Harassed by Debt Collectors? Know Your Rights and How to Fight Back

Debt can be overwhelming, but what makes it worse is when you’re being harassed by aggressive debt collectors. If you’re receiving relentless phone calls, threatening letters, or abusive messages, it’s important to know—you have rights. This article is your definitive guide to understanding what constitutes debt collector harassment, what laws protect you, and the steps you can take to protect yourself and fight back.

What Is Debt Collector Harassment?

Debt collector harassment refers to any unfair, deceptive, or abusive behaviour used by collectors in an attempt to recover a debt. These actions often go beyond polite reminders and enter the realm of intimidation.

Examples of harassment include:

- Repeated calls at odd hours

- Threats of arrest or legal action

- Use of profanity or abusive language

- Contacting friends, family, or your employer

- Misrepresenting the amount you owe

Understanding what qualifies as harassment is the first step in identifying if your rights are being violated.

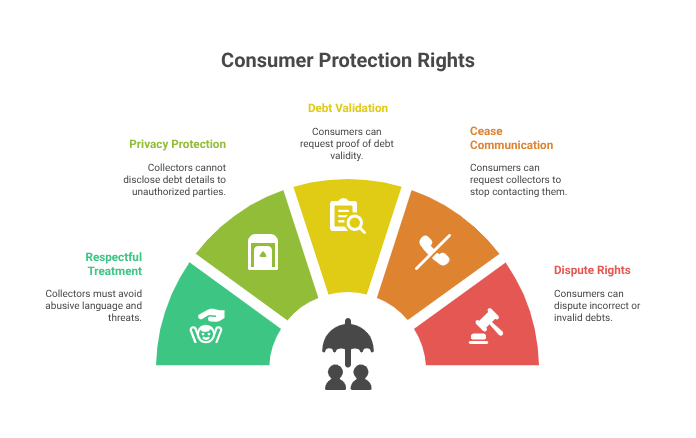

Key Consumer Rights Under Debt Collection Laws

Several laws are designed to protect consumers from abusive collection tactics. The most notable one is the Fair Debt Collection Practices Act (FDCPA) in the U.S., but other countries have their own laws (like the Consumer Credit Protection Act in Australia or Financial Conduct Authority rules in the UK).

1. Right to Be Treated with Respect

Collectors are not allowed to:

- Use obscene or abusive language

- Call repeatedly with the intent to annoy or harass

- Threaten violence or harm

2. Right to Privacy

Collectors cannot disclose your debt to anyone other than you, your spouse, or your attorney. Contacting your employer, family members, or friends for anything other than locating you is a violation.

3. Right to Request Validation of the Debt

You have the right to request that the collector validate the debt. This includes providing proof of:

- The original creditor

- The amount owed

- That they are authorized to collect it

If you request this in writing within 30 days of the first contact, they must stop collection until the debt is verified.

4. Right to Cease Communication

You can request that the debt collector stop contacting you altogether. Once they receive your written request, they are legally required to stop, except to notify you of legal actions.

5. Right to Dispute the Debt

If you believe the debt is incorrect, partially paid, or doesn’t belong to you, you have the right to dispute it. Disputes must be made in writing and submitted within the legal timeframe to be valid.

A Detailed Guide on Consumer Rights and Legal Protections

Consumer rights in debt collection are enshrined in laws designed to ensure fair treatment and protect against abuse. Knowing these laws is crucial when you’re being pursued by collectors—especially if their behaviour crosses the line. Below is a deeper look at the legal framework that shields you and how you can use it to your advantage.

Fair Debt Collection Practices Act (FDCPA) – U.S. Law

The FDCPA is one of the strongest consumer protection laws in the United States. It applies to third-party debt collectors (not original creditors) and prohibits them from using deceptive, abusive, or unfair practices.

Key protections under the FDCPA include:

- Debt collectors must identify themselves and state that the communication is an attempt to collect a debt.

- They must provide a written validation notice within five days of first contact.

- Consumers have the right to dispute the debt within 30 days.

- Debt collectors are barred from calling at inconvenient times (before 8 AM or after 9 PM).

- Legal threats or false representation (such as pretending to be law enforcement) are illegal.

Telephone Consumer Protection Act (TCPA)

The TCPA protects consumers from unwanted robocalls or texts from debt collectors. Collectors must have your prior express consent to contact you using auto-dialling systems or prerecorded messages.

State-Level Protections

Many U.S. states have their own debt collection laws that provide even more robust protections. For example, California’s Rosenthal Fair Debt Collection Practices Act mirrors and expands on the FDCPA, applying to original creditors as well.

Protections in Other Countries

If you’re outside the U.S., you’re not without protection:

- Australia: The Australian Competition and Consumer Commission (ACCC) and the Australian Securities and Investments Commission (ASIC) jointly regulate debt collection under the Australian Consumer Law. Collectors must not mislead, harass, or coerce debtors and must follow strict contact guidelines.

- UK: The Financial Conduct Authority (FCA) governs debt collection under the Consumer Credit Act and FCA Handbook rules. Collectors must treat customers fairly, offer appropriate repayment options, and not misrepresent consequences.

- Canada: Each province regulates debt collection under its own consumer protection laws. For example, Ontario’s Collection and Debt Settlement Services Act outlines how and when collectors can contact debtors.

Right to Legal Representation

In many jurisdictions, once you inform a debt collector that you’re represented by an attorney, they must cease communication with you and contact your attorney directly. This protects you from ongoing stress and allows a legal professional to manage your case.

Right to Compensation

If a collector violates the law, you may be entitled to compensation—even if the debt is valid. You can sue for:

- Actual damages (e.g., lost wages, emotional distress)

- Statutory damages (up to $1,000 under the FDCPA)

- Attorney’s fees and court costs

Knowing these rights is not just about stopping harassment—it’s about reclaiming control. These laws were written to protect you, and when enforced properly, they can turn a distressing situation into a manageable one.

Common Debt Collection Violations

Understanding typical violations can help you spot unlawful behaviour. Here are some red flags:

- Calling before 8 AM or after 9 PM

- Contacting you at work despite being told not to

- Lying about being a lawyer or law enforcement

- Falsely claiming you’ll be arrested

- Threatening legal action they can’t take

If you experience any of these, it may constitute a legal violation.

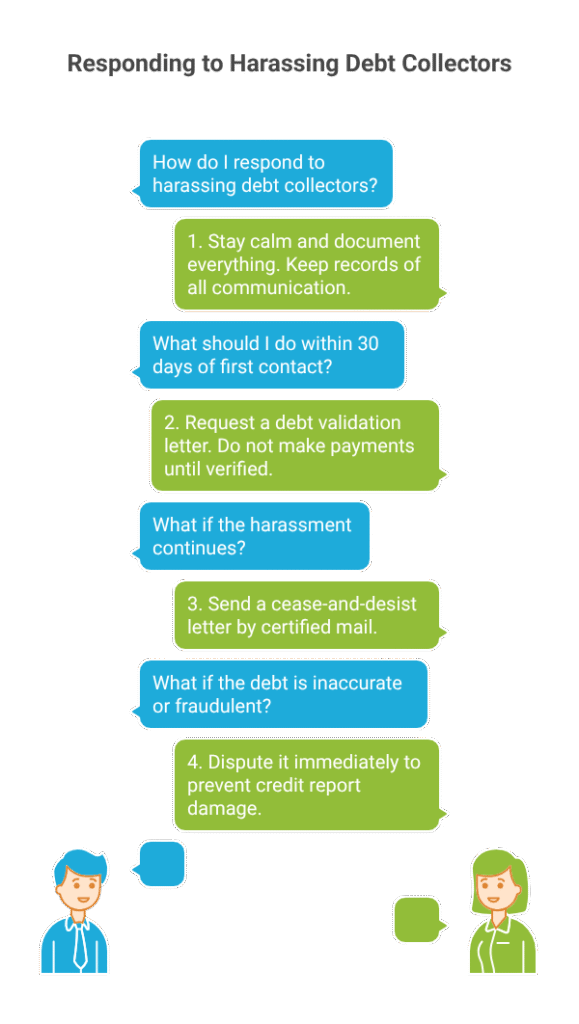

How to Respond to Harassing Debt Collectors

1. Stay Calm and Document Everything

Keep a record of every call, text, email, and letter. Note the time, date, collector’s name, and what was said. These records are critical if you need to take legal action.

2. Request a Debt Validation Letter

Within 30 days of first being contacted, send a formal request asking them to verify the debt in writing. Do not make any payments or promises until this is received and reviewed.

3. Send a Cease-and-Desist Letter

If the harassment continues, send a cease-and-desist letter by certified mail with a return receipt. This document should:

- State that you’re invoking your right under the FDCPA (or local law)

- Request that all further communication cease

- Include your name, address, and account reference (if known)

4. Dispute Inaccurate or Fraudulent Debts

If the debt isn’t yours, or if the amount is incorrect, dispute it immediately. This can prevent negative marks on your credit report and stop illegal collection attempts.

5. Report Violations to Authorities

You can file a complaint with:

- Federal Trade Commission (FTC)

- Consumer Financial Protection Bureau (CFPB)

- State Attorney General

- Local consumer protection agency

Provide detailed evidence, including recordings, screenshots, or letters. Regulatory bodies can investigate and impose fines or penalties on violators.

Legal Actions You Can Take

If debt collector harassment escalates, you have the right to sue. Many consumer protection laws allow you to pursue compensation for:

- Emotional distress

- Lost wages due to harassment

- Legal costs

- Statutory damages (up to $1,000 under FDCPA)

Always consult a consumer rights attorney to explore your options.

When to Seek Legal Help:

- If threats or harassment persist after warnings

- If the debt is not validated and collection continues

- If your credit score is being affected by an invalid debt

- If your employer or family has been contacted unlawfully

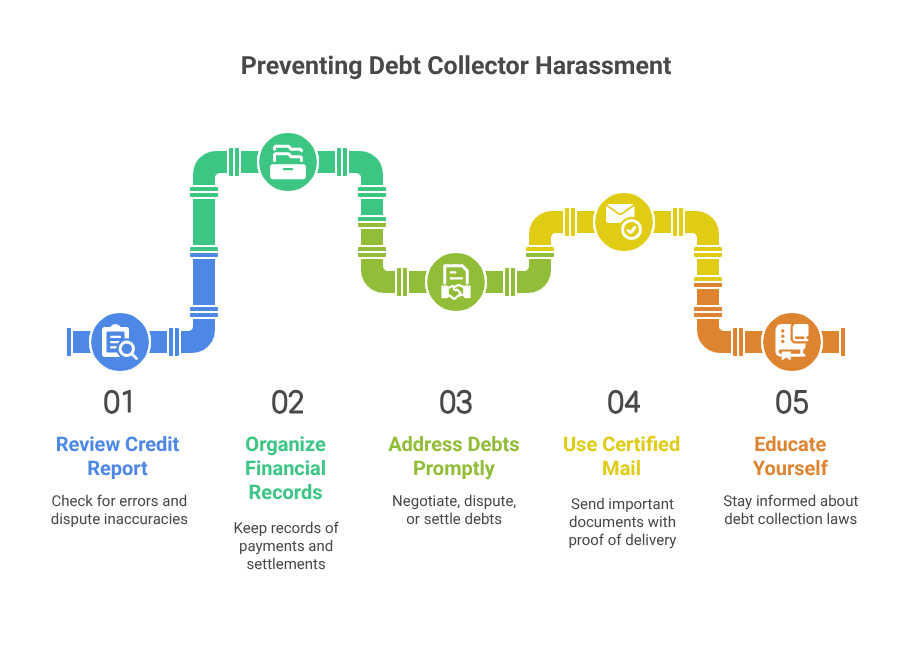

How to Prevent Future Debt Collector Harassment

Being proactive can reduce the risk of being targeted by aggressive collectors:

1. Review Your Credit Report Regularly

Errors on your credit report can lead to unfair collections. Check your credit report from all three major bureaus and dispute any inaccuracies.

2. Keep Financial Records Organized

Always keep records of debts paid, settlement letters, and account closures. These documents can serve as proof if a collector resurfaces.

3. Don’t Ignore Debts

Ignoring calls or letters may lead to lawsuits or wage garnishment. It’s better to negotiate, dispute, or settle debts promptly.

4. Use Certified Mail for All Communications

Always send important documents, such as disputes or cease-and-desist letters, via certified mail. This provides proof of delivery and can protect you in court.

5. Educate Yourself About Your Rights

Awareness is your strongest shield. Keep updated on changes to debt collection laws in your country or region. Agencies like the CFPB offer free resources and sample letters you can use.

Final Thoughts: You’re Not Powerless

Debt collector harassment can feel like a personal attack—but remember, you are not powerless. Knowing your rights, documenting every interaction, and taking the right legal steps can not only stop the harassment but also turn the tables in your Favor.

If you’re being targeted, act fast. Harassment is not only morally wrong—it’s legally punishable. By standing your ground and exercising your rights, you can protect your mental health, your finances, and your future.