Election Year Spending and the Rising U.S. Debt Clock

Washington– As the United States heads into one of the most contentious presidential election years in recent memory, a different clock is ticking — not the countdown to Election Day, but the U.S. Debt Clock, flashing a staggering $34 trillion in total national debt. That figure, coupled with a debt-to-GDP ratio hovering at 120%, underscores a growing fiscal crisis that experts warn could outlast any political cycle and reshape the country’s economic trajectory.

With campaign rallies, televised debates, and policy promises dominating the headlines, fiscal analysts caution that election-year spending is accelerating the country toward uncharted debt territory. Both major political parties are pushing expansive agendas — from infrastructure packages and tax incentives to healthcare reforms and defined boosts — all of which carry hefty price tags.

A Familiar Pattern, Now at Record Highs

Historically, election years see an uptick in government spending, as administrations aim to deliver on campaign pledges and court voter blocs with targeted programs. But the 2025 scenario is uniquely precarious.

The current $34 trillion debt figure is not just a record — it represents nearly double the pre-2008 financial crisis levels and has risen by more than $10 trillion in the past five years alone. Economists attribute this rapid escalation to a combination of pandemic relief measures, rising defence budgets, infrastructure renewal projects, and now, fresh election-year expenditures.

“Election-year politics tend to push fiscal restraint to the back burner,” says Dr. Laura Whitman, a public policy professor at Georgetown University. “But with debt-to-GDP at 120%, every additional dollar borrowed pushes us further into a zone where servicing the debt becomes a major economic risk.”

The Debt-to-GDP Red Flag

A 120% debt-to-GDP ratio means the U.S. owes significantly more than the total value of all goods and services it produces in a year. This metric is often used by global credit rating agencies and investors to gauge a country’s fiscal health.

While Japan has long carried a higher ratio without an immediate crisis, the U.S. situation differs in scale and context. The dollar’s status as the world’s reserve currency allows the U.S. to borrow more cheaply than most nations, but that advantage is eroding. Rising interest rates have already pushed annual debt servicing costs above $1 trillion, an amount larger than the defence budget.

“The danger is not just the debt level, but the cost of maintaining it,” notes Mark Feldman, a senior economist with the American Fiscal Forum. “When interest payments start crowding out investments in infrastructure, education, and innovation, the country’s long-term competitiveness suffers.”

Election-Year Spending: Where the Money Goes

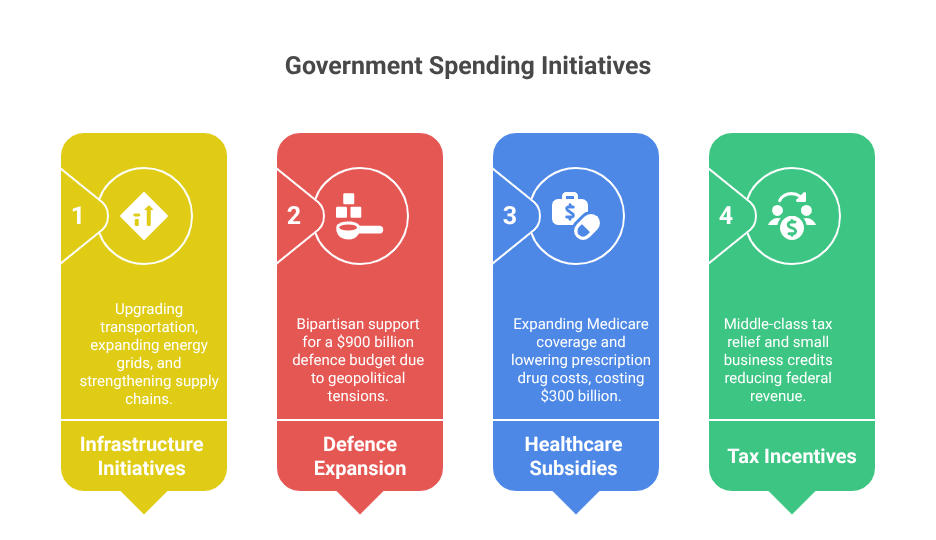

A review of the latest Congressional Budget Office (CBO) estimates reveals several high-expenditure categories driving this year’s fiscal push:

- Infrastructure Initiatives – Both parties have pledged hundreds of billions to upgrade transportation networks, expand renewable energy grids, and strengthen supply chains.

- Defence Expansion – Geopolitical tensions in Eastern Europe and the South China Sea have prompted bipartisan support for a $900 billion defence budget.

- Healthcare Subsidies – Proposals for expanded Medicare coverage and lower prescription drug costs are expected to cost upwards of $300 billion over the next decade.

- Tax Incentives and Rebates – Middle-class tax relief packages and small business credits are being rolled out, reducing near-term federal revenue.

While many of these measures have public support, few come with offsetting spending cuts or revenue increases, deepening the debt spiral.

The Political Calculus vs. Fiscal Reality

Candidates from both parties are leaning heavily into promises that resonate with their voter bases, often without clear plans to finance them. Calls for fiscal restraint rarely feature in stump speeches, where immediate voter appeal trumps long-term budget discipline.

Republican candidates emphasize tax cuts and deregulation, arguing that stimulating growth will eventually offset debt increases. Democrats, meanwhile, focus on expanding social programs and climate initiatives, framing them as investments in future prosperity.

But in practice, both approaches require substantial borrowing in the short term. And with interest rates elevated, the cost of that borrowing is higher than at any point in the past two decades.

Global Implications of a Swelling Debt Clock

The U.S. Debt Clock is not just a domestic concern. As the world’s largest economy, America’s fiscal policy reverberates globally. A rising U.S. debt level can affect:

- Treasury Bond Markets – Foreign governments and investors, particularly China and Japan, hold trillions in U.S. debt. Any loss of confidence could lead to reduced demand for Treasuries, pushing interest rates higher.

- Global Inflation – Increased U.S. borrowing can contribute to global inflationary pressures, especially if it leads to dollar depreciation.

- Currency Stability – The dollar’s role as the reserve currency relies on trust in the U.S. government’s fiscal management. Persistent high debt could weaken that trust over time.

“The dollar’s supremacy isn’t guaranteed forever,” warns Feldman. “If markets start believing that the U.S. political system cannot control its debt, alternatives like the euro or yuan could gain ground in global trade.”

The Rising Cost of Inaction

Ignoring the debt problem now could have severe consequences in the next decade. The CBO projects that without significant policy changes, U.S. debt could reach $40 trillion by 2030 and consume nearly 20% of federal revenues in interest payments alone.

This “crowding out” effect would leave less funding available for defence, social programs, and infrastructure, forcing painful trade-offs. Additionally, in the event of another economic crisis, high existing debt would limit the government’s ability to respond with robust stimulus measures.

The Public’s View: Debt Awareness vs. Debt Fatigue

Polls suggest that while a majority of Americans acknowledge the national debt as a serious issue, it ranks lower on the list of voter priorities compared to healthcare, jobs, and national security. This “debt fatigue” stems from years of warnings without visible consequences — yet economists caution that the turning point often comes suddenly.

“We’ve been in the calm before the storm for a long time,” says Whitman. “When the market finally reacts, it will be swift and unforgiving.”

Calls for Fiscal Reform

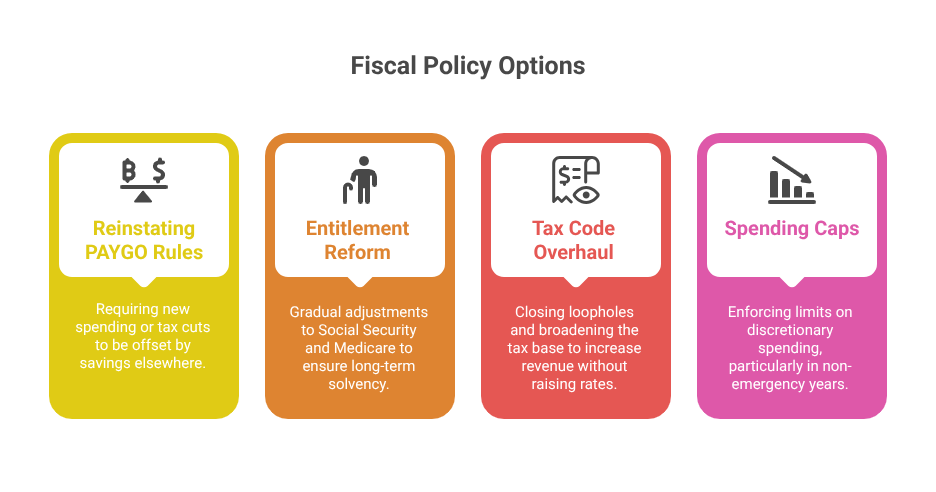

Several bipartisan policy groups are urging Congress to adopt measures that could slow the debt’s growth:

- Reinstating PAYGO Rules – Requiring new spending or tax cuts to be offset by savings elsewhere.

- Entitlement Reform – Gradual adjustments to Social Security and Medicare to ensure long-term solvency.

- Tax Code Overhaul – Closing loopholes and broadening the tax base to increase revenue without raising rates.

- Spending Caps – Enforcing limits on discretionary spending, particularly in non-emergency years.

While politically challenging, these reforms could signal to markets that Washington is serious about fiscal discipline.

A Race Against Time

The election-year frenzy will continue to dominate headlines, but the Debt Clock will keep ticking regardless of who wins the presidency. The decisions made in 2025 — or avoided — could define America’s fiscal future for a generation.

For now, the numbers on that bright green digital display in Times Square tell a stark story: $34,000,000,000,000 and counting, climbing by the second. Every tick is not just a number — it’s a measure of political will, economic resilience, and the cost of promises made in the heat of an election year.