Mortgage Rates Plummet: A Game-Changer for Spring Homebuyers?

LOS ANGELES (AP) — A notable shift in the housing market has emerged as mortgage rates experience a continuous decline, reaching their lowest point since December, signaling a potential revitalization of the spring homebuying season. According to Freddie Mac, the average 30-year fixed-rate mortgage has dropped for seven consecutive weeks, settling at 6.63% this week, a substantial decrease from the 7.04% recorded in mid-January.

This downward trend, primarily attributed to growing concerns about economic growth and the potential repercussions of new tariff policies, has also impacted shorter-term mortgages. The 15-year fixed-rate mortgage has fallen to 5.79%, marking a significant milestone as rates reach their lowest level since December 12th.

The immediate impact of these lower rates is evident in the surge of mortgage-related activity. The Mortgage Bankers Association (MBA) reported a 20.4% increase in mortgage applications, indicating a renewed interest from prospective homebuyers. Furthermore, refinance applications have seen a dramatic 37% jump, suggesting that homeowners are seizing the opportunity to secure more favorable terms.

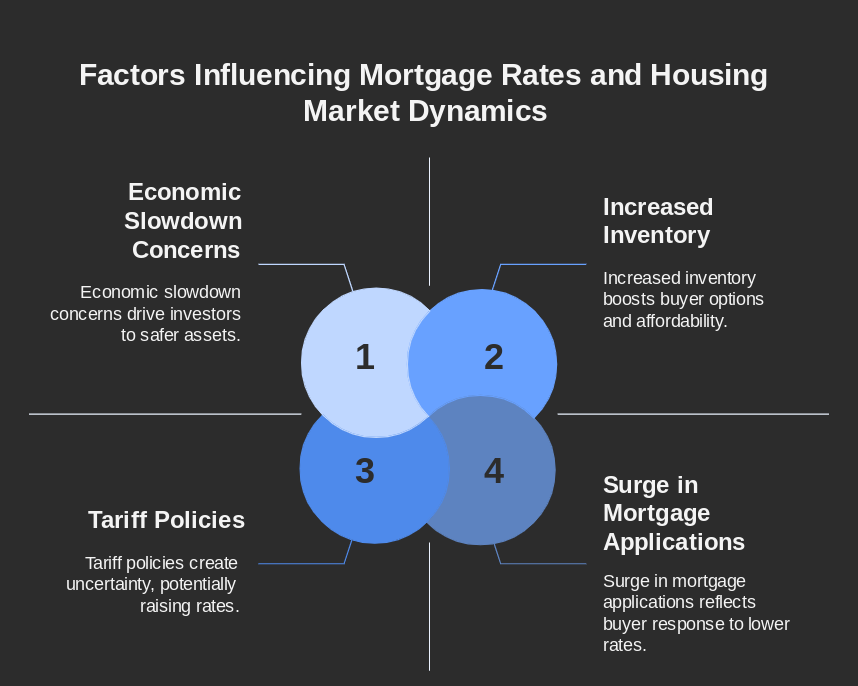

This surge in activity coincides with positive developments in the housing market. Inventory levels have seen a noticeable increase, providing buyers with a broader selection of properties. Additionally, the rapid pace of price growth has slowed nationally, with several metropolitan areas, including Austin, Dallas, and Tampa, Florida, experiencing price declines.

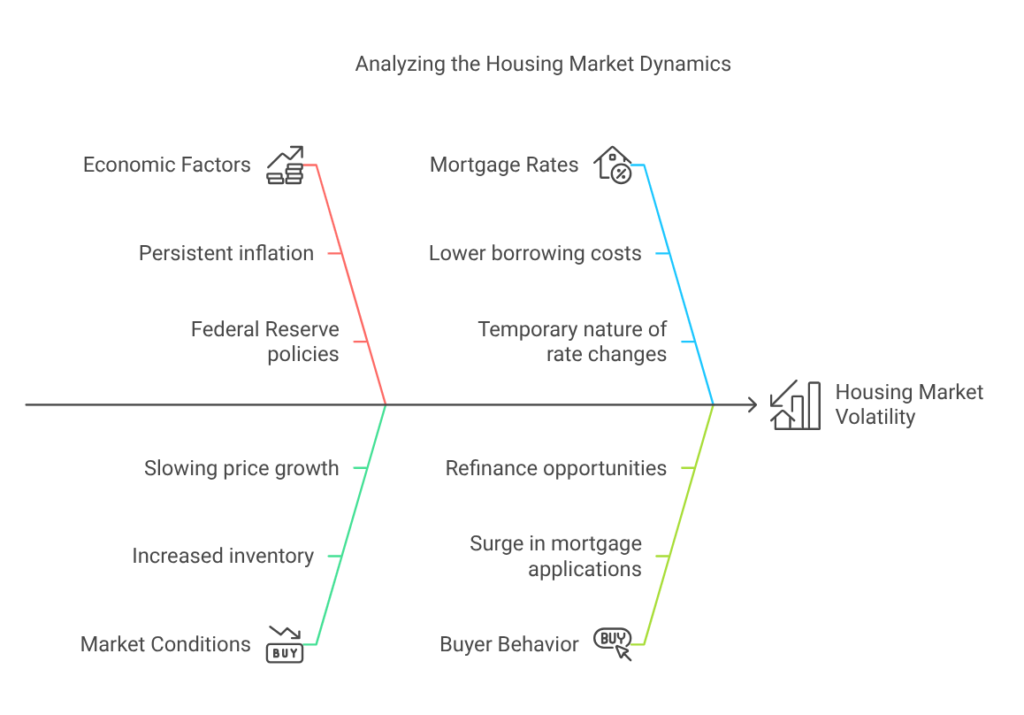

However, economists are urging caution, emphasizing that the current favorable conditions may not be permanent. The housing market remains sensitive to various economic factors, including persistent inflation, the potential impact of tariffs, and the Federal Reserve’s monetary policy decisions. These factors could lead to future rate fluctuations, potentially reversing the current trend.

Despite the positive momentum, the overall housing market landscape remains complex. January saw a decline in the sales of previously occupied homes, and pending home sales data suggest that further declines may be imminent. This indicates that while lower mortgage rates are providing a boost, underlying economic uncertainties continue to weigh on the market.

Nevertheless, the current decline in mortgage rates presents a significant window of opportunity for potential homebuyers. The reduced borrowing costs are effectively mitigating some of the affordability challenges that have plagued the market in recent months. This provides a chance for individuals and families to enter the housing market or secure more favorable terms on their existing mortgages, potentially easing financial pressures.

Key Factors Influencing Mortgage Rates & Housing Market Dynamics and Their Impact:

- Economic Growth Concerns:

- Worries about a potential economic slowdown are driving investors towards safer assets like U.S. Treasury bonds, pushing yields down and subsequently lowering mortgage rates.

- Tariff Policies:

- The potential impact of tariffs on inflation is creating uncertainty, as tariffs could lead to higher prices for imported goods, putting upward pressure on interest rates.

- Federal Reserve Policies:

- The Fed’s decisions on interest rates and its overall monetary policy play a crucial role in shaping mortgage rates. Any changes in the Fed’s stance could have a significant impact on the housing market.

- Inventory and Price Trends:

- Increased inventory provides buyers with more options, while slowing price growth or price declines improves affordability.

- Mortgage Application Surge:

- The large increase in applications indicates that buyers are reacting to the lower rates and attempting to take advantage of them.