How to Use the Debt Clock to Plan Your Financial Future

In today’s unpredictable economy, managing personal finances goes far beyond basic budgeting or saving. With national debt rising, inflation fluctuating and fiscal policies constantly shifting, individuals are impacted in ways that aren’t always immediately visible. One tool that brings clarity to this complexity is the US Debt Clock—a real-time display of America’s financial state. It helps individuals grasp the bigger picture and connect national trends with personal decisions. By using this tool in your financial planning, you can make smarter decisions about debt repayment, saving, investing, and long-term goals. This article explores practical ways to incorporate the Debt Clock into your financial strategy for a more secure future.

Understanding the US Debt Clock

The US Debt Clock is a live online tool that shows real-time financial data about the country’s economy. It tracks a wide variety of indicators and presents them in a clear, accessible way. This isn’t just for economists—anyone can use the Debt Clock to understand how broader economic trends influence personal choices, like buying a home or planning for retirement.

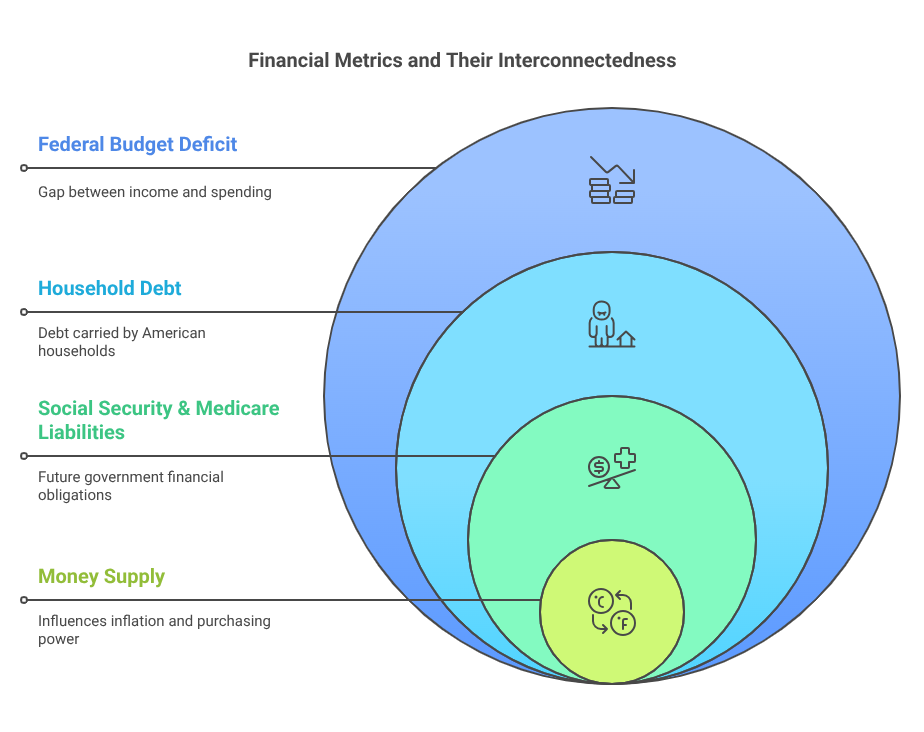

The key metrics include:

- National Debt: The total amount the federal government owes to domestic and international creditors.

- Debt per Citizen / Taxpayer: A calculation of how much debt is attributed to each American and each tax-paying individual.

- Federal Budget Deficit: The gap between government income (like taxes) and its spending on programs and services.

- Household Debt: The total debt carried by American households—mortgages, student loans, credit cards, and auto loans.

- Social Security & Medicare Liabilities: Future financial obligations of the government to these programs.

- Money Supply: The total amount of currency circulating in the economy, which can influence inflation and purchasing power.

These aren’t just numbers. They directly affect interest rates, taxes, employment, and more. Checking the Debt Clock regularly helps you better time your borrowing, saving, and investment decisions.

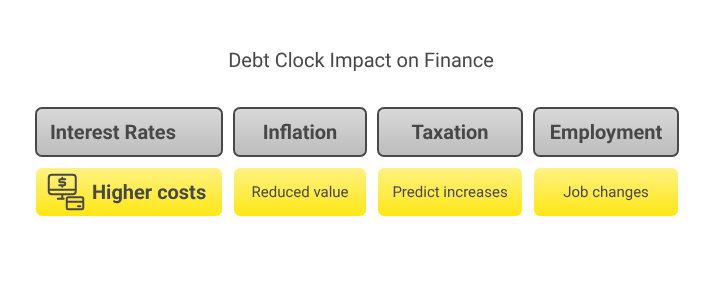

Why the Debt Clock Matters for Personal Finance

You may think national debt and government spending have little to do with your personal budget, but their influence is significant. The Debt Clock helps bridge that gap by showing how large-scale economic changes can impact your daily life and future plans.

1. Interest Rates and Borrowing Costs

As national debt increases; the government borrows more money. This creates competition for credit, which can drive interest rates higher. When that happens, it becomes more expensive to take out loans—whether for a home, car, or credit card. By watching debt indicators on the clock, you can anticipate rate increases and make timely decisions, like locking in a low-rate mortgage or postponing big purchases until rates settle.

2. Inflation and Purchasing Power

A growing national debt may lead to inflation, especially when the money supply increases to cover deficits. Inflation reduces the value of money, driving up the cost of living. The Debt Clock tracks inflation trends, helping you take action to protect your finances. Investing in assets that retain value during inflationary times—like real estate or commodities—can help you preserve purchasing power.

3. Taxation and Disposable Income

Large government debt often triggers changes in tax policy. By monitoring the Debt Clock, you can predict possible tax increases and adjust your strategy accordingly. You might contribute more to tax-deferred accounts like IRAs or 401(k)s, or make big purchases before new tax rules kick in. This kind of planning helps you keep more of your income.

4. Employment and Industry Impacts

Government spending patterns affect employment, especially in sectors like healthcare, education, and defines. Debt Clock trends can hint at cuts or expansions in these areas. If you work in a government-funded field, monitoring these indicators can help you anticipate changes and prepare for career moves. Even if you’re in the private sector, understanding economic trends supports smart career and financial planning.

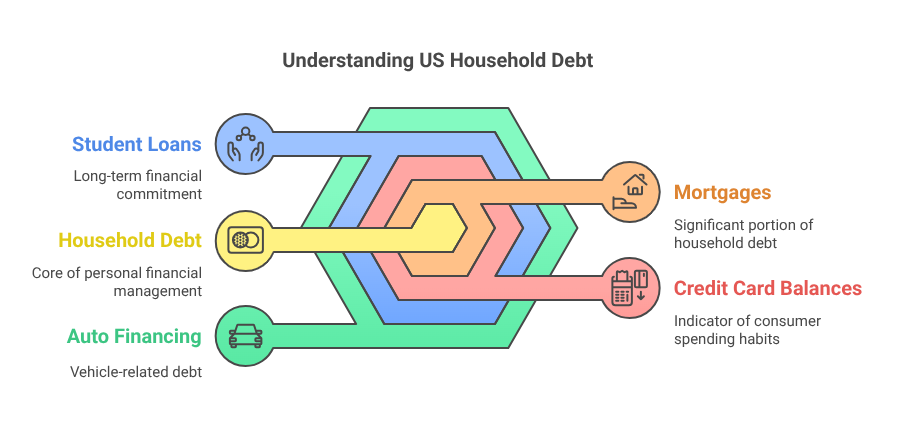

Breaking Down US Household Debt: What the Debt Clock Reveals

The Debt Clock doesn’t just focus on government finances—it also gives a detailed picture of household debt across the country. This includes data on mortgages, credit card balances, student loans, and auto financing. These figures reveal how Americans are managing personal debt and what that means for the economy and for you.

Composition of Household Debt

Household debt covers everything from home loans to student and auto loans, credit card balances, and other consumer credit. The Debt Clock breaks down each category so you can see which ones are growing fastest. For instance, a sharp increase in credit card debt could signal that people are relying on plastic to cope with higher costs, while an uptick in mortgage debt might reflect a housing boom or a surge in refinancing activity.

Economic Signals from Debt Trends

When household debt rises quickly, it can indicate financial stress—people might be borrowing more to deal with stagnant wages, inflation, or job loss. But it could also mean people are confident and spending freely. A drop in household debt might point to more saving or cautious financial behaviour. These insights help you anticipate challenges or opportunities in your own financial life.

Benchmarking Your Finances

Use national household debt data to evaluate your own borrowing. If your credit card debt is rising while national rates are climbing, consider paying it down faster. If student loans are a growing concern nationwide, it might be time to refinance or increase your monthly payments. Comparing your financial habits to national trends gives you a better understanding of how to stay on track.

Implications for Borrowing Costs

Household debt trends can affect interest rates. When people are borrowing more, lenders may raise rates to manage risk. This impacts everything from home loans to car financing. Watching these patterns on the Debt Clock helps you decide when to borrow, refinance, or wait.

Strategic Financial Planning

If household debt is surging, it could be a signal to cut back, avoid new loans, and build your savings. On the flip side, when debt is stable or falling, you might find better opportunities for investment or refinancing. These trends highlight the importance of an emergency fund—high debt levels can leave families vulnerable to unexpected expenses, making saving even more essential.

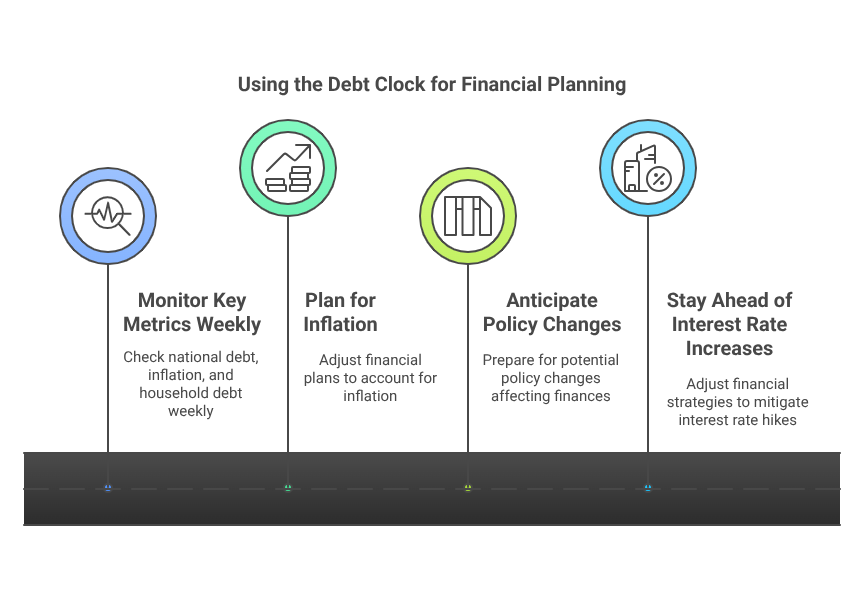

Using the Debt Clock: Practical Steps

The US Debt Clock isn’t just for information—it’s a tool you can use in daily life. Here’s how to make it part of your financial routine:

1. Monitor Key Metrics Weekly

Make a habit of checking national debt, inflation, and household debt every week. These numbers can help you decide when to:

- Rebalance your investment portfolio to reduce risk.

- Refinance a loan or make a major purchase at the right time.

- Prepare for upcoming policy changes that could affect your income or expenses.

2. Plan for Inflation

If the clock shows inflation rising, adjust your investment strategy:

- Buy real estate, which usually gains value in inflationary periods.

- Invest in TIPS (Treasury Inflation-Protected Securities).

- Consider commodities like gold, which often hold value during economic uncertainty.

- Look at consumer staples stocks—these companies tend to perform well regardless of inflation.

3. Anticipate Policy Changes

A growing deficit might mean cuts to public services or higher taxes. Use the clock’s data to prepare:

- Assess how much you rely on government benefits and seek alternatives if needed.

- Max out your contributions to Roth or traditional IRAs to reduce future tax exposure.

- Time large expenses to avoid being caught off-guard by new financial policies.

4. Stay Ahead of Interest Rate Increases

If the clock suggests interest rates will rise:

- Refinance existing loans now to lock in low rates.

- Focus on paying off variable-rate debt before it becomes more expensive.

- Avoid taking on unnecessary new debt—keep your budget flexible.

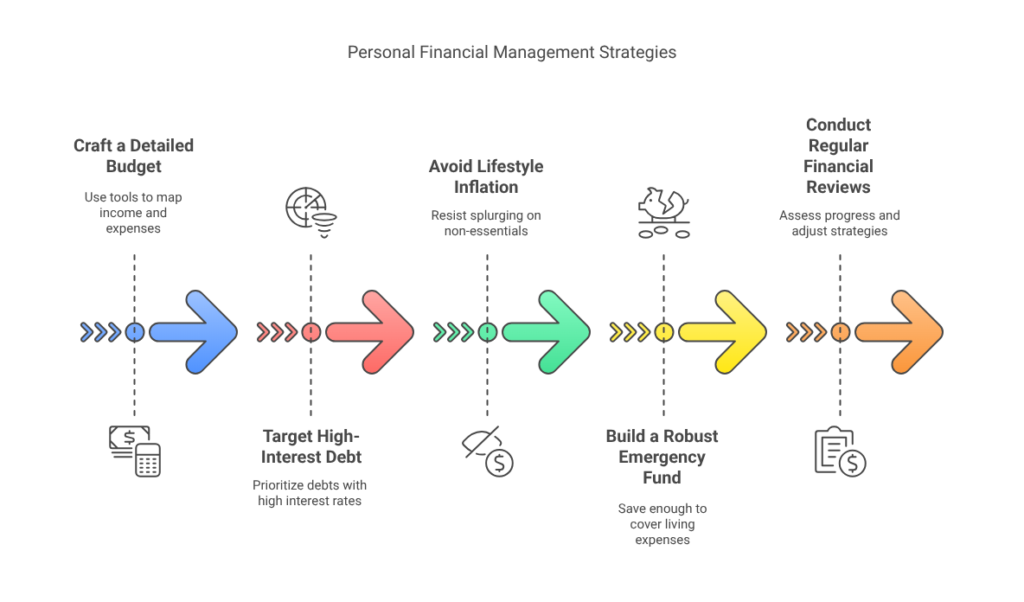

Five Budgeting Strategies to Stay Financially Sound

While the Debt Clock provides a macroeconomic lens, your financial success hinges on disciplined personal habits. These five budgeting strategies complement its insights, helping you maintain control over your finances:

- Craft a Detailed Budget

Use tools like budgeting apps or simple spreadsheets to map your income and expenses. Allocate specific amounts for debt repayment, savings, and discretionary spending, ensuring every dollar has a purpose. Review and tweak your budget monthly to reflect changes in income or goals, keeping your finances on track. - Target High-Interest Debt First

Prioritize debts with the highest interest rates, such as credit cards, to minimize total interest paid over time—this is known as the avalanche method. If you prefer quick wins to stay motivated, use the snowball method, paying off smaller balances first. Either approach reduces debt systematically, freeing up resources for savings or investments. - Avoid Lifestyle Inflation

When your income increases, resist the urge to splurge on non-essentials like luxury goods or frequent dining out. Instead, channel extra funds into savings accounts, retirement plans, or debt repayment. This discipline builds a foundation for long-term financial security, shielding you from economic fluctuations. - Build a Robust Emergency Fund

Aim to save enough to cover three to six months of living expenses in a high-yield savings account. This safety net prevents reliance on credit for unexpected costs, like medical emergencies or car repairs, keeping you out of debt. Start small if needed, but contribute consistently to reach your goal. - Conduct Regular Financial Reviews

Just as you monitor the Debt Clock, check in on your personal finances monthly. Assess whether you’re reducing debt, meeting savings targets, or staying within budget. Identify areas for improvement, like cutting subscriptions or boosting retirement contributions, and make small adjustments to stay aligned with your objectives.

Conclusion: Building a Resilient Financial Future

The US Debt Clock is far more than a dashboard of economic statistics—it’s a roadmap for navigating the intricate interplay between national trends and personal finance. By dedicating a few minutes each week to its data, you can anticipate how factors like rising debt, inflation, or policy shifts will shape your financial landscape. Whether you’re paying down loans, saving for a major purchase, or planning for retirement, the Debt Clock provides the clarity to make decisions rooted in evidence, not guesswork.

In an unpredictable economy, knowledge is your greatest ally. The Debt Clock empowers you to borrow wisely, save diligently, and invest strategically, ensuring your financial future is not just secure but thriving. Start harnessing this tool today to take charge of your financial destiny, building resilience against whatever economic challenges come your way.

By integrating insights from the Debt Clock into your financial strategy, you not only understand the broader economic forces at play but also position yourself to thrive amidst uncertainty. With proactive planning based on real-time economic data, you can navigate financial challenges with confidence and make more informed choices about debt repayment, investments, and long-term financial security. Your financial future can be resilient—start today by using the Debt Clock as a powerful tool to shape a prosperous tomorrow.