Federal Reserve vs. The Debt Clock: Can Interest Rate Cuts Help?

Washington, D.C. – August 2025: The U.S. economy is entering a defining moment as the Federal Reserve weighs the delicate balance between fighting inflation and addressing the nation’s ballooning debt. With the U.S. Debt Clock racing past $35 trillion, policymakers face mounting pressure to determine whether interest rate cuts can truly ease the burden—or whether they risk fueling the very crisis they hope to prevent.

Mounting Debt Meets US Economic Uncertainty

The U.S. Debt Clock, long considered a stark symbol of the nation’s fiscal imbalance, has become more than just a digital counter. It now serves as a daily reminder that Washington is borrowing at an unprecedented pace. Rising federal debt, combined with high consumer borrowing, is straining both households and the government.

At the same time, the Federal Reserve is under pressure to pivot from its aggressive rate hikes of the past two years, which were designed to tame inflation but also raised borrowing costs across the board. Businesses, homeowners, and consumers have been grappling with higher credit card rates, more expensive mortgages, and reduced access to credit.

With signs of slowing job growth and weakening retail sales, the question now dominating Wall Street and Main Street alike is simple: Can interest rate cuts really help America escape its debt spiral—or will they make it worse?

The Case for Rate Cuts

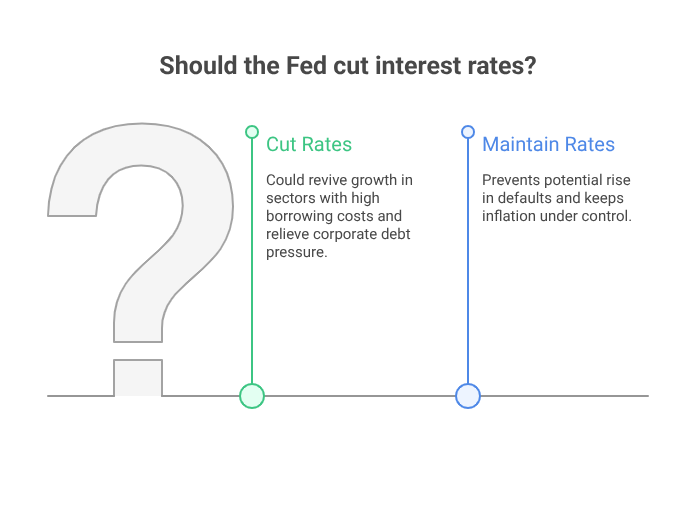

Supporters of rate cuts argue that lowering borrowing costs could provide much-needed relief for households and corporations. By reducing the interest paid on credit cards, auto loans, and mortgages, consumers may find breathing room to manage their existing debts.

For the federal government itself, lower interest rates mean less money spent on servicing debt. In fiscal year 2024, the U.S. spent more than $1 trillion on interest payments alone, rivaling major budget categories like defense and Medicare. Cutting rates could slow the growth of that staggering figure, buying policymakers more time to address structural budget imbalances.

Economists in favor of a Fed pivot emphasize that easing monetary policy could stimulate investment and consumer spending at a critical time. “A controlled reduction in interest rates might help balance growth without reigniting runaway inflation,” noted one Washington-based analyst.

“U.S. Federal Debt and Interest Payments have surged over the past decade, highlighting the fiscal strain as the Federal Reserve debates rate cuts.”

The Risk of Fueling the Debt Clock

Yet critics warn that the Fed’s rescue plan could backfire. Lower rates may encourage more borrowing, both from consumers already stretched thin and from a federal government with little appetite for austerity.

The Debt Clock’s relentless climb is not just about existing obligations but about future promises. Programs like Social Security and Medicare are expected to cost trillions in the coming decades. Adding further borrowing to this trajectory could push the nation toward a tipping point.

Opponents of rate cuts argue that any short-term relief will be offset by long-term instability. If inflation rebounds due to increased spending, the Fed may be forced to re-tighten, creating more volatility for financial markets. “It’s a dangerous gamble,” warned a former Treasury official. “You can slow the Debt Clock temporarily, but unless fiscal discipline is restored, the problem only worsens.”

Consumer Debt: The Silent Crisis

While government borrowing dominates headlines, consumer debt is becoming an equally urgent problem. Credit card balances have surpassed $1.3 trillion, with delinquency rates creeping upward. Student loans, despite temporary relief measures, remain a crushing weight for millions of households.

For ordinary Americans, the debate over Fed rate cuts is not abstract. A lower monthly mortgage payment or reduced credit card interest could mean the difference between solvency and bankruptcy. But financial experts caution that without real wage growth, many families will continue to depend on debt as a survival tool, feeding into the broader crisis.

“The reality is that interest rates alone can’t fix America’s debt problem,” explained a New York financial strategist. “They may ease the pain temporarily, but structural reforms are what’s really needed.”

Global Implications

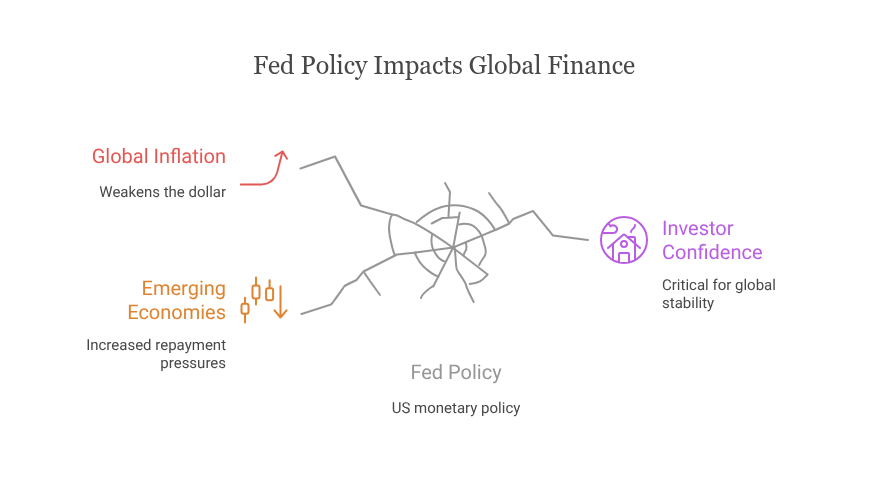

The Federal Reserve’s decisions extend far beyond U.S. borders. With the dollar serving as the world’s reserve currency, shifts in American monetary policy ripple through global markets. Emerging economies, many of which borrowed heavily in dollars, face increased repayment pressures when U.S. rates rise.

A Fed pivot toward cuts could bring relief to these countries, lowering debt-servicing costs and stabilizing currencies. However, it may also weaken the dollar, sparking inflationary pressures worldwide.

For investors, the Debt Clock’s symbolism is increasingly global. Sovereign wealth funds, foreign central banks, and international creditors are watching closely. Confidence in the United States’ fiscal management remains critical for the stability of global finance.

Political Pressure on the Fed

Complicating matters is the political calendar. With the 2026 midterm elections looming, lawmakers are keenly aware of voter frustration with high borrowing costs, rising debt, and economic uncertainty. Some critics accuse politicians of leaning on the Fed to cut rates for electoral reasons rather than economic necessity.

Federal Reserve Chair Jerome Powell has repeatedly insisted that decisions are made based on data, not politics. Still, history shows that central banks often face political heat when economic pain threatens electoral prospects.

The optics of the Debt Clock flashing red numbers while millions of Americans struggle with bills create fertile ground for populist narratives. “The Fed is caught between economic reality and political theater,” remarked a senior policy analyst.

The Business Community Responds

Corporations are already adjusting to the uncertainty. Banks are tightening lending standards, tech companies are delaying expansions, and manufacturers are reassessing supply chain investments.

For small businesses, access to affordable credit remains a lifeline. A cut in rates could revive growth in sectors that have been battered by high borrowing costs. However, lenders remain cautious, wary of rising defaults as both households and firms take on more risk.

The corporate debt market, too, is flashing warning signs. With trillions in bonds set to mature over the next three years, refinancing at higher rates has already strained balance sheets. A Fed pivot may relieve some of that pressure—but only if inflation remains under control.

Looking Ahead: Can the Fed Buy Time?

The central question is whether interest rate cuts can buy enough time for policymakers to enact meaningful fiscal reforms. Reducing the federal deficit, reforming entitlement programs, and promoting sustainable growth are long-term solutions that go beyond the Fed’s toolkit.

Until then, the Debt Clock will continue its relentless countdown. Economists stress that interest rate policy alone cannot substitute for fiscal responsibility. Without bipartisan solutions in Congress, even the most carefully calibrated Fed strategy may fail to prevent a debt-driven crisis.

What’s at Stake for Ordinary Americans

For the average household, the stakes could not be higher. From mortgage payments to credit card bills, the Fed’s decisions directly affect daily life. A successful balancing act could bring relief to millions of families, while a misstep could deepen financial strain.

Rising debt levels also threaten the nation’s long-term prosperity. Future generations may face higher taxes, reduced public services, and slower economic growth if today’s borrowing spree continues unchecked.

As the nation debates the Fed’s next move, one truth remains clear: the Debt Clock is not stopping, and America’s window to address its fiscal challenges is narrowing.

Final Word: Between Relief and Reckoning

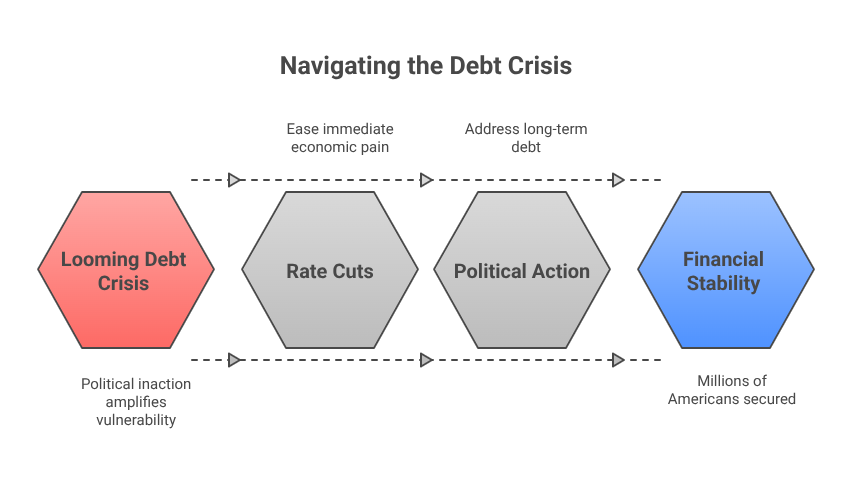

The Federal Reserve’s dilemma encapsulates the tension at the heart of modern American economics. Cutting rates could ease immediate pain, but without deeper reforms, it risks amplifying the long-term debt crisis.

The Debt Clock’s red digits are not just numbers—they represent the stakes of political inaction, economic vulnerability, and generational responsibility. Whether the Fed can help the nation navigate this precarious moment will determine not just the course of the economy, but the financial stability of millions of Americans.