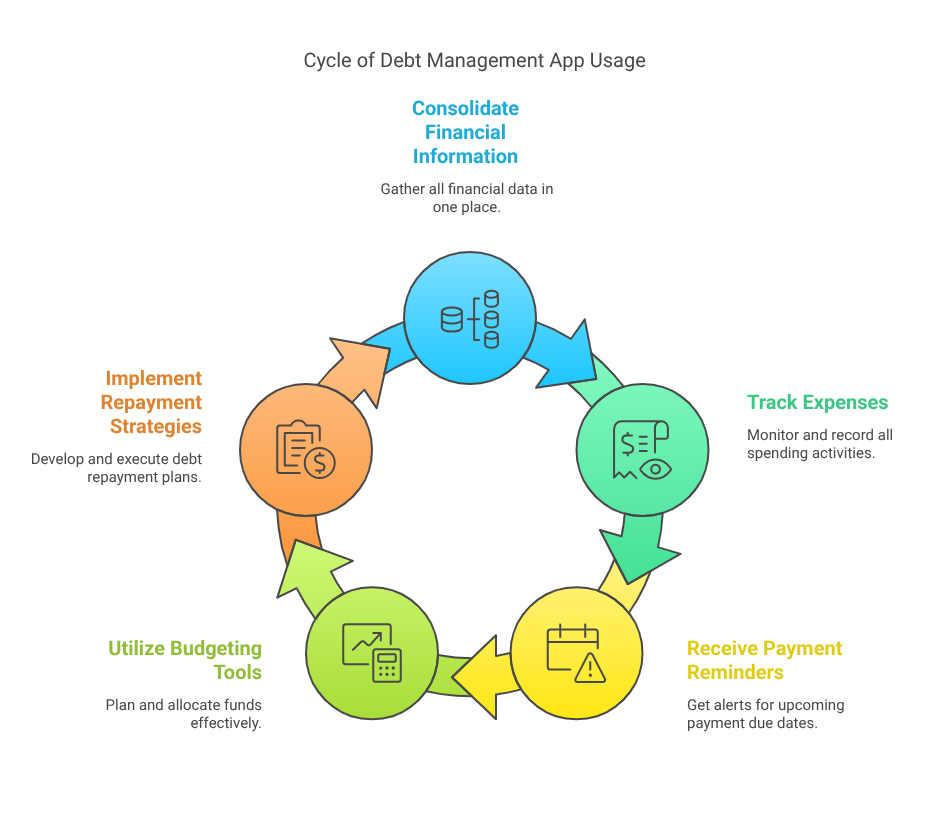

Debt management apps are software tools designed to simplify financial management. They offer various features such as payment reminders, budgeting tools, expense tracking, and even debt repayment strategies. By consolidating your financial information in one platform, these apps can provide a clear picture of your financial health and suggest actionable steps to improve it.

Benefits of Using Debt Management Apps

Debt management apps provide several advantages that make them valuable tools for improving financial stability. These include:

- Automation and Convenience: Managing multiple debts manually can be overwhelming. Debt management apps automate calculations, reminders, and tracking to simplify the process.

- Improved Financial Awareness: These apps provide a clear picture of your finances, highlighting areas where you can cut costs and optimize spending.

- Goal-Oriented Planning: Most apps allow you to set debt-free goals and create step-by-step strategies to achieve them.

- Time Savings: Automated payment reminders and budgeting tools reduce the time spent manually tracking expenses and debts.

- Motivation and Accountability: Seeing your progress through visual reports can motivate you to stay on track.

Potential Drawbacks of Debt Management Apps

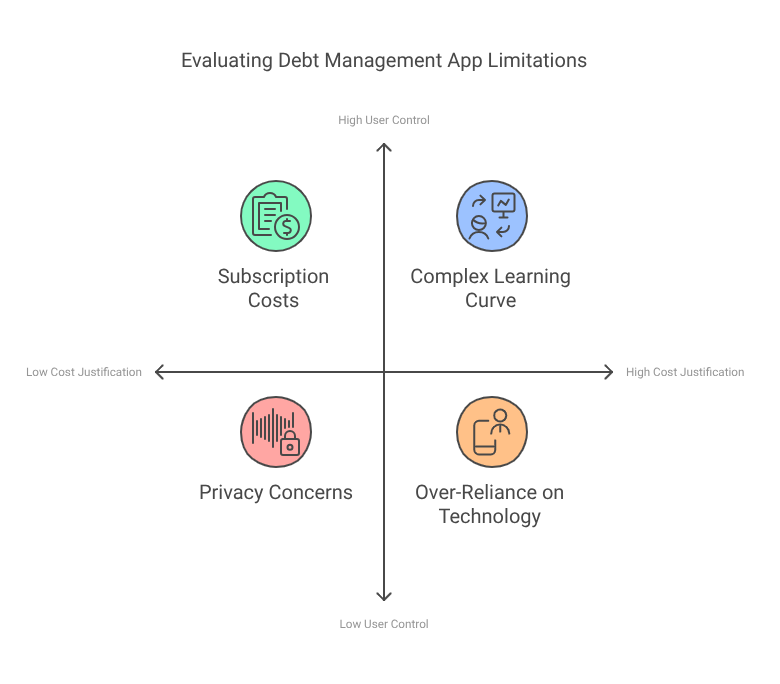

Despite their benefits, debt management apps have some limitations:

- Subscription Costs: While some apps are free, others require monthly or annual subscriptions. The cost may not always justify the benefits, especially for those with minimal debt.

- Privacy Concerns: Debt management apps often require access to your financial accounts, raising concerns about data security and privacy.

- Learning Curve: Some apps can be complex, requiring time to understand and utilize their full potential.

- Over-Reliance on Technology: Relying solely on an app may prevent users from developing essential financial discipline and habits.

Are Debt Management Apps Right for You?

Determining whether a debt management app is worth it depends on your financial goals, tech-savviness, and the complexity of your debt situation. These apps are especially helpful for individuals who:

- Struggle to keep track of multiple debts and deadlines.

- Prefer visual aids and automated reminders to stay organized.

- Need help developing a structured repayment plan.

- Want to build better budgeting habits.

Conversely, if you have minimal debt or prefer manual tracking methods, a debt management app may not provide significant value.

Tips for Choosing the Right Debt Management App

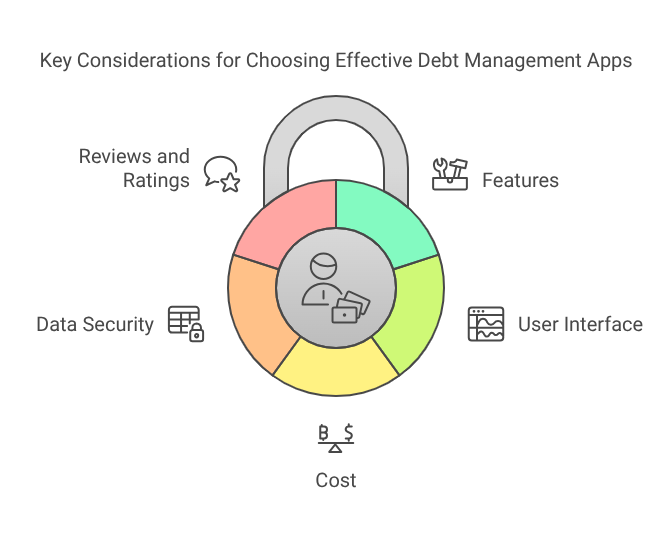

To maximize the benefits of a debt management app, consider these factors:

- Features: Choose an app that aligns with your debt situation. If credit score improvement is your priority, look for an app that offers credit monitoring. For budgeting assistance, prioritize apps with robust budget creation tools.

- User Interface: Select an app that is easy to navigate and offers a clear layout of your financial data.

- Cost: Determine whether the app’s features justify its subscription fee.

- Data Security: Ensure the app uses encryption and other security measures to protect your financial information.

- Reviews and Ratings: Check user feedback to understand the app’s reliability, performance, and customer support.

Additional Debt Management Strategies

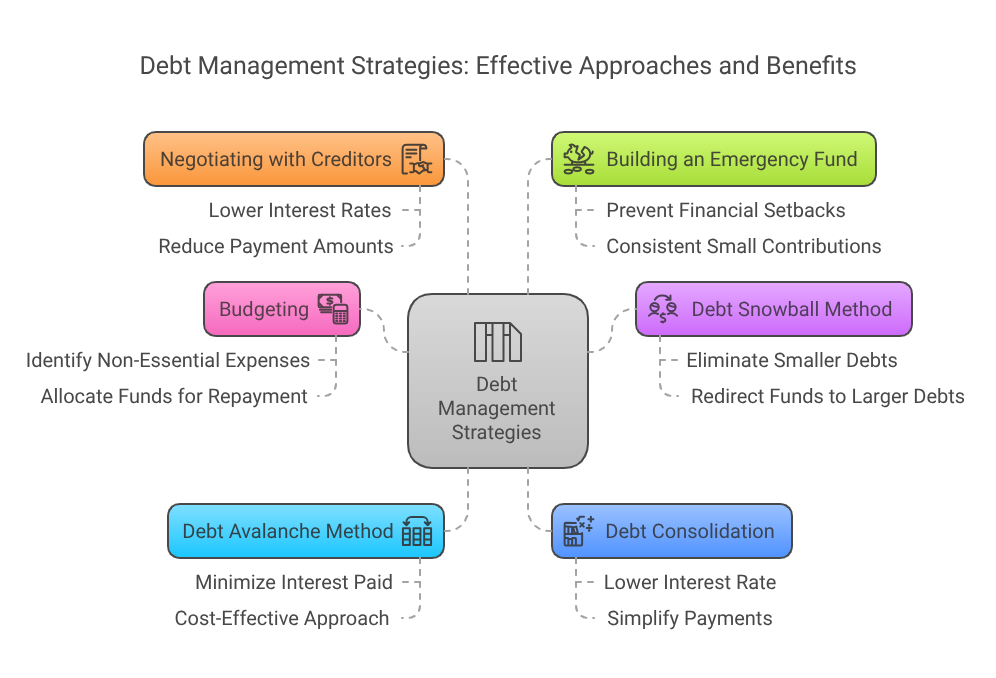

While debt management apps can be effective tools, combining them with practical financial strategies can enhance your results.

Consider the following steps to improve your debt management efforts:

- Budgeting: Establishing a clear monthly budget can provide better visibility into your income, expenses, and savings goals. Identify non-essential expenses and allocate those funds toward debt repayment.

- Debt Snowball Method: This method involves paying off smaller debts first while continuing minimum payments on larger debts. As smaller debts are eliminated, the money is redirected toward larger obligations.

- Debt Avalanche Method: This strategy prioritizes debts with the highest interest rates first. While it requires patience, it minimizes the total interest paid over time, making it a cost-effective approach.

- Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate can simplify payments and reduce financial stress. This strategy is especially useful for individuals managing credit card debt.

- Negotiating with Creditors: Contacting lenders to negotiate lower interest rates, reduced payment amounts, or extended deadlines can improve your financial situation without taking on additional loans.

- Building an Emergency Fund: Establishing an emergency fund can prevent unexpected expenses from derailing your debt repayment progress. Setting aside even small amounts consistently can provide significant financial stability.

Establishing Strong Financial Habits

In addition to using debt management apps and proven strategies, adopting disciplined financial habits is crucial for long-term success.

Consider these practices to improve your financial well-being:

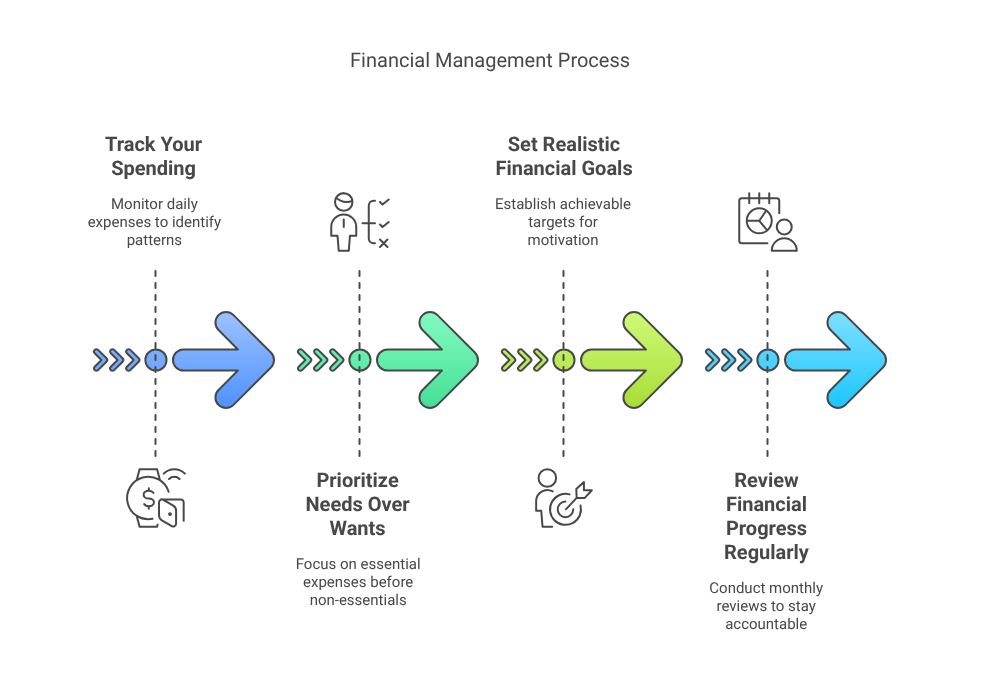

- Track Your Spending: Monitor your daily expenses to identify spending patterns. Understanding where your money goes can help you make informed decisions and cut unnecessary costs.

- Prioritize Needs Over Wants: Focus on essential expenses like rent, utilities, and groceries before spending on non-essentials.

- Set Realistic Financial Goals: Establish achievable targets for debt repayment, savings, and future expenses to stay motivated.

- Review Financial Progress Regularly: Conduct monthly reviews of your budget and progress toward financial goals. This practice helps you stay accountable and make adjustments when needed.

Professional Support for Debt Management

If your debt situation feels overwhelming or complex, seeking professional guidance may be beneficial. Financial advisors, credit counselors, and debt relief agencies can offer tailored solutions to help you regain control of your finances. These professionals can assess your debt situation, recommend repayment strategies, and provide support throughout the process.

When choosing professional support, ensure the service provider is reputable and transparent. Avoid companies that demand upfront fees or guarantee immediate debt elimination, as these are often warning signs of scams.

Key Takeaways

Debt management apps can be powerful tools for streamlining debt repayment and improving financial stability. While they offer valuable features such as budgeting tools, payment reminders, and personalized repayment plans, their effectiveness ultimately depends on your commitment to following the strategies they provide. By choosing the right app for your needs and staying disciplined in your approach, you can take significant steps toward achieving a debt-free future.

Debt management strategies work best when combined with practical financial habits. Establishing a clear budget, reducing unnecessary expenses, and seeking guidance from financial experts can further improve your financial standing. Additionally, consider strategies such as debt consolidation or negotiating lower interest rates with creditors to accelerate your repayment process.

For those with more complex financial obligations, consulting a credit counselor may provide additional insights and support. These professionals can help you assess your debt situation, create tailored repayment strategies, and provide advice on building healthier financial habits.

Finally, while debt management apps are useful, remember that no technology can replace personal responsibility and smart financial decision-making. The key lies in understanding your financial goals, choosing the right tools to support those objectives, and maintaining a proactive approach toward debt reduction.