FTC Provides Annual Letter Summarizing Debt Collection Activities

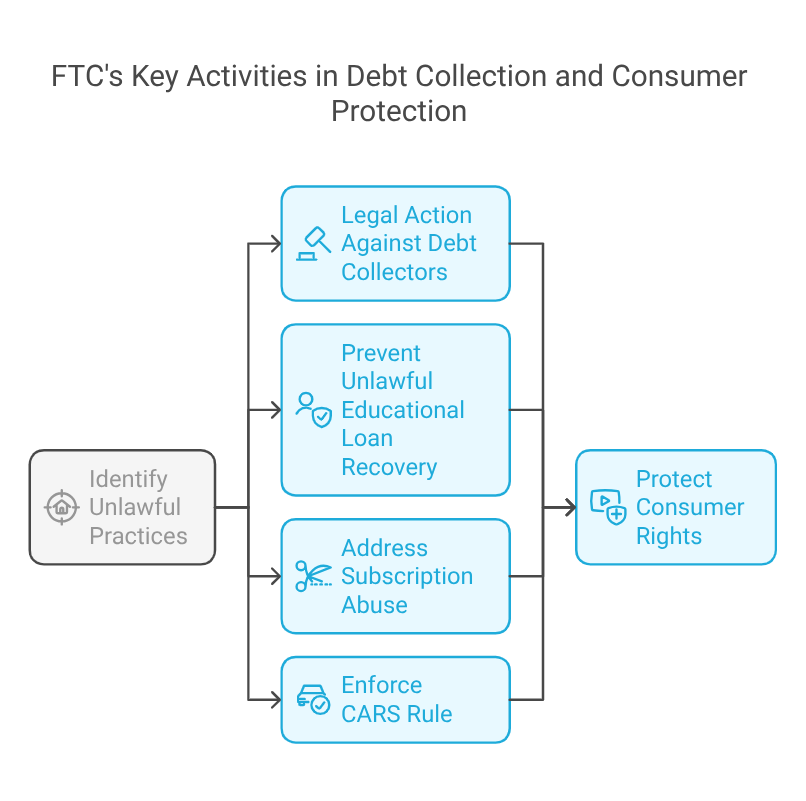

The Federal Trade Commission (FTC) plays a crucial role in ensuring fair practices within the debt collection industry, and its annual report, provided to the Consumer Financial Protection Bureau (CFPB), highlights key activities and enforcement actions aimed at protecting consumers. This report outlines the FTC’s commitment to addressing unlawful practices, safeguarding consumer rights, and ensuring transparency in debt collection processes.

Overview of the FTC’s Key Activities

The FTC’s annual letter outlines several significant actions undertaken to address debt collection issues, protect consumers, and enforce regulations. The report provides insights into FTC’s major initiatives, enforcement actions, and consumer education efforts. Below are some key areas the FTC focused on:

1. Legal Action Against Unlawful Debt Collection Practices

The FTC’s commitment to consumer protection was evident through its active legal pursuits against debt collectors engaging in illegal tactics. These cases involved organizations that violated federal laws such as the Fair Debt Collection Practices Act (FDCPA) and the FTC Act. The violations ranged from harassment and threats to consumers to the use of false or misleading information to collect debts.

In one prominent case, the FTC secured settlements against collectors who adopted aggressive and unlawful tactics, including misrepresenting the amount owed, threatening consumers with legal actions they could not pursue, or falsely claiming to be law enforcement officers. These settlements not only resulted in financial penalties but also prohibited the involved entities from continuing their illegal practices.

The FTC also targeted debt collection agencies that repeatedly violated consumer rights. For instance, companies that failed to verify debts before pursuing collections were held accountable. By enforcing strict compliance standards, the FTC ensured that debt collectors could no longer operate unchecked, providing consumers with enhanced protection against abusive collection tactics.

2. Prevention of Unlawful Educational Loan Recovery

The FTC actively worked to prevent the recovery of illegal educational loans. Certain educational institutions engaged in deceptive practices by offering questionable financial aid programs, leading students to accumulate debts under false pretenses. The FTC’s efforts in this area helped ensure that deceptive educational institutions could not pursue debts that were tied to such unlawful practices. By blocking the recovery of these loans, the FTC upheld consumer protection principles and safeguarded student borrowers from financial exploitation.

In one notable case, the FTC intervened when a for-profit educational institution aggressively pursued students to repay loans that were deemed unlawful. The commission’s actions ensured that these loans were nullified, giving affected students relief from unjust financial burdens. This intervention reinforced the importance of fair lending practices in educational financing and deterred predatory behavior within the student loan sector.

3. Addressing Subscription Abuse through Dark Patterns

Dark patterns, and deceptive online practices designed to manipulate users into actions such as unintended subscriptions or financial commitments, have increasingly drawn FTC’s attention. The report highlights cases where companies used manipulative designs that trapped consumers in recurring subscription models without clear consent or easy cancellation options. The FTC’s actions targeted businesses employing these unethical methods, ensuring that consumers could easily terminate subscriptions and understand financial commitments upfront.

The FTC issued warnings to multiple companies that relied on dark patterns, emphasizing the need for clear opt-in options and transparent billing practices. By penalizing firms that used misleading designs to enroll consumers in recurring payment schemes, the FTC safeguarded customer interests and reinforced ethical marketing standards.

4. Enforcement of the CARS Rule for Auto-Related Debt Issues

The FTC also emphasized its enforcement of the CARS Rule, which is designed to regulate the sale and financing of motor vehicles. Car dealerships and lenders must adhere to clear guidelines to prevent consumers from falling victim to misleading information or unfair lending practices. The FTC’s activities ensured transparency in car financing agreements and worked to eliminate deceptive tactics that burdened consumers with unexpected debts or unfavorable loan terms.

Through investigations, the FTC found that some dealerships misrepresented the terms of car loans or failed to disclose essential information about financing conditions. By addressing these violations, the FTC ensured consumers could make informed decisions when purchasing vehicles. The CARS Rule also introduced stricter guidelines for dealerships regarding contract clarity, loan repayment expectations, and interest rate disclosures.

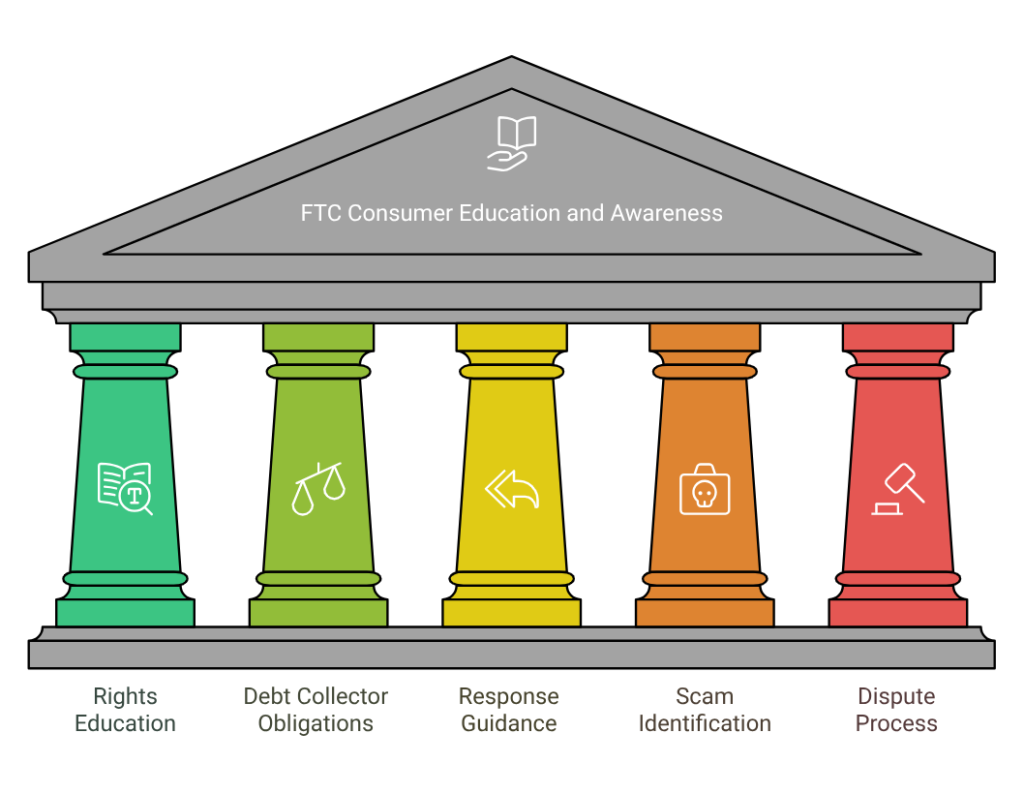

Consumer Education and Awareness Efforts

In addition to enforcement actions, the FTC actively educated millions of consumers about their rights under the FDCPA and FTC Act. The commission distributed training materials that informed consumers of their rights, outlined debt collectors’ obligations, and provided guidance on how to respond to unethical debt collection practices. By empowering consumers with knowledge, the FTC strengthened their ability to recognize and challenge inappropriate behavior in debt collection interactions.

The FTC launched targeted campaigns that leveraged social media, educational webinars, and outreach events to educate consumers about emerging threats in the debt collection industry. The materials covered vital information such as how to identify debt collection scams, how to dispute inaccurate claims, and what steps consumers should take if they are being harassed by collectors.

Collaborative Efforts with the CFPB

The FTC’s annual report is part of its collaboration with the CFPB to ensure comprehensive consumer protection. By sharing its findings, case outcomes, and recommendations, the FTC helps shape regulatory policies that promote ethical debt collection standards and accountability within the industry.

This partnership allows both agencies to coordinate enforcement efforts, share resources, and enhance consumer protection mechanisms. By combining their strengths, the FTC and CFPB improve the oversight of financial institutions and debt collectors, ensuring that unethical practices are swiftly addressed.

The Broader Impact on the Debt Collection Industry

The FTC’s actions have had a lasting impact on the debt collection landscape. Agencies and debt collectors are now more aware of the legal boundaries established under the FDCPA and FTC Act. By holding violators accountable and ensuring educational outreach, the FTC fosters a fair and transparent environment where consumers are better protected from aggressive and unlawful collection tactics.

In response to the FTC’s increased enforcement, many debt collection agencies have revamped their policies, improved employee training, and implemented stronger compliance frameworks. This shift has created a more ethical approach to debt recovery, minimizing incidents of harassment, deception, or threats against consumers.

Looking Ahead: The Future of Debt Collection Oversight

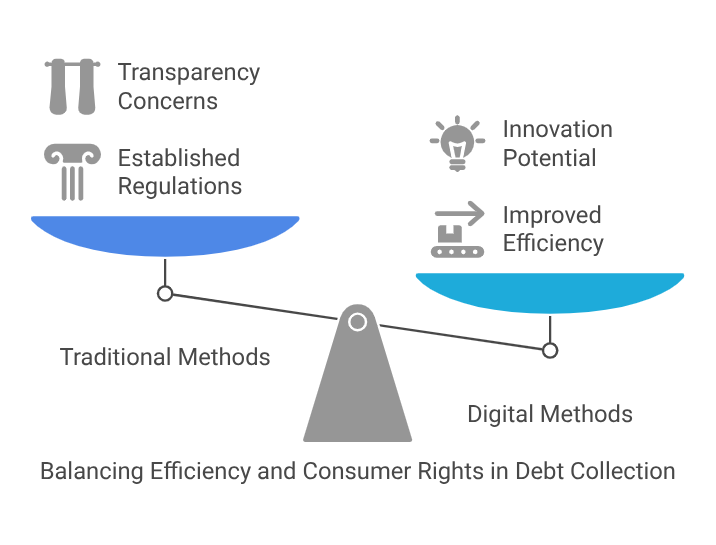

The FTC continues to monitor emerging trends in debt collection practices, particularly those influenced by digital transformation and online financial services. As new technologies evolve, the FTC is committed to ensuring that consumers are not exploited by digital debt collection methods that bypass existing regulations.

The FTC has expressed concerns over the rise of automated messaging systems and artificial intelligence tools that are increasingly used to contact consumers about debts. While these systems can improve efficiency, they also pose risks if used improperly. The FTC aims to establish clearer guidelines to ensure that digital communication methods remain fair, transparent, and respectful of consumer rights.

Conclusion

The FTC’s annual report serves as a powerful reminder of the commission’s dedication to protecting consumers in the debt collection industry. By enforcing the law, preventing unethical practices, and raising consumer awareness, the FTC continues to promote fair collection practices. Its collaborative efforts with the CFPB further strengthen consumer protection initiatives, ensuring that both regulatory bodies work together to uphold the highest standards in debt collection activities.

Through proactive enforcement, educational campaigns, and partnerships with key stakeholders, the FTC ensures that consumers are informed, protected, and empowered when dealing with debt collection challenges. Moving forward, the FTC’s focus on digital transformation and evolving consumer behaviors will play a critical role in shaping the future of debt collection oversight.

To learn more check out FTC’s official website resource: https://www.ftc.gov/news-events/news/press-releases/2024/09/ftc-provides-annual-letter-summarizing-debt-collection-activities