Debt Management vs. Debt Relief: Which One Do You Need?

Living with debt can feel like you’re trapped in a never-ending cycle of payments, interest, and stress. But there’s hope—and options. Two primary paths people explore are debt management and debt relief. Each offers a different route to regaining financial control, and the right choice depends on your financial situation, goals, and how much hardship you’re facing.

Debt Management: Taking Control Before Things Spiral

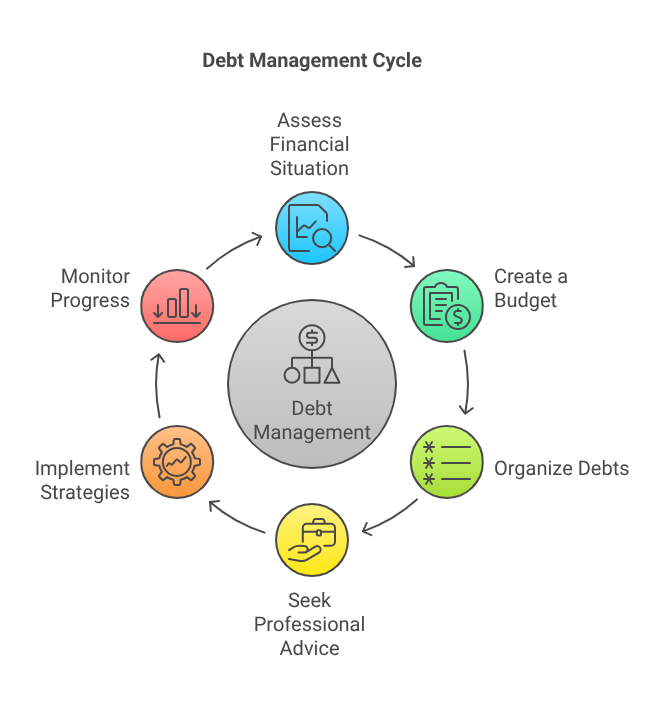

Debt management involves creating a structured plan to pay off your debt in full, often with the support of financial planning tools or professionals. It’s ideal for individuals who can still make payments but need better organization and strategies to do it more effectively.

Which Debt Payoff Strategy Works Best? Snowball vs. Avalanche

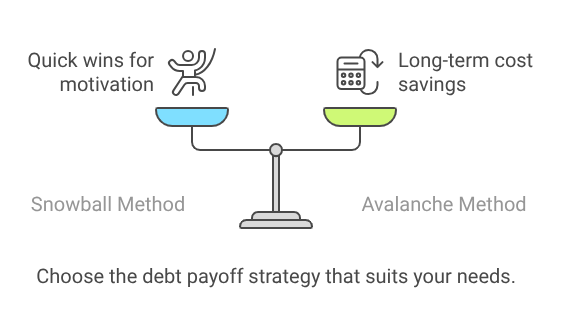

When it comes to managing debt, two popular strategies are often recommended: Snowball and Avalanche. Both have the same ultimate goal—getting you out of debt—but they take slightly different paths.

- The Snowball Method involves paying off your smallest debts first, regardless of interest rate. The idea is to build momentum and motivation with quick wins. Every time you clear a balance, you roll that payment amount into the next smallest debt.

- The Avalanche Method, on the other hand, targets debts with the highest interest rates first. This method saves you more money in the long run by reducing how much interest you pay, though the psychological satisfaction might come slower compared to Snowball.

Which one should you use? If you’re driven by motivation and like seeing progress quickly, the Snowball method might work best for you. But if your priority is saving the most money over time, the Avalanche method is your go-to. Both approaches can be effective—it comes down to what keeps you committed.

Top Budgeting Tools to Keep Your Debt Under Control

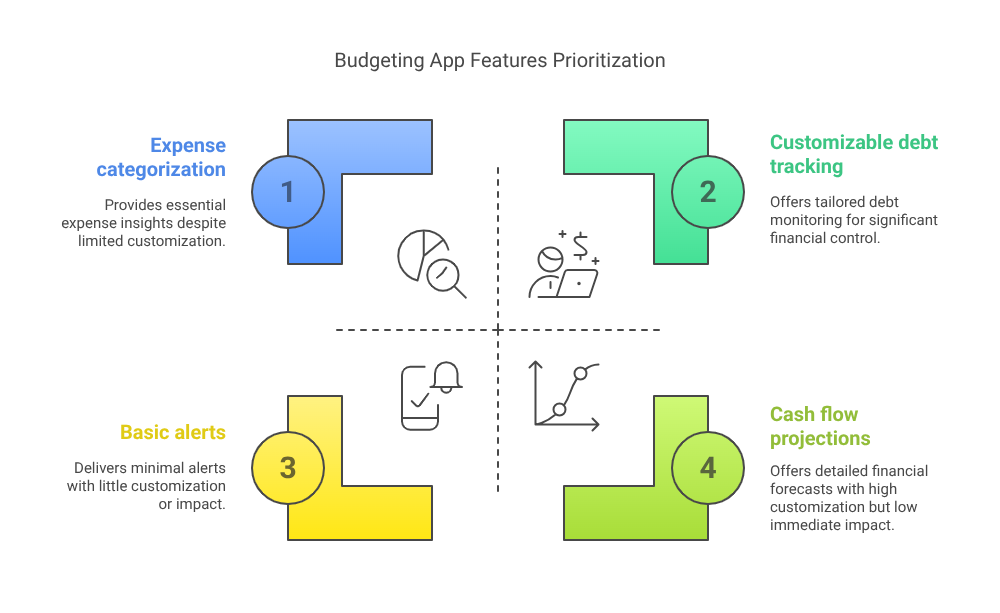

A well-organized budget is the backbone of any debt management strategy. Instead of winging it, use budgeting tools that let you track income, expenses, and debts in one place. The goal is to make conscious decisions about where your money goes.

Here’s what to look for in a budgeting app:

- Expense categorization so you know where your money is going

- Customizable debt tracking to monitor balances

- Alerts to keep you from overspending

- Cash flow projections that show how fast you can be debt-free

These tools help you stick to a repayment plan while avoiding new debt. Some offer integration with bank accounts and even provide tips to improve your spending habits. Whatever tool you choose, consistency is key.

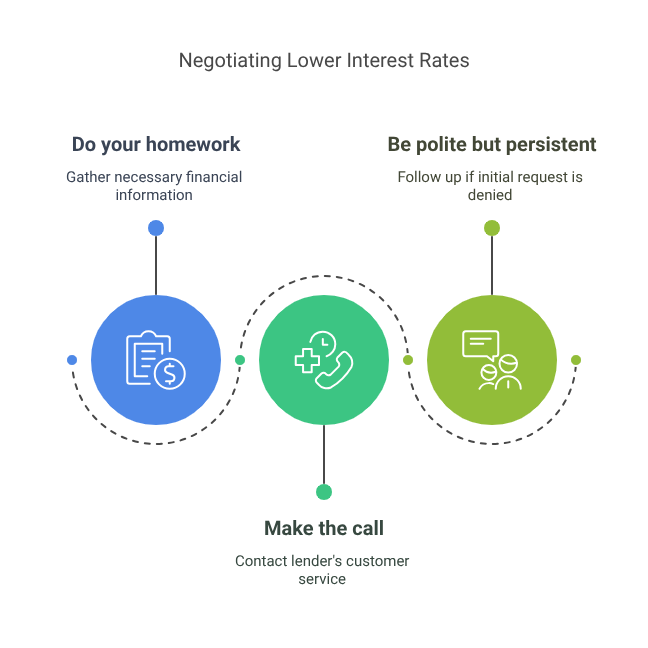

How to Negotiate Lower Interest Rates on Your Loans

Paying less interest makes a big difference in how quickly you can escape debt. One effective tactic is negotiating with your creditors. While it might feel intimidating, many lenders are open to working with customers who show good faith and financial responsibility.

Here’s how to approach the conversation:

- Do your homework: Know your current interest rate, how long you’ve had the account, and your recent payment history.

- Make the call: Contact your lender’s customer service and ask if they can lower your interest rate due to your positive payment history or hardship.

- Be polite but persistent: If the first representative says no, consider calling again or speaking with a supervisor.

You can also look into consolidating high-interest debts into a lower-rate option, but this falls more in line with debt relief tactics and must be approached with caution.

Debt Relief: When You Need a Lifeline

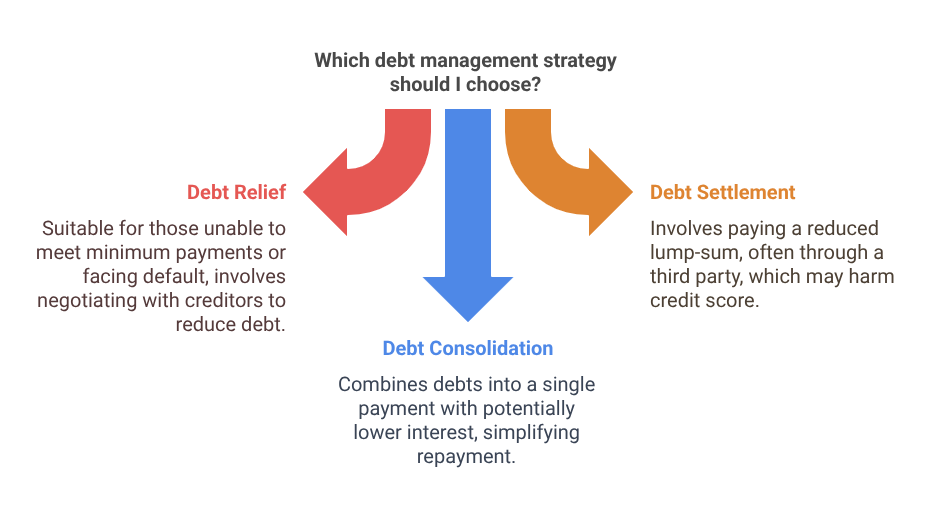

Debt relief is a more drastic solution and is typically used when you can’t keep up with minimum payments or face default. It may involve negotiating to reduce the total amount you owe or combining multiple debts into one new agreement with different terms.

Debt Settlement vs. Consolidation: Which One Is Right for You?

Debt Settlement and Debt Consolidation are often confused, but they serve different purposes.

- Debt Settlement involves negotiating with creditors to accept a reduced lump-sum payment as full repayment. This can significantly cut your total debt, but it often requires stopping payments for a period, which can hurt your credit score and lead to collection calls. It’s usually done through a third-party company that charges a fee.

- Debt Consolidation combines multiple debts into a single payment, ideally with a lower interest rate. This doesn’t reduce what you owe, but simplifies repayment and may lower your monthly burden. You can consolidate through a personal loan, a balance transfer, or a specialized program.

If you’re still earning a stable income but are overwhelmed by multiple payments, consolidation may be the safer option. However, if you’ve already fallen behind and can’t afford to pay your debts in full, settlement might be a last choice.

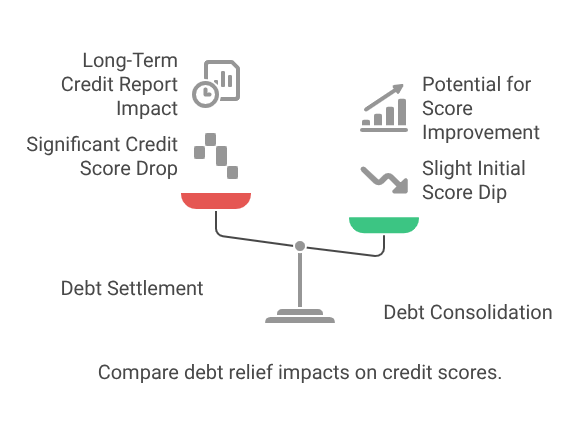

How Debt Relief Affects Your Credit Score & How to Recover

Any form of debt relief can have a negative short-term impact on your credit score, especially debt settlement. When you miss payments, settle for less than what you owe, or close old credit accounts, your creditworthiness takes a hit.

Here’s what you can expect:

- Debt Settlement: Can lower your score by 100 points or more. It also stays on your credit report for up to 7 years.

- Debt Consolidation: Can slightly lower your score at first due to new credit inquiries, but it may improve your score over time if you make timely payments.

The good news? Credit recovery is possible. Here’s how:

- Make all future payments on time

- Keep balances low on revolving credit

- Avoid applying for new credit unnecessarily

- Monitor your credit report for accuracy and dispute errors

By sticking to these habits, your score can begin to rebound within 6–12 months and significantly improve within a couple of years.

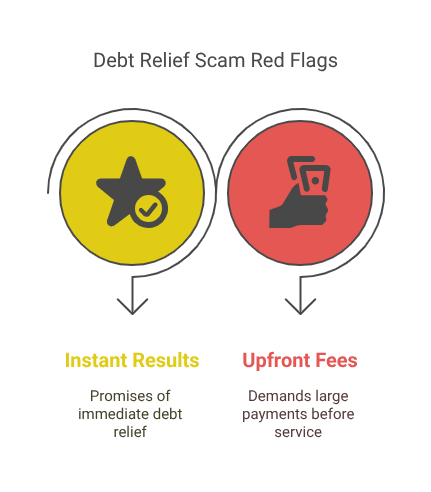

Common Debt Relief Scams and How to Avoid Them

Unfortunately, the debt relief industry has its share of scams targeting vulnerable individuals. Be cautious of companies that promise instant results or ask for large upfront fees.

Here are red flags to watch out for:

- “Guaranteed” debt elimination claims

- Pressure to pay upfront before any service is rendered

- Lack of clear documentation or avoidance of written agreements

- Telling you to stop communicating with your creditors

To protect yourself:

- Research the company’s reputation

- Check with your local consumer protection agency

- Verify accreditation from financial industry organizations

Remember, a legitimate provider will be transparent about the process, fees, and possible outcomes. If it sounds too good to be true, it probably is.

So, Which One Do You Need?

Choosing between debt management and debt relief comes down to your current financial position and your long-term goals.

Debt Management May Be Right If:

- You can make at least the minimum payments on your debts

- You want to repay the full amount owed and avoid harming your credit

- You need better budgeting and planning tools to stay on track

- You prefer a disciplined approach with long-term benefits

Debt Relief May Be Right If:

- You’ve fallen behind on multiple payments

- You’re at risk of default or already facing collection efforts

- You need to reduce the total amount you owe

- You’re willing to accept a hit on your credit for a chance at faster relief

There’s no one-size-fits-all solution, and sometimes a combination of approaches works best. You might start with debt management and transition to relief if your circumstances change. The key is to take action sooner rather than later.

Final Thoughts: The First Step Matters Most

Whether you lean toward debt management or debt relief, the most important step is to take action. Avoiding the problem only leads to more stress, deeper financial trouble, and fewer options down the road.

Start by assessing your situation:

- How much debt do you owe?

- What is your income and monthly budget?

- Are you able to meet the minimum payments?

Then, map out a plan—on your own or with the help of a certified credit counsellor. Just remember that neither path works overnight. Both require commitment, planning, and often, a change in money habits.

In both cases, your financial health starts with awareness and a solid plan. The sooner you take that first step, the sooner you’ll move toward peace of mind and a debt-free future. Financial freedom isn’t just a dream—it’s a choice you can begin working toward today.