Debt Settlement and Your Credit Score: What You Need to Know?

Overview of How Debt Settlement Affects Credit Scores

Debt settlement can be a viable option for individuals struggling with overwhelming debt. However, many people worry about how it will impact their credit score. Settling debt means paying less than what you owe, which can significantly lower your credit score and leave a lasting mark on your credit report. This negative impact can make it more difficult to obtain loans, credit cards, or favorable interest rates in the future.

When you settle a debt, creditors report it to credit bureaus as “settled” rather than “paid in full.” This distinction signals to future lenders that you did not fully meet your original repayment obligations, potentially making them hesitant to extend credit. Additionally, the process of debt settlement often involves ceasing payments for months, further damaging your credit score before a settlement is even reached.

Despite these consequences, debt settlement may be a preferable alternative to bankruptcy, which can have even more severe and long-lasting effects on your financial standing. Understanding the potential credit score implications before proceeding with debt settlement is crucial to making an informed decision.

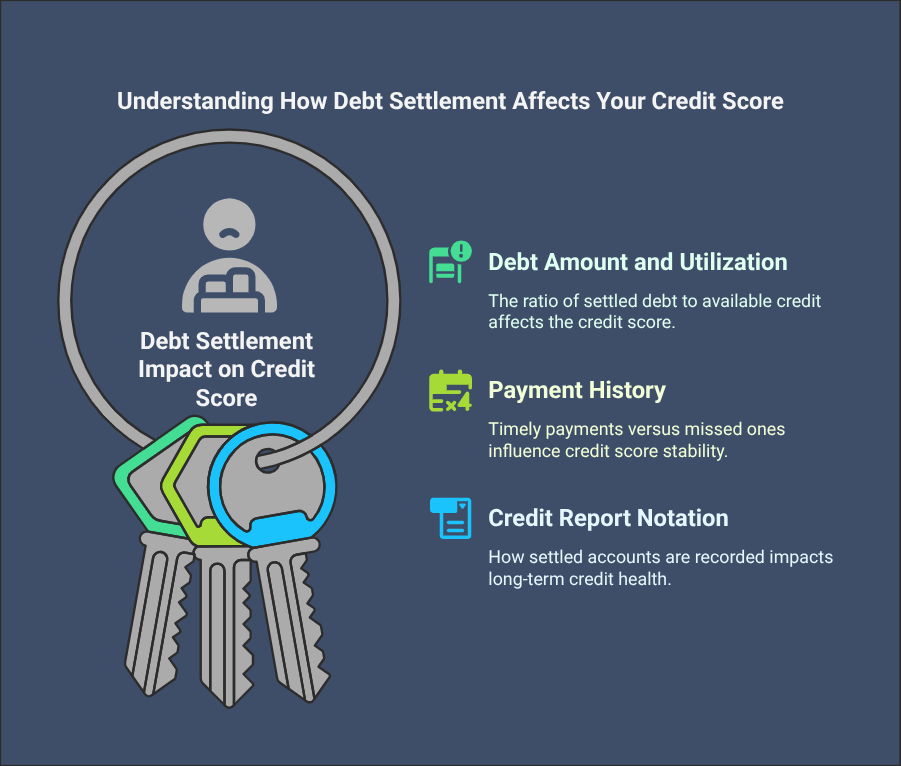

Top 3 Factors That Influence Credit Scores During Debt Settlement

- Amount of Debt Settled and Credit Utilization Ratio: Larger settlements and high remaining debt relative to available credit can significantly lower your credit score.

- Payment History and Debt Collection Involvement: Missed payments and accounts sent to collections before settlement can severely impact your credit.

- Credit Report Notation and Length of Credit History: Accounts marked as “settled” and the closure of long-standing accounts can negatively affect your creditworthiness and shorten your credit history.

Understanding these factors can help you mitigate some of the negative effects by taking strategic steps before and after settling your debts.

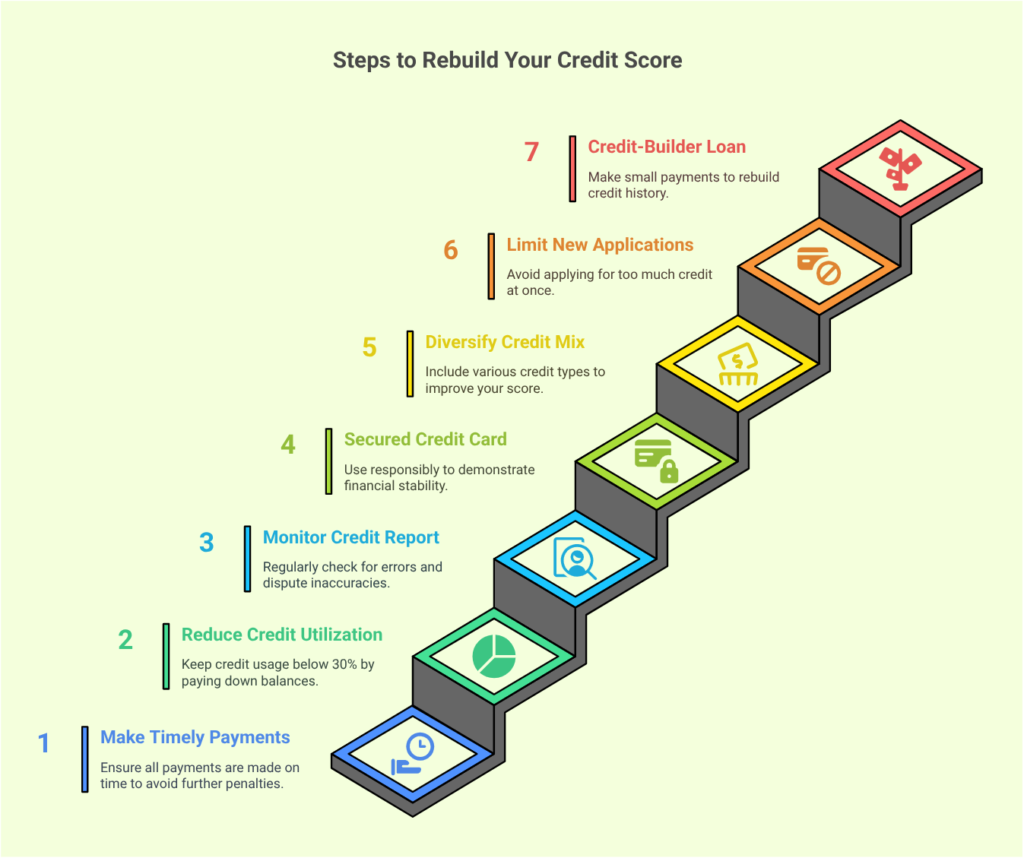

Ways to Rebuild Your Credit After a Settlement

Although debt settlement can negatively impact your credit score, there are steps you can take to rebuild it:

- Make Timely Payments: Pay all remaining debts, bills, and financial obligations on time. Even a single late payment can hinder your recovery.

- Reduce Credit Utilization: Keep your credit usage below 30% by paying down existing balances and avoiding unnecessary new debt.

- Monitor Your Credit Report: Regularly check your credit report for errors or inaccuracies. If you notice any mistakes, dispute them with the credit bureaus to ensure your score reflects accurate information.

- Apply for a Secured Credit Card: Using a secured credit card responsibly can help demonstrate financial stability and rebuild a positive credit history.

- Diversify Your Credit Mix: Having a healthy mix of credit types, such as credit cards, installment loans, or retail accounts, can improve your score over time.

- Limit New Credit Applications: Applying for too much credit in a short period can negatively impact your score. Instead, focus on responsible credit usage with your existing accounts.

- Consider a Credit-Builder Loan: Some financial institutions offer credit-builder loans, designed to help individuals improve their credit scores through small, manageable payments.

By following these strategies, you can gradually restore your credit and regain financial stability.

The Long-Term Effect on Your Credit History

Debt settlement remains on your credit report for up to seven years, influencing your creditworthiness for an extended period. Here’s how the effects evolve:

- Short-Term Impact: Immediately after settlement, your credit score will drop significantly. This decline can make it difficult to obtain new credit, secure loans, or qualify for competitive interest rates.

- Mid-Term Recovery: Over time, the impact of settlement lessens, especially if you demonstrate responsible financial behavior. Regular on-time payments and prudent credit management will help rebuild your score.

- Long-Term Stability: After seven years, settled accounts are removed from your credit report. Once they disappear, your credit score may see a significant boost, assuming you’ve maintained good financial habits.

While debt settlement is not without consequences, understanding its effects and taking proactive measures to rebuild your credit can help you recover financially. Weighing the pros and cons carefully and exploring alternatives such as debt management plans or credit counseling can provide a clearer path to financial stability.